Introduction

Cryptocurrencies are digital or virtual currencies that use cryptography for security. They operate independently of a central bank. They can transferred directly between individuals without the need for a financial institution to facilitate the transaction. Bitcoin is the most well-known and widely used cryptocurrency. There are other cryptocurrencies, such as Litecoin, that are gaining in popularity. Understanding the differences and similarities between Litecoin and Bitcoin is important for anyone in cryptocurrency world. Whether as an investment opportunity or as a means of payment.

The Basics of Cryptocurrency

Cryptocurrencies are digital currencies that use cryptographic techniques to secure transactions and to control the creation of new units. They operate on a peer-to-peer network that allows individuals to send and receive transactions without the need for intermediaries. Transactions are on a public ledger – a blockchain. Which is a database that has a network of computers around the world.

Process called mining creating cryptocurrencies. It involves solving complex mathematical problems to validate transactions and to add new blocks to the blockchain. Miners are receiving new units of the cryptocurrency for their efforts.

History of Litecoin and Bitcoin

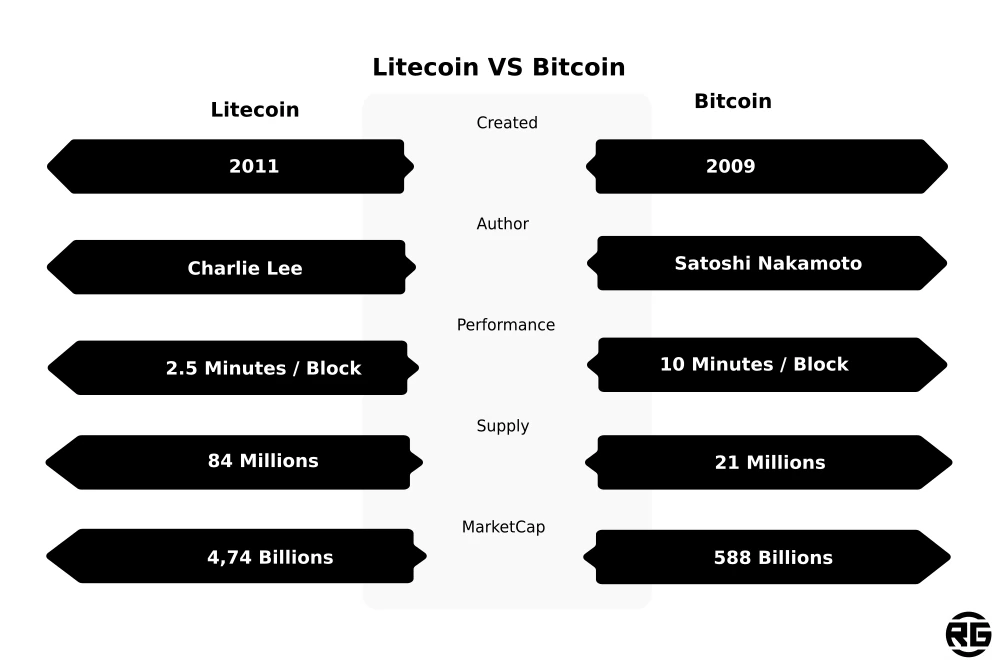

Bitcoin was created in 2009 by an individual or group of individuals using the pseudonym Satoshi Nakamoto. It was the first cryptocurrency and has since become the most widely used and recognized digital currency in the world. Bitcoin’s success has inspired the creation of other cryptocurrencies, such as Litecoin.

Litecoin was created in 2011 by Charlie Lee, a former Google engineer. Disign cryptocurrency is to be a faster and more efficient version of Bitcoin. With a block generation time of 2.5 minutes compared to Bitcoin’s 10 minutes. Litecoin was also designed to be more abundant than Bitcoin. Maximum supply of 84 million coins compared to Bitcoin’s 21 million.

Key Differences Between Them

One of the key differences between those cryptocurrencies is the transaction speed. Litecoin transactions are processed more quickly than Bitcoin transactions. Block generation time of 2.5 minutes compared to Bitcoin’s 10 minutes. This means that Litecoin transactions can be confirmed more quickly, making it a better choice for smaller transactions.

Another difference between them is the mining process. Litecoin uses a different mining algorithm than Bitcoin. It makes more accessible to individuals who don’t have specialized mining equipment. Litecoin’s mining algorithm is called Scrypt, while Bitcoin’s is called SHA-256.

Litecoin also has a different maximum supply than Bitcoin. Litecoin’s maximum supply is 84 million coins, while Bitcoin’s is 21 million. This means that Litecoin will be more abundant than Bitcoin, which could have implications for its long-term value.

Similarities Between Litecoin and Bitcoin

Despite the differences between Litecoin and Bitcoin, there are also some similarities between the two cryptocurrencies. Both are decentralized digital currencies that operate on a peer-to-peer network. They both use a public ledger called a blockchain to record transactions. Both of them rely on a process called mining to validate transactions and to add new blocks to the blockchain.

