Introduction

What is investment and speculation? Very important question and I would like to write a few words about it. In this article I explore topic of investment and speculation.

First of all, I would write about basic information, then qualify assets to those two categories, give some interesting thesis about topic, cover all together with some ground-breaking data.

Finally, I will write some personal conclusions.

Please read, share and comment it!

Investment and Speculation Basics

Let’s write definitions for both of this terms, then I would be clear about what I am writing about.

Investment is action to buy shares of company based on its business. Which clearly means buying shares for the medium or long term.

A person called an investor makes decisions about buying and holding shares due to the dividend from the shares held and the increase in the share price.

In the case of speculation, the matter is completely different. Speculators don’t care what industry it is in or how good a company it is to buy as long as the company’s price increases. Which means that the speculator is not interested in the business itself, but in the rising price of its shares.

So, is buying cryptocurrencies an investment or speculation? Exactly. I will answer this question in a moment.

Investment and Speculation Examples

Okay. Now that you know what investment is and what speculation is, what assets are investment assets and speculators’ assets.

Typically, investment assets include bonds and shares. The forex and cryptocurrency markets are often referred to as speculators’ markets, but is that really the case?

After all, you might as well buy cryptocurrency shares. In this case, Bitcoin and hodling it. In this case, you become an investor. Basically, however, they are buying into the speculators’ market.

As you can probably see, the definition of investment and speculation is fluid. You can as well buy the share prices of a company you know well, but… you will make the decision to buy based on facts coming from the environment and the market. So now are you a speculator or still an investor?

You can as well, as the author of the text does, buy cryptocurrency shares based on business knowledge, but equally important aspects are price increases. In a relatively short time. I would describe it as 1 – 5 years for an investment in the market known as the speculative assets market.

Investment or Speculation?

Cryptocurrency market is speculative, because is young, immature and its participants, most often want to make money in a short time. Preferably as much as possible and the only thing that matters is the price.

However, if we reverse this model. There are more and more professionals on the market looking for investments.

So what’s the deal with these cryptocurrencies?

Is it an investment or speculation?

Let’s look at examples of 2 archetypes – Bitcoin and Ethereum.

Bitcoin is the king and Ethereum is the businessman.

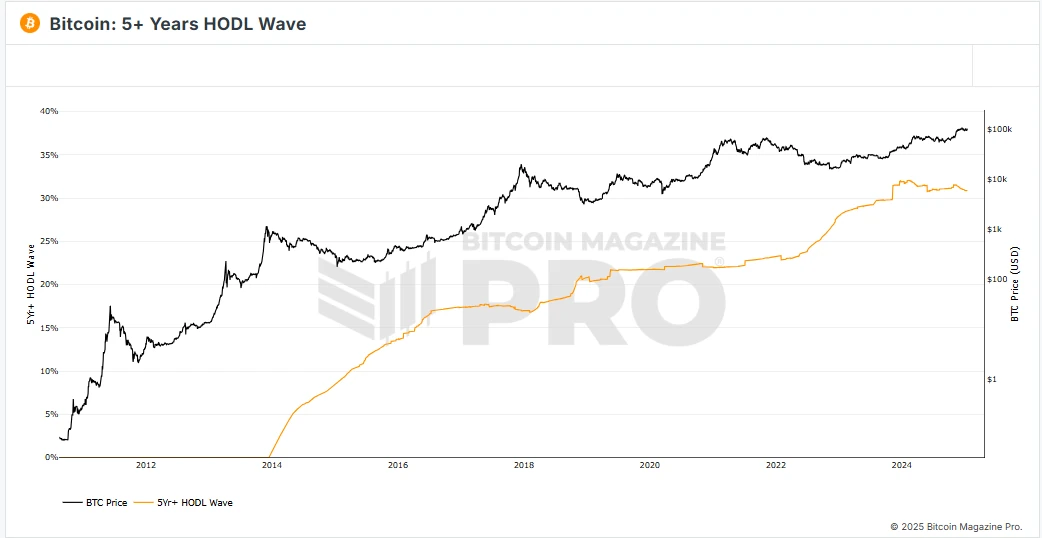

Bitcoin King is only one. Here below you can see Bitcoin 5+ Years HODL Wave. What do you see?

From 2014 this wave growing strongly, because after first bear market prices of Bitcoin come back to growth. People then (innovators) realised that this asset is very volatile, but can be HODL for longer time.

