Introduction

The cryptocurrency industry has witnessed significant advancements over the years, surely. One of the most revolutionary developments is the rise of Automated Market Makers (AMMs) without a doubt.

As the name suggests, in reality AMMs are algorithms that automate the process of market making in the cryptocurrency space.

Indeed, AMMs leverage smart contracts and decentralized protocols to provide liquidity and facilitate trading.

In todays article about Automated Market Makers in some details.

Enjoy your reading!

How do AMMs Work?

At first, AMMs function by utilizing mathematical formulas and algorithms to determine the price of a particular cryptocurrency.

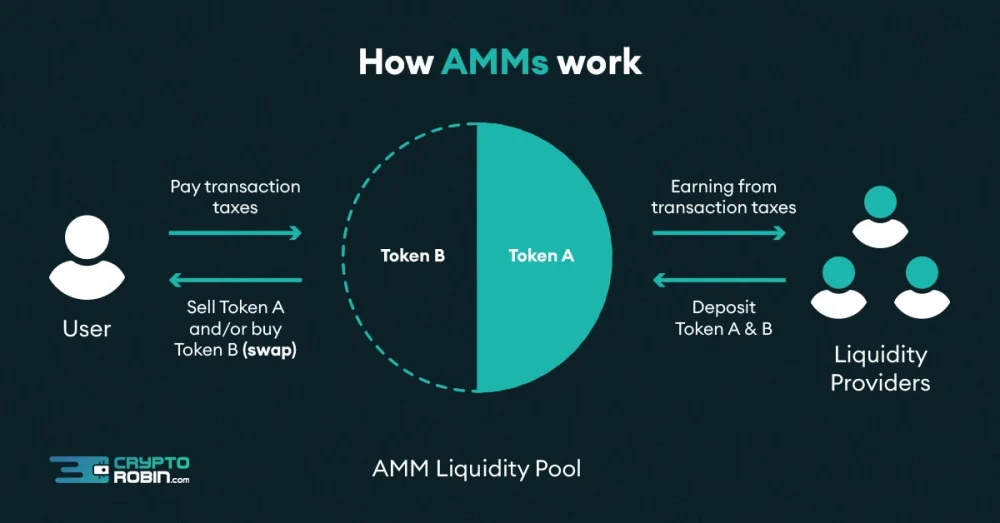

Instead of relying on order books, Automated Market Makers utilize liquidity pools that are created by users who contribute their assets to the pool. These pools serve as reserves for various tokens indeed.

In general, by that allowing traders to buy or sell cryptocurrencies directly from the pool at algorithmically determined prices.

The most common algorithm used by AMMs is the Constant Product Market Maker (CPMM) algorithm, also known as the x*y=k formula.

This formula ensures that the product of the quantities of two tokens in a liquidity pool remains constant.

When a trade is executed, the algorithm automatically adjusts the price.

All of that happen based on the demand and supply of the tokens in the pool, maintaining the constant product.

Isn’t it that great?

AMMs topic is strictly related with Liquidity Pools because they play very important role in whole token transaction and setting up price during exchange.

Of course, about how they do it decide algorithms – one of a few types.

In next subsection couple of words about AMMs types. Let’s still continue enjoy of your exploration.

Types of AMMs

CPMM

A constant product market maker (CPMM) is the first type of Constant Function Market Maker.

CPMM was popularized by the first AMM DEX, Bancor.

CPMMs use the function x*y=k.

This equation establishes a range of prices for two crypto tokens based on the available liquidity.

CSMM

The second type of CFMM is a constant-sum market maker (CSMM).

CSMMs are ideal for zero-price impact trades but do not provide infinite liquidity.

CSMMs follow the function, x+y=k.

CSMM allows arbitrageurs to drain their reserves if the off-chain price between the tokens is not 1:1.

CMMM

The constant-mean market maker is the third type of CFMM.

It enables AMMs to have more than two cryptos, outside the standard 50/50 distribution.

