Introduction

One of the major concerns associated with cryptocurrencies is their price volatility, indeed. The value of cryptocurrencies can fluctuate dramatically, so stablecoins came to live.

Within a short period, which poses risks for investors and also limits their mainstream adoption.

This is in reality true moment where stablecoins come into play. In this article, I will delve into the world of stablecoins.

Then explore how they impact and stabilize crypto prices. Firstly, let’s start from price volatility explanation.

Understanding Cryptocurrency Price Volatility

Before we dive into the concept of stablecoins. It is essential to understand why cryptocurrency prices are so volatile.

In fact, the volatility of cryptocurrencies can be attributed to various factors.

Including market speculation, lack of regulations, limited liquidity, and also market manipulation.

Especially, these factors contribute to sudden price swings.

For investors it give a hard time to predict and manage their investments effectively.

So, what about those stablecoins ?

In fact, phenomena such as market manipulation occur on the cryptocurrency market.

There are also periods when it is difficult to sell a given asset.

This all, of course, depends on the volume of a given asset.

Finally, it is worth adding that the lack of regulation favors scams and fraud.

Regulations are not always bad, so to say, sometimes they are even necessary to protect stock exchange customers from abuses.

What They Are?

Firstly, they are a type of cryptocurrency designed to minimize price volatility.

By pegging their value to a stable asset.

Such as fiat currencies like the US Dollar or commodities like gold.

Unlike other cryptocurrencies like Bitcoin or Ethereum.

They attempt to maintain a stable value.

That ensuring their price remains relatively constant.

This stability is achieved through different mechanisms.

Such as collateralization, algorithmic control, or a combination of both.

But not only …Stablecoins are assets to open your gates for buying ans selling during bad time on the markets.

Here is, in fact, whole true what I mean by that.

Let’s take in consideration worse time on the market, so many investors evacuate from the market as soon as possible.

Moreover, they even don’t care if they are in lost and they leaving market! Surely, that’s fact for most investors or traders.

So, I have a great news for you! You don’t have be that guy. Read be fuc… loser.

Stablecoins give you that opportunity, but you need to know it and use them in the right time.

This point allowed you to understand what storing value is and making transactions at the right time using stablecoins.

Stablecoins in Portfolio

I forgot to add one more point that is worth mentioning. Stablecoins should always be part of your portfolio.

This is cash in the cryptocurrency market. Not once in a while, but always, stablecoins must be at your disposal.

Because of a few reasons. Access to cheap assets, psychological comfort or even to keep losses smaller when there are large price fluctuations for your other assets.

Here I will suggest another strategy that just came to my mind!

Stablecoins can constitute your entire portfolio during a bear market!!! Why not go out to cash (stabelcoins at this point) when the asset is losing value.

The bear market ends and you return to assets whose prices are depressed and then a bull market begins.

At first it’s weak, and then it gets stronger. In fact, I probably described the mechanism that smart money operates.

In fact, they have huge capital, which you, as an individual investor, do not have. Don’t worry, me too 😉

Consider stablecoins as an asset for storing unchanged value.

Of course, currency changes do occur, but they are usually very small. Holding the value of an asset is an important part of your investment portfolio, obviously.

Of course, this is the equivalent of cash in a more universal investment portfolio.

By the way, when you sell or buy other assets, you use stablecoins.

Keeping stablecoins in your wallet in the amount of at least 30% of your portfolio is a good practice.

Regardless of what others say and write. Keep the limits of your own reason.

Different Types of Stablecoins

There are several following types of them available in the market. In fact, each with its unique approach to maintaining stability.

Firstly, the most common types include fiat-collateralized coins.

Secondly, I should mantion crypto-collateralized stablecoins as well.

Finally finish with algorithmic coins, and commodity-collateralized coins.

What’s more, fiat-collateralized stablecoins are backed by reserves of fiat currency.

The best example is the US Dollar, held in bank accounts.

It could be another currency, but as dollar is world reserves currency.

Crypto-collateralized stablecoins, on the other hand, are backed by other cryptocurrencies.

Algorithmic stablecoins use smart contracts and algorithms to maintain stability.

In the same time, adjusting the supply of coins based on market demand.

Lastly, commodity-collateralized stablecoins are pegged to the value of physical assets like gold or silver.

As the cryptocurrency market is developing, the potential in the stablecoin category has also been noticed.

There are more and more of them on the market. As I write the article, there are almost 100 of them.

Is it a little or a lot?

Well, the author personally used only 3 stablecoins – Tether, Binance USD and USDC.

