Introduction

Cryptocurrency has taken the financial world by storm in the past few years. Obviously, the exponential growth of digital assets has led to many investors looking to diversify their portfolio with these digital assets. So to say, XRP and Cardano are two popular cryptocurrencies that have established themselves as promising investment options.

While first is known for its fast transaction speeds and partnerships with major financial institutions, Cardano boasts advanced technology and a strong focus on sustainability.

In this article, we will explore the key differences between XRP and Cardano, their potential for growth, and the factors investors should consider before making a decision.

Understanding the Differences Between XRP and Cardano

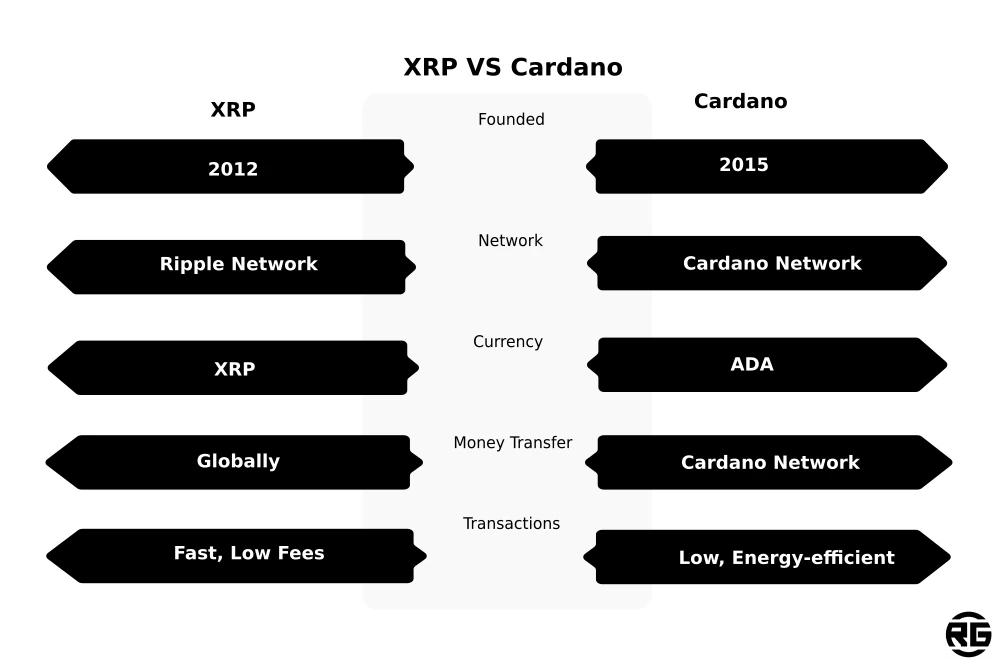

Before we delve into the details of each cryptocurrency, it is essential to understand their basic differences. Moreover, XRP was created in 2012 and aims to revolutionize the banking and financial industry.

It offers a fast, secure and reliable way to transfer money globally. Native currency is XRP, which is used to facilitate transactions on the Ripple network.

On the other hand, Cardano was created in 2015 and is designed to offer a more sustainable and scalable blockchain platform. Cardano’s native currency is ADA, and it is used to facilitate transactions and pay for services on the Cardano network.

The History and Growth of XRP and Cardano

XRP has been around since 2012, and it has come a long way since then. The company initially focused on developing a payment protocol for banks and financial institutions.

Over the years, XRP has managed to establish partnerships with major financial institutions like American Express, Santander, and Standard Chartered. The company’s native currency, XRP, has also seen significant growth in recent years, reaching an all-time high of $3.84 in early 2018.

Cardano, on the other hand, was created in 2015 by a team of developers led by Charles Hoskinson. The team behind Cardano aimed to create a more sustainable and scalable blockchain platform that would offer better security and efficiency.

The Cardano network went live in 2017, and its native currency, ADA, has seen steady growth since then. As of August 2021, Cardano’s market capitalization stands at over $60 billion.

XRP and Cardano Market Capitalization Comparison

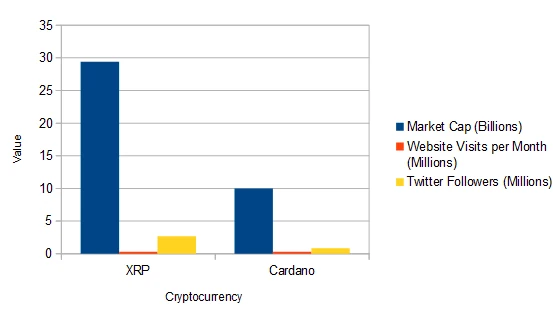

Market capitalization is a crucial metric that investors use to assess the value of a cryptocurrency. XRP’s market capitalization is currently around $27.4 billion, making it the sixth largest cryptocurrency by market cap.

