Introduction

Indeed, cryptocurrency Maker (MKR) is a revolutionary smart contract platform built on the Ethereum blockchain. It aims to address the issue of volatility in the crypto market and provide stability through its collateral-backed cryptocurrency, called DAI Stablecoin.

In this article, I will write about the concept of Maker crypto, its unique features. Finally, I explain how it functions to create a more secure and predictable financial system.

Please read it, comment it and share!

Understanding Maker and DAI

Maker (MKR) serves as the governance token for the Maker Protocol, which powers the DAI Stablecoin. DAI is a decentralized digital currency that is designed to maintain a stable value by being pegged to the US dollar.

It achieves this stability through a system of smart contracts known as Collateralized Debt Positions (CDPs). Users can leverage their Ethereum assets to generate DAI, which can then be used for various purposes such as payments, savings, or investments.

The Dual Coin System

The Maker platform operates on a unique dual coin system, with Maker coin (MKR) and DAI Stablecoin serving different purposes. MKR is a utility token that plays a vital role in governing the platform and managing the stability of DAI.

It is used to pay fees associated with generating DAI, and each time fees are paid, MKR tokens are burned, reducing the token supply. MKR holders also have the right to vote on risk management and the overall direction of the Maker system.

On the other hand, DAI Stablecoin is the collateral-backed cryptocurrency that maintains its value by being pegged to the US dollar. It is used for transactions, savings, and as a store of value. The value of 1 DAI is always equivalent to 1 USD, providing stability and predictability in an otherwise volatile market.

How Maker Works

The Maker Protocol utilizes smart contracts called Collateralized Debt Positions (CDPs) to generate DAI. Users deposit their Ethereum assets as collateral into these CDPs and generate DAI against the value of their collateral. The collateral remains locked in the CDP until the user repays the debt, at which point they can withdraw their collateral.

It’s important to note that the value of the collateral assets is always higher than the value of the DAI generated. This ensures that the system remains secure and that the collateral can cover any potential losses in value.

The Maker platform also incorporates risk parameters such as debt ceilings, stability fees, liquidation ratios, and liquidation penalties to manage the risks associated with the collateralized assets.

The Role of MKR Token

One of the key aspects of Maker is its decentralized governance system. MKR token holders have the power to vote on proposals and decisions that affect the Maker Protocol and the DAI Stablecoin. This includes voting on which cryptocurrencies can be accepted as collateral, setting risk parameters, adjusting the stability fees, and selecting oracles to provide real-time market data.

The governance process ensures that the Maker community has a say in the development and management of the protocol, making it a truly decentralized and community-driven platform. The voting power of each MKR token holder is proportional to the size of their stake, encouraging active participation and responsible decision-making.

Advantages of Maker Crypto

Stability and Predictability

One of the main advantages of Maker crypto is its ability to provide stability and predictability in the volatile world of cryptocurrencies. DAI Stablecoin’s peg to the US dollar ensures that its value remains steady, allowing users to transact and hold assets without the fear of sudden price fluctuations.

This stability makes DAI an attractive option for individuals and businesses looking for a reliable digital currency.

Decentralized Governance

The decentralized governance model of Maker sets it apart from traditional financial systems. By allowing MKR token holders to participate in decision-making, Maker ensures that the platform’s development and direction are driven by the community. This fosters transparency, accountability, and innovation, making Maker a truly democratic financial ecosystem.

Accessibility and Inclusivity

Maker aims to create a more inclusive financial system by providing access to banking services for individuals and businesses around the world. With Maker, anyone can leverage their assets to generate DAI and participate in the global economy, regardless of their location or financial background.

This opens up opportunities for financial inclusion and economic empowerment on a global scale.

Maker Price in Depth

What does it look like in the case of the Maker DAO project?

