Introduction

If you’re new to the world of cryptocurrency, you may be wondering what a decentralized exchange. Indeed, decentralized exchanges (DEXs) use smart contracts to facilitate peer-to-peer trading. If you ask what is Uniswap?

Answer is simple. Uniswap is one of the most popular DEXs. It has quickly become a favorite among crypto enthusiasts due to its innovative approach to liquidity provision. In this guide, I’ll explore the basics of Uniswap. How it works, and the benefits and risks associated with using it.

What is a Decentralized Exchange?

A decentralized exchange is a platform that allows users to trade cryptocurrencies without the need for a central authority. Instead, users can trade directly with each other using smart contracts. This eliminates the need for a middleman, which can result in faster, cheaper, and more secure transactions.

Unlike traditional exchanges, which require users to deposit funds and trade through a third party, decentralized exchanges allow users to maintain control of their funds at all times. This makes them a popular choice for those who value privacy, security, and transparency.

How Uniswap Works

Uniswap is a decentralized exchange that uses an automated market maker (AMM) system to provide liquidity. In traditional exchanges, buyers and sellers must be matched in order for a trade to occur. This can result in low liquidity and high volatility.

Uniswap, on the other hand, uses liquidity pools to provide liquidity. These pools consist of pairs of tokens, such as ETH/USDC, and are created and managed by users. Users can contribute to these pools by depositing an equal value of both tokens. In exchange, they receive liquidity provider (LP) tokens, which represent their share of the pool.

When a user wants to trade one token for another, they can do so by swapping them in a liquidity pool. For example, if a user wants to trade ETH for USDC, they can do so by swapping their ETH for USDC in the ETH/USDC liquidity pool.

The price of the tokens is determined by a simple algorithm that balances the supply and demand of each token in the pool. This means that the price of the tokens can fluctuate based on market conditions, but it also ensures that there is always enough liquidity for trades to occur.

The Benefits of Using Uniswap

One of the biggest benefits of using Uniswap is its high liquidity. Because liquidity is provided by users rather than a centralized authority, there is always a large pool of tokens available for trading. This can result in faster trades and lower slippage, which is the difference between the expected price of a trade and the actual price at which it is executed.

Additionally, Uniswap is a non-custodial exchange, which means that users maintain control of their funds at all times. This makes it a popular choice for those who value privacy, security, and control over their assets.

Another benefit of using Uniswap is its accessibility.

Unlike traditional exchanges, which often require users to go through a lengthy verification process and may have restrictions on who can use them, Uniswap is open to anyone with an internet connection.

There are no restrictions on who can use the platform, and users can trade any ERC-20 token listed on Uniswap. This makes it a popular choice for those who want to trade less popular tokens that may not be available on other exchanges.

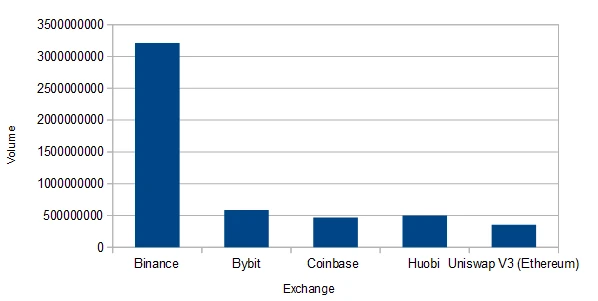

Uniswap vs Traditional Exchanges

While Uniswap has many benefits over traditional exchanges, there are also some drawbacks to consider. One of the biggest differences between Uniswap and traditional exchanges is the price of trading. Uniswap charges a 0.3% fee on all trades, which is higher than many traditional exchanges.

Additionally, users must pay gas fees to execute trades on the Ethereum network, which can be expensive during times of high network congestion.

Another difference is the user experience. While Uniswap is designed to be user-friendly, it may take some time for new users to understand how it works.

Traditional exchanges often have more intuitive interfaces and may be easier for beginners to navigate.

Additionally, Uniswap does not have the same level of regulatory oversight as traditional exchanges, which may make some users hesitant to use it.

Understanding Liquidity Pools

One of the key features of Uniswap is its use of liquidity pools to provide liquidity. These pools are created and managed by users, and consist of pairs of tokens such as ETH/USDC or DAI/USDT.

Users can contribute to these pools by depositing an equal value of both tokens. In exchange, they receive liquidity provider (LP) tokens, which represent their share of the pool.

The price of the tokens in the pool is determined by an algorithm that balances the supply and demand of each token. When a user wants to trade one token for another, they can do so by swapping them in a liquidity pool.