Cardano’s market capitalization, on the other hand, is around $9.7 billion, making it the eigth largest cryptocurrency by market cap. This indicates that XRP is currently more valuable than Cardano, but market capitalization alone should not be the sole factor in making an investment decision.

XRP and Cardano Technological Differences

One of the key differences between XRP and Cardano is their underlying technology. XRP uses a consensus algorithm called the Ripple Protocol Consensus Algorithm (RPCA), which is a form of a federated consensus algorithm. This algorithm allows for faster transaction speeds and lower transaction fees.

On the other hand, Cardano uses a proof-of-stake (PoS) consensus algorithm, which is more energy-efficient and sustainable than proof-of-work (PoW) algorithms used by other cryptocurrencies like Bitcoin.

Another significant technological difference between XRP and Cardano is their approach to smart contracts. XRP does not have a built-in smart contract functionality, while Cardano’s smart contract platform is called Plutus. Plutus allows developers to create complex smart contracts that can execute automatically when certain conditions are met. This makes Cardano a better platform for decentralized applications (dApps) and smart contract development.

XRP and Cardano Team and Community Comparison

The teams behind XRP and Cardano are both highly skilled and experienced in the blockchain and cryptocurrency industry. XRP’s team is led by CEO Brad Garlinghouse, who has extensive experience in the tech industry. The company also has a strong advisory board that includes individuals with backgrounds in finance, technology, and academia.

Cardano’s team is led by Charles Hoskinson, who was also one of the co-founders of Ethereum. Hoskinson is a well-known figure in the cryptocurrency industry and has been actively involved in the development of several blockchain projects. Cardano also has a strong community of developers and supporters who contribute to the development of the platform.

XRP and Cardano Investment Potential

Both XRP and Cardano have significant potential for growth in the coming years. XRP’s partnerships with major financial institutions and its fast transaction speeds make it a strong contender in the financial industry. The company’s focus on cross-border payments and remittances also makes it a valuable asset in countries with high remittance fees.

Cardano’s strong focus on sustainability and scalability makes it a promising platform for decentralized applications and smart contracts. The platform’s PoS algorithm also makes it more energy-efficient than other cryptocurrencies like Bitcoin, which is a significant advantage in today’s environmentally conscious world.

XRP and Cardano Price Analysis in Depth

Historical data will be an invaluable source in analyzing the trend of both cryptocurrencies. I’ll start with XRP first. Next, I’ll deal with Cardano.

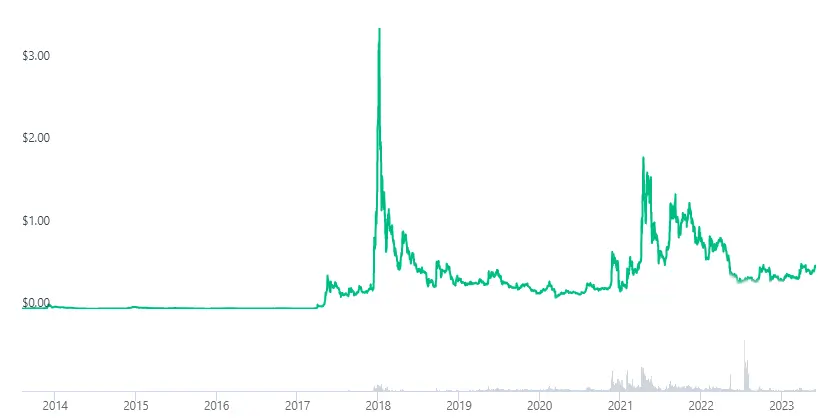

It is an example of a cryptocurrency with a relatively long trend history (relative to the rest of the cryptocurrencies). The trend analysis is more illustrative, because it presents nearly 10 years of the trend. I wish everyone could analyze trendlines for at least 10 years in the case of cryptocurrencies. Yeah. This is not obvious to some.

1st Bull Market

During the first bull market, the price soared every $0.057. Which means that the first bull market could bring a profit of 10 times.It seems that in May 2014, the price bottomed out at $0.0026. From top to bottom the difference was 95%!! What a reckless driving.

2nd Bull Market

Since reaching the bottom, the price has started to rise steadily. It wasn’t a spectacular increase. We had to wait until the beginning of 2017 for a more interesting moment. Here you can see a significant difference in the price of a cryptocurrency.

I already explain what I mean.

In January 2017, the price was $0.06. The price in January 2018, i.e. during the mega boom for the cryptocurrency, was $3.40.

It was an exciting price increase of about 55 times!!!

Those are some out of control values. This is probably the best thing about cryptocurrencies.

