Introduction

Ethereum Classic (ETC) is a decentralized platform that enables the execution of smart contracts, at first.

In fact, it is a secure, reliable, and resilient blockchain network that has gained prominence in the cryptocurrency market.

In this comprehensive guide, I will explore the concept of fundamental analysis, so stay here.

From then I will tell you about its importance in making informed investment decisions in Ethereum Classic.

Let’s get start it !

What is Fundamental Analysis?

Fundamental analysis is a method used to evaluate the intrinsic value of an investment asset, such as a cryptocurrency.

It involves analyzing various factors that could influence the asset’s price and long-term viability.

By examining the fundamentals, investors can gain insights into the underlying value and then growth potential.

Honestly, looking for growth is always the case in investing, in fact.

In this case about a cryptocurrency like Ethereum Classic.

Fundamental analysis is a commonly known method for assessing the value of assets such as shares or real estate.

This is not the only method available to an investor, without a doubt. This does not change the fact that, if done carefully, after that it allows for a good selection of assets for investment. In most of the cases as a matter of fact. Is it not attractive?

It’s all a matter of a few steps that require quite a lot of commitment when collecting information. Don’t be scared, however, because this analysis can be used by almost anyone…

When it comes to cryptocurrencies, this analysis works slightly worse.

The cryptocurrency market is revolutionary, but young, dynamic and, unfortunately, toxic.

In fact, fundamental analysis cannot be fully applied here, but it should still be there. This is only the author’s assessment, but…

For next stop I willl tell you about importance of fundamental analysis, because is a lot to talk about.

Importance of Fundamental Analysis

In the highly volatile and speculative cryptocurrency market, but you know that already.

But fundamental analysis plays a crucial role in making sound investment decisions.

Unlike technical analysis, which focuses on price patterns and market trends, fundamental analysis provides a deeper understanding. Undestanding of the underlying asset’s value proposition, technology, and market dynamics, then …

Investors can make informed decisions, certainly.

Those decisions are based on solid research rather than on market sentiment.

One of the key advantages of fundamental analysis is its ability to identify undervalued assets that have strong growth potential.

Fundamental factors of a cryptocurrency like Ethereum Classic give investors opportunities to invest in this asset.

Surely, this approach allows investors to potentially benefit from future price appreciation as the market recognizes the asset’s true worth.

Fundamental Analysis for Ethereum Classic

When conducting fundamental analysis on Ethereum Classic, there are several key factors to consider.

These factors provide insights into the sustainability and growth potential of the cryptocurrency.

Let’s explore these factors in detail.

Understanding the Ethereum Classic Blockchain

Firstly, in fundamental analysis is to understand the underlying technology of this cryptocurrency.

This includes studying the architecture, then consensus mechanism, and scalability of the blockchain.

By evaluating the technical aspects of the network, investors can assess the robustness and long-term viability of Ethereum Classic. This platform is as a platform for executing smart contracts, but not only.

Evaluating the Development Team and Community

The development team and community behind project play a vital role in its success.

Assessing the expertise, experience, and track record of the development team. All of that for provides insights into their ability to deliver on the project’s roadmap. This is how you do it!

Additionally, evaluating the size and engagement of the community can indicate the level of support and adoption for project.

Analyzing the Use Cases of Ethereum Classic

Another important factor to consider is the use cases and adoption of Ethereum Classic.

Understanding how the cryptocurrency is being utilized in real-world applications provides insights into its potential value and demand.

Why analyzing the industries and projects that are leveraging this cryptocurrency? Because then investors can assess the scalability and long-term viability of the cryptocurrency.

Assessing the Market and Competition

The cryptocurrency market is highly competitive, and Ethereum Classic is no exception.

Conducting a competitive analysis can help investors understand how this project compares to other similar cryptocurrencies in terms of technology, market share, and adoption.

By understanding the competitive landscape, investors can identify Ethereum Classic’s unique selling points and potential market advantages.

Examining the Financials and Partnerships

Evaluating the financial health and partnerships of Ethereum Classic is crucial for understanding its growth potential.

Examining the financial statements and funding sources of the project provides insights into its sustainability and ability to execute its roadmap.

Additionally, analyzing partnerships with other companies or projects can indicate potential collaborations and market opportunities for Ethereum Classic.

Tools for Fundamental Analysis on Ethereum Classic

Conducting a comprehensive fundamental analysis requires access to reliable tools and resources.

Here are some recommended tools and resources that can assist investors in their analysis of Ethereum Classic:

CoinMarketCap

Overall, a popular cryptocurrency market data platform that provides information on market capitalization, trading volume, and price trends of Ethereum Classic.

