Introduction

DEX crypto exchange is platform that have not only democratized access to financial services but also enhanced transparency and trust through blockchain technology.

In this article, I am examining some of the leading DEX crypto exchanges.

From Uniswap’s innovative liquidity pool mechanisms to PancakeSwap’s user-friendly interface.

Then, Curve’s specialization in stablecoin trading, then dYdX’s leverage and margin trading capabilities, to 1Inch’s aggregation service that ensures users get the best rates.

I cover the essential facets that make these platforms stand out.

My aim is to equip you with the knowledge to confidently explore the dex exchange space, ensuring that you’re well-positioned to take advantage of the opportunities that DeFi offers in the coming years.

Let’s get start it!

Uniswap

Overview

Uniswap stands out as a leading decentralized exchange (DEX) on the Ethereum blockchain, renowned for its user-centric approach and open-source protocol.

It enables seamless swaps of Ethereum and ERC-20 tokens, fostering a decentralized trading experience. Governed by its community through the UNI token, Uniswap empowers users with a say in its future developments.

Key Features

Decentralized and User-Governed

Uniswap operates without a central authority, with governance conducted by UNI token holders who propose and vote on changes.

Automated Market Maker (AMM)

Utilizes liquidity pools instead of traditional order books, allowing users to trade directly against a pool of tokens.

Community Incentives

Liquidity providers earn fees from trades occurring within their pools, incentivizing the provision of liquidity.

Open-Source Software

Anyone can access and build upon the Uniswap codebase, enhancing transparency and collaboration in the development process.

Supported Chains & Tokens

Uniswap supports multiple networks beyond Ethereum, including Polygon, Optimism, Arbitrum, and Celo.

This multi-chain support ensures that users have broad access to various tokens across different blockchains.

Notably, Uniswap aggregates and lists top tokens by blockchain, providing a comprehensive view of market trends and token popularity.

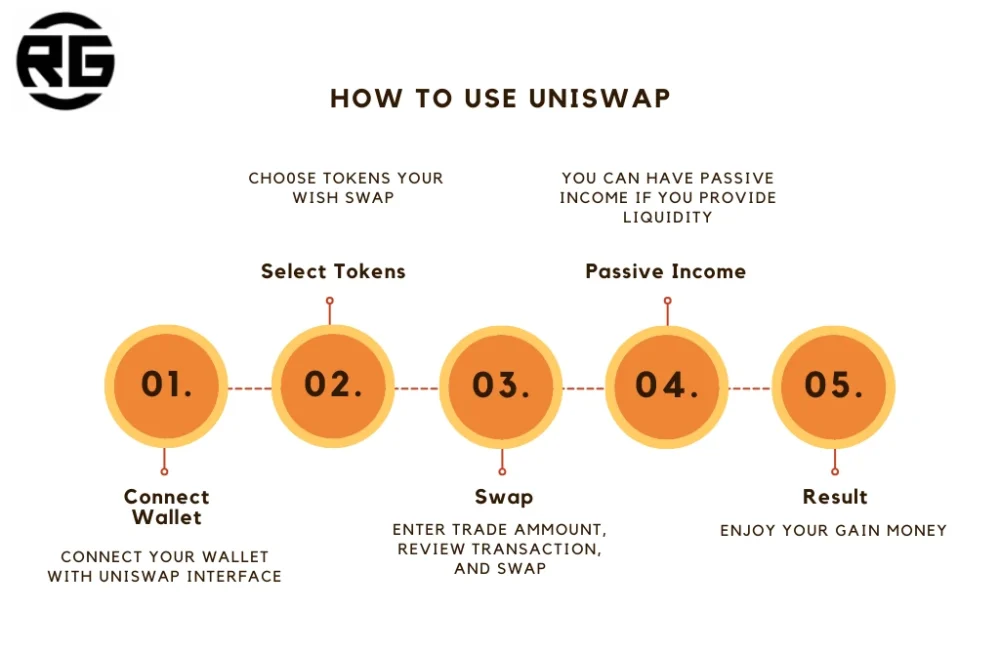

How to Use Uniswap

In this graphic I present very common use on Uniswap, but remember because of unlimited liquidity there are a lot of options of using this decentralized exchange.