For a liquidity pool of three crypto assets, the equation will be (x*y*z)=k.

This function enables variable exposure to different assets in the liquidity pool.

Hybrid CFMMs

New advanced hybrid CFMMs have emerged as AMM-based liquidity evolves.

Hybrid CFMMs combine multiple functions to achieve specific results, such as a reduced price impact on traders.

Curve AMMs combine CSMM and CPMM using an advanced formula to create more liquidity, bringing down price impacts within a range of trades.

DAMM

Sigmadex leverages Chainlink price feeds using a DAMM model to help dynamically distribute liquidity.

Dynamic automated market makers can become more robust market makers by adapting to changing crypto market conditions. They concentrate liquidity near the market price and increase capital efficiency during periods of low volatility.

They expand during periods of high volatility to protect crypto traders from impairment losses.

There are also another Automated Market Makers like PPM or vAMM. About them maybe next time.

Benefits of AMMs

AMMs have revolutionized the cryptocurrency industry in several ways, offering numerous benefits to traders and investors.

Firstly, AMMs provide liquidity to the market, making it easier for users to buy and sell cryptocurrencies without the need for a centralized exchange.

This increased liquidity improves market efficiency and reduces price slippage, benefiting both small and large traders.

Moreover, Automated Market Makers eliminate the need for intermediaries. Such as brokers or market makers, thereby reducing transaction costs.

Traditional market makers often charge high fees for their services, but AMMs operate on decentralized protocols, allowing users to trade directly with the liquidity pools at minimal costs.

Another significant advantage of Automated Market Makers is their 24/7 availability. Unlike traditional markets that have specific trading hours, AMMs operate round the clock, enabling users from different time zones to access the market at their convenience.

This accessibility has attracted a global user base, contributing to the growth and adoption of cryptocurrencies.

Common Misconceptions About AMMs

Despite their growing popularity, there are some common misconceptions about AMMs that need to be addressed.

One misconception is that Automated Market Makers are prone to manipulation due to their algorithmic nature. While it is true that AMMs are based on mathematical formulas, they are designed to be fair and transparent.

The smart contracts underlying AMMs are open source and audited by the community, ensuring that the algorithms are not manipulated.

Another misconception is that AMMs are only suitable for small-scale trades.

In reality, Automated Market Makers can handle trades of all sizes. While larger trades may have a greater impact on the price due to the algorithmic nature of AMMs, the depth of liquidity in popular AMM protocols has significantly improved, allowing for larger transactions with minimal slippage.

Traditional Market Makers and AMMs

To understand the true potential of AMMs, it is essential to compare them with traditional market makers.

Traditional market makers operate in centralized exchanges and rely on human intervention to provide liquidity. They often have higher fees and require trust in the intermediary.

On the other hand, Automated Market Makers operate on decentralized protocols, eliminating the need for intermediaries and reducing transaction costs.

AMMs also provide continuous liquidity, allowing users to trade at any time.

Additionally, AMMs offer greater transparency as the algorithms governing their operations are open source and auditable.

While traditional market makers may have an advantage in terms of their ability to offer personalized services and handle complex trades, Automated Market Makers are rapidly evolving, and their efficiency and scalability are improving.

As a result, traditional market makers are facing increasing competition from AMMs in the cryptocurrency industry.

The Role of Liquidity Pools in AMMs

Liquidity pools are at the core of the AMM ecosystem, indeed. In fact, these pools are created by users who deposit their assets into the pool, enabling other users to trade against these reserves.

Liquidity providers are incentivized with fees generated from trades executed in the pool.

The success of Automated Market Makers heavily relies on the depth and diversity of liquidity pools.

Deeper pools ensure lower slippage and better price discovery, while diversified pools allow for a wider range of trading pairs.

To attract liquidity providers, AMMs often offer incentives in the form of additional tokens or yield farming opportunities, encouraging users to contribute their assets to the liquidity pools.

