Exploring Cryptocurrency

As the world becomes more digital, indeed, the need for decentralized finance is increasingly becoming paramount. Without a doubt, cryptocurrencies have been at the forefront of this revolution, with new tokens entering the market every day. One such token that has recently gained popularity is the AAVE cryptocurrency, surely.

In this article, I will explore the AAVE ecosystem, then its advantages, use cases, risks, and its future prospects.

So sit relax and enjoy reading!

Introduction

AAVE cryptocurrency is a decentralized finance protocol that enables lending and also borrowing without intermediaries. It was launched in November 2020, and since then, it has gained a lot of traction in the cryptocurrency market. The protocol was previously known as ETHLend, and it was rebranded to AAVE in September 2020.

In fact, the AAVE protocol is built on Ethereum, and it uses smart contracts to enable lending and borrowing. Its main aim is to provide a decentralized and transparent platform for borrowing and lending, making it possible for anyone to access financial services regardless of their location or social status.

Understanding the AAVE Ecosystem

Firstly, the AAVE ecosystem is made up of different components that work together to provide a seamless lending and borrowing experience. Moreover, the main components of the ecosystem include the AAVE protocol, token, governance, and staking.

The protocol is responsible for the core lending and borrowing functions, while the token is used for governance and staking. The governance component of the ecosystem is used to make decisions on the future direction of the protocol, while the staking component is used to incentivize users to hold and use the AAVE token.

What is AAVE Coin/Token?

The AAVE token is an ERC-20 token that is used to facilitate transactions within the ecosystem. It is used for governance, staking, and after that as a utility token for paying transaction fees. The token is also used for collateral within the AAVE protocol.

In truth, the AAVE token has a total supply of 16 million tokens, and it has a circulating supply of 14.6 million tokens. Then, the remaining tokens are reserved for the team, advisors, and community incentives.

AAVE Tokenomics and Distribution

As a matter of fact, the AAVE token has a unique distribution model that ensures that the community is incentivized to use and hold the token. The distribution model is divided into two following phases. The first phase was the initial distribution, and then the second phase is the ongoing distribution.

The initial distribution was done through an Initial Coin Offering (ICO), where 30% of the total token supply was sold, surely. Indeed, the remaining 70% of the tokens were reserved for the team, advisors, and community incentives.

The ongoing distribution is done through liquidity mining, so users who provide liquidity to the protocol are rewarded with AAVE tokens. Besides this incentivizes users to hold and use the token, helps in the growth and development of the ecosystem.

AAVE Cryptocurrency in DeFi

In fact, AAVE cryptocurrency has several advantages that make it a preferred choice for users looking to access decentralized finance. Some of the following advantages of using this cryptocurrency.

Decentralization

Of course, AAVE is a decentralized protocol that eliminates the need for intermediaries. Then, this means that users can access financial services without the need for banks or other financial institutions.

Transparency

The AAVE protocol is transparent, so all transactions are recorded on the blockchain. Surely, this makes it easy to track transactions and reduces the risk of fraud and corruption.

Accessibility

AAVE is accessible to anyone with an internet connection, so making it possible for people in remote areas to access financial services.

Security

AAVE uses smart contracts to facilitate transactions, then it making it secure and reducing the risk of fraud and errors.

