Introduction

We all want to know what big players do in the crypto market. That’s where a crypto whale tracker comes in handy. It helps us see when large amounts of coins move. This can give us clues about what might happen next in the market. Whale watching has become a key part of crypto monitoring for many traders and investors.

In this guide, I’ll walk you through how to use a crypto whale tracker step by step. I’ll cover the basics of tracking whales, how to pick a good tracker, and how to set it up. Then I’ll show you how to make sense of whale moves.

By the end, you’ll have the tools to keep an eye on big market players and use that info to your advantage.

Please read it, comment it and share!

Basics of Crypto Whale Tracking

Crypto whale tracking is a crucial skill for anyone looking to understand market trends and make informed decisions in the cryptocurrency world. Let’s dive into the basics of this practice and explore what makes a crypto whale and the types of whale activity to watch.

What makes a crypto whale

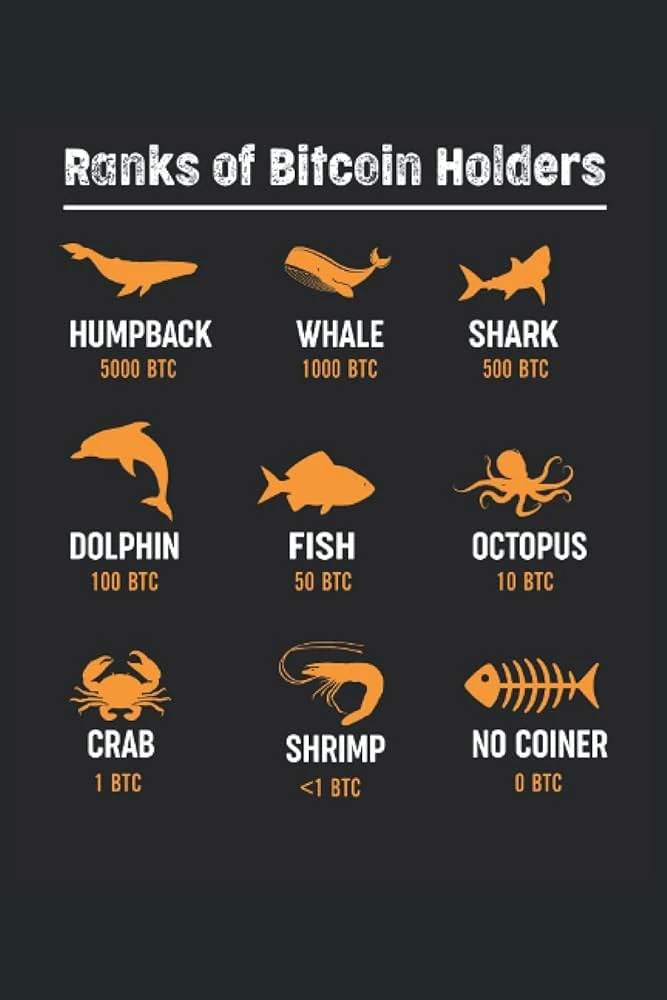

A crypto whale is an individual or entity that holds a substantial amount of cryptocurrency. While there’s no fixed threshold, it’s generally agreed that owning a large portion of a cryptocurrency’s circulating supply qualifies one as a whale. For instance, in the Bitcoin market, someone holding 1,000 or more BTC is often considered a whale.

Whales have the power to influence market trends, create price volatility, and impact market sentiment due to their large holdings.

When a whale makes a big move, it can cause noticeable price changes in the market. This is why whale watching has become an essential part of crypto monitoring for many traders and investors.

In the earlier phases of the cryptocurrency market, changes in whale wallets had a greater impact on the price of Bitcoin.

Currently, only very large transactions can affect the price of Bitcoin. Watching whales and humpback whales in the cryptocurrency market allows us to draw valuable conclusions. There are a few red flags, however, which I will mention later.

Types of whale activity to watch

To use a crypto whale tracker effectively, you need to understand the different types of whale activity and what they might mean for the market. Here are some key movements to keep an eye on:

- Large exchange inflows. When whales move significant amounts of cryptocurrency to exchanges, it might signal an intention to sell. This can lead to a drop in prices if other investors react by selling their holdings.

- Substantial exchange outflows. If whales withdraw large amounts from exchanges to personal wallets, it often indicates a plan to hold onto their assets. This can be seen as a bullish signal and might lead to price increases.

- Wallet-to-wallet transfers. These movements between wallets owned by whales don’t usually affect prices directly but can hint at over-the-counter trades or strategic repositioning.

- Accumulation during market downturns. If you notice whales consistently buying during price dips, it could signal confidence in the asset’s long-term potential.

- Coordinated movements. Sometimes, multiple whales might act together, amplifying their impact on the market.

By using a crypto whale tracker and paying attention to these activities, you can gain valuable insights into potential market shifts. Remember, whale movements don’t always lead to immediate price changes, but they can provide clues about market sentiment and possible future trends.