For example, if a user wants to trade ETH for USDC, they can do so by swapping their ETH for USDC in the ETH/USDC liquidity pool. The price of the tokens is determined by the amount of each token in the pool. The more ETH in the pool, the lower the price of ETH will be relative to USDC, and vice versa.

How to Use Uniswap for Trading

To use Uniswap for trading, users must first connect their Ethereum wallet to the platform. This can be done using a browser extension such as MetaMask. Once connected, users can select the token they want to trade and the token they want to receive.

Uniswap will then display the current price of the tokens, as well as the estimated amount of tokens the user will receive.

Users can then confirm the trade by paying the gas fee associated with the transaction. Once the transaction is confirmed, the tokens will be swapped in the liquidity pool and the user will receive the new tokens in their wallet.

It’s important to note that the price of the tokens may fluctuate during the transaction, which can result in slippage.

Uniswap Fees and Gas Costs

Uniswap charges a 0.3% fee on all trades, which is used to incentivize liquidity providers to contribute to the pools.

Additionally, users must pay gas fees to execute trades on the Ethereum network. Gas fees are used to pay miners for processing transactions on the network, and can vary depending on network congestion.

During times of high network congestion, gas fees can be expensive, which can make trading on Uniswap more costly.

Risks Associated with Uniswap

While Uniswap has many benefits, there are also risks associated with using it. One of the biggest risks is the potential for smart contract bugs or vulnerabilities.

While Uniswap has been audited and is considered to be relatively secure, there is always a risk that a vulnerability could be discovered. Additionally, because Uniswap is a decentralized exchange, there is no central authority to regulate it.

This means that users must rely on the community to identify and report any issues that arise.

Another risk to consider is the potential for impermanent loss. Impermanent loss occurs when the price of tokens in a liquidity pool changes over time.

If the price of one token increases relative to the other, liquidity providers may experience a loss when they withdraw their funds. While impermanent loss can be mitigated by carefully selecting the tokens in a liquidity pool, it is still a risk that users should be aware of.

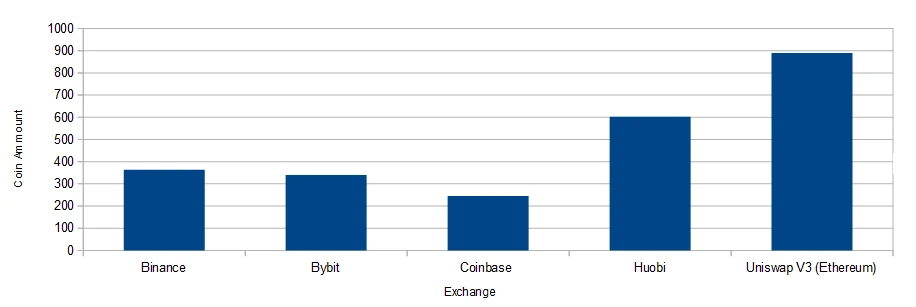

Uniswap Tokens and Governance

Uniswap has its own token, called UNI, which is used for governance. UNI holders have the ability to propose and vote on changes to the platform, such as adding new tokens or changing the fee structure.

Additionally, UNI holders can earn a portion of the fees collected by the platform by staking their tokens in the governance pool.

Another Decentralized Exchanges Tokens

DEX exchanges are springing up like mushrooms after the rain. Nothing foreshadows these changes in this trend. This subcategory of projects developed in the cryptocurrency industry is constantly evolving.

Some interesting alternatives to the Uniswap design:

Curve

Decentralized exchange with The Curve Finance Protocol and governed by the CRV token. The project was launched in January 2020.

ApeX Pro

It is a decentralized and non-custodial derivatives protocol that facilitates the creation of perpetual swap markets for any token pair, launched in 2022.

Pancakeswap

Decentralized Echange with token CAKE and runs on Binance Smart Chain. Launched in 2020.

Uniswap Price in Depth

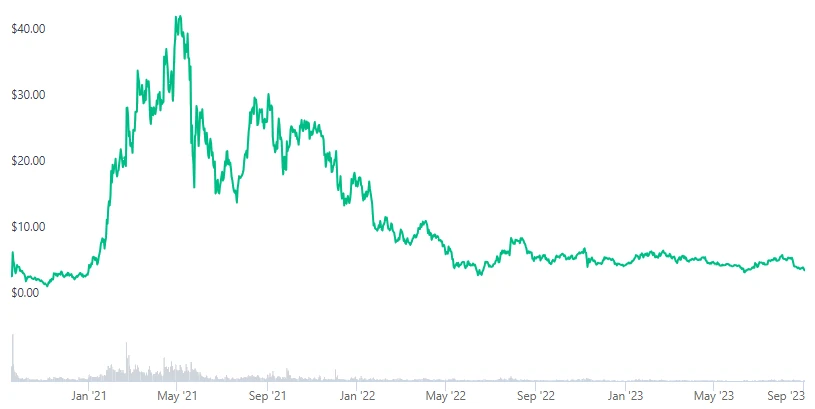

Bull Market

In the case of the Uniswap token, we could only observe one bullish price.

