Introduction

Are you new to the world of cryptocurrency and wondering what all the fuss is about Polygon (MATIC)? Look no further, as I present the ultimate guide to understanding what is Polygon. As one of the most promising projects in the blockchain space.

Polygon has been making waves with its unique approach to solving some of the most significant issues in the decentralized finance ecosystem, surely.

Indeed, Polygon is very promising project.

Understanding the Basics of Blockchain

Before diving into what Polygon is and how it works, let’s first understand the basics of blockchain technology. Of course, a blockchain is a distributed ledger that records transactions in a secure and transparent manner. It is a decentralized system that allows for peer-to-peer transactions without the need for intermediaries like banks.

Each block in a blockchain contains a set of transactions, and once a block is added to the chain, it cannot be altered. So, this makes blockchains immutable, meaning that the data stored on them is tamper-proof.

Obviously, the most well-known blockchain is Ethereum, which allows for the creation of smart contracts and decentralized applications (dApps).

However, as Ethereum’s popularity grew, so did its scalability issues, leading to high fees and slow transaction times. This is where Polygon comes in.

What is a Polygon Network?

Surely, Polygon is a layer 2 scaling solution for Ethereum that aims to improve the network’s scalability, interoperability, and user experience. So, project was launched in 2017 under the name Matic Network and was rebranded to Polygon in 2021.

Cryptocurrency is an open-source platform that allows developers to create dApps with faster transaction times and lower fees than Ethereum. It achieves this through the use of two main components:

Polygon SDK

This is a software development kit that allows developers to create their own custom blockchains with Ethereum compatibility. Developers can choose to use Polygon’s pre-built modules or create their own.

Polygon POS Chain

This is a proof-of-stake blockchain that is connected to the Ethereum mainnet. It is used to secure transactions and provide faster confirmation times.

Of course, Polygon network has components like CDK, public chains and so on.

Advantages of Using Polygon (MATIC)

There are several advantages to using Polygon over other cryptocurrencies and blockchain platforms.

Scalability

One of the primary advantages of this project is its scalability, surely. By using sidechains, this cryptocurrency can process thousands of transactions per second, indeed. Compared to Ethereum’s 15 transactions per second. What’s more, this means that dApps built on Polygon can handle a much higher volume of users without experiencing slow transaction times or high fees.

Lower Fees

Another advantage of using Polygon is its low fees. Because transactions are processed on sidechains, the fees are significantly lower than on the Ethereum mainnet. This makes cryptocurrency a more accessible platform for users who want to participate in DeFi but may not have the resources to pay high fees.

Interoperability

Obviously, Polygon is interoperable with Ethereum, meaning that dApps built on Polygon can communicate with those built on Ethereum. This makes it easier for developers to create cross-chain applications and for users to access a wider range of decentralized services.

Surely, cryptocurrency Polygon is one of the projects with many advantages. Be aware of it.

How does MATIC Work?

Now that we understand what this cryptocurrency is and its advantages let’s dive into how it works.

PoS Consensus Mechanism

Polygon uses a proof-of-stake (PoS) consensus mechanism, which is energy-efficient and more scalable than Bitcoin’s proof-of-work (PoW) mechanism. In a PoS system, validators stake their tokens to participate in block validation. Validators are selected to create new blocks based on the number of tokens they have staked. This reduces the risk of centralization and makes the network more secure.

Sidechains

Polygon uses sidechains to process transactions. Sidechains are separate blockchains that are connected to the main Ethereum network. They allow for faster transaction processing times and lower fees. When a user makes a transaction on Polygon, it is first processed on a sidechain before being committed to the Ethereum mainnet.

Plasma

Polygon also uses the Plasma framework, which is a scaling solution for Ethereum that was first proposed by Vitalik Buterin in 2017. Plasma allows for the creation of child chains that run alongside the main Ethereum chain. This allows for faster transaction processing times and reduces the load on the main Ethereum network.

In fact, better understanding how polygon works may convince you to investment.

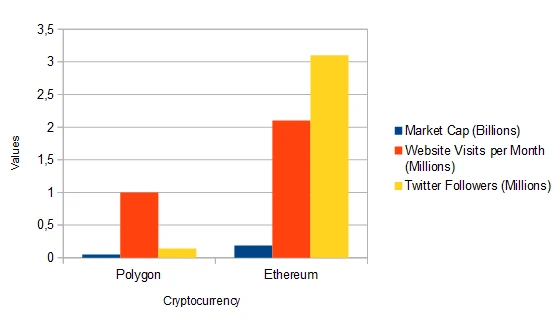

Polygon (MATIC) vs Ethereum

While Polygon is built on top of Ethereum, there are some key differences between the two platforms.

Scalability

As I mentioned earlier, one of the main differences between Polygon and Ethereum is scalability. Ethereum’s current capacity is limited to around 15 transactions per second. While Matic can process thousands of transactions per second. This makes Polygon a more attractive platform for developers who need to process a high volume of transactions.

Fees

Another difference between Polygon and Ethereum is fees. Because transactions are processed on sidechains, Polygon’s fees are significantly lower than Ethereum’s. This makes Polygon a more accessible platform for users who want to participate in DeFi without paying high fees.

Consensus Mechanism

Ethereum uses as like Polygon a PoS consensus mechanism, which is energy-intensive. PoS is more energy-efficient than PoW (used by Bitcoin), making it a more sustainable option for the future.

In case of Polygon and Ethereum competition is without any disscusion. Ethereum is dominant.