Understanding these basics of crypto whale tracking will help you make more informed decisions in your crypto journey. As you become more familiar with whale alerts and crypto whale monitoring, you’ll be better equipped to navigate the often turbulent waters of the cryptocurrency market.

Choosing Your Whale Tracker

When it comes to picking the right crypto whale tracker, we have a lot of options. Let’s look at some popular tools, both free and paid, to help you keep an eye on big market moves.

Popular free tools

For those just starting out or on a tight budget, there are some great free options to track whale activity.

Whale Alert is one of the most well-known names in this space. It gives real-time alerts about large transactions across many different blockchains, including Bitcoin and Ethereum. What’s cool about Whale Alert is that it covers a wide range of blockchains, giving you a broader view of what’s happening in the market.

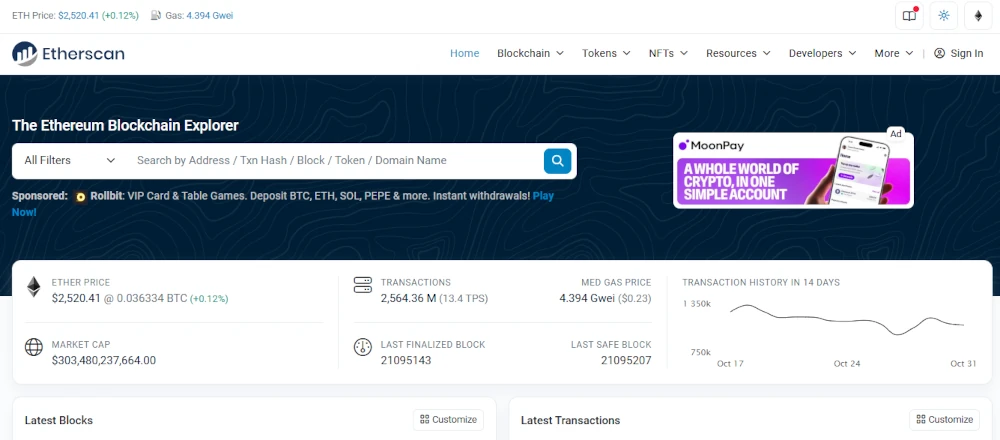

Another free tool worth checking out is Etherscan. While it’s mainly for Ethereum-based transactions, it’s super helpful if you’re focused on that network. You can use it to track token holders, including whales, and see what they’re up to.

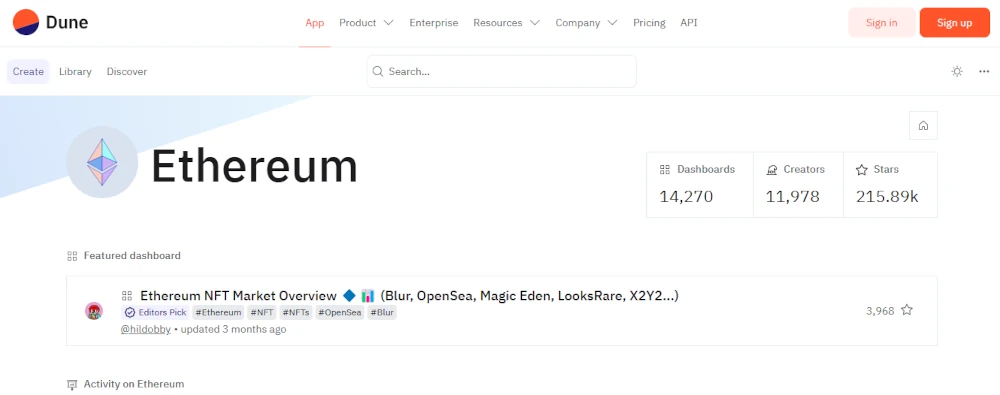

An equally great free tool is Dune Analytic. The program interface is in a web browser.

Dune provides powerful tools and analysis of all onchain data. You can find a dashboard for pretty much anything web3-related, including for EVMs like Ethereum, Polygon, Goerli, and Optimism—and non-EVM chains like Solana and Bitcoin.

Paid tools with extra features

If you’re ready to invest a bit more in your whale tracking, there are some powerful paid tools out there.

