Introduction

What is RWA crypto and what is hidden behind this acronym. As you probably know cryptocurrency community is full of acronyms and in case of asset is happen as well.

Before I will explain more about it I write RWA means Real World Assets. In this article all about Real World Assets, what they are, different types, top of them, interesting facts and future.

Please read, share and comment!

After that, to the job.

What is RWA Crypto

Time to write about Real World Assets(RWA) little bit more, because what they really mean? I am quickly explain – they are physical or tangible assets that exist in the real world. Examples include real estate, goods, art, and intellectual property. All of these assets can be represented in the blockchain using tokens.

Of course, each token represents the ownership of the asset. Digitization of assets allows for greater flexibility – easier liquidation and availability of the asset. It is possible to say that NFTs as works of art on the blockchain were the first form of RWA in the world of cryptocurrencies. They paved the way for further progress in the digitization of assets.

Thanks to RWA, the world of traditional finance is approaching the modern world of decentralized finance. Digital transformation is progressing and RWA is a very important part of it. For this reason, it is worth familiarizing yourself with the different types of RWA.

So, let’s check what I’m writing about below.

Types of RWA Crypto

As I wrote earlier, these assets can have different characteristics and forms.

Physical assets such as real estate allow you to buy a piece of real estate of high value.

I wouldn’t be surprised if many high-end properties around the world are tokenized. Examples include football stadiums, mansions, or palaces. The question is whether the owner will want to tokenize the property.

Next asset is commodity – gold, silver, oil, agricultural and industrial products. They are demanded on the world and RWA tokenization give opportunities to make them more accessible. What about intellectual property (patents, copyrights and so on)?

Without any doubts, they are another Real World Assets what are tokenized and traded on many platforms.

There are a lot of more Real World Assets like luxury goods, financial instruments, hyperledger fabrics and stablecoins. This list could go on and on, but I will stop here and write about tokenization of Real World Assets.

Together with digitalization come digital form of money and things like real estate or land, ideas and technology, precious metals, art and stocks.

Those a few points are far from being complete. Real World Assets can be in such a many forms.

About tokenization of RWA

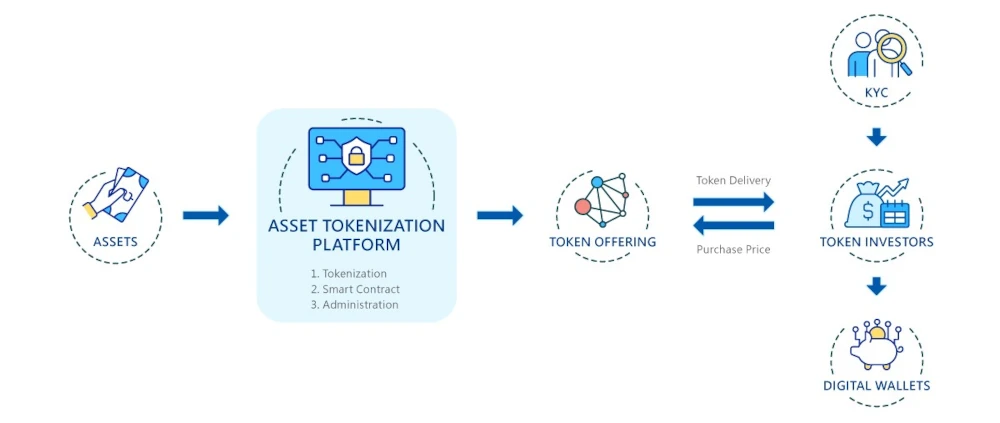

You know what Real World Assets are, so it’s time to better understand tokenization process. It’s process of converting ownership or value of a material asset into digital form on blockchain.

Tokens represent digital ownership – part of full, depend from the structure of the smart contract. What’s more smart contact give full transparency, security and traceability to transactions and ownership. This is great!

Whole process starts from asset validation. Then, asset has confirmed value and is linked to digital tokens. All of that happen on one of the tokenization platforms. In ecosystem, later in this article, I mention a few of them. Don’t worry. Of course, all process not finishing here.

What next happen is token offering. More about token offering I wrote in another article. Token offering is key to the success of the entire venture. This is where the token is bought and sold on specific terms via smart contact.

