Introduction

Without doubt, retirement planning is a crucial aspect of financial stability, and Bitcoin IRAs brings one of the options in digital world.

There is not surprise, because Bitcoin and another cryptocurrencies are adopted very quick. Especially by millennials and gen Z.

They will build future our generations and today topic about investing in Bitcoin IRAs.

In this article, I will explore the world of cryptocurrency investments and explore how Bitcoin IRAs are revolutionizing the retirement portfolio landscape, indeed.

I am exciting to do that, because as one of millennials I thinking about open one of those account. Probably, I will do it, but first time for research and some conclusions after that.

So, enjoy your reading!

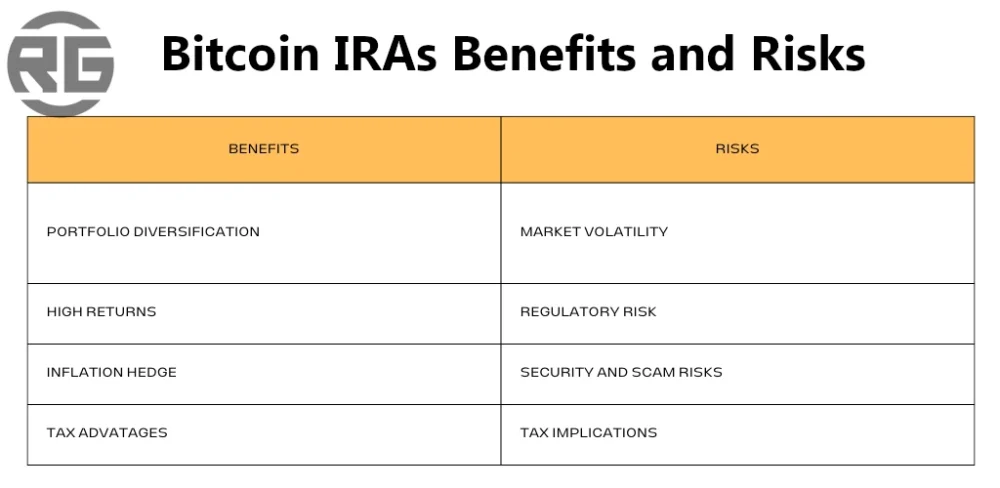

What Benefits of Bitcoin IRAs?

Bitcoin IRAs offer several unique advantages that make them an attractive option for retirement planning.

What advantages I mean? Just in a second.

First and foremost, Bitcoin and other cryptocurrencies have shown tremendous growth potential, making them an excellent long-term investment. Please read about HODL strategy.

Moreover, the decentralized nature of cryptocurrencies also provides a hedge against traditional financial systems, offering protection against inflation and economic volatility. Of course, if you take in consideration longer investment.

Another significant advantage of Bitcoin IRAs is the ability to diversify your retirement portfolio.

By adding cryptocurrencies to your investment mix, you can potentially increase your returns while reducing overall risk.

Additionally, Bitcoin IRAs provide an opportunity to invest in an emerging asset class.

That allowing you to stay ahead of the curve and capitalize on the future growth of cryptocurrencies.

But there are risks as well. Please take a look below.

Despite many advantages, there are also disadvantages that should be noted.

One of the most basic information about the cryptocurrency market is its high volatility. Even during one day, that’s why watching the market every day can be quite dizzying.

Regulatory issues are another problem, but as this year has shown, ETFs have been created in the case of Bitcoin.

Which means everything is going in the right direction.

An IRA allows you to opt out of taxes, but only if certain conditions are met.

Ultimately, the investment custodian takes responsibility for the security of the platform and the investment itself.

In most cases, storing capital in a Bitcoin IRA is very safe due to cryptography.

More about risks little bit later in this article.

How Bitcoin IRAs Work?

Bitcoin IRAs function similarly to traditional IRAs.

The difference is that they allow you to invest in cryptocurrencies.

To open a Bitcoin IRA, you need to find a reputable custodian or investment platform that specializes in cryptocurrency investments.

Once you’ve chosen a custodian, you’ll need to complete the necessary paperwork and transfer funds from your existing retirement account.

Once your Bitcoin IRA is set up, you can start investing in cryptocurrencies.

The custodian will securely hold your digital assets on your behalf, ensuring their safekeeping.

You can choose to invest in Bitcoin, Ethereum, or other cryptocurrencies based on your risk tolerance and investment goals.

As with any investment, it’s crucial to conduct thorough research and seek professional advice before making any decisions.

Why Cryptocurrency For Retirement?

Including cryptocurrency in your retirement portfolio offers several advantages.

Firstly, cryptocurrencies have the potential for significant long-term growth. Bitcoin, for example, has experienced tremendous price appreciation over the past decade, making it an attractive investment for retirement planning.

Secondly, cryptocurrencies provide diversification. Traditional investment assets such as stocks and bonds are susceptible to market volatility and economic downturns. By including cryptocurrencies in your portfolio, you can potentially offset losses in other assets, ensuring a more stable retirement income.