Those cryptocurrencies are also accepted as payment by a growing number of merchants around the world. As cryptocurrencies become more mainstream, it’s likely that they will continue to gain acceptance. Acceptance as a means of payment for goods and services.

Market Value and Adoption of Litecoin and Bitcoin

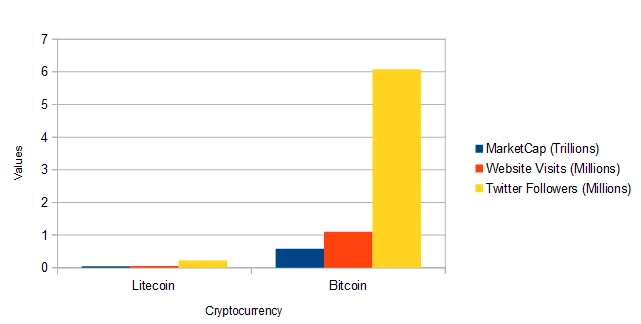

Bitcoin has a much higher market value than Litecoin. Market capitalization of over $580 billion compared to Litecoin’s market capitalization of around $5 billion. Bitcoin is also more widely adopted than Litecoin, with more merchants and businesses accepting it as payment.

However, Litecoin’s market value and adoption are growing. Its market capitalization has increased significantly in recent years, and it is now the ninth-largest cryptocurrency by market capitalization. Litecoin is also accepted by a growing number of merchants and businesses, including some major online retailers.

Litecoin and Bitcoin Mining

Mining is the process of validating transactions and adding new blocks to the blockchain. Both Litecoin and Bitcoin use a proof-of-work consensus algorithm. That means that miners must solve complex mathematical problems to validate transactions. Then they receive new units of the cryptocurrency as a reward.

However, Litecoin uses a different mining algorithm than Bitcoin. Litecoin’s mining algorithm is called Scrypt. While Bitcoin’s is called SHA-256. Scrypt has design to be more memory-intensive than SHA-256, which means that it can be mined using less specialized equipment.

Security and Transaction Speed Comparison

Both cryptocurrencies are secure digital currencies that use cryptographic techniques to protect transactions and to prevent fraud. However, there have been some security concerns with both cryptocurrencies in the past.

Bitcoin has experienced several high-profile security breaches, including the Mt. Gox hack in 2014, which resulted in the loss of over 850,000 bitcoins. Litecoin has not experienced any major security breaches, although there have been some concerns about the security of its mining process.

In terms of transaction speed, Litecoin is faster than Bitcoin. His, block generation time of 2.5 minutes compared to Bitcoin’s 10 minutes. This means that Litecoin transactions are more quickly than Bitcoin transactions. This making a better choice for smaller transactions.

Investment Potential of Litecoin and Bitcoin

Two of them have the potential to be good investments for those interested in cryptocurrencies. Bitcoin has the advantage of being the most widely recognized and adopted cryptocurrency, with a market capitalization of over $0,58 trillion. However, Litecoin has the advantage of being faster and more efficient than Bitcoin, with a growing market capitalization and adoption.

Investing in cryptocurrencies is inherently risky, as the market can be volatile and prices can fluctuate rapidly. It’s important to do your own research and to understand the risks before investing in any cryptocurrency.

Litecoin Price in Depth

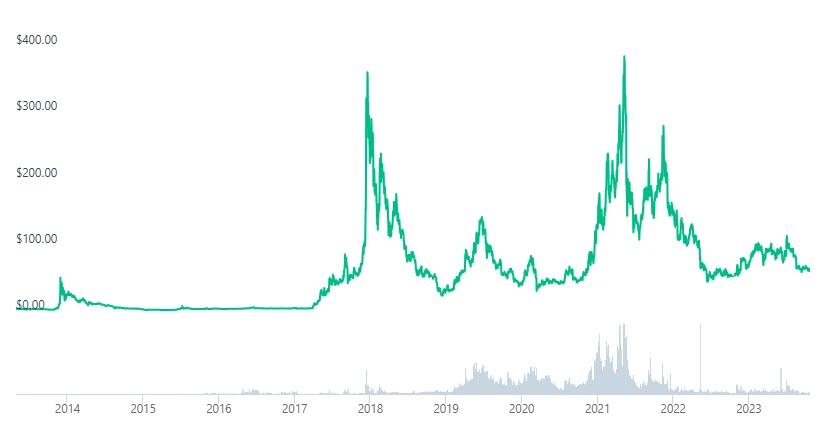

Litecoin is one of the few cryptocurrencies that has a long price history. At least this is the case compared to the rest of the assets on the market.

The cryptocurrency was created in 2011 and is one of the oldest on the market (proof of the asset’s reliability). What does this mean for?