Obviously, after purchasing the tokens, they are transferred to the digital wallets of their new owners.

This is how the whole process ends.

The tokens are in the possession of the new owner or owners.

Benefits of RWA Crypto

You can ask what is the purpose of this whole Real World Assets? It’s right question to ask.

First of all, tokenization give smaller investors more opportunities. In case of digital asset, this asset is global and not limited by borders. The moment when asset in on blockchain is fully transparent, secure and has global accessibility.

From this moment liquidity of high-value costs assets is higher. Fractional ownership and trading on secondary markets is a key factor here.

Finally, administration costs are lower or much lower. All digital platforms are much cheaper than fully-equipped stuff in the office what manage your asset selling. Don’t you think?

Top RWA Crypto

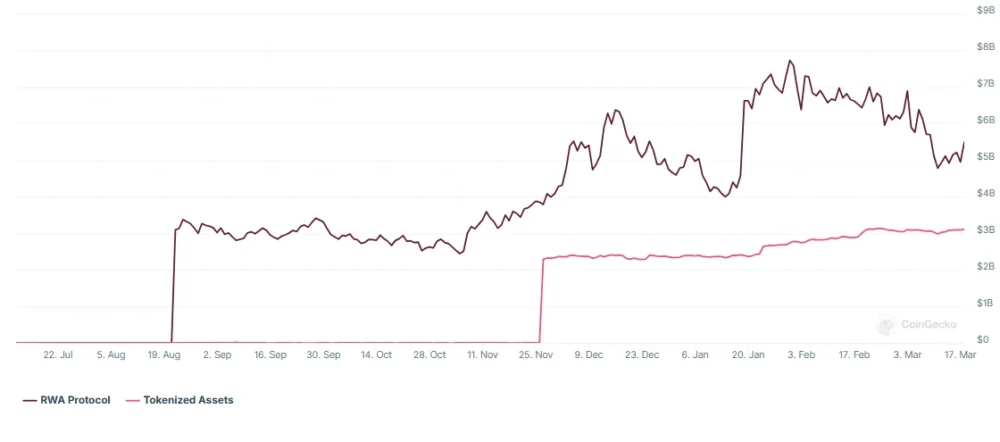

In this part of article I would like to write about top project in this category. I will tell you that from the last year from August Real World Asset Protocols had huge capital inflow. Of course, when so much money come to projects media and analytics tell a lot of about it.

In this case it was similar. Let’s take a look how it was look like on the graph below.

Source: https://www.coingecko.com/en/categories/real-world-assets-rwa#key-stats

By the way, I wrote about tokenization of the assets many months before it really happens. I think first time I have mention about tokenization in this article. Almost one year and half later in the end of November 2024 this sector of cryptocurrency industry really skyrocket.

Obviously, first RWA protocols skyrocket as they are base for tokenization assets.

I come back to top Real World Asset projects.

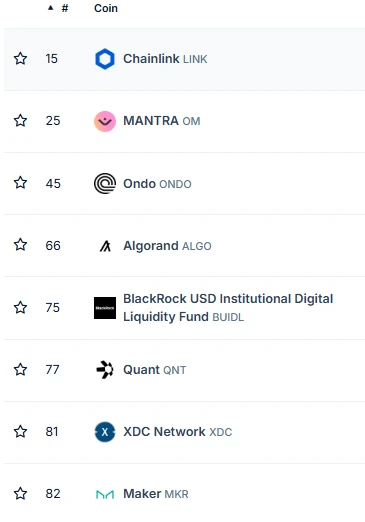

Source: https://www.coingecko.com/en/categories/real-world-assets-rwa

On the top of the list a projects like Chainlink, Mantra, Ondo or Alogrand. About 2 of them I have written here on the blog. From 8 from the top you can find 4 of them in blog posts. I would say, not so bad.

Beside that, you can see how powerful Coingecko platform is. On this blog I used a lot of time data from Coingecko, because simply it’s great tool for crypto analysis. Great job Coingecko!

RWA Crypto Ecosystem

Surely, if you read this blog then you know I am almost writing always about ecosystem in the project. For one simple reasons I am doing it. Without ecosystem projects would die.

A project without a developing ecosystem will simply fail. When comparing the project’s effectiveness and adoption, it is worth comparing it with other ecosystems in the sector. Then everything becomes quite obvious.

