Introduction

Indeed, technological advancements have revolutionized the way we conduct business. One such innovation that has gained significant attention is the concept of smart contracts.

They are self-executing contracts with the terms of the agreement directly written into lines of code.

These contracts automatically execute actions once the predetermined conditions are met. They rely on blockchain technology for their implementation, offering transparency, security, and efficiency.

In today article all about Smart Contracts, surely. Moreover, I will write how they are work, benefit you business and some dangers.

Let’s not wait and jump into interesting topic straight away!

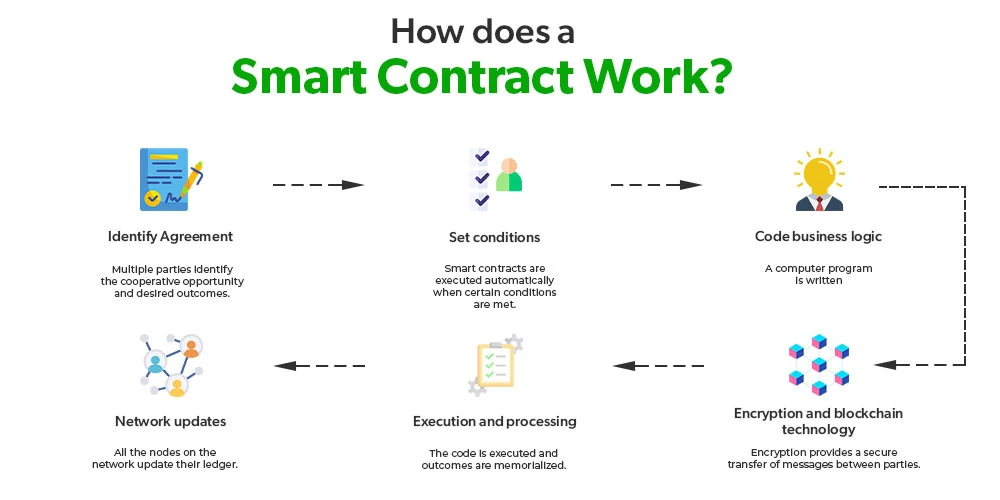

How Smart Contracts Work?

Smart contracts are essentially computer programs that facilitate, verify, and enforce the negotiation and performance of a contract.

They operate on the principle of “if-then” logic, where certain conditions trigger specific actions. These contracts eliminate the need for intermediaries, such as lawyers or brokers, reducing costs and enhancing trust between parties.

They are executed on a blockchain network, which is a decentralized and distributed ledger technology.

This ensures that the contract is immutable, transparent, and secure. Once the conditions specified in the contract are met, the code is automatically executed, and the associated actions are performed. So, this automation eliminates human error and ensures the contract’s integrity.

As you can easily see, the smart contract implementation cycle has its own well-thought-out logic.

At the beginning, there is always a willingness to cooperate, as it happens between parties of different interests.

The terms of the contract are then established and implemented in the smart contract. When these conditions are met, the contract is executed automatically.

To put it simply, once a contract is initiated, the blockchain is responsible for its transparency and security.

Pretty simple, huh?

Smart Contracts Examples

Smart contracts are revolutionizing the way we conduct business and interact with technology. The use cases for smart contracts are endless, and they are being adopted in various industries to streamline operations and increase efficiency.

One example of a smart contract use case is in the real estate industry.

Traditionally, buying or selling a property involves numerous intermediaries such as real estate agents, lawyers, and banks. This process can be time-consuming and costly.

However, with smart contracts, the entire transaction can be automated, from the listing of the property to the transfer of ownership. This eliminates the need for intermediaries, reduces paperwork, and ensures a transparent and secure transaction for both parties.

Another exciting use case for smart contracts is in supply chain management.

With traditional supply chains, there is often a lack of transparency and trust between different parties involved in the process. Smart contracts can address this issue by creating a decentralized and immutable ledger that records every step of the supply chain.

This allows for real-time tracking of goods, verification of authenticity, and automatic payments based on predefined conditions. This not only increases efficiency but also reduces the risk of counterfeit products entering the market.

Smart contracts are also being used in the healthcare industry to improve patient care and data security.

For example, medical records can be stored on a blockchain network using smart contracts, providing patients with full control over their data and ensuring its privacy and integrity.

Additionally, smart contracts can automate insurance claims processing, making it faster and more accurate.

What Benefits of Smart Contracts?

Smart contracts offer numerous potential benefits in various industries.

Firstly, they provide automation, streamlining processes and reducing the need for manual labor. This increases efficiency and saves time, enabling businesses to focus on more critical tasks.

Secondly, smart contracts enhance security. Traditional contracts can be vulnerable to fraud, tampering, or unauthorized modifications. However, smart contracts are based on cryptographic principles, making them highly secure and resistant to manipulation. The decentralized nature of blockchain ensures that all transactions are recorded and verified, further enhancing security.

