Introduction

Cryptocurrency Initial Coin Offering (ICO) have gained significant popularity in recent years, offering individuals the opportunity to invest in innovative blockchain projects and potentially reap substantial returns.

In this article, I will explore the world of ICOs and provide you with valuable insights on how to make smart investment decisions in this exciting and rapidly evolving space.

As like always let’s get start it!

What is an ICO?

An ICO, short for Initial Coin Offering, is a fundraising method used by blockchain projects to raise capital by selling their own cryptocurrencies or tokens to investors.

These tokens are usually issued on a blockchain platform, such as Ethereum, and represent a stake or utility in the project. Investors participate in an ICO by purchasing these tokens with established cryptocurrencies, such as Bitcoin or Ethereum.

ICOs typically have a specific fundraising goal and a predetermined timeline.

Once the ICO is launched, interested investors can contribute to the project by sending their desired amount of cryptocurrency to a designated address.

In return, they receive a proportional amount of the project’s tokens. The tokens can later be traded on cryptocurrency exchanges or used within the project’s ecosystem.

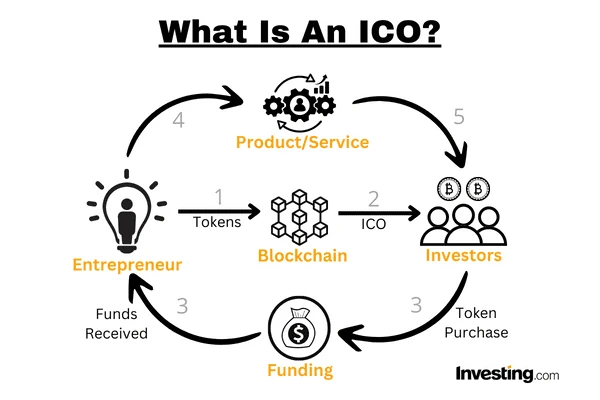

In fact, the entrepreneur first creates tokens in the blockchain, then proposes the ICO project to investors, explaining the business model and tokenization of the project.

The first investors buy the project’s tokens in the belief that they will achieve a high ROI from the entire investment.

The entrepreneur then receives the funds needed to create services or a product related to the entire project.

The services or product are then offered first to investors.

Then, after some time, the project is listed on stock exchanges and available to a wider group of investors.

This is how the circle closes. Indeed, this is the entire concept of ICOs.

The graphic was taken from Investing.com

Benefits of Investing in ICO

Firstly, ICOs provide early access to innovative blockchain projects that have the potential to disrupt traditional industries.

By investing in the early stages, you may benefit from the project’s growth and success, potentially realizing significant returns on your investment.

Secondly, ICOs offer liquidity.

Unlike traditional venture capital investments, where your funds may be tied up for several years, ICO tokens can be bought and sold on cryptocurrency exchanges, allowing you to enter or exit your investment at any time.

Without a doubt, CO attracts many investors because of the opportunity to get rich.

It should be remembered that there is a high risk that the investor bears when investing.

If we add that we are dealing with a cryptocurrency project, the risk increases even more.

All this is due to the fact that cryptocurrencies are a young sector. It is true that adoption is progressing, but there is still a long way to go.

Moreover, we are talking about technology companies and startups! The tokenization ideas themselves are often very innovative. The public may not understand the concept itself, and then the enthusiasm and support of investors does not matter much.

Risks related with ICO

Despite these benefits, it’s important to recognize the inherent risks associated with ICO investments.

The cryptocurrency market is highly volatile, and many ICO projects fail to deliver on their promises.

There is a risk of losing your entire investment if the project fails or if the market sentiment turns against it.

Additionally, the lack of regulation and oversight in the ICO space opens the door for scams and fraudulent projects.

So what do you say about ICO now?

Of course, there are many advantages, but just as many risks.

One of the biggest is the total loss of capital.

Moreover, many ICO projects are scams and have a low success rate.

Which, simply put, means that you will most likely lose the money you invested in the ICO.

However, what you do with your own money is your business.

Before Investing in an ICO

Before investing in an ICO, it’s crucial to thoroughly evaluate the project and consider several factors.

Firstly, assess the project’s viability and potential for success. Look for a strong and experienced team behind the project, with a track record of delivering on their promises.

Research the project’s whitepaper, which outlines its technology, roadmap, and goals, to gain a deeper understanding of its vision and objectives.

Analyzing the token economy is equally important. Evaluate the utility and scarcity of the tokens being offered.

A well-designed token economy should incentivize token holders to actively participate in the project’s ecosystem, driving demand and potentially increasing the value of the tokens over time.

Furthermore, assess the market and competition.

Is the project solving a real problem or addressing an untapped market?

Is there a demand for the project’s product or service?

Conduct market research and analyze the competitive landscape to determine if the project has a unique value proposition and a competitive advantage.

