Introduction

In fact, cryptocurrency Balancer has emerged as a powerful tool that transforms the way we trade and manage our crypto assets.

Balancer is a decentralized exchange and automated portfolio manager built on the Ethereum blockchain.

It allows users to create and manage liquidity pools, which are self-balancing cryptocurrency portfolios. These pools consist of multiple tokens, and the weights of each token can be adjusted to maintain the desired balance.

In this article little bit more about Balancer cryptocurrency, how it works, benefits, implementations and so on…

Enjoy your reading!

How Balancer Works

Balancer operates on the concept of Automated Portfolio Management (APM). What is APM?

APM is a set of algorithms that manage the assets in a liquidity pool to maintain a desired balance.

When a user creates a liquidity pool on Balancer, they can specify the tokens and their desired weights. Balancer then uses smart contracts to ensure that the pool remains balanced by automatically rebalancing the assets if the weights deviate from the desired allocation.

One of the key features of Balancer is its ability to support multiple tokens in a single liquidity pool. This allows users to create highly diversified portfolios and gain exposure to a wide range of cryptocurrencies.

Balancer also offers customizable fees for liquidity providers, enabling them to earn additional income by providing liquidity to the pools. Moreover, Balancer has a user-friendly interface and is compatible with various wallets, making it accessible to both experienced traders and beginners.

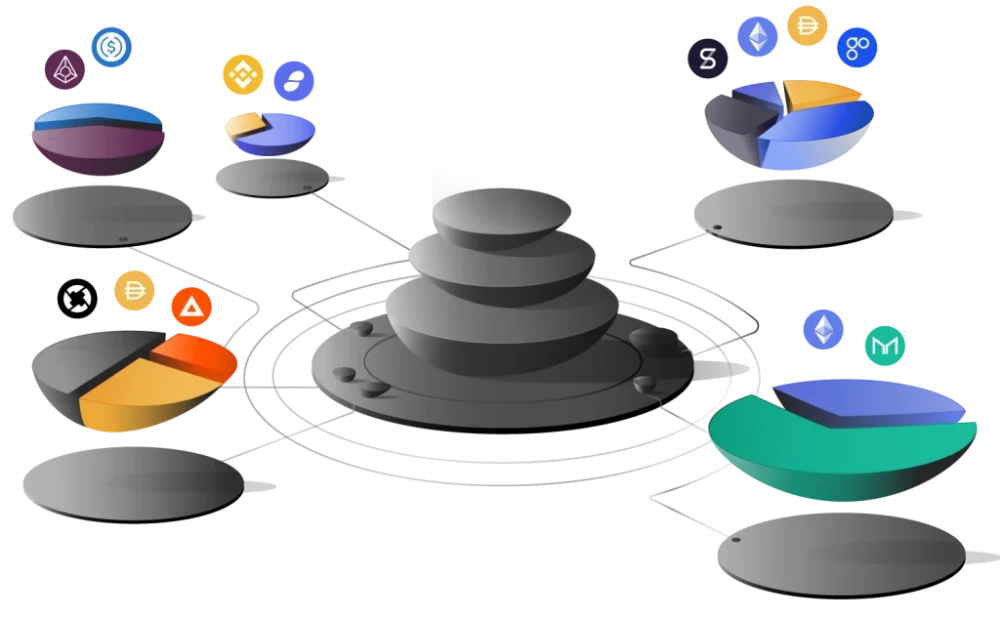

Among the various liquidity fields, Balancer does all the work.

In fact, thanks to Balancer, different liquidity pools maintain their balance.

This is where the name of the project comes from.

In addition, the second version v2 of the protocol has been used in many other projects. I’ll mention this a bit later.

Benefits of Using Balancer

Using Balancer in cryptocurrency trading offers several benefits.

Firstly, it provides users with greater flexibility and control over their crypto assets. By creating a liquidity pool on Balancer, users can define the tokens and their weights according to their investment strategy. This allows for a highly customized and tailored approach to cryptocurrency trading.

Secondly, Balancer allows for efficient and cost-effective trading.

Traditional exchanges often charge high fees for trading, especially for smaller trades. With Balancer, users can trade directly from the liquidity pools without the need for intermediaries, resulting in lower fees.

Additionally, Balancer’s automated portfolio management ensures that the assets are rebalanced automatically, saving users time and effort.

Lastly, Balancer enhances liquidity in the crypto market.

By creating liquidity pools, users contribute to the overall liquidity of the ecosystem. This benefits both traders and investors, as it increases the availability of assets and reduces price volatility. Increased liquidity also attracts more participants to the market, making it more efficient and vibrant.

Successful Balancer Implementations

Several real-world examples demonstrate the success and effectiveness of Balancer in the crypto landscape.

One such case is the implementation of Balancer by a decentralized finance (DeFi) project called Yearn Finance. Yearn Finance leveraged the power of Balancer to create a liquidity pool for its governance token, YFI.

This not only provided liquidity to YFI holders but also enabled them to earn additional income through fees generated by the pool.

Another case study involves a cryptocurrency hedge fund that utilized Balancer to manage its portfolio.