First of all it as like always in case of DEX connect your own wallet with Uniswap interface and then select tokens – pair of tokens what you want to swap.

Of course, you can only swap tokens in pairs what are available on the exchange and in your wallet.

After this step decide how much your want to trade and simply do it.

Uniswap’s platform not only facilitates token swaps but also serves as a gateway to the broader DeFi ecosystem.

So, users can to engage with innovative financial services in a secure and decentralized manner.

Finally, you can have passive income if you provide liquidity by staking your own tokens.

PancakeSwap

PancakeSwap has quickly become a cornerstone in the decentralized finance (DeFi) space, especially on the Binance Smart Chain (BSC), since its inception in September 2020.

Developed by anonymous creators with a penchant for pancakes, it has carved out a significant niche for itself by offering a wide array of services that rival even some centralized exchanges.

At its core, PancakeSwap is a decentralized exchange (DEX) that utilizes an automated market maker (AMM) system to facilitate token swaps.

But what truly sets it apart is its comprehensive DeFi experience provided to users through an intuitive interface.

Overview

Launched by a group of anonymous developers with support from Binance in September 2020, PancakeSwap has quickly ascended to become the largest DEX and DeFi application on the BSC network by total value locked (TVL), boasting an impressive $2.95 billion in assets.

This platform stands out not just for its trading capabilities but also for its extensive features including liquidity provision, farming, staking, perpetual trading, a lottery system, an NFT marketplace, and even a launchpad for new projects.

Key Features

Automated Market Maker (AMM)

At its heart, PancakeSwap uses an AMM model, allowing users to trade directly against a liquidity pool.

Comprehensive DeFi Services

Beyond token swaps, it offers liquidity farming, staking, perpetual trading, a lottery, an NFT marketplace, and a launchpad, among others.

Governance and Rewards

CAKE, PancakeSwap’s native token, serves both as a governance token and as a rewards/utility token, enabling users to farm rewards by providing liquidity and to stake CAKE for additional rewards.

Security Audits

It emphasizes security with multiple audits by reputable firms like Certik, Peckshield, and SlowMist, ensuring a safer trading environment.

User-Friendly Interface

Designed with simplicity in mind, it provides easy access to a broad range of financial products and features.

Supported Chains & Tokens

PancakeSwap primarily operates on the Binance Smart Chain, enabling the trading of any BEP-20 token provided there’s a liquidity pool for it.

This focus on BSC allows for faster transactions and lower fees compared to Ethereum-based DEXs.

Despite its primary association with BSC, PancakeSwap’s ambition and continuous development hint at potential multi-chain support in the future, broadening its accessibility and utility.