They can make you rich or beggar in one year!! I have to admit I’m still excited about this analysis, but back to the rest of the trend analysis. Wow!!

The price was falling until March 2020 to the level of USD 0.13.

The difference from the peak in December 2017 is simply crushing. It was 96.7%. If you bought at the top then literally in 2 years you lost the value of the entire investment if you let your nerves go. Such a ride ends with almost everyone at a loss.

3rd Bull Market

The next rally at the top ended at $1.84. Subsequently, the price drops for nearly 2 and a half months to the price $ 0.53. From this point, the price starts to increase and continues its upward trend from the price of $1.39.

Interestingly, the momentum of growth in a bull market is getting smaller. In technical analysis, there is a rule that an uptrend in price is determined by rising prices in a bull market. It’s not here.

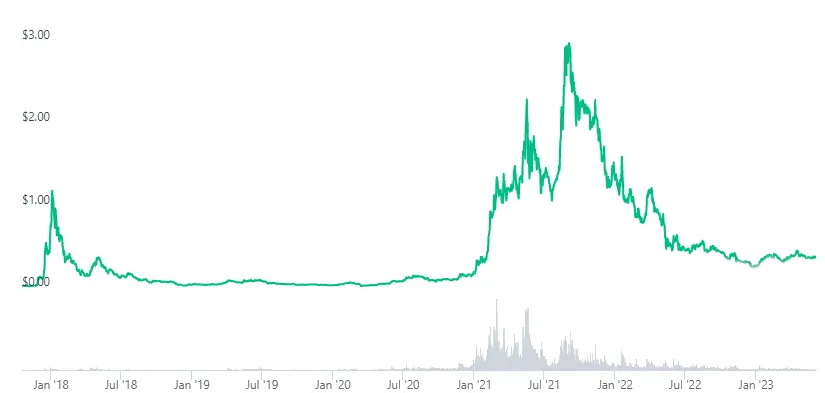

It is a cryptocurrency with a much shorter trend history.

1st Short Bull Market

This starts from mid-October 2017. The starting price is $0.02. In the first cryptocurrency boom, we hit a peak of $1.18. Then the price drops to the starting price, which is $0.02. The downward trend prevailed throughout 2018.

When the price reached the bottom, it began to bounce back and increase regularly, but without spectacular increases.

2nd Bull Market

Either way, annual growth was close to 50% at the end of 2019. The price was $0.033 per cryptocurrency unit.

Another year is already a huge price difference. The price at the end of December reaches the value of 0.18 dollars. However, the boom has only just begun. It is not the end.

The price at the end of the bull market was $3.09. Which means that the price increase from the bottom from December 2018 to October 2021 skyrocketed by 94 times !!!

2 and a half years would bring the investor rates of return that can only be seen in the cryptocurrency market!!

Here I will leave a historical analysis of the cryptocurrency price. Let me just add that we reached the bottom after the last bull market around May-November 2022.

Take a look at another post about the bottom of the cryptocurrency market.

Risks Associated with Investing in XRP and Cardano

As with any investment, there are risks associated with investing in XRP and Cardano. The cryptocurrency market is highly volatile, and prices can fluctuate rapidly. Regulatory changes and changes in market sentiment can also have a significant impact on cryptocurrency prices. Additionally, both XRP and Cardano are still relatively new compared to other established cryptocurrencies like Bitcoin and Ethereum, which means that there is still some uncertainty about their long-term potential.

Expert Opinions

Many experts in the cryptocurrency industry have shared their opinions on XRP and Cardano. Some experts believe that XRP’s partnerships with major financial institutions make it a valuable asset in the financial industry. Others are more skeptical about the long-term potential of XRP, given its centralized nature and the regulatory challenges it faces.

As for Cardano, many experts believe that the platform’s focus on sustainability and scalability makes it a promising investment option. The platform’s advanced technology and strong community of developers also make it an attractive option for decentralized applications and smart contract development.

Conclusion

Overall, both XRP and Cardano have their strengths and weaknesses as investment options. First cryptocurrency partnerships with major financial institutions and its fast transaction speeds make it a valuable asset in the financial industry. However, its centralized nature and regulatory challenges may limit its long-term potential.

On the other hand, Cardano’s strong focus on sustainability and scalability, advanced technology, and strong community of developers make it a promising investment option for the future. The platform’s PoS algorithm also makes it more energy-efficient than other cryptocurrencies like Bitcoin, which is a significant advantage in today’s environmentally conscious world.

Ultimately, the decision of whether to invest in XRP or Cardano depends on an investor’s individual goals and risk tolerance. As with any investment, it is important to conduct thorough research and seek professional advice before making any investment decisions.

Leave a Reply

You must be logged in to post a comment.