Introduction

In the world of cryptocurrency, HEX crypto has become a hot topic, sparking debates about its potential as an investment. As more people look for ways to grow their wealth, understanding what HEX is and how it works is crucial. We’ve seen the HEX price today fluctuate, leaving many wondering if it’s a smart financial move or just another digital coin to avoid.

I’ll explore the ins and outs of HEX crypto in this article. Then, take a look at what makes it unique, why some see it as a promising investment, and the risks involved. Finally, I’ll also address the big question on everyone’s mind: Is HEX a legitimate investment or a scam?

By the end, you’ll have a clearer picture to help you make an informed decision about HEX.

Please read it, comment it and share it!

What is HEX?

Definition and basic concept

HEX crypto is a blockchain-based digital currency that aims to revolutionize the concept of traditional certificates of deposit (CDs). Launched in December 2019, HEX operates on the Ethereum network as an ERC-20 token. It’s designed to be a store of value and a decentralized finance (DeFi) alternative, offering users the chance to earn high returns through a unique staking mechanism.

The primary goal of HEX is to provide a more efficient and rewarding way to save money compared to traditional banking products. By leveraging blockchain technology, HEX allows users to become their own bank, eliminating the need for intermediaries and potentially offering higher yields than conventional savings accounts.

How HEX works

HEX uses a hybrid consensus algorithm that combines elements of Proof-of-Work (PoW) and Proof-of-Stake (PoS). This approach, often referred to as “Proof-of-Wait,” rewards users for holding their tokens for extended periods. Here’s how it works:

- Staking: Users can stake their HEX tokens by committing them for a fixed period, ranging from 1 to 5,555 days (about 15 years).

- T-Shares: When staking, users receive T-Shares, which accrue daily interest in HEX. The longer the stake and the more HEX locked up, the more T-Shares a user receives.

- Rewards: Upon completion of the staking period, users get back their initial investment plus interest paid in HEX tokens. The reward system is designed to increase the value of HEX over time.

- Penalties: To discourage early withdrawals, the HEX smart contract imposes penalties on users who end their stakes prematurely.

The HEX price today fluctuates based on market demand and the overall crypto market conditions. However, the staking mechanism is designed to create scarcity and potentially drive up the value of HEX tokens.

Key features

HEX crypto boasts several unique features that set it apart from other cryptocurrencies:

- Time-locked deposits: HEX may be the first financial product to offer true time-locked deposits for up to 15 years, making it a potentially attractive option for long-term savers.

- Inflation distribution: HEX has a maximum annual inflation rate of 3.69% after the first year, which is distributed among stakers rather than miners.

- Speculative stickiness: The staking mechanism encourages users to hold their tokens for longer periods, potentially reducing market volatility.

- Transparent supply: HEX provides a unique chart of its future locked supply, offering users insight into potential market dynamics.

- Low energy consumption: Unlike Bitcoin’s energy-intensive PoW system, HEX’s consensus mechanism is more environmentally friendly.

- Self-minting rewards: Stakers mint their own rewards when they end their stake, putting users in control of their earnings.

While HEX offers innovative features and potential high returns, it’s important to note that it’s still an experimental project. As with any cryptocurrency investment, thorough research and understanding of the risks involved are crucial before deciding to invest in HEX crypto.

The Investment Case for HEX

Potential returns

We’ve seen the HEX price today fluctuate, but many investors are drawn to its potential for high returns. HEX’s unique design aims to serve as a blockchain-based Certificate of Deposit, offering users a chance to earn interest through a decentralized staking mechanism. This innovative approach has caught the attention of those looking to grow their wealth in the crypto space.

The staking rewards in HEX are designed to be more attractive than traditional savings accounts. By locking up their HEX tokens, users can potentially earn significant interest. The system is set up to reward long-term holders, with longer stakes often resulting in higher yields. This feature has made HEX an interesting option for investors seeking passive income in the cryptocurrency market.

Staking mechanism

HEX’s staking mechanism is at the heart of its investment appeal. When users stake their HEX, they’re essentially locking up their tokens for a set period. This process is similar to a time deposit in traditional banking, but with potentially higher rewards.

The staking system uses a ‘Share Rate’ that favors early adopters. The earlier you stake, the more shares you can get for the same amount of HEX. As more users join and stake their tokens, the share rate increases. This setup aims to reward those who commit to the project early and for longer periods.