I am able to examine price behavior during three bull and bear markets. All this to determine how the price may behave in the current cycle. The potential of this cryptocurrency cannot be ignored. Let’s get to work.

1st Bull Market

The price of the first listing on the stock exchanges is approximately $4. Quite high, demand was high. Let me remind you that it was 2011.

The level of adoption was really low. Who heard about cryptocurrencies then?

If you are one of these people and you don’t have at least $1 million in your account, you have missed out on a lot of opportunities. I would give anything to be a person who heard about cryptocurrencies in 2010 or 2011.

But not about that now. The price drops to about $2 in mid-2013 and this is the moment when a real bull market in cryptocurrencies begins (at least for this asset).

The peak price is $50 in just six months. You don’t have to be a mathematician to calculate 25 times profit. How can you not love or hate cryptocurrencies! ?

1st Bear Market

After the boom, there comes a bear market that lasts almost a year. The price drops to around $1. It’s the beginning of 2015.

Among the small number of the cryptocurrency public, there are huge winners, but most of them are losers. Damn, I wish I had heard about Bitcoin and Litcon right then. Damn!!

2nd Bull Market

It’s time to move on to the description of bull market 2. In fact, the next boom cycle began after the declines in early 2015. At the beginning, however, capital gradually flowed into the cryptocurrency market.

Private investors and traders are often just licking their wounds from the previous boom. Of course, only if they did not withdraw their capital early enough. Maybe they haven’t moved their capital into stablecoins.

By the way, were there stablecoins at all back then? This interesting question gives me opportunities for development and research. How could capital be transferred to cash at that time?

Wow. I forgot what I was writing about again.

Next come my assumption that the asset price was in a sideways trend for 1.5 years. I won’t argue about how it really was, because why?

From $1 in early 2015, the price increased to $360 within 2 years. The price in a sideways trend reached a ceiling of around $4. The difference between $4 and $360 is 90 times!!!

This is essential madness. I will write again – 90 times!!!

Whoever could not cope with greed lost and did not withdraw the capital until the bear market.

2nd Bear Maket

The 2nd bear market also lasts almost 1 year. Price drop to $22-23. It is easy to calculate 17-18 times the value of the loss.

3rd Bull Market

Cycle 3 starts in mid-2018. It’s not really a proper boom, but it will happen in March 2020.

From around $35 per unit. The price increases until May 2021 and reaches $410. Bear market time is coming.

3rd Bear Market

3 bear market ended in June 2022. I would advise you to read the post on whether we are at the bottom of the cryptocurrency market. The price drops to around $50. 8 times decrease.

What conclusions?

If we observe how the price behaves, in the next bull market the price will reach around $450-500! I wouldn’t fully trust these analyses, because there are so many variables that determine price behavior.

Either way, price history shows. Litecoin is a cryptocurrency that attracts more capital every bull market.

Another issue is that they are often speculators. If you want to read about them, please refer to the article about speculative wars or trading.

Bitcoin and Litecoin Price

For the purpose of this entry, I compared the prices of Litecoin and Bitcoin. The time window is 5 years. Granted, this isn’t the whole pricing story. This time range is sufficient to observe a strong price correlation between both cryptocurrencies. Hello, hello. Not so fast, this does not mean that prices behaved identically!

It should be added that capital flowed into Bitcoin much more strongly (which is not surprising). During the Bitcoin boom, you could earn nearly 8 times from this.

In the case of Litecoin, it was a 6-fold profit. Not bad ! However, the outflow of capital in the case of Litcoin was crushing. After the decline (around June 2022), the price returned to the levels from the beginning of 2020.

Actual Price Situation

As we are currently experiencing a bull market, but (mainly smart money capital is flowing in), capital is flowing more strongly into Bitcoin. Which is also no surprise! I suggest you take a look at the article about the movement of capital on the cryptocurrency market.

I just realized that such a whole post about capital flows has not been written yet (apart from the subsection about stablecoins). Pardon. Then this will be my task for the future and I will leave the situation as it is now.

Future Outlook for Litecoin and Bitcoin

The future outlook for Litecoin and Bitcoin is difficult to predict, as the cryptocurrency market is still relatively new and rapidly evolving. However, both cryptocurrencies have a strong community of supporters and are likely to continue to gain adoption as a means of payment and as an investment opportunity.

As cryptocurrencies become more mainstream, it’s likely that they will face increased regulation and scrutiny from governments and financial institutions. This could have both positive and negative implications for the future of cryptocurrencies.

Conclusion

Litecoin and Bitcoin are two of the most well-known and widely used cryptocurrencies in the world. While they share some similarities, there are also key differences between the two. Understanding these differences and similarities is important for anyone interested in cryptocurrencies, whether as an investment opportunity or as a means of payment. As the cryptocurrency market continues to evolve, it’s likely that Litecoin and Bitcoin will continue to play an important role in shaping the future of digital currencies.

Leave a Reply

You must be logged in to post a comment.