Finally, investing in cryptocurrencies allows you to participate in the digital revolution. As the world becomes increasingly digital, cryptocurrencies are expected to play a significant role in the future of finance.

By including them in your retirement portfolio, you can stay ahead of the curve and benefit from the growth of this emerging asset class.

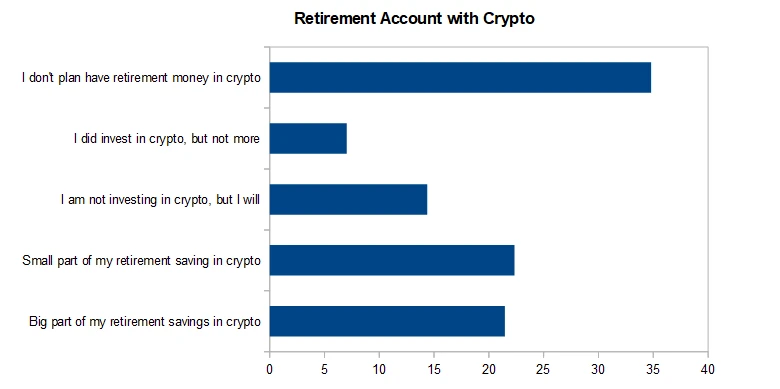

According to a FinanceBuzz survey, 44% of Americans saving for retirement have their savings in cryptocurrencies.

Nearly 14% are interested in investing in cryptocurrencies. It is true that at this point it cannot be said that this is a retirement savings plan.

Either way, some of this group will decide to save in the HODL strategy, i.e. investing through bitcoin IRA, bitcoin ETF or investing in cryptocurrencies on their own.

Of the remaining group, nearly 35% are not at all interested in investing in cryptocurrencies as a retirement plan.

Before Investing in a Bitcoin IRA

Before investing in a Bitcoin IRA, it’s important to consider several factors.

Firstly, cryptocurrencies are highly volatile and can experience significant price fluctuations. It’s crucial to have a long-term investment horizon and a high-risk tolerance when considering Bitcoin IRAs.

Furthermore, regulatory risks should not be overlooked. Cryptocurrencies are still relatively new, and governments around the world are continually updating regulations. It’s important to stay informed about any regulatory changes that may impact the value and legality of cryptocurrencies in your jurisdiction.

Additionally, consider the fees associated with Bitcoin IRAs. Custodians and investment platforms typically charge fees for their services, including account maintenance fees and transaction fees. It’s essential to understand and compare these fees before selecting a custodian for your Bitcoin IRA.

The three risks I mentioned are, in my opinion, the greatest. At the same time, by learning how to take advantage of market volatility, you can earn much more. But more about that another time.

Steps to Open a Bitcoin IRA

Opening a Bitcoin IRA or cryptocurrency IRA involves several steps.

Firstly, research and choose a reputable custodian or investment platform that specializes in cryptocurrency investments. Look for custodians that have a proven track record, strong security measures, and transparent fee structures.

Once you’ve selected a custodian, you’ll need to complete the necessary paperwork to open your Bitcoin IRA. This typically includes providing personal information, such as your name, address, and social security number. You may also need to transfer funds from your existing retirement account to fund your Bitcoin IRA.

After your Bitcoin IRA is set up and funded, you can start investing in cryptocurrencies.

Research different cryptocurrencies and their historical performance, and consider diversifying your investments to mitigate risk. Regularly monitor your Bitcoin IRA and make adjustments as needed to align with your long-term retirement goals.

Bitcoin IRA Custodians and Investment Platforms

When choosing a custodian or investment platform for your Bitcoin IRA, it’s crucial to consider factors such as reputation, security measures, and fees.

Some popular Bitcoin IRA custodians and investment platforms include BitIRA, BitcoinIRA, and CoinIRA.

These platforms offer a wide range of services, including secure storage, easy account management, and access to a variety of cryptocurrencies.

Before selecting a custodian, conduct thorough research and read customer reviews to ensure their credibility and reliability.

Additionally, compare the fees charged by different custodians and investment platforms to find the most cost-effective option for your needs.

Besides, in the following sections you will read about facts related to these platforms.

Common Misconceptions About Bitcoin IRAs

There are several common misconceptions surrounding Bitcoin IRAs that need to be addressed.

It’s only Tech-Savvy Investors

One such misconception is that Bitcoin IRAs are only for tech-savvy individuals.

While a basic understanding of cryptocurrencies is helpful, you don’t need to be an expert to invest in Bitcoin IRAs. Reputable custodians and investment platforms provide user-friendly interfaces and educational resources to assist investors of all levels.

Bitcoin IRAs are Risky

While it’s true that cryptocurrencies can be volatile and there have been instances of hacking, reputable custodians employ robust security measures to safeguard investors’ digital assets.

These measures include cold storage, multi-factor authentication, and insurance coverage.