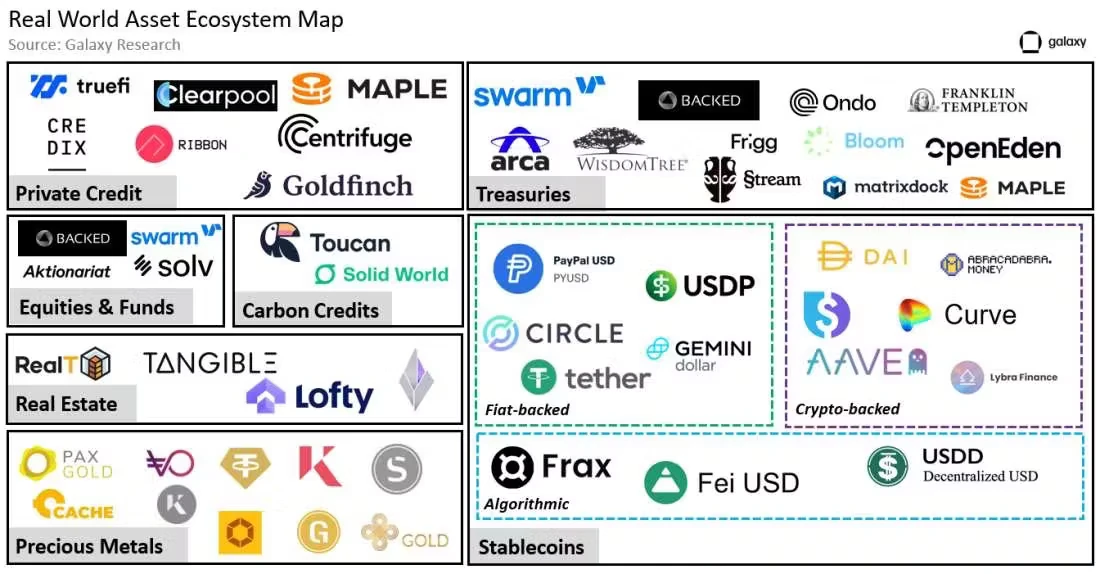

A bit off topic, but about ecosystems in cryptocurrencies. So what does this look like in the RWA ecosystem? Take a look for yourself.

Source: https://www.galaxy.com/insights/research/

Based on Galaxy research Real World Assets (RWA) seems to be fine. There are projects from real estate like Tangible, precious metals like Pax Gold, and much more.

Let me just mention a few more examples: private credit – Goldfinch, treasuries – Ondo, or stablecoins like Tether (fiat-backed), Aave (crypto-backed) or Frax (algorithmic).

We are just at the beginning of Real World Assets, but in my opinion it’s looks really good. Just watching how this sector will grow in next 5-10 years.

Future of RWA Crypto

I am truly believe that, tokenization will be in strong growing trend by next 10 years. I don’t think Real World Assets will share the same path what happen with NFTs. In general, tokenization will progress, because a few aspects: adoption, awareness and more technology in this category of cryptocurrencies.

It’s rather difficult to write what happen next, because nobody knows that. For sure, you can expect more projects in Real World Assets. More businesses will see the value and of course, customers… They will find the way to make a money out of opportunity what brings RWA.

I am really optimistic if I am writing about RWA. At first we have NFTs what can be counted as part of RWA, but… it’s was huge and short trend of adoption. In case of RWA it’s will happen more smoothly, I guess. Let me explain why I think so.

Real World Assets brings value constantly and business model around them can brings money all the time. As example I give you Tangible and renting apartments. Apartments are there sold out in the from of tokenization. If you own tokens from apartment then you are partly owner of the asset. To fully be the owner you have to buy all tokens available on the market. Do you understand right now?

Conclusion

Real World Assets are new form of investment assets accessible on global markets. It’s difficult not see all of good things what they are bring for investors and sellers.

They are creating opportunities on both sides of selling transaction. It’s win-win situation. Beside that, they are part of bigger digital transformation. Tokens representing new ownership are transparent and secure located on blockchain.

You may like RWA or not. It’s not a point. It seems it’s just a matter of time when business all around the world take next step into full digitalization. Real World Assets are important part of it.

Leave a Reply

You must be logged in to post a comment.