Introduction

In the fast-evolving world of cryptocurrency, surely Synthetix Network stands out as a unique and innovative project.

This decentralized asset insurance protocol, built on the Ethereum blockchain at first. All users to can trade synthetic decentralized assets, known as Synths in fact.

Formerly known as Havven, Synthetix (SNX) offers an accessible and user-friendly trading experience within the decentralized finance (DeFi) ecosystem.

In this article all about Synthetix Network Token, so enjoy reading!

Synthetix Network Token (SNX)

At the heart of the Synthetix Network is the Synthetix Network Token (SNX), indeed.

This token serves as collateral for the synthetic assets, or Synths, created on the platform, but not only.

By staking SNX tokens, users can mint and hold a wide range of derivatives. Including commodities, fiat currencies, stocks, and even cryptocurrencies like Bitcoin (BTC). These Synths replicate the value of real-world assets, then allowing users to gain exposure to various markets. All of that without actually owning the underlying assets.

The Unique Features of Synthetix Network

Synthetix Network stands out for several key features that set it apart from other projects in the cryptocurrency space.

One of its notable strengths is the ability to convert Synths without the need for a counterparty, so it cool thing.

This means that any Synth can be easily traded for another Synth on the Synthetix Exchange, providing a high level of liquidity and flexibility for users.

Another innovative aspect of Synthetix is its peer-to-contract (P2C) trading system. Unlike traditional order book-based decentralized exchanges, Synthetix operates on a peer-to-contract model. This means that trades are executed directly against a smart contract, eliminating the need for counterparties and reducing counterparty risks and slippage.

Synthetix also offers a diverse range of Synths, denoted with the prefix “s.”

Especially, users can trade fiat Synths like sEUR and sUSD, as well as synthetic cryptocurrencies, indexes, and even inverse cryptocurrencies. Additionally, Synthetix has introduced two synthetic cryptocurrency indexes: sDEFI and sCEX. First, tracks a basket of DeFi assets, and second, tracks a basket of centralized exchange tokens.

How Synthetix Network Works

To start trading Synths on the Synthetix network, users have two primary methods.

The first method involves purchasing Ethereum (ETH) on an exchange and swapping it for sUSD on Kwenta. By the way, it’s a decentralized application (dApp) built on Synthetix. Once they have sUSD, users can then trade it for other Synths, such as sBTC.

The second method is to obtain SNX tokens on an exchange and stake them on the Mintr dApp. By staking SNX, users can create Synths and begin trading them on Kwenta.

It’s worth noting that all Synths minted through staking SNX tokens are backed by a collateralization ratio of 750%. This rule is determined through community governance.

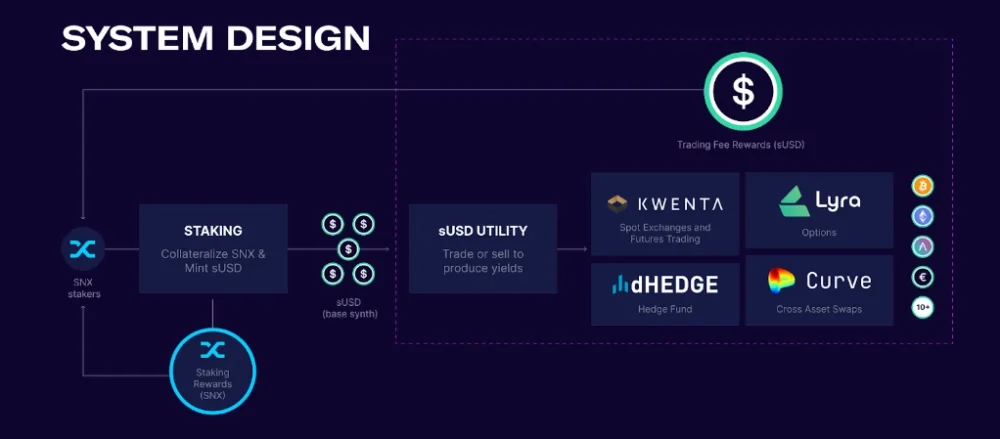

In fact, Synthetix Network is the capital liquidation layer of Defi projects.

Staking Collateral with Synthetix helps support deep liquidity, low slippage, and highly competitive trading fees for our derivatives markets.

An ecosystem of decentralized applications such as Curve, Lyra, dHEDGE and KWENTA is being built around Synthetix Network.

These applications contain various financial instruments such as options, spot and futures instruments.

Governance and Development of Synthetix Network

Synthetix was initially governed by the Synthetix Foundation, a not-for-profit entity based in Australia.

However, in 2020, control of the protocol was transitioned to three decentralized autonomous organizations (DAOs): ProtocolDAO, GrantsDAO, and SynthetixDAO.

ProtocolDAO is responsible for funding protocol upgrades and managing changes to Synthetix’s smart contracts. GrantsDAO allocates funds for community proposals related to public goods on Synthetix. SynthetixDAO supports entities working on advancing the development of the network.

The Value of Synthetix Network Token (SNX)

Firstly, as users mint Synths and participate in the Synthetix ecosystem, they become part of the platform’s debt pool.

Then, the total debt pool represents the value of all Synths on the network, and users’ debts can fluctuate based on the supply of Synths and their exchange rates. To ensure stability, Synths are collateralized at a rate of 750%, in fact. What a leverage!

In practise this means users must deposit a certain amount of SNX or other collateral to back the value of the Synths they create.

Finally, by staking SNX and minting sUSD, users receive rewards in the form of staking rewards (denominated in SNX) and exchange fees from Synth trades (denominated in sUSD). These rewards are distributed based on the amount of debt each staker has issued, so incentivizing users to maintain the collateralization ratio and ensuring Synths are sufficiently backed by collateral.