Everything else is just a shell for me. I don’t mean to say that other stablecoins are bad, but…

The stablecoins with the highest liquidity and established reputation are the most secure.

Speaking of reserves, it is, of course, best to bet on stablecoins that have reserves in gold, dollars or other stable assets.

Well, the dollar is not entirely stable, but it is still a reserve currency and this will not change any time soon!

Advantages of Stablecoins

Stablecoins offer several advantages in stabilizing crypto prices and addressing the issue of volatility.

Firstly, they provide a safe haven for investors during periods of high market volatility.

By holding stablecoins, investors can protect their investments from sudden price drops and also reduce their exposure to market risks.

Secondly, they enable easier and faster transactions within the cryptocurrency ecosystem.

As stablecoins offer price stability. They can be used as a medium of exchange.

They facilitating seamless and efficient transactions without the need to convert to fiat currencies.

Furthermore, they provide a bridge between traditional financial systems and the world of cryptocurrencies.

Their stable value makes them more appealing to businesses and individuals.

Whose looking to adopt cryptocurrencies for everyday transactions.

As they eliminate the fear of losing value due to price volatility.

I have already mentioned some of the advantages earlier!

Stablecoins are used for transactions and can store value like cash.

That’s why choosing the right stablecoin is so important.

Well, if you want to protect your asset with a stablecoin that goes bankrupt, you are in a bad situation.

This is, of course, only a theoretical example, but an important one.

You are fleeing to the stablecoin from the market to protect your own assets.

And here it is, in the event of bankruptcy of the company managing the stablecoin, you still lose!

Now you know why stablecoins are so important to any investor or trader.

Examples on the Market

Several stablecoins have gained traction and made a significant impact on the cryptocurrency market.

Tether (USDT), one of the most popular among them. Is pegged to the US Dollar and

has become widely used for trading and storing value. Another prominent stablecoin is USD Coin (USDC).

This cryptocurrency is backed by a consortium of companies and regulated by financial authorities.

The introduction of stablecoins has also influenced the development of decentralized finance (DeFi) applications.

Stablecoins are crucial in providing liquidity and stability within DeFi platforms.

Enabling users to earn interest. Not only.

You can borrow, or lend cryptocurrencies while minimizing the risks associated with price volatility.

Personally, I would avoid stablecoins that are experimental. In this case, look at Tether, USD Coin, Binance USD, or another stablecoin with a high capitalization like DAI!

Stablecoin reserves are another key role for the security of your assets.

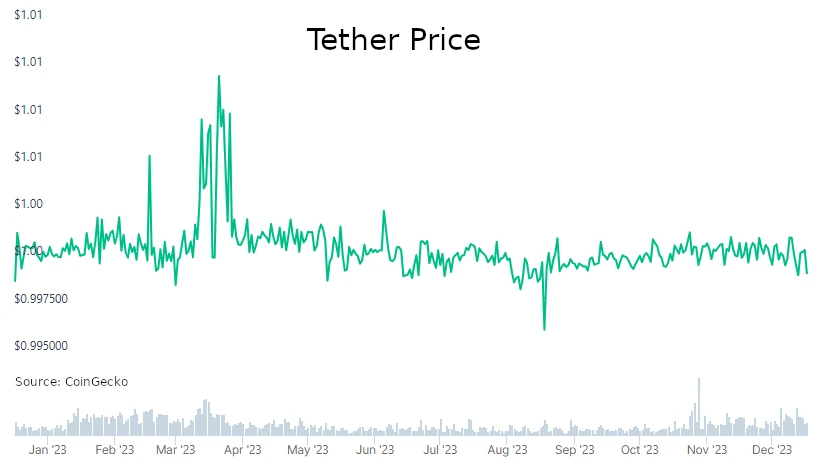

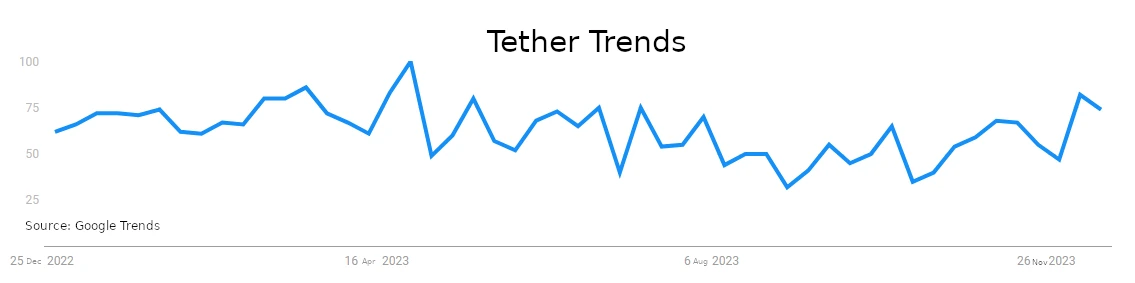

By the way, I decided to look at how stablecoin prices fluctuated and at the same time compare how much the market was interested in these stablecoins at a given time. I’m curious what will come of this.

