What is Decentraland?

Decentraland is a virtual reality platform built on the Ethereum blockchain, at first. This platform allows their users to create, explore, and monetize digital content of course.

In fact, it’s a decentralized metaverse where users can buy and sell virtual land. Maybe you want to build and experience virtual reality applications, and interact with others in a virtual environment, so here you are.

The platform is powered by the MANA coin, which serves as the native cryptocurrency of Decentraland.

An Overview of the MANA Coin

The MANA coin is an ERC-20 token that is used within the Decentraland ecosystem.

It serves multiple purposes, including the purchase of virtual land, but not only.

Firstly, in this projct you creation and trading of digital assets, or participate in the governance of the platform.

Secondly, MANA can be bought and sold on various cryptocurrency exchanges, for sure.

Overall, its price is determined by supply and demand dynamics in the market.

Factors Influencing the MANA Coin Price

There are several factors that can influence the price of the MANA coin.

One of the main factors is the demand for virtual land and digital assets within the Decentraland platform. As more users join the platform and engage in buying and selling virtual assets, the demand for MANA increases, which can drive up its price.

Additionally, developments and updates to the Decentraland platform can also impact the price of MANA.

Another factor that can influence the MANA coin price is the overall sentiment in the cryptocurrency market.

Cryptocurrencies are known for their volatility, and the price of MANA can be affected by market trends and investor sentiment.

For example, if there is a general positive sentiment in the cryptocurrency market, investors may be willing to buy MANA. Then, it can lead to an increase in its price.

Regulatory developments and government policies related to cryptocurrencies can also impact the price of MANA.

Changes in regulations or restrictions on cryptocurrencies can affect the overall market sentiment and investor confidence.

Historical Price Movements of MANA

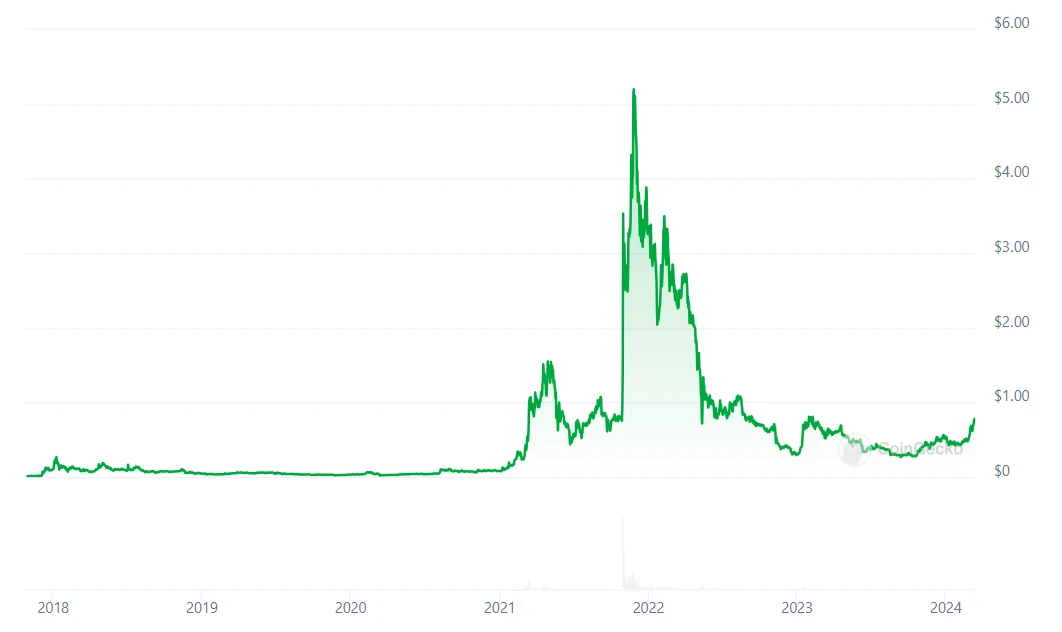

The price of MANA has experienced significant fluctuations since its launch in 2017.

In the early days, the price was relatively stable, but as the popularity of the Decentraland platform grew, the price started to rise. In December 2017, during the peak of the cryptocurrency bull run, the price of MANA reached an all-time high.

However, like many other cryptocurrencies, MANA also experienced a significant price correction in the following months.

Since then, the price of MANA has been subject to market trends and investor sentiment.

It has experienced both periods of growth and decline, reflecting the overall volatility of the cryptocurrency market. It is important for investors to understand the historical price movements of MANA in order to make informed decisions about buying or selling the coin.

Understanding the Impact of Decentraland

Decentraland has the potential to have a significant impact on the cryptocurrency market.

As a decentralized virtual reality platform, it offers a unique and innovative way for users to engage with digital content and assets.

The concept of virtual land ownership and digital asset trading has the potential to disrupt traditional industries and create new opportunities for investors and content creators.

The success of Decentraland and the adoption of its platform could attract more users to the cryptocurrency market and increase overall interest in blockchain technology.

As more people become familiar with the concept of virtual reality and digital assets, the demand for cryptocurrencies like MANA could increase, leading to a positive impact on its price.

Furthermore, Decentraland’s open and decentralized nature aligns with the core principles of blockchain technology.

By empowering users to own and control their digital assets, Decentraland promotes a more transparent and equitable digital economy. This can attract investors who value decentralization and seek to support projects that align with their principles.

How to Analyze the MANA Coin Price

Analyzing the MANA coin price requires a combination of fundamental and technical analysis.