Ethereum Classic Explorer

A blockchain explorer that allows users to view transaction history, account balances, and other data on the this project network.

Community Forums

Engaging with the Ethereum Classic community through forums such as Reddit or Discord it always good idea. You can provide valuable insights and updates on the project’s development.

Whitepaper

The official whitepaper of Ethereum Classic provides a detailed overview of the project’s vision, technology, and roadmap. It is a valuable resource for understanding the fundamentals of the cryptocurrency.

Ethereum Classic Price in Depth

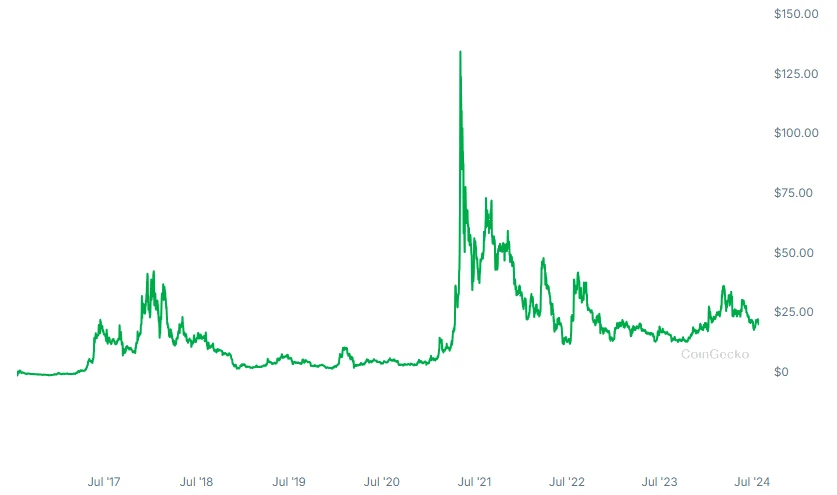

This cryptocurrency is one of those projects that has been on the market longer than others.

At least most of them. You can read about the history of the Ethereum and Ethereum Classic split here, but not about it.

This section is devoted to analyzing the price of Ethereum Classic, but… In reality, what can you write about her?

Indeed, 2 full cycles and lots of data to analyze. In fact, Ethereum Classic has taken its own path by staying with the PoW consensus.

There are many indications that thanks to this decision, Ethereum Classic moved towards a carrier of value, but not only?

1st Bull Market

The starting price is up to $0.75 per unit, which is not too high a price.

During the bull market, the price went to around $44. What does it mean?

Only one thing – the profit is almost 55 times from the beginning of the investment. And now what do you say about Ethereum Classic?

Okay, but the bear market has come.

Well, that’s true, but the value of not only assets such as Ethereum Classic fell by nearly 90 percent.

This is how assets behave on the cryptocurrency market between the peak of the bull market and the bottom of the bear market.

This is a simple fact.

1st Bear Market

In fact, the price from the peak to the bottom of the bear market is a loss of 90 percent.

This was the price range between the first bear market and the bull market – $3.5 to $44.4.

The price was in a bear market throughout 2018. So 12 months is a loss of 91% of the price.

You already know that!

This is what you can expect at the next bull market peak and bear market bottom.

The only exceptions are Bitcoin and Ethereum, and maybe individual cryptocurrencies.

2nd Bull Market

The next boom did not come so early, because we had to be very patient.

Well, it was worth it!

The price jumped from nearly $4 to $136 per unit during the year from March 2020 to May 2021.

What does profit times 34 mean?

The first boom means profit times close to 55.

The momentum decreases, but is maintained. What are the conclusions when describing the third boom.

2nd Bear Market

Finally, the second bull market means losses of around 90 percent.

But, it is nothing new if you know how asset prices behave on the cryptocurrency market.

The price drops over the course of a year to around $15. If we are looking for a pattern, the price should go to around $15 before a strong boom.

However, this cannot be stated as certain. Every bull market is different.

3rd Bull Market

We are currently in a bull market, surely. As a consequence the price of Ethereum Classic should continue to increase over the next year.

This fact is reinforced by the Bitcoin halving in April 2024, but what about the Ethereum Classic halving?

In reality, the next Ethereum halving is planned for late May or early June 2024. Things are going to happen, without a doubt!

Conclusion

In conclusion, mastering fundamental analysis is essential for making informed investment decisions in Ethereum Classic.

Underlying technology, development team, market dynamics, and financials of Ethereum Classic – finally you can decide. It’s much easier then. As investors you can develop a sound investment strategy that aligns with your risk tolerance and long-term goals. You have to!

Leave a Reply

You must be logged in to post a comment.