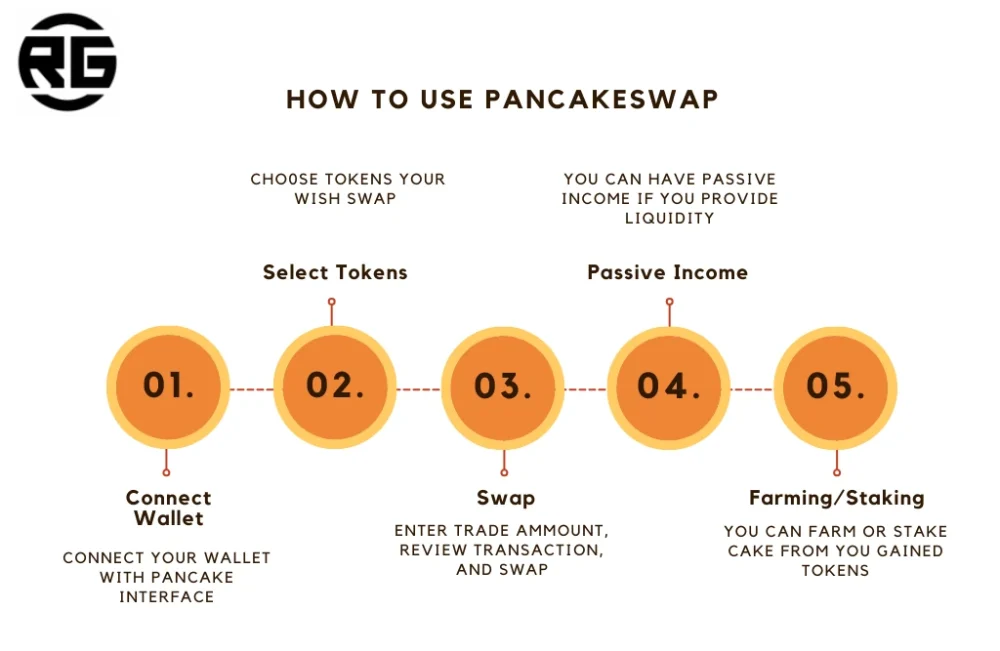

How to Use PancakeSwap

Similar like in case of Uniswap at the beginning it’s connecting wallet, then one of the swapping options and swap.

Beside that, you can gain tokens by offering liquidity pool and all of that tokens you can farming or staking.

Pancake it’s not just a platform for swapping tokens but a comprehensive ecosystem that caters to a wide range of DeFi activities, all the while being governed by its users through the CAKE token.

Finally, PancakeSwap stands as a beacon of innovation and community engagement.

Curve

Overview

Curve, a cornerstone in the world of Decentralized Finance (DeFi), is a decentralized exchange (DEX) that revolutionizes the trading of stablecoins with its highly efficient and cost-effective mechanisms.

Launched in 2020, Curve aims to bolster the liquidity of stablecoins while maintaining their value as close to one dollar as possible.

By employing advanced algorithms, Curve optimizes liquidity and minimizes trading costs, making it an attractive platform for investors seeking to trade stablecoins efficiently.

Key Features

Optimized for Stablecoin Trading

Designed specifically for the stablecoin market, Curve offers a seamless trading experience with minimal slippage.

Low Trading Fees

One of Curve’s standout features is its low trading fee structure, making it a cost-effective option for traders.

CRV Token Governance

The CRV token, an Ethereum-based asset, empowers holders with governance rights, allowing them to participate in crucial platform decisions.

Security Rewards

CRV holders are rewarded for their participation and contributions to liquidity, enhancing the platform’s overall liquidity.

Interoperability and Integration

Curve’s integration with other DeFi protocols expands its utility beyond a mere trading platform.

Supported Chains & Tokens

Curve supports a wide array of stablecoins and cryptocurrencies, including major assets like USDC, DAI, and USDT.

Its automated market maker (AMM) model facilitates trades across various blockchain networks, with Ethereum being the primary platform.

This multi-chain approach ensures broad access to diverse tokens and enhances the platform’s appeal to a wide user base.