Lastly, consider the regulatory landscape. While ICOs offer exciting opportunities, they also operate in a regulatory gray area in many jurisdictions.

Stay informed about the legal and regulatory implications of investing in ICOs in your country to ensure compliance and mitigate potential risks.

Researching ICO

Thorough research and evaluation are crucial when it comes to investing in ICOs.

In this section, I will guide you through the steps to effectively research and evaluate ICO projects, enabling you to make informed investment decisions.

Whitepaper and Project Team

The whitepaper is a fundamental document that outlines the project’s technology, goals, and roadmap.

Take the time to carefully read and analyze the whitepaper, assessing the project’s underlying technology, its potential use cases, and its competitive advantages.

Look for a well-documented and well-thought-out whitepaper, as it reflects the project’s level of professionalism and attention to detail.

Additionally, research the project team behind the ICO. Evaluate the team’s experience, expertise, and track record in the blockchain and cryptocurrency space.

A strong and reputable team increases the project’s credibility and the likelihood of its success.

Analyzing the Token Economy

The token economy plays a crucial role in the success of an ICO project.

Carefully analyze the tokenomics of the project, including factors such as the total supply of tokens, the distribution mechanism, and the use cases of the tokens within the project’s ecosystem.

A well-designed token economy should create a strong incentive for token holders to participate actively in the project, driving demand and potentially increasing the value of the tokens.

Furthermore, assess the level of community support and engagement surrounding the project. Look for an active and supportive community that believes in the project’s vision and actively participates in discussions and events.

A strong community indicates a higher likelihood of project success and adoption.

Assessing the Market

Evaluate the market and competition surrounding the ICO project.

Conduct thorough market research to determine if there is a real demand for the project’s product or service.

Analyze the competitive landscape to identify potential competitors and assess the project’s unique value proposition and competitive advantage.

Additionally, consider the market dynamics and potential barriers to entry.

Are there any regulatory or technological challenges that the project may face?

Understanding the market and competition will enable you to make a more informed investment decision.

Regulatory Considerations

Performing due diligence is crucial before investing in an ICO.

Conduct a background check on the project, its team members, and its advisors. Look for any red flags or negative reviews that may indicate potential risks or fraudulent activity.

Furthermore, consider the regulatory landscape. Stay informed about the legal and regulatory implications of investing in ICOs in your country.

Some jurisdictions have imposed restrictions or guidelines for ICO investments, and it’s important to ensure compliance to avoid legal issues.

Investment in Cryptocurrency ICO

Now that you have conducted thorough research and evaluation, it’s time to make smart investment decisions in cryptocurrency ICOs.

In this section, I will provide you with valuable tips to maximize your chances of success.

Tips for Success in ICO Investing

Diversify your portfolio

Invest in a variety of ICO projects to spread your risk and increase your chances of investing in a successful project.

Set a budget

Determine the amount of money you are willing to invest in ICOs and stick to it.

Set a budget that you can afford to lose, as ICO investments are inherently risky.

Stay updated

Continuously monitor the market and stay informed about the latest developments in the cryptocurrency and blockchain space. Stay updated on the progress of the ICO projects you have invested in.

Common Mistakes

FOMO (Fear of Missing Out)

Avoid investing in ICOs solely based on hype or fear of missing out. Conduct thorough research and evaluation before making investment decisions.

Overlooking Regulatory Considerations

Be mindful of the legal and regulatory implications of investing in ICOs.

Ensure compliance with the regulations in your jurisdiction to mitigate potential risks.

ICO Investment Strategies

Developing a sound investment strategy and diversifying your portfolio are key to successful ICO investing.

Consider allocating a certain percentage of your investment portfolio to ICOs, while also diversifying your investments across different projects and sectors.

Additionally, consider the timing of your investments.

Investing in the early stages of an ICO may offer higher potential returns, but it also carries higher risks.

Alternatively, investing in a more mature ICO project may offer a more stable investment opportunity.

Managing your ICO Investments

Once you have made your investments in cryptocurrency ICOs, it’s essential to actively monitor and manage your portfolio.

Stay updated on the progress of the ICO projects you have invested in, and assess their performance against their stated goals and milestones.

Additionally, regularly review your portfolio and rebalance your investments if needed.

As the cryptocurrency market is highly volatile, it’s important to adjust your portfolio to mitigate potential risks and maximize your returns.

Conclusion

Investing in cryptocurrency ICOs offers exciting opportunities for individuals to participate in innovative blockchain projects and potentially realize substantial returns.

However, it’s crucial to approach ICO investments with caution and perform thorough research and evaluation before making investment decisions.

By understanding the fundamentals of ICOs, conducting due diligence, and developing a sound investment strategy, you can unlock the potential of ICO investments and make smart investment decisions in this rapidly evolving space.

Leave a Reply

You must be logged in to post a comment.