SNX and its Circulation

The maximum supply of SNX tokens is 328,193,104, with 327,769,196 SNX currently in circulation. During its initial coin offering (ICO), Synthetix sold over 60 million tokens, raising $30 million USD.

A portion of the tokens was distributed to the team and advisors, while others were allocated for bounties, marketing incentives, partnerships, and funding further development.

Synthetix Network Token Price in Depth

4 years on the cryptocurrency market is not quite a long time.

It only seems that way, because in the case of this cryptocurrency it means 2 bull cycles and 2 bear cycles.

And the current bull cycle. So what do you say now?

The example of this cryptocurrency shows how important time is in investments.

But let me come back to the topic.

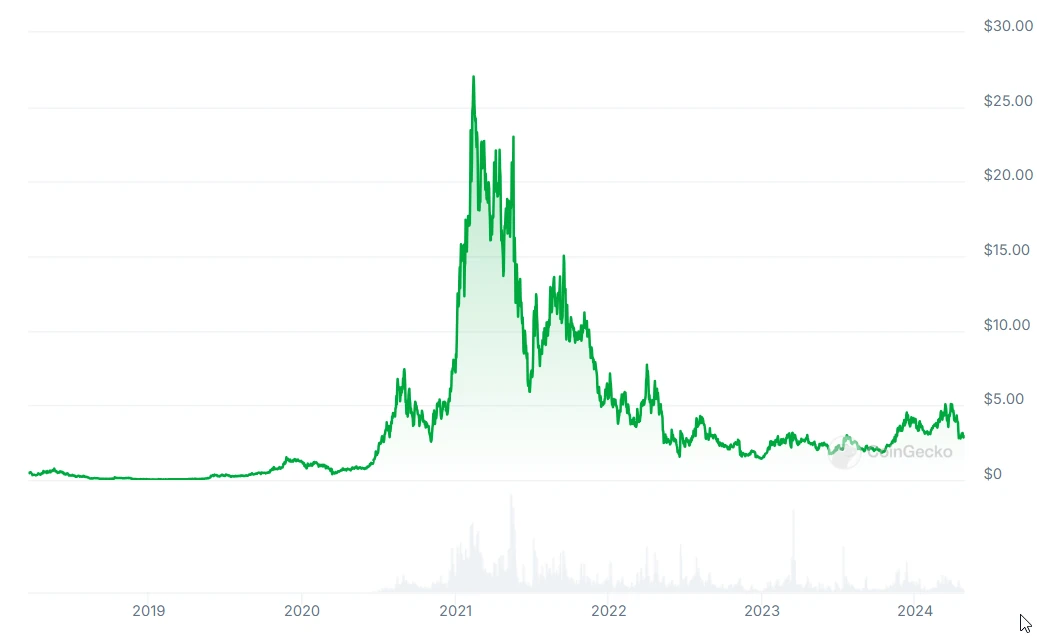

1st Bull Market

Well, it’s time to write something more about the details.

The first bull market was short for the Synthetix Network cryptocurrency. It lasted only a few months.

The starting price was $0.48 per unit, and at the peak it was $0.76 per unit. Nothing special you could say.

1st Bear Market

Although there were no huge increases during the short bull market, the bear market gave investors and traders a hard time.

Well, that’s the market!

The price bottom was reached in January 2019. Price around $0.036 per unit.

Which means big drops!!

Even without counting too much, you can estimate the loss from top to bottom at 95-99% of the price difference.

2nd Bull Market

The second bull market is a normal cycle and basically starts from the price bottom in January 2019.

The price in November 2019 is in a small boom and reaches $1.52 per unit and one could say that this is the end, but no…

This is only the beginning of what awaited us on the market.

By March 2020, the price corrected and…

The mega bull market returns.

This will last until September 2021.

The price reaches a ceiling of $28.53 per unit. So what do you think, dear traders?

2nd Bear Market

Huge price increases are followed by huge price drops. You can be sure of that.

This was also the case with the Synthetix Network price during the second bear market.

This has been falling throughout almost the entire year of 2022. It stopped at $1.49 per unit.

The price during the bull market at its peak was $28.53 per unit. Just a reminder! 99% loss.

3rd Bull Market

As of January 2023, the bull market has returned. The price a year later is around $4 per unit. It’s not bad…

March 2024 is already $5 per unit.

We are currently in a correction before what I suspect is a huge bull market, which will take place from the end of May to probably the end of 2024.

Where do these conclusions come from in fact?

First, elections in the USA, then falling inflation, improving macro conditions in the world, time after the bitcoin halving (and where is the bull market?). Moreover, the support of giants such as Blackrock and many other factors support a very strong bull market.

The end of 2023 and the first quarter of 2024 showed how much optimism there is among traders and investors on the crypto market.

Synthetix Network Token Wallet and Trading

In truth, to store and manage SNX tokens, users can choose from various compatible wallets. These wallets provide a secure and convenient way to access and trade SNX tokens. In detail, some popular wallet options include MetaMask, Ledger, and Trezor.

When it comes to trading Synthetix Network Tokens (SNX), users can find liquidity on decentralized exchanges (DEXs) that support SNX trading pairs. Platforms such as Uniswap and Sushiswap offer SNX trading, allowing users to exchange SNX for other cryptocurrencies or tokens.

Conclusion

Of course, Synthetix Network has emerged as a leading decentralized asset insurance protocol, providing users with the ability to issue and trade synthetic decentralized assets.

With its unique features, such as peer-to-contract trading and a wide range of Synths, Synthetix offers a user-friendly and accessible experience within the DeFi ecosystem.

As the project continues to evolve, it aims to bring more liquidity, stability, and accessibility to the world of decentralized finance, indeed.

Leave a Reply

You must be logged in to post a comment.