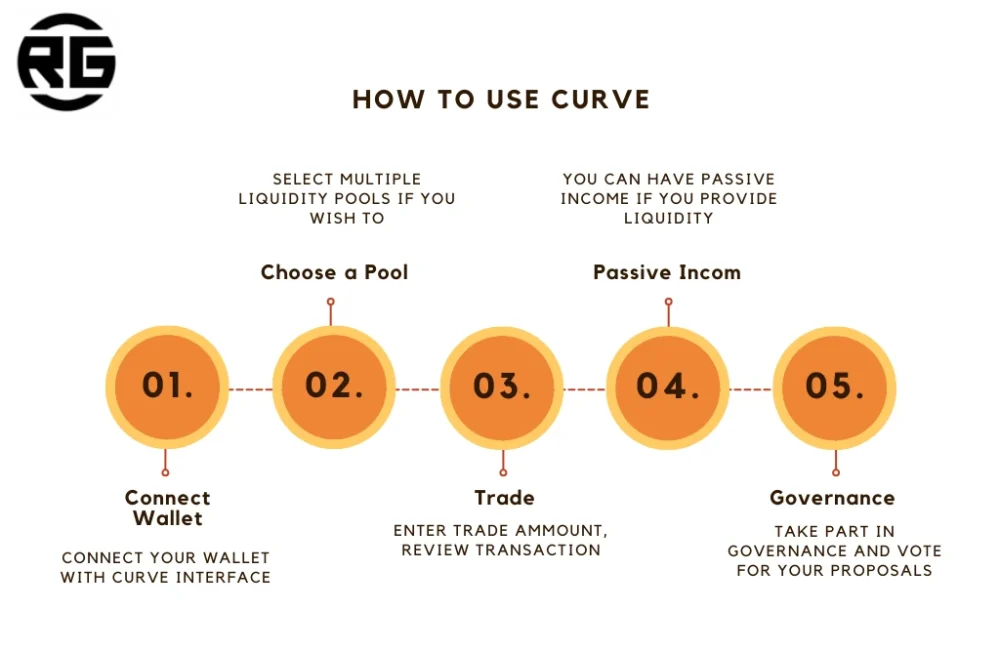

How to Use Curve

In case of Curve you can use multiple liquidity pools in the same time. Moreover, as an owner of token voting your proposals will be taken in consideration.

Curve’s emphasis on stablecoin trading efficiency, coupled with its low fees and robust governance model.

Its advanced algorithms and supportive community further enhance its appeal, making it a go-to platform for those looking to trade stablecoins or delve deeper into the DeFi space.

dYdX

Overview

We’ve been closely observing dYdX, a decentralized exchange (DEX) that’s been making waves with its advanced trading options, such as perpetual contracts and margin trading.

By December 2023, dYdX had already seen over $1 trillion in lifetime trading volume and a rapidly expanding user base, establishing itself as a frontrunner among DEXs.

Its journey began in 2017 on the Ethereum blockchain, but a significant transition to its own dYdX Chain in October 2023 has solidified its position as a leader in the DeFi sector, boasting increased transaction speed and reduced gas fees.

Key Features

Advanced Trading Options

dYdX specializes in sophisticated financial instruments like perpetual contracts, margin trading, and leveraged positions, setting it apart from traditional DEXs.

Order Book Model

Unlike the automated market maker (AMM) models used by many DEXs, dYdX employs an order book model, offering users the ability to execute trades at precise prices through limit orders.

dYdX Chain

The platform operates on its own custom Layer-2 blockchain, built on the Cosmos SDK. This architecture is optimized for trading, particularly high-frequency trading, derivative products, and complex trading strategies.

Staking and Governance

With dYdX v4, users can stake their dYdX tokens, participating in the platform’s governance and earning rewards.

Unique NFT Collection

‘Hedgies’ is an exclusive NFT collection within the dYdX ecosystem, offering various benefits and utilities on the platform.

Supported Chains & Tokens

dYdX initially operated on the Ethereum blockchain but has since transitioned to its own dYdX Chain, leveraging the Cosmos SDK for enhanced modularity and interoperability.

This move allows for fast, low-cost transactions tailored to the needs of advanced traders. dYdX supports a wide range of trading options for derivatives and margin trading, focusing primarily on perpetual contracts.