Moreover, smart contracts promote transparency. Since all parties involved have access to the same information, there is a reduced risk of misunderstandings or disputes. This transparency fosters trust and accountability among parties, facilitating smoother business interactions.

There is undoubtedly a long list of advantages of using Smart Contracts.

As an author, I personally believe that the market share in this matter will gradually increase.

Among other things, due to these benefits.

By the way, why didn’t anyone come up with this way of concluding transactions before?

It seems that progress related to digitization, software development and the cryptocurrency industry itself has led to a situation from which there is no turning back.

Much can be written about the advantages themselves, but it is difficult to point out the greatest advantage among many.

The fact is, however, that it is this great flexibility, speed, trust and security that push smart contracts to the forefront of the financial revolution. DeFi is here and more will come.

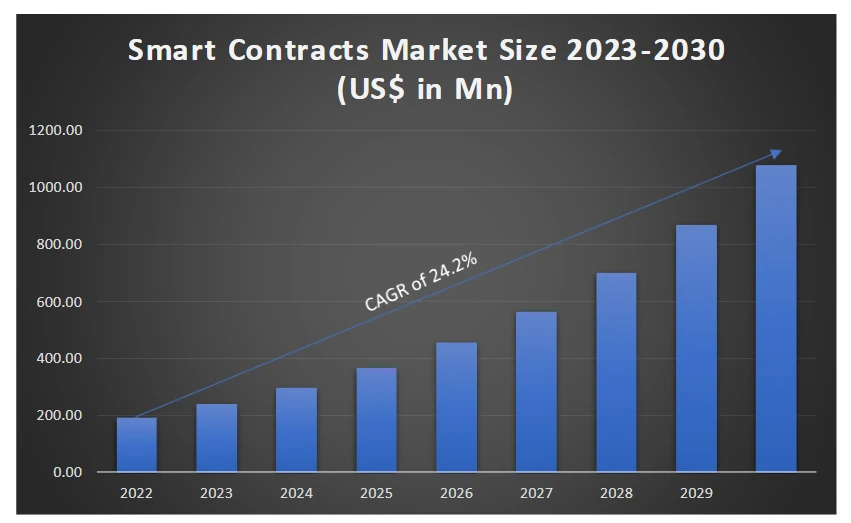

Smart Contract Market Size

To confirm this thesis, I refer to research conducted by ResearchGate, which clearly confirms the market growth by 24.2% by 2030.

Moreover, while checking this data, I came across several other sources confirming this result.

Therefore, it can be concluded that these data are close to the truth.

The cryptocurrency market itself is constantly in an upward trend, which will also have a positive impact on the greater share of smart contracts in the market.

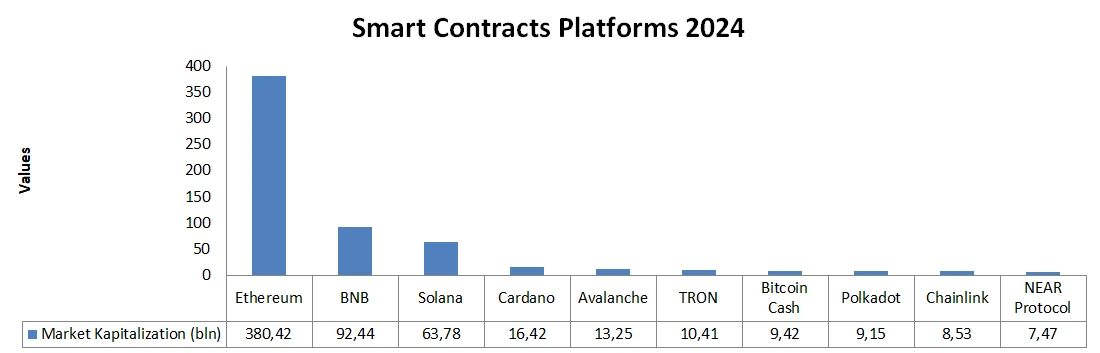

Smart Contacs Platforms

It’s time to write a few words about the Smart Contract platforms themselves.

Quite a lot of them have already been created. Coingecko currently lists 169 platforms, led by Ethereum.

The leadership position is not in danger. Let’s look at the marketcaps of the top ten on the list.

Indeed, Ethereum has the largest market share, but this is not surprising.

This only confirms the rule that the first project on the market usually dominates that market. One of the principles of marketing.

It is no different in the case of Ethereum.

Interestingly, all the rest of the projects from the top ten have smaller capitalization than the Ethereum project.

Now you know why Ethereum is so important for DeFi and cryptocurrencies.

Potential Dangers of Smart Contracts

While smart contracts offer numerous advantages, it is crucial to understand their potential dangers.

One of the primary concerns is the presence of security vulnerabilities in the code. Since smart contracts are written in code, any flaws or mistakes can lead to severe consequences.

Hackers can exploit these vulnerabilities to gain unauthorized access, manipulate the contract, or steal sensitive information.

Additionally, the irreversible nature of smart contracts poses a risk.