Tether Research

In fact, with this example I wanted to check whether the search trend for Tether would have any impact on the price.

Well, it didn’t exactly influence the price directly, but rather the behaviour of investors.

These, in turn, lead to price fluctuations.

What surprises me is that both in the case of the largest price fluctuations and when searching for phrases in Google, a pattern is visible. I’m excited.

I will check on the next stablecoins whether the rule will be confirmed.

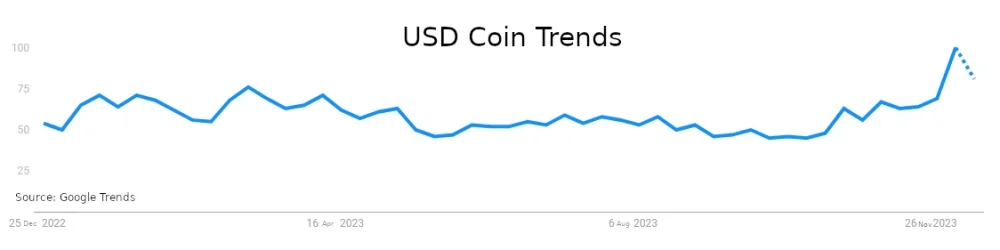

USD Coin Research

In the case of USD Coin, there is clearly less interest in searching for the phrase and a large price fluctuation.

At this point, I would look for fundamental reasons for the change in this price.

Let’s remember that I’m writing about stablecoins, and such price fluctuations almost always come from fundamentals.

However, I am currently unable to determine what actually happened.

I can only speculate that it was about FUD (i.e. media attack on Coinbase).

As we know from the perspective of time, Coinbase cooperates closely with several investment companies that apply for the rights to issue ETFs of cryptocurrencies such as Bitcoin or Ethereum.

I’ll stop at this point because I realized it’s taking a bit too much time.

Their Role in the Future of Cryptocurrency

As cryptocurrencies continue to evolve and gain mainstream adoption a few things will happen.

They are expected to play a vital role in their future. Stablecoins offer a bridge

between the traditional financial system and cryptocurrencies. They providing stability and familiarity to users.

Moreover, they have the potential to disrupt traditional banking systems.

All of this, by offering fast and low-cost cross-border transactions.

By leveraging blockchain technology, stablecoins can enable instant transfers and eliminate the need for intermediaries.

Making them an attractive alternative to traditional payment systems.

Will this give food for thought to those defending traditional banking?

Time will tell, but everything indicates that CBDC is an attempt

to transition to a digital payment system. And all this will increase the

control of banks and financial institutions over an individual.

Challenges Surrounding Stablecoins

While stablecoins offer several advantages, they also face challenges and concerns.

One of the main concerns is the transparency and credibility of stablecoin issuers.

As stablecoins are often issued by private companies. There is a need for greater transparency and audits.

All of that to ensure the stablecoin is indeed backed by the claimed reserves.

Another concern is the regulatory landscape surrounding stablecoins.

As they gain popularity. Regulators are increasingly scrutinizing their operations.

There are also raising concerns about potential risks.

Financial stability, money laundering, and consumer protection.

Considerations and Risks

Investing in stablecoins can be an attractive option for individuals.

Everyone whose looking for stability within the cryptocurrency market need to use stablecoins.

However, it is essential to consider the risks associated with stablecoin investments.

One of the main risks is the counterparty risk. It refers to the risk of the stablecoin.

Issuer defaulting or being unable to honor the redemption of stablecoins for the underlying asset.

Additionally, investors should carefully evaluate the stability mechanism.

In maintaining the peg to the underlying asset. It is also crucial to consider the regulatory environment.

Have influence on the reputation of the stablecoin as well. Before making an investment decision.

Conclusion

Stablecoins offer a promising solution to the issue of price volatility in the cryptocurrency market.

By pegging their value to stable assets.

They provide stability and act as a bridge between the traditional financial system and cryptocurrencies.

They offer advantages such as protection against market volatility, seamless transactions, and increased adoption of cryptocurrencies.

However, challenges and concerns surrounding them, including transparency and regulatory issues, need to be addressed for their widespread acceptance.

Leave a Reply

You must be logged in to post a comment.