In this case people invest in Bitcoin and there shouldn’t be any talking about speculation.

Let’s take a look for Bitcoin project by yourself.

What about Ethereum investments or speculations?

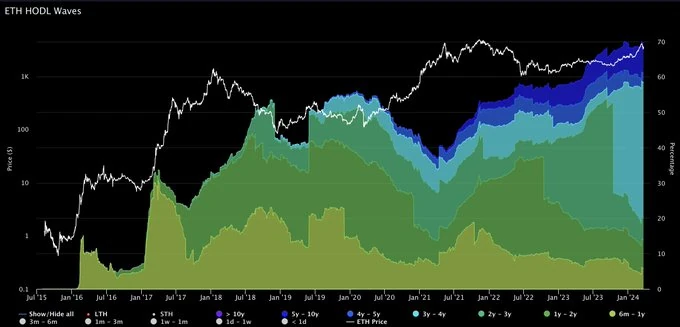

Ethereum HODL Waves in case of Ethereum is different. First of all, Ethereum is not so long on the market. What do you see in this example?

In my opinion, everyone whose invest in Ethereum keep this asset at least for a few months. Speculators would be coming to the market at the last moment. Probably when the media announced the great success of cryptocurrencies. I mean without any knowledge, without any preparation. Then for sure you are speculator.

There is no talking about investment, when you listen media and you don’t have knowledge about asset at all. You speculate your money on asset when its price growth.

All is Investment or Speculation

The truth is that the line between investment and speculation is very thin.

In fact, when making investment decisions, they can only be motivated by revenues over the next few months and years. You use your knowledge and you know the company or asset, but you want to make money from it. You sell when the time is best in your opinion.

What did you invest or were you a speculator?

You may have acted like an investor, but you also exhibited speculative behaviour. I think, speculation and investment are all the same. The motives are different, and the risks taken are different. This is true, but in total an asset is the sum total sold to obtain a profit.

My thesis is for this reason:

Everything is an investment, or everything is speculation. Only the motives and the probability of success are different.

After this somewhat shocking thesis, I would like to move on to the data. These will not be typical figures, but data summarizing both approaches to generating profits.

Because this is how you should define an investment or speculation.

Well, let’s move on to the next section.

Investment and Speculation Data

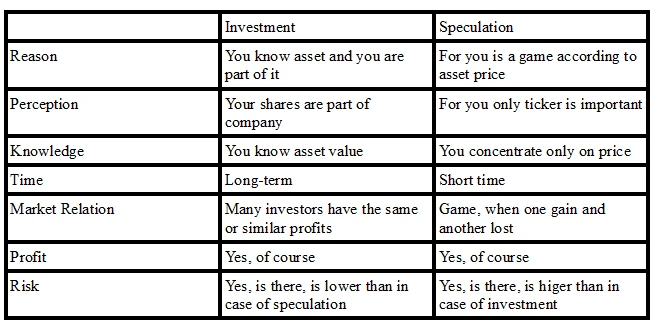

I’ve already written everything you need to know before, it’s time for hard data. Basically, specifics about investing and speculation.

You can see that investment and speculation are little bit another, but everyone of them want to have profits. Only approach are completely different. I would write – knowledge, time and risk make the biggest difference.

I want you to take from this article one thing. When you are on the cryptocurrency market, study it and think long-term or middle-term and minimize risk.

That’s true it’s speculative market, but for now on. Maturity of the market can change perspective.

Investment and speculation is just you approach to transfer the value of your assets.

It is true that it is better to understand the asset. Then, the market and market behaviour before taking any steps to generate your own profits in the market.

For this reason, I invite you to browse the blog and read it regularly.

In many of these articles, I’m basically doing business analysis for projects.

Such an analysis brings us, investors, closer to success in transferring value from our investments.

Yes, without a doubt, I consider myself an investor, not a speculator.

Conclusions

Investment and speculation are just your approach to generating profit.

I presented the thesis that they are the same. I did this on purpose to shock a little, but I wasn’t too far wrong.

Investment and speculation are in many cases interchangeable.

If you are on the cryptocurrency market, try to be more of an investor than a speculator.

This approach will certainly bring you closer to success, while taking less risk.

Leave a Reply

You must be logged in to post a comment.