One unique aspect of HEX staking is the penalty system for early unstaking. If someone ends their stake before the agreed-upon time, a portion of their staked amount is distributed to those still staking. This feature is designed to encourage long-term commitment and potentially increase rewards for loyal stakers.

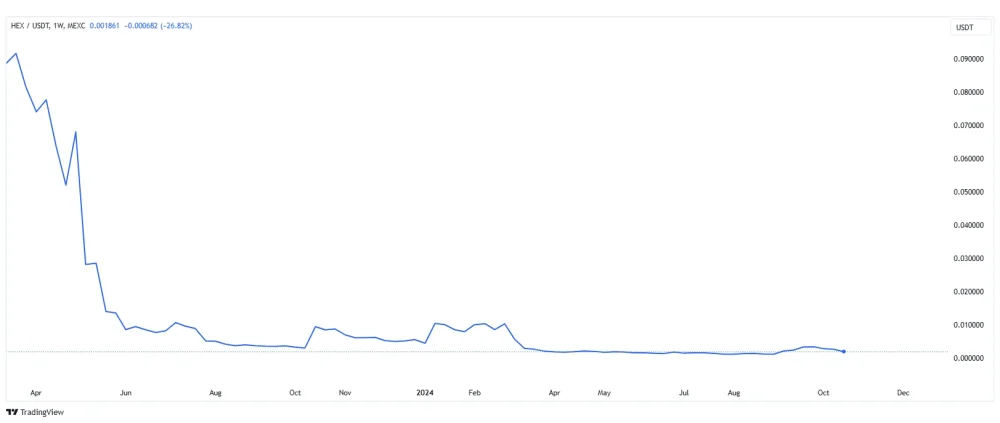

Price performance history

Looking at the HEX price history, we can see that it has had its ups and downs. The highest price paid for HEX was USD 0.51, recorded on September 19, 2021. Compared to that all-time high, the current price is significantly lower, showing a decrease of over 99%.

On the flip side, the lowest price recorded for HEX was USD 0.00 on January 5, 2020. From this all-time low, the current price represents an increase of over 4,000%. This wide range in price performance highlights the volatile nature of cryptocurrency investments.

It’s worth noting that in its first two years, HEX made headlines by outperforming Bitcoin in terms of value appreciation. However, like many cryptocurrencies, HEX has experienced significant price fluctuations. These price swings can present opportunities for traders but also carry substantial risks.

The investment case for HEX is built on its innovative staking mechanism, potential for high returns, and unique features designed to encourage long-term holding. However, as with any investment, especially in the volatile world of cryptocurrencies, it’s crucial to carefully consider the risks and do thorough research before making any financial decisions.

HEX Price in Depth

Just as you see. The HEX project turned out to be a one-cycle bull market project. There is no indication that the next bull market will bring similar profits as the previous one.

By the way, the project has been rebranded to Pulsechain, but I won’t write about it today.

The price, of course, was inflated to around $0.51 per unit before listing on the stock exchanges. The current price per unit is within 99.6% of All Time High.

We are no longer in a bear market. The price actually shows what a project HEX was.

I will not comment and leave it to the readers to judge.

Just add that a similar story happened with LUNA, FTX and other such projects.

Risks and Criticisms

We’ve seen the hex price today fluctuate wildly, which brings us to one of the main concerns surrounding this cryptocurrency. Like many digital assets, HEX faces several challenges that potential investors should be aware of before deciding to put their money into it.

Volatility concerns

The cryptocurrency market is known for its high volatility, and HEX is no exception. In fact, HEX has shown extreme price swings that can be unsettling for many investors. Over the past year, HEX’s value dropped by a staggering 63%, while Bitcoin saw a 67% increase during the same period. This stark contrast highlights the unpredictable nature of HEX’s price movements.

Even more concerning is HEX’s long-term performance. Over a two-year span, HEX underperformed Ethereum by almost 94%, despite being considered a riskier investment. This underperformance raises questions about HEX’s ability to deliver on its promises of high returns.

Centralization issues

One of the core principles of cryptocurrencies is decentralization, but HEX has faced criticism for potentially centralized aspects of its ecosystem. The project’s founder, Richard Heart, plays a significant role in HEX’s operations and marketing, which some view as a centralization risk.

