Introduction

Trading has long been considered a high barrier-to-entry profession. However, in today’s fast-paced and interconnected world. It has become increasingly accessible to individuals from all walks of life. With the right blend of ambition, patience, and knowledge. Anyone can turn trading into a full-time job or a lucrative investment opportunity.

In this comprehensive guide, I will dive deep into the various aspects of trading. As a job and an investment opportunity. From understanding the different markets to exploring strategies. I’ll cover everything you need to know to make informed decisions and unlock your full potential as a trader.

A New Era of Trading

Technological advancements and increased trading volumes have revolutionized the trading landscape, lowering barriers to entry and opening up a world of possibilities. In some cases, no personal capital is required to start trading, while in others, a small amount of capital is needed as a commitment to the profession.

By the way, now all you need to start trading is access to one of the exchanges. In my case, it was the Binance exchange. There are several other options. If you are interested in it, read this article.

When I mention Binance, you automatically know that the assets are cryptocurrencies.

Key Takeaways

Trading is no longer limited to those with large amounts of capital and expendable time; anyone can trade for a living with ambition and patience.

Trading can become a full-time career opportunity, a part-time opportunity, or a way to generate supplemental income.

The global nature of trading means there’s always an open market somewhere, providing opportunities for people with full-time jobs or family commitments.

Trading from Home

One of the most popular ways to enter the world of trading is by doing so from home. This option offers incredible flexibility and can easily be adapted to fit around your daily life. However, day trading stocks from home can also be one of the most capital-intensive endeavors.

To be designated as a pattern day trader, you need a minimum equity of $25,000. If your account falls below this minimum, you will not be permitted to day trade until you restore the required equity level. Despite this barrier, working from home remains an attractive option for many.

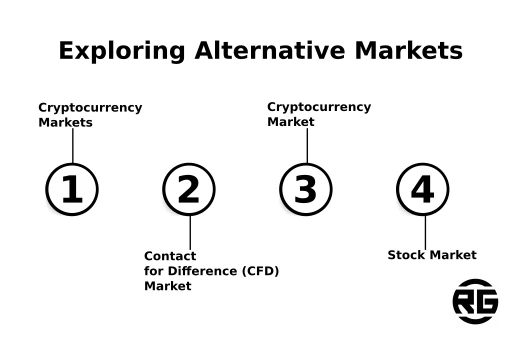

Exploring Alternative Markets

If the capital requirements for day trading stocks seem daunting, don’t worry. There are alternative markets with lower barriers to entry and diverse opportunities for traders.

Currency Markets

The foreign exchange (forex) or currency markets provide an accessible option for aspiring traders. With accounts opening for as little as $100, you can control a large amount of capital using leverage. Forex markets are open 24 hours a day during the week, making them ideal for those who cannot trade during regular market hours.

Contract for Difference (CFD) Market

The contract for difference (CFD) market is another option worth considering. CFDs are electronic agreements between two parties that do not involve ownership of the underlying asset. This allows you to capture gains for a fraction of the cost of owning the asset.

As with forex, the CFD market offers high leverage, enabling you to enter the market with smaller amounts of capital.

However, keep in mind that higher leverage also means higher risk. It’s essential to educate yourself on the risks involved and build a robust trading plan before engaging in any trading activity.

Cryptocurrency Market

The cryptocurrency market is a relatively young market with great earning potential. The price differences can be huge. This makes the opportunity for large profits as well as losses.

Stock Market

In the case of the stock market, the possibilities are truly endless. The largest stock market is US stocks, but … using the power of the Internet, you can buy and sell stocks from around the world.

If you want to trade you have a lot of options. Chose the best one for you.

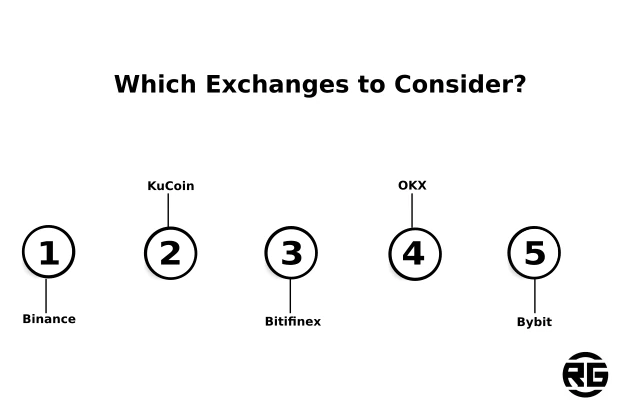

Which Exchanges to Consider ?

Exactly. Where is the best place to trade? Once again, I will refer to my own article on cryptocurrency exchanges review.

It is after reading this article that you should come to the conclusion that …

Binance is the safest option to trade. Certainly not the only one though. KuCoin, Bitfinex, OKX, and Bybit are other options that are also safe.

To be sure, I also refer to the article about the reserves of cryptocurrency exchanges.

Let me remind you that when cryptocurrency exchanges have user capital reserves, we have the smallest problems with liquidity.

Of course, only when we trade an asset with a large enough volume.

Those 5 options are not the only ones. In cryptocurrency industry you have much more options. I just gave you the most safe ones (in author opinion based on research).