AAVE Cryptocurrency Use Cases

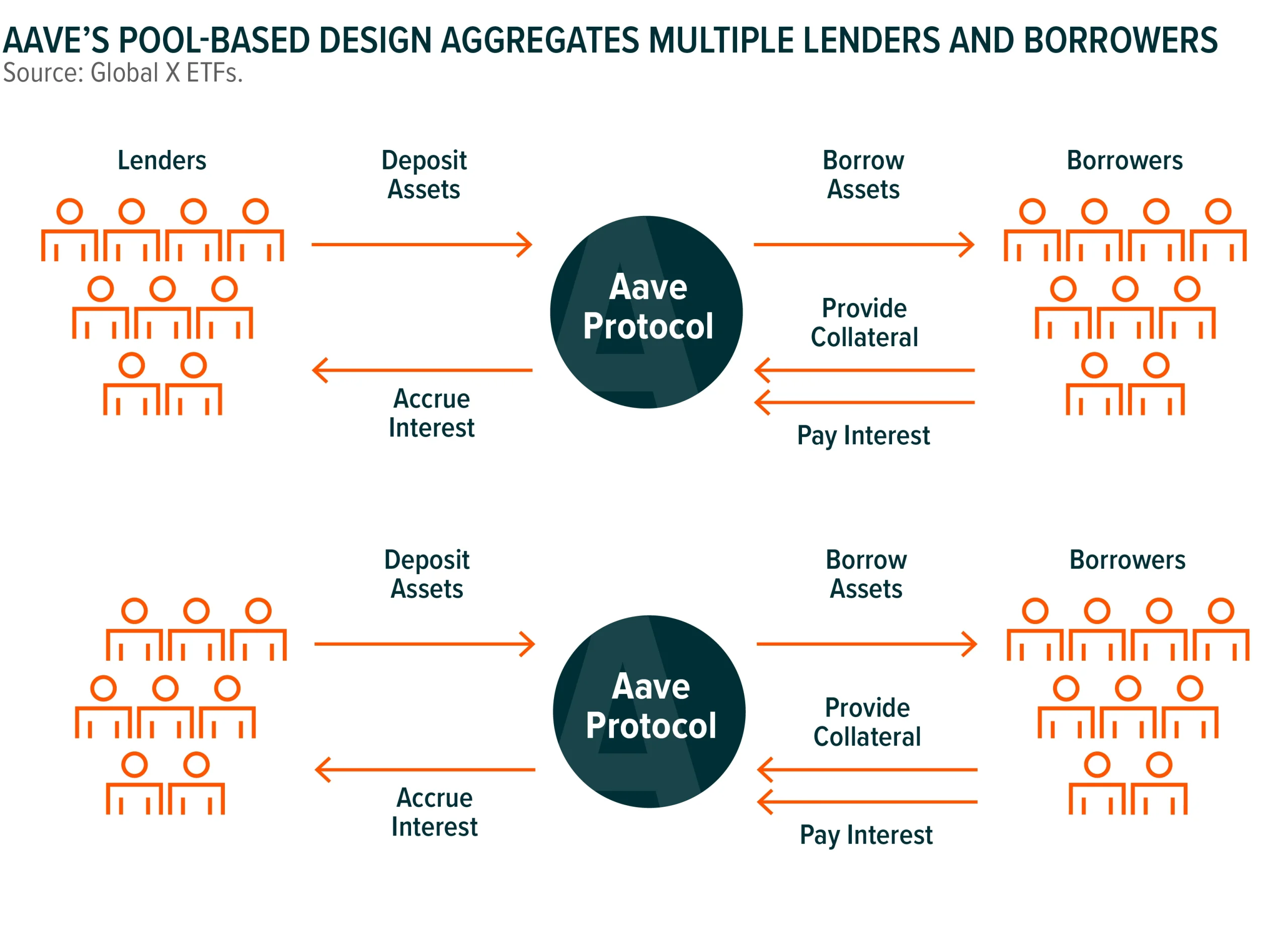

The cryptocurrency has several use cases, surely. In fact, the protocol is designed to support multiple lenders and borrowers.

The protocol is a layer that handles an asset by changing its owner according to a Smart Contract under certain conditions.

Let us remember that AAVE is based on Ethereum and draws from what Ethereum offers as a platform.

Moreover, AAVE is part of the Ethereum ecosystem and also creates its own ecosystem.

De facto, the AAVE ecosystem can be classified as a sub-ecosystem of Ethereum. Sure!

Lending and Borrowing

This cryptocurrency enables lending and borrowing without intermediaries. This allows users to access loans without the need for banks or other financial institutions.

Collateral

The AAVE token is used as collateral within the AAVE protocol, allowing users to borrow against their holdings.

Governance

The AAVE token is used for governance, allowing token holders to make decisions on the future direction of the protocol.

How to Buy and Store AAVE Coin/Token

Buying and storing coin/token is a straightforward process. Users can buy this cryptocurrency on various cryptocurrency exchanges, including Binance, Coinbase, and Kraken. Once purchased, the tokens can be stored in a crypto wallet, either a hardware wallet or a software wallet.

Hardware wallets are more secure, as they store the tokens offline, making it harder for hackers to access them. Some of the popular hardware wallets that support AAVE include Ledger and Trezor. Software wallets, on the other hand, are more convenient, as they are accessible from anywhere with an internet connection.

Some of the popular software wallets that support cryptocurrency include MyEtherWallet and MetaMask.

Risks with Cryptocurrency

Despite the numerous advantages of using AAVE cryptocurrency, there are also risks and challenges associated with it. Some of the risks and challenges include:

Market Volatility

The cryptocurrency market is highly volatile, and the value of cryptocurrency can change rapidly, making it a risky investment.

Smart Contract Risks

AAVE uses smart contracts, which are susceptible to errors and vulnerabilities. A smart contract bug could result in the loss of funds, which could be catastrophic.