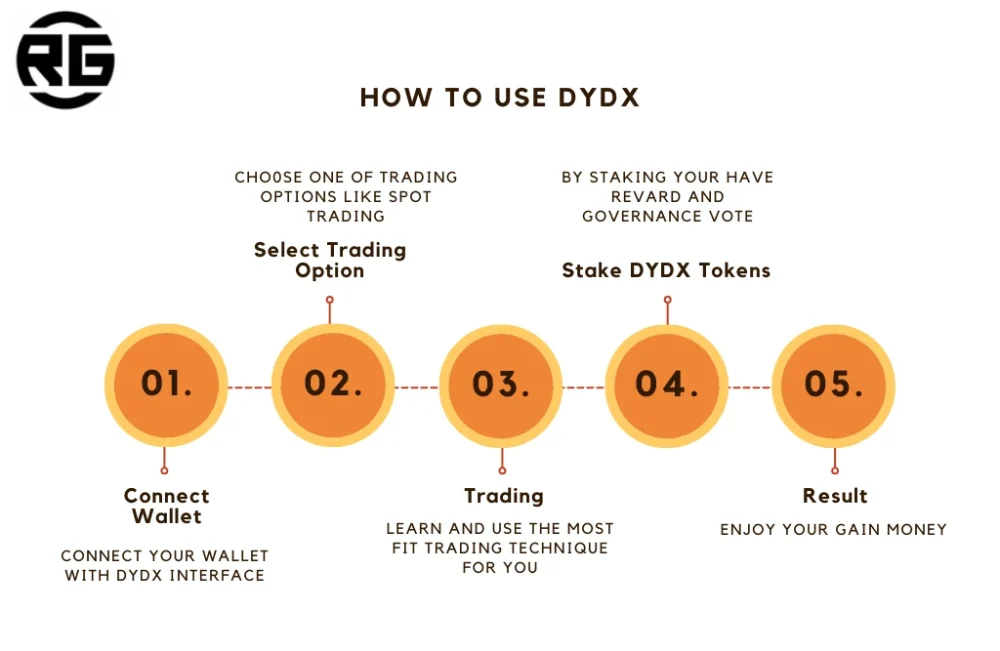

How to Use dYdX

dYdX stands out for its focus on advanced trading options and sophisticated financial instruments, catering to experienced traders seeking complex strategies and leverage.

The transition to the dYdX Chain marks a significant evolution in its capabilities, offering a decentralized, secure, and efficient trading environment.

As we continue to explore the future of decentralized finance, dYdX’s innovative approach and robust platform features make it a compelling option for traders looking to leverage the full potential of DeFi.

1Inch

Overview

1Inch stands as a premier decentralized exchange (DEX) aggregator, designed to source liquidity from a variety of DEXs.

This unique capability enables 1inch to offer users superior token swap rates compared to those available on any single exchange.

By eliminating the need to manually check each exchange for the best prices, 1Inch significantly enhances efficiency in the swapping process, making it a go-to platform for optimized trading.

Key Features

DEX Aggregator

1inch consolidates liquidity from multiple decentralized exchanges, ensuring users receive the best swap rates available.

Advanced Trading Options

Includes features like limit orders and gasless swaps, particularly for ETH and assets that support permits.

User-Friendly Interface

The platform offers an intuitive trading experience, which is easy to navigate for both new and experienced traders.

Cost Efficiency

Options like ‘Maximum return’ and ‘Lowest gas cost’ allow users to optimize their swaps for price or gas fees, respectively.

CHI Gastoken

Users can activate CHI Gastoken to reduce gas costs by up to 43%, enhancing the cost-effectiveness of transactions.

Security and Compliance

1Inch is committed to security, partnering with leading specialists to ensure a safe trading environment.

Supported Chains & Tokens

1Inch supports a broad range of tokens across multiple blockchains including Ethereum, Binance Smart Chain (BSC), Polygon, and many others.

This multi-chain support not only widens the scope of accessible tokens but also enhances user convenience by providing more trading options.

