Introduction

Welcome to the beginner’s guide to Curve cryptocurrency!

In this comprehensive guide, I will explore the world of Curve, a blockchain protocol that operates an automated market making service focused on stablecoins.

Whether you’re new to cryptocurrencies or an experienced investor, this guide will provide you with the knowledge and insights you need to understand and navigate the Curve ecosystem.

Enjoy your reading!

What is Curve?

Curve is a decentralized finance (DeFi) protocol built on the Ethereum blockchain.

It functions as an automated market maker (AMM) and facilitates the trading of cryptocurrencies without the need for a centralized order book. Instead, Curve relies on liquidity pools provided by users, who can earn fees through their deposits.

While there are other popular AMM platforms like Uniswap and Balancer, Curve sets itself apart by focusing on markets for stablecoins.

Stablecoins are cryptocurrencies that are designed to maintain a stable value by pegging their price to an external asset, such as the US dollar or Bitcoin.

How does Curve work?

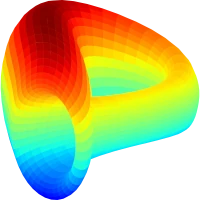

At the core of Curve’s trading platform is a mathematical feature known as a bonding curve. This bonding curve allows stablecoins to be traded for one another at the best possible price, with minimal variation in their relative prices.

By focusing on stablecoins, Curve aims to provide low fees and stability in trading.

To ensure the availability of liquidity, Curve requires users to lock up their cryptocurrencies in lending pools.

These pools maintain a certain ratio of different stablecoins, which fluctuate in value based on supply and demand. By locking up their coins, users can earn a return on their investment and a proportion of the fees generated from trades.

Curve also employs a governance model that allows token holders to participate in decision-making.

The native token of Curve, called CRV, plays a crucial role in the governance process. Holders of CRV tokens can vote on proposals that set the rules of the Curve system, such as fee structures, rewards for liquidity providers, and the addition of new liquidity pools.

Who created Curve?

Curve was created by a team led by Michael Egorov, who is also the co-founder of NuCypher, a company focused on data privacy. The project’s white paper, authored solely by Egorov, was published in November 2019.

While the project has raised financing from prominent figures in the DeFi space, specific details have not been disclosed.

Advantages of Curve

Curve offers several advantages that make it a popular choice in the DeFi ecosystem.

Low fees and slippage

Curve’s focus on stablecoins and its efficient bonding curve algorithm result in lower fees and minimal price slippage compared to other AMMs.

Stability

By targeting stablecoins, Curve provides a more stable trading environment, reducing the risk of volatility commonly associated with other cryptocurrencies.

Composability

Curve integrates with other DeFi protocols like Compound, Yearn Finance, and Synthetix, allowing users to maximize their rewards and explore additional investment opportunities.

Liquidity

Curve’s liquidity pools ensure a steady supply of assets, making it easier for traders to buy and sell stablecoins at fair prices.

Potential Risks and Challenges

While Curve offers numerous benefits, it’s important to be aware of potential risks and challenges associated with the protocol.

First of all, the biggest risk is related to smart contracts. Because project is built on smart contracts, and any vulnerability can be critic for security of project.

Next one is regulations. As much cryptocurrency market evolving, as DeFi sector as well. Changes in regulations or legal challenges could impact the operation and viability of Curve.

The last one I want to mention is impermanent loss. While Curve’s focus on stablecoins minimizes impermanent loss compared to other AMMs, there is still a potential risk of loss due to fluctuations in the value of the underlying assets.

Users should carefully consider the risks before providing liquidity to Curve’s pools.

Curve Price in Depth

The project has been listed on stock exchanges for 4 years.

As you can see, the price reached its peaks at the very beginning, and on July 5 this year it reached the bottom.

4 years is normally a bull and bear market cycle, but in this case we are dealing with a different case.

It is true that there was a boom, but it did not reach the peaks seen at the beginning of the list.

The price of the project itself decreased…

For almost 2 and a half years! But, let’s come back to beginning.

1st Bull Market

The price exploded right from the start!

At its inception, it peaked at $15.37 per unit in August 2020.

By November, the price had dropped to $0.36 per unit. What’s going on here?

After which, the return of the upward trend lasts until the end of 2021.

Then the price stops at $6.51 per unit. I rarely encounter such a boom.

Well, since the beginning of 2022, the price has basically been in a downward trend.

The boom lasted almost a year and a half.

And what about the bear market?

1st Bear Market

The price at the beginning of 2022 reaches $6.51 per unit. At the end of the bull market.

Normally, after about a year, the price should find its bottom and start to recover, but…

Here the price has been falling for almost two and a half years.

The most dynamic decline could be observed during the first six months.

Later, the price failed to defend its bottom and the price went even lower.

Currently it is $0.27 per unit. Such a price was not visible from the beginning of the listing. Well, maybe except July this year.

Getting Started with Curve

To get started with Curve, you’ll need a compatible Ethereum wallet and some stablecoins to trade.

At first, select a wallet that is compatible with Ethereum and supports Curve. Popular options include MetaMask, Ledger, and Trezor.

Then, obtain the stablecoins you want to trade on platform. You can purchase stablecoins from cryptocurrency exchanges or convert other cryptocurrencies into stablecoins.

As a next step, connect your Ethereum wallet to the Curve platform by following the instructions provided on the Curve website.

Further, explore the available liquidity pools on Curve and select the one that suits your trading needs. Each pool focuses on specific stablecoins or tokenized assets like Bitcoin.

Before the end, deposit your stablecoins into the chosen liquidity pool to become a liquidity provider.

In return, you will earn fees and potentially CRV tokens as rewards.

At the end, once your stablecoins are deposited, you can start trading on Curve.

Take advantage of the low fees and stable prices to buy, sell, or exchange your stablecoins.

Conclusion

Curve cryptocurrency is a powerful decentralized finance protocol that brings stability and efficiency to the world of automated market making. By focusing on stablecoins and employing innovative algorithms, Curve offers a unique trading experience with low fees and minimal price slippage.

Whether you’re a beginner or an experienced cryptocurrency enthusiast, Curve offers a platform that combines stability, liquidity, and potential rewards. By participating in the Curve ecosystem, you can unlock the power of automated market making and be a part of the growing DeFi revolution.

In case of price of project I see things what are not expected for stable growing projects on cryptocurrency market. Price of project was in two and half downtrend. Nothing good! In the same time capitalization started to grow from half of 2022 year during lost of project price.

Leave a Reply

You must be logged in to post a comment.