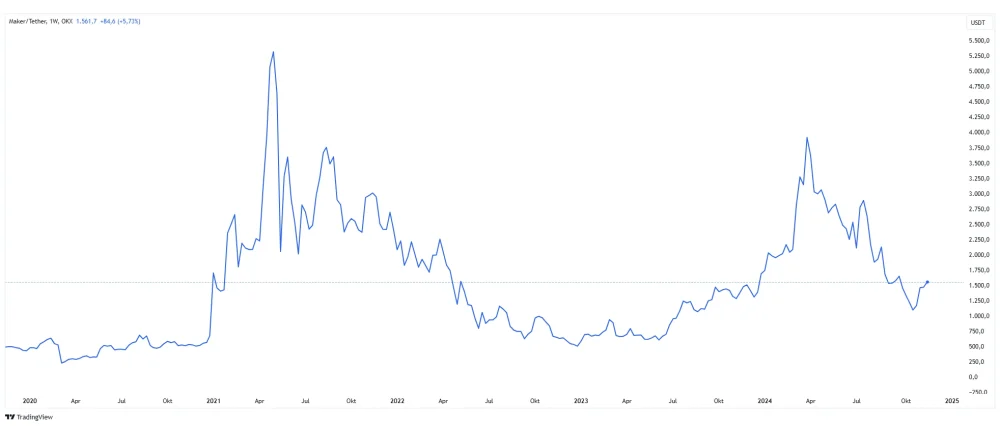

Bull market, bear market and the current boom. On the stock exchanges since March 2020 – that’s over 4 years.

I will now describe the pricing behaviour of this project.

1st Bear Market

I will start, as always, with an analysis of the initial price and then describe how much you could earn. Of course, if something interesting comes to my mind while writing, I’ll add it. Here I go! Starting price is close to $1,090 per unit! Wow, I’m surprised when I write this. It is rare to come across a project whose initial price is so high. This is a fact, not my observations!

Either way, the price continued to rise for almost a month, and the cryptocurrency market was already at the beginning of a bear market. In fact, one could write about a very short boom in this project, but since there was already a bear market on the entire market, I will assume that the price increased due to the enthusiasm of the new project!

And then there was a time of decline, just like for the rest of the cryptocurrencies. Bitcoin was already in this trend even before the project was listed on the exchanges!

The price rose to $1,800 and then went into a downward trend.

During the first 3 months, the price dropped with great momentum.

In April it was already at the level of $500! Wait, wait, it’s not over yet. October 2018 is already $310. It was the last local bottom, but not ATL!

The lowest price was recorded on March 16, 2020 and it was $168! Oh well. This was the moment when the trend turned into an upward trend.

1st Bull Market

The first bull market is the price momentum in almost 1 year.

The price reversed from $168 and then soared to $6,070 per unit. Pretty good for almost 1 year. Price multiplier times 36.

Well, really good, but… if you look around carefully, you could pay less for the project and earn more (this is a fact!)

Hereby, the project paid off for wise investors.

2nd Bear Market

The bull market has been down for nearly 18 months.

The bottom of the bear market is the price of $500. Oh well! From 6000k per unit to 500 to drop times 12. Ouch.

Such falls make you jump out of your seat!

Welcome to the cryptocurrency market!

The strongest declines were recorded in the first six months!

Well, there’s nothing to be surprised about…

2nd Bull Market

Since the beginning of January 2023, it could be said that the price has been in an upward trend. Without a doubt! The current price is $1,620 per unit, while at the beginning of January 2023 the price was approximately $510.

Also, in 2 years the price increased almost 3 times, and in March it was already at the level of $4,000.

There has been a correction and now we are at the previously mentioned level of $1,620!

The Future of Maker Crypto

In fact, Maker is well-positioned to play a significant role in shaping the future of decentralized finance. With its stable and reliable DAI Stablecoin, Maker offers a viable solution to the issue of volatility in the cryptocurrency market. The growing ecosystem of apps and services integrating DAI demonstrates its increasing adoption and potential for widespread use.

Maker’s commitment to decentralized governance and community-driven decision-making ensures that it will continue to adapt and innovate in response to the changing needs of its users. In year 2024 project rebrand to Sky Money as next generation DeFi.

As the technology and infrastructure supporting Maker crypto continue to mature, it has the potential. Potential to become a leading player in the global financial landscape. Project offering a secure and accessible alternative to traditional banking systems.

Conclusion

Maker crypto and the DAI Stablecoin present a ground-breaking solution to the issue of volatility in the crypto market. By leveraging Ethereum assets and utilizing smart contracts, Maker provides stability, predictability, and accessibility in the form of DAI.

As a matter of fact, Maker is poised to revolutionize the way we transact, save, and invest in the digital age. As the future of finance unfolds, Maker stands as a beacon of innovation, empowering individuals and businesses to take control of their financial destinies.

From investment perspective it’s really interesting project and one of the leaders in this DeFi subsector. One more thing, price behaviours looks really good. At least, that showing graphs.

Without doubt, taking closer look on this project is productively spend time!

Leave a Reply

You must be logged in to post a comment.