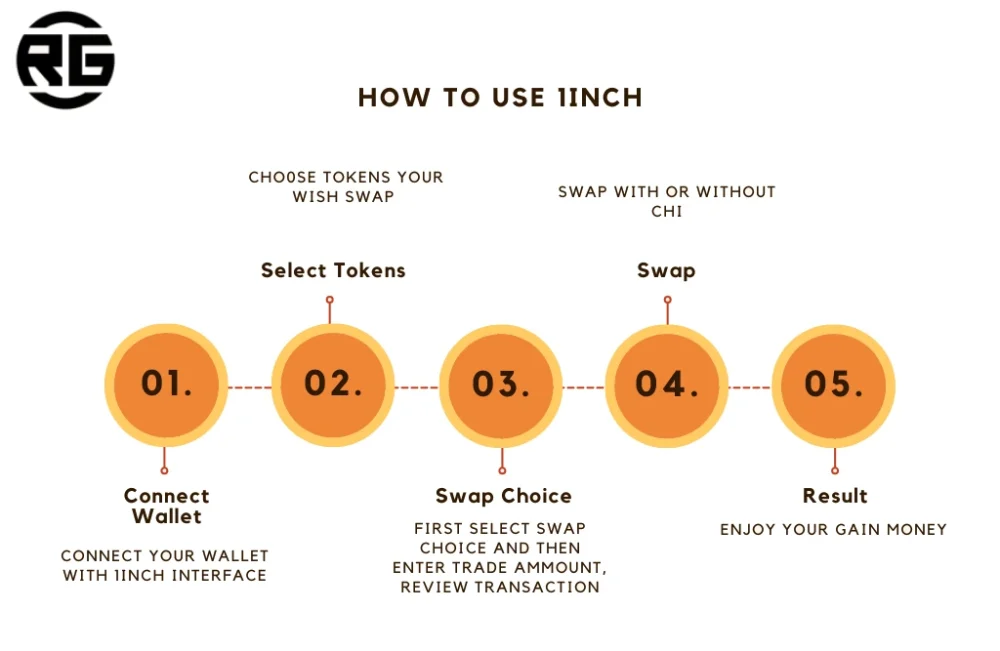

How to Use 1Inch

In case of 1Inch everything looks the same like in case of another DEX exchanges, but you can use it CHI gastoken for reduce gas fees.

In general, 1Inch provides a comprehensive and efficient platform for decentralized trading, catering to a wide range of user needs from basic swaps to complex trading strategies.

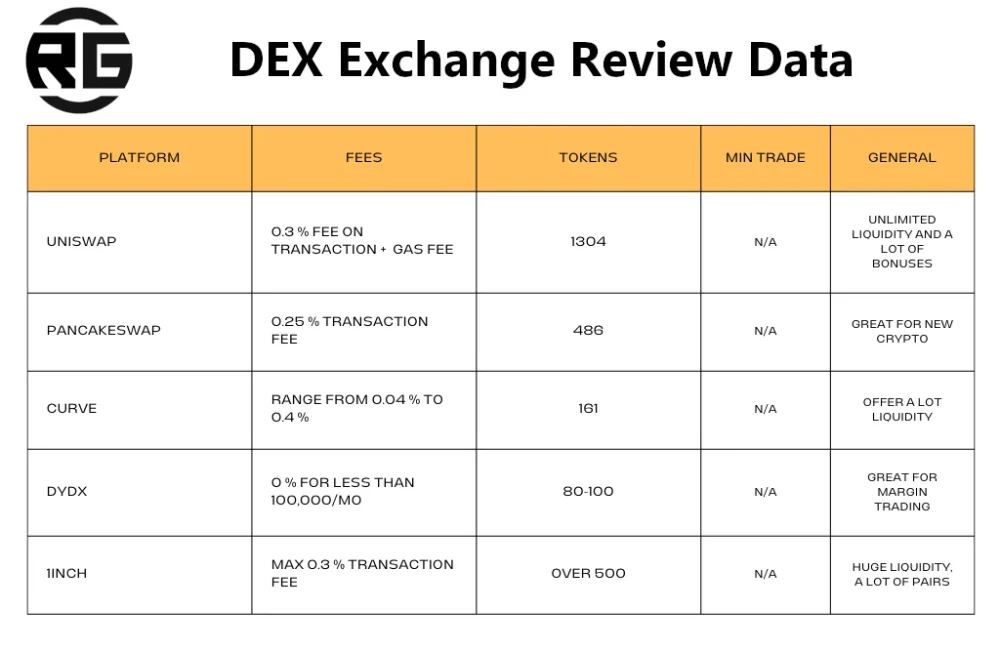

DEX Exchange Data

Here I have decided to present all data together, because it’s very good to compare them in one place. I guess you know what I mean.

In the event of capital liquidation, Uniswap has the largest resources. There are almost endless possibilities you can write. 1Inch is in second place, Pancakeswap is in third place.

Dydx offers an interesting price offer, where transactions are free of costs up to PLN 100,000 per month.

In other cases, Pankecakeswap and 1Inch are most preferred.

