Introduction

In the dynamic world of digital currencies, Bitcoin Cash has carved out a distinct identity as a peer-to-peer electronic cash system.

Emerging from the Bitcoin blockchain through a hard fork in 2017. Then, this cryptocurrency has garnered significant attention for its innovative approach. I mean the way how to addressing the scalability challenges.

In this article, I write about Bitcoin Cash. I explain the unique features, the historical context, technical aspects, price in depth and little bit more.

Please enjoy your reading and leave comment at the first place!

What is Bitcoin Cash?

Bitcoin Cash is a decentralized digital currency that was created as a result of a hard fork from Bitcoin blockchain. All thigs happen in August 2017.

The primary motivation behind the creation of project was to address the scalability issues! They had plagued the Bitcoin network, which had led to increasingly longer transaction times and higher fees.

The Bitcoin Cash network was designed to offer faster transaction processing and lower fees. The goal of making it a more practical and accessible payment solution for everyday transactions.

The Origins of Bitcoin Cash

The story of Bitcoin Cash can be traced back to the early days of Bitcoin.

As Bitcoin gained traction and adoption grew, the network began to face challenges.

One of them was ability to handle the increasing number of transactions. This led to a debate within the Bitcoin community about the best way to address these scalability issues.

On one side of the debate were those who advocated for increasing the block size limit. It would allow the network to process more transactions per block.

On the other side were those who favoured the implementation of a technology called SegWit (Segregated Witness). This solution would address the scalability problem through a different approach.

The inability to reach a consensus on the way forward ultimately led to a split in the Bitcoin community. Group of developers, miners, and users deciding to create a new cryptocurrency – Bitcoin Cash – that would implement the larger block size solution.

Key Features of Bitcoin Cash

The primary distinguishing feature of Bitcoin Cash is its larger block size. It was initially set at 8 MB and has since been increased to 32 MB.

This allows the network to process more transactions per block. As a result there are faster transaction times and lower fees compared to the original Bitcoin network.

In addition to the increased block size, Bitcoin Cash also features a different approach to the mining process. Known as the “Difficulty Adjustment Algorithm.”

This algorithm adjusts the mining difficulty based on the network’s hash rate. Ensuring that blocks are produced at a consistent rate regardless of changes in the number of miners.

Another important aspect of this cryptocurrency is its commitment to decentralization and permissionless innovation.

Bitcoin Cash is developed by a decentralized community of contributors. Each of whom has a say in the direction of the project.

The Benefits of Bitcoin Cash

Bitcoin Cash offers a range of benefits that make it an attractive option for both individuals and businesses. These benefits include:

Fast and Reliable Transactions

With its larger block size, project is able to process transactions more quickly and with lower fees than the original Bitcoin network. This makes it a more practical choice for everyday purchases and payments.

Increased Accessibility

The lower transaction fees associated with Bitcoin Cash make it more accessible to users. Particularly those in developing countries or with limited financial resources.

This aligns with the original vision of Bitcoin as a peer-to-peer electronic cash system that can be used by anyone, anywhere.

Privacy and Anonymity

While Bitcoin Cash does not offer the same level of privacy as some other cryptocurrencies, it still provides more anonymity than traditional financial systems.

This can be particularly appealing for users who value their financial privacy.

Decentralized Development

The decentralized nature of Bitcoin Cash’s development process ensures that no single entity or group can control the direction of the project. This helps to maintain the network’s integrity and resilience in the face of potential threats or interference.

Merchant Adoption

As more merchants and businesses begin to accept Bitcoin Cash as a payment method, the ecosystem around the cryptocurrency continues to grow.

This increased adoption can lead to greater liquidity, stability, and real-world usability for users.

The Adoption of Bitcoin Cash

Since its inception, Bitcoin Cash has seen varying levels of adoption and usage, both among individuals and businesses.

While it has not yet achieved the same level of mainstream recognition as its progenitor, Bitcoin, the cryptocurrency has managed to carve out a dedicated user base and has been embraced by a growing number of merchants and service providers.

Individual Adoption

One of the key drivers of Bitcoin Cash’s adoption has been its appeal to individuals who value the cryptocurrency’s focus on scalability and low fees.