Bitcoin is Already very Expensive

Whatever you may think if you taka a look what profits you could have from investment in Bitcoin in last 10 years then definitely you change your mind.

Another think is, that adoption is still going on and even there will be worse years like time of bear markets (they always happen), after that price of Bitcoin come back to price before fall down and consistently growing.

Bitcoin and Crypto are Scams

14 years of Bitcoin on the market and enormous improvement around the cryptocurrency market is clear proof that cryptocurrencies will stay with us for very long time.

By the way, narrative about scams always occur during worse time like bear market just to convince you about selling your probably the best investment of your own life (or at least one of the best)!

Any Regulations for IRAs

Indeed, cryptocurrencies are regularly monitored by regulators. In this case, digital IRAs are no exception.

Some cryptocurrency exchanges purchasing cryptocurrencies for digital IRAs are regulated by the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

Custodians such as BitIRA took the extra step of registering as a money services business (MSB) with the Financial Crimes Enforcement Network (FinCEN), a branch of the U.S. Treasury Department.

Any Benefits over Standard Crypto Trading

Assets in an IRA are actually tax-deferred.

So, for example, cryptocurrency held in a Roth IRA that appreciates in value significantly over the years would not incur any taxes on those gains. If that same crypto was held outside of an IRA as a typical investment, it would incur capital gains taxes every single year.

Bitcoin IRAs and Traditional Retirement

Bitcoin IRAs offer several advantages over traditional retirement accounts.

Firstly, they provide an opportunity to invest in an emerging asset class with significant growth potential. Traditional retirement accounts typically limit investments to stocks, bonds, and mutual funds, which may not offer the same level of growth as cryptocurrencies.

Secondly, Bitcoin IRAs offer diversification beyond traditional assets. By including cryptocurrencies in your retirement portfolio, you can potentially increase your returns while reducing overall risk. This diversification can help protect your retirement savings from market volatility and economic downturns.

Thirdly, Bitcoin IRAs provide a hedge against inflation.

Cryptocurrencies, particularly Bitcoin, have a limited supply, making them resistant to inflationary pressures. This characteristic ensures that your retirement savings maintain their purchasing power over time.

Retirement Planning and Crypto

The future of cryptocurrency investments in retirement planning appears promising.

As cryptocurrencies become more widely adopted and integrated into the global financial system, their value and acceptance are expected to increase. This growth presents a unique opportunity for retirement investors to capitalize on the emerging digital economy.

Furthermore, advancements in blockchain technology, the underlying technology behind cryptocurrencies, are likely to revolutionize various industries, including finance.

By including cryptocurrencies in your retirement portfolio, you can position yourself to benefit from these technological advancements and potentially achieve higher returns.

It is also worth noting that cryptocurrency prices are really low.

Remember that companies creating cryptocurrencies are technology companies. This opens a window to large profits while bearing high risk.

Therefore, it is important to invest only part of the capital.

Is it Bitcoin IRAs for you?

One more time the same question: is it Bitcoin IRA for me?

After reading this article you should little bit know about Bitcoin IRAs itself,

but still l there could be some doubts. I am not surprise.

If you ever consider traditional IRAs plan or was planning to save some money for retirement then probably it is.

The best is if you know quite a bit about cryptocurrencies, because then your decision about investment would be much more easier.

What age are you? Very important question in any investment.

How much time and money do you have to invest?

Because cryptocurrencies have big return of investments, but they are risky in the same time. The good think is, that custodian taking all management on their own. You don’t need to worry to much, in general.

Bitcoin IRAs Facts

In this sections little bit about some facts from 3 the most popular Bitcoin and cryptocurrency IRAs.

Bitcoin IRA

Cryptocurrencies:

60 and more

Fees:

$1,000 account minimum

2% crypto transaction fee

2.99% upfront service fee

0.08% monthly security fee

Rating:

4.3 (TrustPilot)

BitIRA

Cryptocurrencies:

9 cryptocurrency supported

Fees:

$0 monthly fees

$5,000 account minimum

$50 account setup fee, $195 annual maintenance fee

0.05% crypto storage fee

Rating:

n/a

Coin IRA

Cryptocurrencies:

18 cryptocurrencies supported

Fees:

$50 one-time setup fee

$80 annual maintenance fee

$100 storage fee

Trading Fees:

1.25% on buy trades

1% on sell orders

2.25% on assisted transactions

Rating:

3.7 (TrustPilot)

Conclusion

In fact, Bitcoin IRAs offer a new and exciting way to build a future-proof retirement portfolio.

By investing in cryptocurrencies, you can diversify your investments, hedge against inflation, but also participate in the digital revolution.

However, it’s important to thoroughly research and consider the risks and advantages before making any investment decisions. By staying informed and working with reputable custodians and investment platforms, you can navigate the world of Bitcoin IRAs and revolutionize your retirement planning, surely.

Of course, I convince everyone to investment in cryptocurrencies, but for sure they are not for everyone!

As my experience shows, you have to have balls to be in the crypto market.

Leave a Reply

You must be logged in to post a comment.