By creating a liquidity pool on Balancer, the hedge fund was able to achieve a desired asset allocation and automate the rebalancing process. This resulted in improved portfolio performance and reduced operational costs for the fund.

Who hasn’t heard of projects such as Aave, 1inch or PlutusDAO?

It’s true that the last one may be a bit less known.

But that’s not the end. The second version (v2) Balancer protocol has been implemented and is a partner of many well-known marketplaces in the cryptocurrency world.

Here are the statistics taken from the project website itself.

Without a doubt, Balancer is used by projects that are more famous.

Just look at the market capitalizations of these projects.

Conclusions? Now what can you say about the project itself and its concept?

Balancer vs. Other Cryptocurrency Platforms

While there are several cryptocurrency platforms available in the market, Balancer stands out due to its unique features and benefits.

Unlike traditional exchanges, Balancer allows for the creation of highly customized and diversified portfolios. This sets it apart from platforms that offer only a limited selection of cryptocurrencies.

Moreover, Balancer’s automated portfolio management feature gives it an edge over other decentralized exchanges. The ability to automatically rebalance assets ensures that the portfolio remains aligned with the desired allocation, reducing the need for manual intervention.

This is particularly advantageous for users who prefer a hands-off approach to managing their crypto assets.

Additionally, Balancer’s customizable fees for liquidity providers make it more attractive than traditional exchanges that charge fixed fees. This flexibility allows liquidity providers to maximize their earnings based on market conditions and demand for their assets.

Balancer Price in Depth

The Balancer cryptocurrency has been listed on stock exchanges since June 2020.

Over the course of 4 years, the cryptocurrency has gone through one bull market and one bear market. And now we have another bull market in progress.

Wait a minute… I’ll move on to discussing price behaviour in the next stages.

Of course, I will limit myself to the bull and bear market, ignoring the sideways price trend.

1st Bull Market

The starting price on the stock exchanges was really quite high, $15.20 per unit.

We can only talk about such prices when listing a new project on stock exchanges when the project is a so-called game-changer.

Is there? Judge for yourself.

After a short boom, the price underwent a correction and dropped to around $8.50.

We are in mid-July 2020, and by October the price had rebounded and remained in an upward trend. Hitting another high of $33 per unit. Then it’s time for another correction…

This time the bottom is around $10.

Interestingly, from November to May of the following year, i.e. 2021, the price remained in a strong upward trend.

New ATH at $74.45 per unit. From $10, that’s a significant increase in nearly half a year.

Meanwhile, the cryptocurrency market is still booming.

The time of bear market has come for the Balancer price.

1st Bear Market

As I mentioned, the bear market has already arrived since the beginning of May 2021.

In fact, the most dynamic price drop came by the end of June, but it was not the only one.

This phase of the bear market turned out to be the most drastic. After which the price returned to the short uptrend.

Either way, the main trend remained downward and by June 2022 the price dropped to around $4 per unit. It seemed that this was the end of the bull market …

Meanwhile, if you look at the current price of Balancer, the price is still in a downward trend. Has the price broken out of the bear trend then? I don’t think so…

The June 2024 price of $2.50 per unit is the lowest local low since the listing of the cryptocurrency.

2nd Bull Market

Balancer price is constantly waiting for a bull market.

Currently, it can be determined that we are certainly not in an upward trend in the price of Balancer. At most, in a sideways trend…

Potential of Balancer in the Crypto Industry

Balancer has already made a significant impact on the crypto industry, but its potential is far from exhausted.

As the popularity of DeFi continues to grow, Balancer is well-positioned to play a crucial role in the ecosystem. The platform is constantly evolving, and new features and improvements are being introduced regularly.

In version two (v2) of the Balancer protocol, it was integrated with DeFi. This enable cross-platform interoperability and enhance the overall efficiency and functionality of the DeFi ecosystem.

Additionally, Balancer is exploring the possibility of integrating with Layer 2 solutions to address scalability challenges and reduce transaction fees.

Work is underway on the third version (v3) of the project. What’s in this version?

Balancer v3’s architecture focuses on simplicity, flexibility, and extensibility at its core. The v3 vault more formally defines the requirements of a custom pool, allowing us to shift core design patterns out of the pool and into the vault.

What will this mean for us as investors and traders?

It seems that managing our cryptocurrency portfolio will become even more flexible.

I will try to provide a more eloquent explanation next time, when I will certainly return to the topic.

Conclusion

In conclusion, Balancer has emerged as a powerful force in the crypto landscape, revolutionizing the way we trade and manage our crypto assets. Its unique features, such as customizable portfolios and automated portfolio management, provide users with greater flexibility, control, and cost-effectiveness.

Version two of the protocol has been widely integrated into many DeFi projects, proving the project’s success. However, you need to look critically at the price of the Balancer token itself.

The project is being further developed, as evidenced by version 3 (v3), but interest in the project itself is decreasing despite the project’s progress. Therefore, it seems only a matter of time to see whether the project will actually confirm its value thanks to the new ATH in the current bull market.

In my opinion it won’t happen, but like everyone else I could be wrong.

Leave a Reply

You must be logged in to post a comment.