Polygon vs Ethereum Zero-Knowledge

Polygon zkEVM is fundamentally equivalent to the Ethereum Virtual Machine (EVM) itself and fully benefits from all of Ethereum’s ecosystem. EVM-equivalence is different from EVM-compatibility because it creates less user friction, removing the need for any kind of modification or re-implementation of code.

Polygon zkEVM, which stands for zero-knowledge Ethereum Virtual Machine, leverages the power of zero-knowledge (ZK) proofs to reduce transaction costs and greatly increase throughput, all while inheriting the security of Ethereum.

The ZK proof technology works by batching transactions into groups, which are then relayed to the Ethereum Network as a single, bulk transaction.

The ‘gas fee’ for the single transaction is then split between all the participants involved, dramatically lowering fees.

Investing in MATIC

Now that we understand what Polygon is and how it works. Let’s explore investing in it. As with any investment, there are several things to consider before making a decision.

Market Capitalization

Polygon’s market capitalization has grown significantly over the past year. Reaching over $10 billion at its peak. While this is still small compared to Ethereum’s market cap, it is a sign of Polygon’s potential for growth. In this moment cryptocurrency has $5.56 billion market capitalization – 12th place on the the Coingecko list. We are already after bear market, when Bitcoin price hit about 15 500 $ for unit (May-November 2022).

Development Team

The Polygon development team is made up of experienced blockchain developers and entrepreneurs (10 people). They have a track record of delivering on their promises and have a clear vision for the future of the platform. More you can follow how is going on progress of job on their website or Github page.

Use Cases

Polygon has several use cases, including decentralized exchanges, gaming, and NFTs. As the DeFi ecosystem continues to grow, Polygon’s use cases are likely to expand as well. Polygon team working on to make network as much useful as it’s possible.

As a result of these efforts, the project ecosystem is developing very dynamically, and the number of its users is constantly growing.

Just look at these numbers:

294.042 total contract creators,

225.74M+ unique addresses,

2.57B+ transactions,

4 years of project development.

Don’t these numbers prove the right way to develop the project?

Polygon Price Analysis in Depth

Bull Market

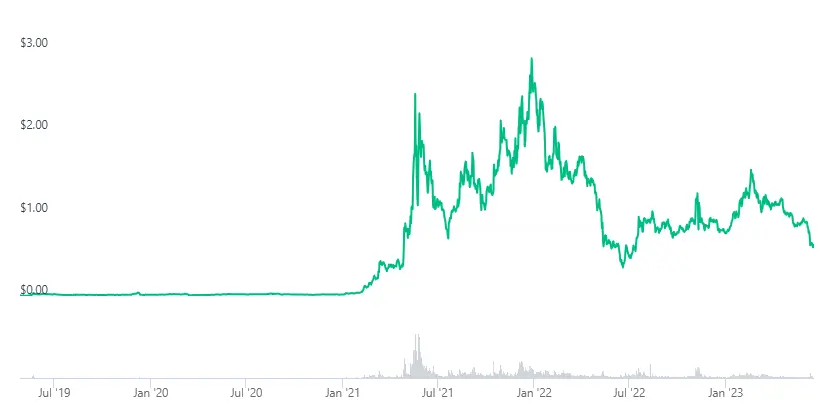

In the case of Polygon, I can only write about one bull market, because only one took place. The price starts at $0.005. It was around May 2019.

Over two years, the price has increased every $2.45.

Amazingly, at the end of the same year, the cryptocurrency entered the bull market after a price correction. This time the price reached $2.92.

Possible Profits for Investor

In the first case, $0.005 to $2.45, the difference is colossal, surely. Within 2 years the price increases 490 times !!!

Without a doubt, it should be added that one cannot expect such increases as a bull market. Usually, it is the first bull market that brings the highest rates of return on investment. The risk of investing in a startup cryptocurrency is huge, but if you choose a good cryptocurrency, you can gain 100 – 400 times the return on investment.

Price Adjustment

The price from its peak loses momentum and drops from $2.45 to $0.69 in two months.The boom is not over yet. The price reaches a new high in five months at $2.92 per Polygon.

This time, from low to high, you could earn 4 times the value of your investment.

Bear Market

From December 2021 to mid-2022, the price drops to $0.34 per unit. From then on, a slow upward trend begins. Here I will end the historical analysis of the cryptocurrency.

Staking and Earning Rewards

One way to earn rewards with this cryptocurrency is through staking. By staking your MATIC tokens, you can earn a portion of the transaction fees generated on the network. Staking also helps to secure the network and maintain its decentralization.

Future Developments

Particularly, project has several upgrades and developments in the pipeline, including the launch of Polygon SDK 2.0 and the implementation of EIP-1559.

These upgrades are designed to improve the user experience and make Polygon a more attractive platform for developers, surely.

Of course, team of entreprenuers monitor trends what happen on crypotcurrency market and trying adopt changes to their project. All this is making this cryptocurrency as much usuful as it’s possible for their users, developers and investors.

Conclusion

Overall, Polygon (MATIC) is a promising project with a strong development team and several use cases.

Its scalability and low fees make it an attractive platform for developers. Its interoperability with Ethereum makes it a valuable addition to the DeFi ecosystem.

While investing in any cryptocurrency comes with risks. Polygon’s potential for growth and development make it a compelling investment opportunity for both newcomers and seasoned investors.

Leave a Reply

You must be logged in to post a comment.