Moreover, HEX’s relationship with the Ethereum network has raised concerns about potential security vulnerabilities. Some users worry that centralization on the Ethereum network could compromise the integrity of the HEX ecosystem.

Regulatory uncertainties

The regulatory landscape for cryptocurrencies is still evolving, and HEX faces its share of legal challenges. In a significant development, the U.S. Securities and Exchange Commission (SEC) has filed a lawsuit against Richard Heart, accusing him of selling unregistered securities and defrauding investors.

The SEC alleges that Heart raised over $1 billion through unregistered securities offerings and misappropriated at least $12 million of investor funds for personal luxury purchases. These accusations have cast a shadow over HEX’s legitimacy and future prospects.

The regulatory uncertainties surrounding HEX extend beyond the U.S. As global authorities grapple with how to regulate cryptocurrencies, HEX and similar projects face an uncertain future. This regulatory ambiguity adds another layer of risk for potential investors.

In light of these risks and criticisms, it’s crucial for anyone considering an investment in HEX crypto to conduct thorough research. The project’s controversial nature, combined with its volatile price history and regulatory challenges, makes it a high-risk investment. As with any cryptocurrency, potential investors should be prepared for the possibility of significant losses and never invest more than they can afford to lose.

Is HEX a Scam or Legitimate Investment?

We’ve seen the hex price today fluctuate wildly, leaving many to question whether HEX crypto is a legitimate investment or a sophisticated scam. To address this concern, we need to analyze common allegations, examine transparency efforts, and evaluate community adoption.

Analyzing common scam allegations

HEX has faced numerous accusations of being a scam or Ponzi scheme since its inception in 2019. Critics point to the founder’s background and aggressive marketing tactics as red flags. Richard Heart, HEX’s creator, has acknowledged using “tactics a scam might use” in promoting the project. This admission, combined with promises of improbably high returns, has raised eyebrows in the crypto community.

The project’s design, which encourages long-term staking with penalties for early withdrawal, has also come under scrutiny. Some view this as a mechanism to lock up funds and artificially inflate the token’s value. However, HEX proponents argue that this feature promotes “delayed gratification” and “generational wealth.”

Transparency and audits

To address concerns, HEX has taken steps toward transparency. The project underwent audits by CoinFabrik and Chainsecurity, with reports available on their website. These audits found no critical security issues, though minor problems were identified and addressed.

HEX’s smart contracts are public, allowing anyone to verify the code. This openness is a positive sign, as it enables independent scrutiny of the project’s technical foundations. However, transparency in code doesn’t necessarily guarantee the legitimacy of the investment proposition.

One concerning aspect is the concentration of HEX tokens. Reports suggest that the founder controls a significant portion of the supply, potentially up to 90%. This level of centralization poses risks to the ecosystem’s stability and fairness.

Community and adoption

HEX has cultivated a dedicated community of supporters who actively promote the project across social media platforms. This grassroots marketing has contributed to the project’s visibility and adoption. However, critics argue that this enthusiasm resembles the behavior seen in other controversial crypto projects.

The HEX ecosystem includes tools like HEXFire.io, which provides detailed insights into network dynamics. These platforms offer transparency in stake observations and community growth statistics, potentially fostering trust among users.

Despite community support, HEX has faced significant challenges. The U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Richard Heart in July 2023, accusing him of selling unregistered securities and defrauding investors. This legal action has cast a shadow over HEX’s legitimacy and future prospects.

In conclusion, while HEX crypto has implemented some measures to appear legitimate, such as code audits and transparency tools, it continues to face serious allegations and regulatory scrutiny. The project’s aggressive marketing, centralized token distribution, and ongoing legal issues raise significant red flags. Potential investors should approach HEX with extreme caution, conducting thorough research and understanding the high risks involved before considering any investment.

Conclusion

HEX crypto stirs up a mix of hope and worry in the digital money world. It promises big rewards through its unique staking system, but also brings risks like wild price swings and legal troubles. The project’s openness with its code is good, but concerns about who controls most tokens and ongoing lawsuits cast a shadow on its future.

In the end, HEX is a risky bet that needs careful thought. Its bold claims and devoted fans clash with serious doubts about its long-term value. For anyone thinking about putting money into HEX, it’s crucial to look closely at both sides, understand the risks, and never risk more than you can afford to lose. The crypto world moves fast, so staying informed is key to making smart choices.

Leave a Reply

You must be logged in to post a comment.