Many users have found Bitcoin Cash to be a more practical and accessible option for everyday transactions, particularly in regions where traditional financial services may be less readily available.

However, the level of individual adoption has been somewhat uneven, with Bitcoin Cash struggling to match the sheer user base and trading volume of Bitcoin.

This can be attributed in part to the first-mover advantage that Bitcoin has enjoyed, as well as the lingering perception among some users that Bitcoin Cash is a mere “fork” or offshoot of the original Bitcoin.

Merchant Adoption

One area where Bitcoin Cash has seen more consistent growth is in the realm of merchant adoption.

Many businesses, particularly those in the e-commerce and online services sectors, have embraced Bitcoin Cash as a payment option, attracted by its lower transaction fees and faster processing times.

This increased merchant adoption has helped to drive the real-world usability of Bitcoin Cash, as users can now utilize the cryptocurrency to make purchases from a growing number of vendors.

Additionally, some merchants have even begun to offer discounts or incentives for customers who choose to pay with Bitcoin Cash, further incentivizing its use.

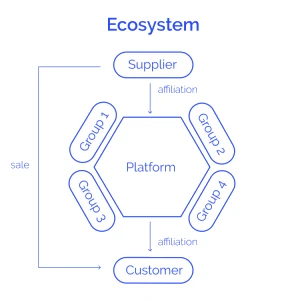

Ecosystem Development

Beyond individual and merchant adoption, the Bitcoin Cash ecosystem has also seen the development of a range of supporting services and applications.

These include wallets, exchanges, and various tools and platforms that enable users to store, trade, and interact with their Bitcoin Cash holdings.

The decentralized nature of Bitcoin Cash’s development has also allowed for a diverse range of projects and initiatives to emerge, each with its own unique focus or approach.

This diversity helps to strengthen the overall ecosystem and ensures that the cryptocurrency remains adaptable and responsive to the evolving needs of its users.

The Technical Aspects of Bitcoin Cash

While the benefits and adoption of Bitcoin Cash are important considerations, it is also crucial to understand the technical aspects that underpin the cryptocurrency’s functionality.

From its consensus mechanism to its block structure and scaling solutions, the technical details of Bitcoin Cash play a crucial role in shaping its capabilities and performance.

Consensus Mechanism

Like the original Bitcoin, Bitcoin Cash utilizes a Proof-of-Work (PoW) consensus mechanism to validate transactions and maintain the integrity of the blockchain.

This means that miners, who use specialized hardware to solve complex mathematical problems, are responsible for verifying and adding new blocks to the chain.

However, Bitcoin Cash has implemented a modified version of the PoW algorithm, known as the “Difficulty Adjustment Algorithm,” which helps to ensure that blocks are produced at a consistent rate, even in the face of fluctuations in the network’s hash rate.

Block Structure

One of the most significant technical differences between Bitcoin and Bitcoin Cash is the size of their respective block sizes.

While Bitcoin has a block size limit of 1 MB (with a block weight limit of up to 4 MB), Bitcoin Cash initially had an 8 MB block size limit, which has since been increased to 32 MB.

This larger block size allows the Bitcoin Cash network to process more transactions per block, resulting in faster transaction times and lower fees.

It also helps to address the scalability issues that had plagued the original Bitcoin network, at least in the short to medium term.

Scaling Solutions

In addition to its larger block size, Bitcoin Cash has also explored various scaling solutions to further enhance its transaction processing capabilities.

These include the implementation of technologies like Schnorr Signatures and the use of off-chain scaling solutions, such as the Lightning Network.

The development of these scaling solutions is an ongoing process, with the Bitcoin Cash community continuously exploring new ways to improve the network’s performance and efficiency.

This commitment to innovation and adaptability is a key strength of the cryptocurrency.

The Challenges Facing Bitcoin Cash

While Bitcoin Cash has made significant strides in addressing the scalability issues that had plagued the original Bitcoin network, it has also faced its own set of challenges and obstacles along the way.

These challenges range from technical hurdles to issues of adoption and perception.

Adoption and Perception

One of the primary challenges facing Bitcoin Cash is the perception among some users that it is merely a “fork” or offshoot of Bitcoin, rather than a distinct and viable cryptocurrency in its own right.