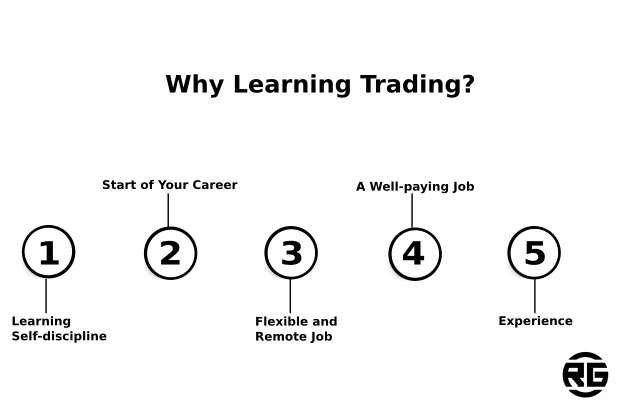

Why is Learning to Trade so Important?

Let me list a few reasons why learning to trade will benefit you for life.

Learning Self-discipline

First let me say that it’s not that simple. Being a disciplined person involves hundreds of hours of training outside of your comfort zone.

However, when you learn self-discipline, you can be not only more effective trader, but also better father, husband, and business partner.

Self-discipline itself can be defined as carrying out planned tasks, despite the problems and difficulties standing in the way. Worse day, lack of motivation, fatigue or something else. There are no excuses for a disciplined person.

Earlier Start of Your Career

You don’t have to finish your school to start learninig about trading. Investing small amount of money and learning how market works from earlier age should be profitable in older age. Can you imagine in age of 20 years old you have 4 or 5 years of experience on financial markets ? From that point even you can choose professional career in this profession or studing and trading in your free time.

Flexibility and Remote Job

Yes, working from home has its advantages. You can work from home and choose any working hours that suit you. By the way, many companies around the world are moving towards remote work.

A Well-paying Career

It’s no secret that traders make a lot of money. However, remember that only the best ones really make money. All the rest are losers. Before you really start making money on the cryptocurrency market, it will take a few years (this is the way of most successful traders).

Experience Above All

By trading on the markets, you gain practical experience, so you will learn how the market works and how you can earn on it (at least after some time). A few years of amateur experience can turn into a very well-paying career, or you can constantly trade and earn money in another profession.

You can imagine that you have a full-time job or you own one of the companies, and in your free time you deal with trading. This scenario is most likely. You can also trade full-time. It’s your choice.

Of course, you can as well consider being professional in this area. These days you don’t really need to join trading firm, but you can.

Learning trading is not just about trading itself. Trading can give you much more than you think. Just think about it.

Proprietary Trading Firms

For those who prefer a more structured environment, proprietary trading firms offer an appealing alternative to trading from home. As a day trader working for a proprietary trading firm, you would be a contractor rather than an employee. Then you receiving a share of the profits made from your job instead of wages or perks.

Working for a firm can alleviate some of the pressure associated with trading independently. As the company provides you with capital, and risk is partially managed by the firm. However, personal discipline and commitment to your strategy are still crucial for success.

Benefits of Working with a Trading Firm

There are benefits of working with professionals without any doubts. Some of benefits I am presenting below:

a) Access to free training and the knowledge of other successful traders

b) Exposure to innovative “buy and sell” ideas

c) Reduced fees and commissions

d) Access to capital and performance monitoring

Do you want to join trading firm ?

Developing a Comprehensive Trading Plan

Once you’ve decided on your preferred trading method, it’s essential to create a comprehensive trading plan. This plan will serve as your roadmap to success, outlining your goals, strategies, and risk management techniques.

A solid trading plan should include:

a) The markets you plan to trade

b) The trading strategies you will employ

c) The time frame for your trades

d) Your risk management approach

e) Your daily routine and trading schedule

Without a plan is difficult reach any destination. When you have one then you know where you heading.

Finding the Right Broker

Choosing the right broker is a crucial step in your trading journey, as they will play a significant role in facilitating your trades and providing access to the markets. When selecting a broker, consider factors such as:

a) Commissions and fees

b) Trading platform features and tools

c) Customer service and support

d) Regulatory compliance and security

Seeking Mentorship

As a novice trader, it’s essential to seek mentorship to help guide you through the learning process. A mentor can provide valuable insights and advice, helping you avoid common pitfalls and accelerate your development as a trader.

When searching for a mentor, consider:

a) Trading style and approach

b) Experience and track record

c) Willingness to provide guidance and support

Continuing Education

The world of trading is constantly evolving, and staying up to date with the latest trends and developments is essential for long-term success. Make a commitment to lifelong learning, whether through online courses, books, or attending industry conferences and events.

Embracing Technology

In today’s digital age, there are numerous tools and platforms available to help traders optimize their performance. From advanced charting software to automated trading systems, embracing technology can provide you with a competitive edge in the trading world.

Unlocking Your Trading Potential

Trading as a job or investment opportunity is more accessible than ever before, but your success ultimately depends on your dedication, discipline, and continued learning. By carefully considering your options, developing a comprehensive trading plan, and seeking guidance from experienced mentors, you can unlock your full potential as a trader and create lasting wealth.

Leave a Reply

You must be logged in to post a comment.