Each of these DEX exchanges has its own specific use. An example would be Dydx as a great DEX for margin trading.

DEX Exchange vs CEX Exchange

If your reading regularly this blog then you notice from last blog posts huge shift VC investments in last years.

It was natural that at first there were CEX exchanges, but after a while come to voice DEX exchanges as well. This

trend seems to be very strong and as a matter of fact more and more DEX exchanges will be available.

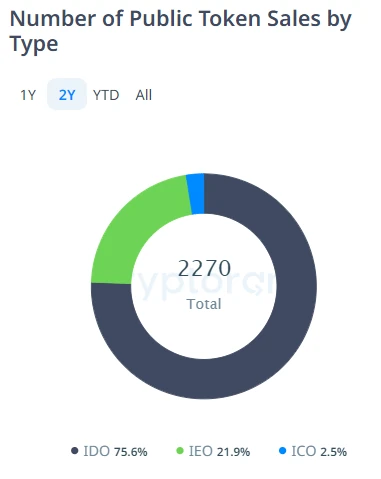

Let’s first show you again one graphic from last blog posts and then you would know it what I mean.

Let me explain what that mean for you as an investor or trader. More than 75 % on the market were sold as IDO – projects of decentralized exchanges. In comparison to IEO – projects of centralized exchanges. You can read more about it in Fundraising article.

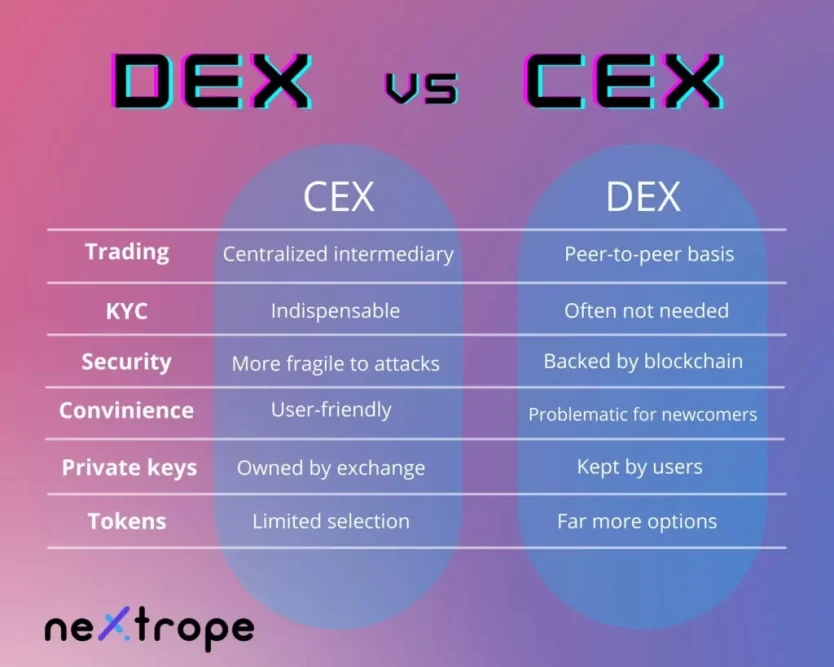

In meantime let’s come back to comparison of DEX exchange and CEX.

In fact, in the case of DEX there are more trading options and security is on the user’s side (storage of private keys).

What is also worth noting is that the operation of DEX exchanges is definitely more difficult for new users.

Trading, of course, is p2p in the case of DEX options, but large CEX exchanges also provide this option.

Conclusion

Through the lens of platforms like Uniswap, PancakeSwap, Curve, dYdX, and 1Inch, I’ve ventured deep into the mechanics that empower users to trade with unprecedented security, efficiency, and decentralization.

These platforms not only exemplify the strides made in enhancing user experience and expanding accessibility but also underscore the significance of innovation in fostering a more inclusive financial ecosystem.

Investments in case of DEX projects in last 2 years just booming, so as a natural consequence DEX exchanges and projects related to DEX will trending in next years.

Leave a Reply

You must be logged in to post a comment.