Once a contract is deployed on the blockchain, it cannot be modified or reversed. If there are errors or unforeseen circumstances, it becomes challenging to rectify the situation.

This lack of flexibility can have significant implications, especially in complex business scenarios.

Furthermore, the reliance on blockchain technology itself can be a potential danger.

While blockchain is known for its security, it is not entirely immune to attacks. If the underlying blockchain network is compromised, it can impact the integrity and execution of smart contracts.

Security Vulnerabilities in Smart Contracts

Smart contracts are susceptible to a variety of security vulnerabilities.

One common vulnerability is the presence of bugs or coding errors. Even a small mistake in the code can have significant consequences. It can lead to unauthorized access, loss of funds, or exploitation of contract logic.

Another vulnerability is the risk of improper input validation. Smart contracts receive inputs from external sources, such as users or other contracts.

If these inputs are not properly validated, it can allow attackers to manipulate the contract’s behavior and exploit its vulnerabilities.

Moreover, the presence of design flaws in smart contracts can also pose security risks. Poorly structured contracts can have unintended consequences or loopholes that can be exploited by malicious actors. It is essential to thoroughly analyze and review the contract’s design to identify and mitigate such risks.

As you can see, there are many potential weaknesses of smart contracts.

Therefore, I will not be surprised by the fact that as the platforms for these contracts develop, the software security sector will develop even more.

During Covid – this unfortunate time – we could see enormous progress in the field of computerization and remote work. I’m writing all this because it also makes data security even more important.

By the way, I am surprised that companies have not noticed before that the security of data and IT networks is the basis for the functioning of the company’s IT infrastructure.

This in turn has consequences in saving millions for data recovery, court cases and know-how protection.

Examples of Smart Contract Failures

Several notable examples demonstrate the potential dangers of smart contracts.

One such incident is the infamous DAO (Decentralized Autonomous Organization) hack in 2016. The DAO was a smart contract-based investment fund built on the Ethereum blockchain. A vulnerability in the contract’s code allowed an attacker to drain approximately one-third of the fund, resulting in a loss of millions of dollars.

Another example is the Parity Wallet hack in 2017. Parity is a popular Ethereum wallet that allows users to store and manage their cryptocurrencies. A bug in the Parity multi-signature wallet contract enabled an attacker to freeze funds worth millions of dollars, rendering them inaccessible to their rightful owners.

These examples highlight the importance of rigorous testing, auditing, and security measures when deploying smart contracts. Without proper precautions, the potential consequences can be catastrophic.

Regulatory Challenges and Legal Implications

The rise of smart contracts has presented regulatory challenges and legal implications.

As smart contracts operate on a decentralized blockchain network, it becomes difficult for regulators to enforce compliance and resolve disputes. The lack of intermediaries also raises questions about legal liability and accountability.

Moreover, the cross-border nature of blockchain technology poses challenges in terms of jurisdiction and applicable laws. Different countries may have varying regulations regarding smart contracts, leading to legal uncertainties and complexities.

To address these challenges, regulators and lawmakers are working towards developing frameworks and guidelines for smart contracts. They aim to ensure consumer protection, privacy, and legal certainty in the rapidly evolving landscape of blockchain technology.

Mitigating the Risks of Smart Contracts

To mitigate the risks associated with smart contracts, several best practices should be followed.

Firstly, thorough code auditing and testing are essential. Smart contracts should undergo rigorous analysis by security experts to identify and fix vulnerabilities before deployment.

Secondly, it is crucial to implement proper access controls and permissions. Only authorized individuals or entities should be able to interact with the contract and execute actions. This helps prevent unauthorized modifications or malicious activities.

Furthermore, continuous monitoring and auditing of smart contracts are necessary. Regularly reviewing the contract’s behavior and transaction history can help identify any anomalies or suspicious activities. Early detection can help prevent potential attacks or breaches.

Best Practices

When implementing and auditing smart contracts, it is important to follow best practices.

Firstly, developers should adhere to secure coding practices and frameworks. This includes using standardized libraries, avoiding deprecated or vulnerable functions, and ensuring proper input validation.

Secondly, comprehensive testing should be conducted throughout the development process. This includes unit testing, integration testing, and stress testing to identify and rectify any issues or vulnerabilities. External code reviews and third-party audits can provide valuable insights and additional layers of security.

Moreover, following the principle of least privilege is crucial. They should only have the necessary permissions and capabilities required for their intended functionality. Unnecessary access or privileges should be avoided to minimize the attack surface.

Conclusion

In conclusion, smart contracts offer numerous benefits, such as automation, security, and transparency.

However, it is vital to understand the potential dangers they present. Security vulnerabilities, irreversible actions, and also the reliance on blockchain technology can pose significant risks.

In addition, To navigate these pitfalls, thorough testing, auditing, and best practices must be followed.

Finally, developers, businesses, and regulators need to work together to ensure the safe and responsible implementation of them.

Leave a Reply

You must be logged in to post a comment.