This perception, combined with Bitcoin’s first-mover advantage, has made it challenging for Bitcoin Cash to gain widespread mainstream adoption.

Additionally, the ongoing debate within the cryptocurrency community about the merits of Bitcoin Cash versus Bitcoin has led to a certain degree of polarization, with some users staunchly supporting one cryptocurrency over the other.

This division can make it difficult for Bitcoin Cash to gain traction and build a cohesive user base.

Technical Challenges

While Bitcoin Cash’s larger block size has helped to address some of the scalability issues. that had plagued the original Bitcoin network, the cryptocurrency still faces technical challenges in terms of maintaining the stability and security of its blockchain.

For example, the increased block size has led to concerns about the centralization of the network, as larger blocks may require more powerful hardware to validate and process.

This, in turn, could make it more difficult for smaller miners to participate, potentially leading to a concentration of mining power in the hands of a few large players.

Additionally, the ongoing development of scaling solutions, such as the Lightning Network, has led to some debate within the Bitcoin Cash community about the best approach to improving the network’s performance.

This lack of consensus on the technical roadmap can sometimes hinder the cryptocurrency’s progress.

Bitcoin Cash Price in Depth

5 years of Bitcoin Cash on the cryptocurrency market, 2 booms and 2 bear markets. Well, I almost forgot. Of course, I am writing about the current bull market.

You can visit by yourself source of graph.

1st Bull Market

The listing price is around $770. However, remember that this is a project originating from Bitcoin. The price then drops until mid-October 2017. It stops at around $315 per unit.

Wait, wait…

By the end of the year, the price returned to the strong upward trend ending the bull market. The price stopped at an ATH of $3,785 per unit. Quite a lot.

As you can see in the chart, this price was not reached during the next bull market. Will it be different this time in case of Bitcoin Cash?

By the way, in the first bull market the price skyrocketed 10 times in 2 and a half months!

1st Bear Market

The bear market has arrived.

The price has actually been falling throughout 2018.

Ultimately, it lands at $77 per unit. The price dropped most dynamically in the first stage. In April, the price was already visible $650 per unit.

There was a bear trap in May. The price returned to the upward trend locally, but as I mentioned, it was a trap.

2nd Bull Market

After the first bear market, when the price drop was really dynamic.

Will another bull market restore optimism among investors?

However, before the boom occurs, the price was moving in a sideways trend.

The price of Bitcoin Cash peaked at around $475. Then it dropped to around $180. The sideways trend has ended and the real bull market has returned.

This bull market lasted from March 2020 to March 2021.

This time, the price reached its local peak at $1,550 per unit.

That’s a lot less than $3,785, right?

Certainly, a decline in the strength of the project price suffix is not a good thing.

This is a red flag for me, as I mentioned earlier.

2nd Bear Market

The second cryptocurrency bear market lasted a year and a month.

Just like the first time. The period of the first two months from May to July 2021 was the period of the largest declines.

The price sank to the local bottom at $400.

However, this was not the end of the decline, but earlier the so-called “bear trap”. It can be briefly described as the return of an upward trend in the short term. While there is a downward trend in the longer term.

In mid-July 2022, the price reaches its local bottom. We have almost $100 for the cryptocurrency.

The price enters a sideways trend, which often occurs following a downtrend.

3rd Bull Market

The price was in a sideways trend for a year and a bull market occurred. The current price is $323 per unit.

After a few months you could earn 300%, and the best is yet to come.

Looking at the price behaviour, it can be concluded that the price is lower every time there is a boom.

Is something wrong here?

How can a developing project have a lower price every bull market?

I don’t want to state anything here, but for me this is a red flag.

In fact, if the project develops, the capitalization and the price of the token in the project increase.

Otherwise, the project is not going in the right direction. What makes a project uninventable. It’s one thing if someone wants to trade the project, but I won’t deal with that here.

Conclusion

Bitcoin Cash represents a significant evolution in the world of digital currencies.

It offering a unique approach to addressing the scalability challenges that had plagued the original Bitcoin network. Main focus is on fast, reliable, and low-cost transactions.

Bitcoin Cash has the potential to become a more practical and accessible payment solution for everyday use.

Leave a Reply

You must be logged in to post a comment.