The token was actually created in 2018, but, as in the case of other ICOs, it was only later listed on the exchanges.

In fact, it is the moment of listing, which is more or less visible on the chart, that can be interpreted as price changes.

I will only add that people who had access to investments in the project’s ICO earned a lot more, but not everyone is so lucky.

Interestingly. The chart starts at $3.44 per unit. In just 7 months, the price increased to $42.32 per unit (at the peak of the bull market).

There was a 12-fold difference between the price trough and the peak, indeed. Now you understand why crowds of inexperienced investors are pushing for cryptocurrencies. Everyone thinks they’ll make money. And here is an unpleasant surprise and losses that are mentally hard to bear.

Bear Market

Interestingly, the price during the bear market fell to the starting price when the token was listed. I mean $3.61 per unit.

The price has been falling for almost a year, and then a recovery is visible. You can only dream of a real bull market.

At least for the moment.

What About Future?

The development of the project is progressing, because it is a really interesting initiative for well-known centrally managed exchanges (CEX).

It is, among other things, the unique decentralization of the exchange that makes this project so unique.

As decentralization progresses and there are more projects of this type, it can be said that… Uniswap will remain one of the DEX leaders (as long as developers continue to develop the project).

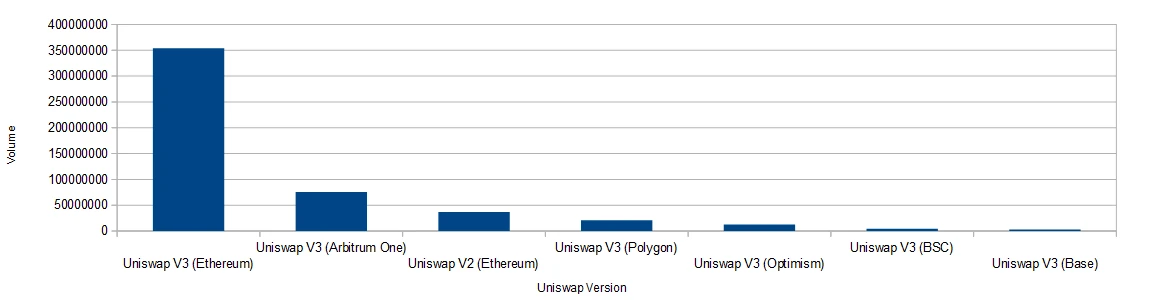

Besides, Uniswap creates subsequent versions improved with new features.

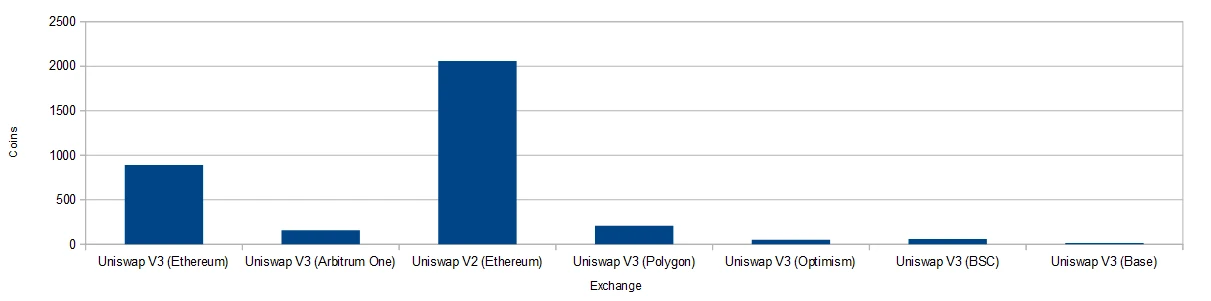

In version 3, the main blockchain is Ethereum. Versions based on the Arbitrum One, Polygon, Optimism, BSC and Base blockchains have also been created.

Interestingly, in each of these sub-projects, the trading volume is significant.

Conclusion

Uniswap is a powerful tool for those who want to trade cryptocurrencies without the need for a central authority. Its use of liquidity pools and automated market makers make it a popular choice for those who value liquidity and accessibility.

However, it’s important to be aware of the risks associated with using Uniswap, such as the potential for impermanent loss and smart contract vulnerabilities.

If you’re comfortable with these risks and are looking for a decentralized exchange that offers high liquidity and a wide range of tokens, Uniswap may be the right choice for you.

Leave a Reply

You must be logged in to post a comment.