Regulatory Risks

The cryptocurrency market is largely unregulated, and there is a risk that regulators could crack down on the use of cryptocurrencies, making it difficult for users to access financial services.

AAVE Competitors and Comparison

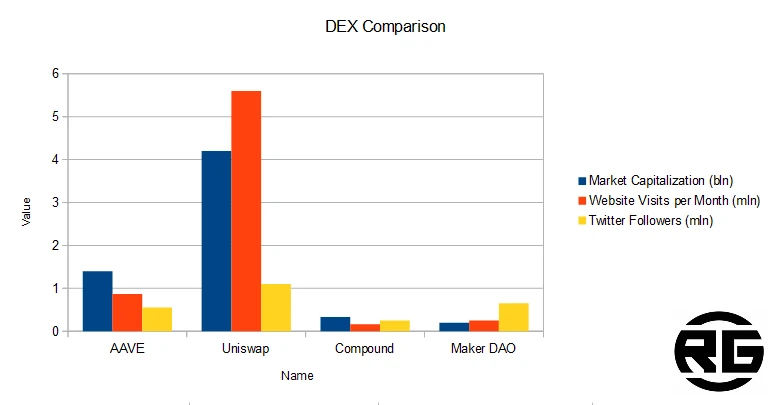

AAVE has several competitors in the decentralized finance space, including Compound, MakerDAO, and Uniswap. These platforms offer similar services to AAVE, but they have different token economics and user interfaces.

Compound, for instance, offers a similar lending and borrowing service, but it uses a different token distribution model. MakerDAO, on the other hand, offers a stablecoin that is pegged to the US dollar, making it a preferred choice for users looking for stability. Uniswap, on the other hand, is a decentralized exchange that enables users to trade cryptocurrencies without intermediaries.

In fact, if we compare DEX projects, Uniswap has no competition at this point.

The advantage is overwhelming. However, the battle is for 2nd place on the market. In this respect, AAVE is doing quite well.

It leaves behind the MakerDAO and Compound projects.

Of course, if I only take into account markers such as market capitalization, the number of page visits and the number of fans of the project on the X platform (former Twitter).

AAVE Price in Depth

AAVE has been on the cryptocurrency market for only 3 years.

This is precisely the time of one bull market, then a bear market.

Well, and the time we currently have on the cryptocurrency market. As I have undoubtedly been calling this time since November 2022, it’s a bull market.

Unlike YouTube experts who try to convince you that the boom is just starting. Consider what their purpose is.

Bull Market

The starting price of AAVE was really high, $26 per unit. This is really high for the cryptocurrency market.

I will only mention that projects such as Bitcoin and Ethereum initially started with prices below a dollar. And that’s a lot.

The price was in an upward trend from November 2020 to August 2021. How many months is that?

Well, about 10 months of a bull market, but what a bull market.

Once again, the project was launched before the mega bull market, i.e. a situation in which retail investors rushed to invest in cryptocurrencies.

The peak price is nearly $662 per unit. For 10 months of growth, it’s still good. An increase of 26 and a half times!!!

And then comes the bear market.

Of course, in the ongoing bull market there were moments of price correction, but I don’t think I need to explain that to anyone.

Bear Market

If we look at the period of price decline, it was the period until the end of 2022.

Which means that capital flowed into the project a little later than larger projects on the cryptocurrency market.

Read Bitcoin and Ethereum!

The bottom price for AAVE was $52 per unit. Which means a loss of 92 – 93%. So nothing new.

A loss that can be expected on the cryptocurrency market. Just don’t say I didn’t warn you.

Future Prospects of AAVE Cryptocurrency

Indeed, the future prospects of AAVE cryptocurrency are promising, as the platform continues to gain popularity in the decentralized finance space. The AAVE team is constantly working to improve the platform, and they have several upgrades and new features planned for the future.

In addition, one of the most significant upgrades planned for the future is the migration from Ethereum to a Layer 2 scaling solution. Then, this will help to reduce transaction fees and improve the speed of transactions. The team is also working on integrating AAVE with other blockchain platforms, including Polkadot and Binance Smart Chain.

Conclusion

AAVE cryptocurrency is a promising platform that has the potential to revolutionize the way we access financial services, indeed. Further, its decentralized and transparent nature makes it an attractive choice for users looking to access decentralized finance.

However, like any other investment, there are risks associated with this cryptocurrency, and users should do their due diligence before investing in the platform.

Overall, AAVE is a platform to watch in the decentralized finance space. Surely, it will be interesting to see how it evolves and competes with other platforms in the future.

Leave a Reply

You must be logged in to post a comment.