Examples of Popular AMM Protocols

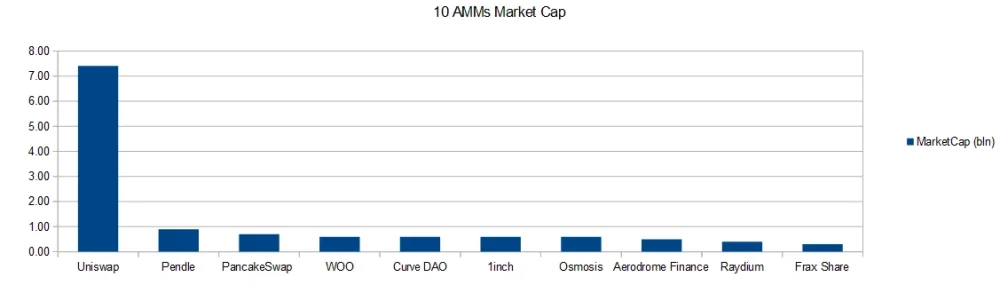

Several popular AMM protocols have emerged in the cryptocurrency industry, each offering unique features and advantages.

One of the most well-known AMM protocols is Uniswap. Built on the Ethereum blockchain, Uniswap allows users to trade ERC-20 tokens directly from their wallets, utilizing liquidity pools created by users.

Another prominent AMM protocol is PancakeSwap, which operates on the Binance Smart Chain.

PancakeSwap offers lower transaction fees compared to Uniswap and has gained popularity among users seeking cost-effective trading options.

SushiSwap is another notable AMM protocol that offers additional features such as yield farming and staking.

SushiSwap aims to provide a community-driven platform that incentivizes participation and rewards users for their contributions to the ecosystem.

In fact what you can easily see it’s Uniswap in huge domination on AMMs market.

Besides that, market capitalization of 9 rest projects from top 10 in AMMs sector can’t even compare themselves to Uniswap capitalizaton. Uniswap is huge leader.

It’s analogical situation like in case of Ethereum in DeFi sector.

Challenges of AMMs

While AMMs have revolutionized the cryptocurrency industry, they are not without their challenges and limitations.

One of the primary concerns is impermanent loss, which occurs when the value of the liquidity provider’s assets changes during their participation in the liquidity pool. Impermanent loss can result in reduced overall returns for liquidity providers compared to simply holding the assets.

Another challenge is the vulnerability to smart contract bugs and exploits.

As AMMs rely on smart contracts for their operations, any vulnerabilities in the code can potentially be exploited by malicious actors.

However, the community has been proactive in auditing and improving the security of AMM protocols to minimize such risks.

Future Trends in AMMs

The future of AMMs looks promising, because ongoing developments aimed at addressing the limitations and expanding the capabilities of these protocols.

One trend is the integration of AMMs with layer 2 scaling solutions, such as Optimistic Rollups and Sidechains. These solutions aim to increase the scalability of AMMs, then allowing for faster transactions and lower fees.

Additionally, the introduction of new token standards, such as ERC-1155, enables the creation of more complex liquidity pools with multiple assets.

This opens up opportunities for Automated Market Makers to support a wider range of trading pairs, for sure, and offer more diverse trading options to users as a matter of fact.

Without a doubt to first generation AMMs belong Uniswap, Curve, Balancer, and rest.

Then, next generation of AMMs are much less popular and still have huge potential to grow.

PancakeSwap and Synthetix are project what worthy to watch.

No discussion about it.

The best if you research those projects by yourself and finally decide if they will be in your investment portfolio.

Conclusion

Automated Market Makers have revolutionized the cryptocurrency industry in fact. Because they are providing efficient and decentralized liquidity solutions.

Through the use of smart contracts and mathematical algorithms, AMMs have significantly improved market accessibility, bit not only… They reduced transaction costs, and increased liquidity as well.

While there are challenges and misconceptions surrounding AMMs, ongoing developments and advancements in the industry are addressing these issues and paving the way for a more inclusive and efficient financial ecosystem.

Leave a Reply

You must be logged in to post a comment.