Fundamental analysis involves evaluating the underlying factors that can influence the price of MANA, such as the demand for virtual land, the adoption of the Decentraland platform, and the overall sentiment in the cryptocurrency market.

Technical analysis, on the other hand, involves studying historical price data and using chart patterns, indicators, and other tools to identify trends and make predictions about future price movements.

Traders and investors often use technical analysis to determine entry and exit points for their trades and investments.

It is important to note that analyzing the MANA coin price, like any other cryptocurrency, involves a certain degree of risk and uncertainty. The cryptocurrency market is highly volatile and influenced by various external factors.

Therefore, it is advisable to conduct thorough research and consult with financial professionals before making any investment decisions.

Decentraland Price in Depth

1st Bull Market

The starting price was very bargain, $0.01 per unit. But who knew about virtual reality back then?

Either way, the price jumped to $0.25 per unit in almost 2 months.

Right at the end of the bull market in the cryptocurrency market.

The project was listed at the end of the bull market, and why? Please draw your own conclusions, because it is quite obvious.

1st Bear Market

The bear market lasts a year and the price drops to $0.035 per unit.

It’s the beginning of 2019, but the price shows even greater losses in March 2020, i.e. before the start of a strong market boom.

Case?

The loss in the bear market is as it should be, i.e. 95-99% in the case of cryptocurrencies with low market capitalization.

At that time, the project was listed somewhere in the top 200 projects with capital size.

2nd Bull Market

2 Cryptocurrency bull market has had ups and downs for almost 2 years, but at the peak we have a price of $5.20 per unit.

If you look at the price before the bull market, i.e. $0.035, you could have made a lot of money.

However, I want to mention that you should never try to catch only the price bottom and the price top.

Even the best analysts and traders fail to do this, and it’s all due to market dynamics, but…

If you buy a project 10-20 percent from the bottom and sell it 10-20 percent to the top, what will happen?

You will earn a lot, or you can stick with the HODL strategy.

However, this works better for more mature projects.

2nd Bear Market

Speaking of, 2 bear markets. Declining once again for almost a year.

The price lands at $0.30 per unit. Uuuuu…

Being a HODLer is not easy, and if you escaped the market in time, congratulations. 99% loss on price during a bear market, but that’s nothing new.

Predictions for the MANA Coin

Predicting the future price of the MANA coin and the success of Decentraland is challenging due to the unpredictable nature of the cryptocurrency market.

However, there are several factors that could potentially contribute to the future growth and adoption of Decentraland.

Firstly, the increasing popularity of virtual reality and digital assets could drive more users to the Decentraland platform.

As more people become interested in virtual reality experiences and the ownership of virtual assets, the demand for MANA could increase, leading to a potential increase in its price.

Secondly, continued development and updates to the Decentraland platform could attract more users and developers. Decentraland has a vibrant community of creators and developers who are constantly building new experiences and applications on the platform. The introduction of new features and partnerships could further enhance the value proposition of Decentraland and drive adoption.

Lastly, the regulatory landscape for cryptocurrencies could also play a role in the future of Decentraland and the MANA coin.

Favorable regulations and clear guidelines for virtual reality platforms and digital assets could attract more institutional investors and mainstream adoption, which could have a positive impact on the price of MANA.

Investing in Decentraland

Investing in Decentraland and the MANA coin requires careful consideration and a long-term perspective, but first of all you should know why you want to invest in.

You are probably already aware of how volatile the cryptocurrency market is.

In fact, this is one of the characteristics of this market. Investing without a fundamental assessment of the investment usually ends with selling it in the worst period of the investment, i.e. when the price per unit drops to low levels.

Risks and Challenges

While Decentraland and the MANA coin offer exciting opportunities, there are also risks and challenges that investors should be aware of. These include:

Regulatory uncertainty

The regulatory landscape for cryptocurrencies is still evolving, and changes in regulations could impact the future of Decentraland and the MANA coin. It is important to stay informed about regulatory developments and assess the potential impact on your investments.

Market volatility

Cryptocurrencies are known for their price volatility, and the MANA coin is no exception. The price of MANA can experience significant fluctuations in a short period of time, which can result in potential losses for investors.

Adoption challenges

While Decentraland has gained traction and has a growing user base, widespread adoption of virtual reality platforms and digital assets is still in the early stages. The success of Decentraland and the MANA coin depends on broader market adoption and the ability to attract users and developers to the platform.

Technology risks

Like any blockchain-based project, Decentraland is subject to technological risks, including security vulnerabilities and scalability challenges. It is important to assess the technical aspects of the platform and the measures taken to mitigate these risks.

Conclusion

Decentraland and the MANA coin have the potential to revolutionize the way we interact with digital content and assets, in fact. The platform offers a unique and immersive virtual reality experience, at first. Within, MANA coin serves as the fuel that powers the ecosystem, surely.

While investing in Decentraland and the MANA coin comes with its own set of risks and challenges, but …

The potential for growth and adoption is significant, because virtual reality sector will constantly develop. As a consequence, Decentraland could become an important player in the sector.

However, it is important to approach investments in Decentraland and the MANA coin with caution and conduct thorough research. The cryptocurrency market is highly volatile, and it is advisable to consult with financial professionals and diversify your investment portfolio.

In fact, investing in Decentraland and the MANA coin could offer exciting opportunities for investors.

Leave a Reply

You must be logged in to post a comment.