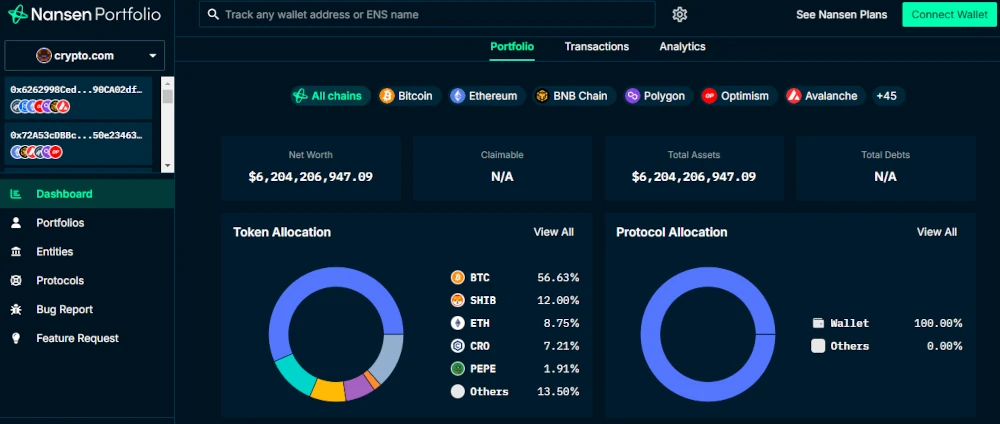

Nansen is a top choice for many serious traders. It’s known for its deep insights into wallet addresses and token movements. One of its coolest features is called “Token God Mode,” which lets you dive deep into on-chain data about specific tokens. This makes it easier to follow large holders and understand how they trade.

Another paid option is ArbitrageScanner. While it’s best known for arbitrage scanning, it has recently added features for tracking and analysing top traders, which includes whale activity. It has a Wallet Analysis section where you can use filters and AI-powered searches to find profitable wallets.

DexCheck is another paid platform that’s worth considering. It focuses on DeFi and has a special crypto whale tracker. You can use it to see the biggest trades made on decentralized exchanges by addresses with large amounts of cryptocurrency.

Mobile vs desktop options

When choosing your whale tracker, think about how you’ll use it most often. Many of these tools work well on both mobile devices and desktops, but some are better suited for one or the other.

For example, Whale Alert has a popular X account that’s easy to follow on your phone for quick updates. But if you want to use their more detailed API, you might prefer to set that up on a desktop.

The Whale Alert app, which was launched in 2012, is a great mobile option. It’s designed to be user-friendly and works well on smartphones and tablets. This app makes it easy for anyone, from scientists to casual whale watchers, to share whale sightings.

On the other hand, tools like Nansen and ArbitrageScanner might be better used on a desktop where you can really dig into the data and use all their features comfortably.

Remember, the best whale tracker for you depends on your needs, budget, and how you plan to use the information. Whether you choose a free or paid option, mobile or desktop, the key is to find a tool that gives you the insights you need to make smart decisions in the crypto market.

Bitcoin Whales Addresses

In this short section, I would like to introduce you to 7 addresses that are very rich bitcoin hodling addresses.

Take a look at the list below.

- Binance Wallet

- Bitfinex Wallet

- Robinhood Wallet

- Binance Wallet 2

- Bitfinex Hack Recovery

- MtGox Hack

- Another Wallet

The truth is that this list contains the richest Bitcoin accounts. The term whale is commonly used, but in the case of these accounts, the term Perucetus colossus, first used by scientists in 2010, is probably more appropriate. I recommend checking what it means.

To satisfy your curiosity, I will add that these accounts belong to the largest cryptocurrency exchanges. Do you still have any doubts that it is worth following the activities of such players?

Setting Up Your Tracking System

Now that we’ve chosen our crypto whale tracker, it’s time to set it up for optimal use. Let’s dive into the key aspects of creating an effective tracking system.

Key coins to monitor

When setting up your crypto whale tracker, it’s crucial to focus on the right coins. While Bitcoin and Ethereum are obvious choices due to their market dominance, don’t overlook other significant players. Consider monitoring popular altcoins and emerging tokens that have shown recent whale activity.

To get started, use tools like Whale Alert or Glassnode to identify coins with high whale concentration. These platforms often provide insights into which cryptocurrencies are experiencing significant whale movements. Pay attention to coins with a history of volatile price swings following large transactions, as these can offer potential trading opportunities.

Creating useful alerts

The heart of an effective whale tracking system lies in its alert mechanism. Most whale trackers allow you to customize alerts based on transaction size, coin type, and wallet addresses. Here’s how to set up useful alerts:

Define your threshold. Determine what constitutes a “whale” transaction for each coin you’re monitoring. This can vary depending on the coin’s market cap and typical trading volume.

Set up multi-channel notifications. Configure alerts to reach you through various channels like email, SMS, or push notifications. This ensures you don’t miss important movements.

Use filters wisely. Too many alerts can be overwhelming. Use filters to focus on the most relevant transactions. For instance, you might want to exclude exchange wallets if you’re more interested in individual whale activity.

Create alerts for specific wallets. If you’ve identified key whale addresses, set up alerts specifically for these wallets to track their every move.

Organizing your dashboard

A well-organized dashboard is key to quickly interpreting whale activity. Here’s how to structure your dashboard for maximum efficiency:

Group by coin. Arrange your dashboard to show whale activity grouped by cryptocurrency. This allows you to quickly spot trends in specific coins.

Visualize data. Use charts and graphs to visualize whale movements over time. This can help you identify patterns more easily than raw numbers alone.

Highlight key metrics. Ensure that critical information like transaction size, frequency of whale moves, and price impact are prominently displayed.

Customize views. Most advanced whale trackers allow you to create custom views. Set up different views for various strategies or time frames you’re interested in.

Remember, the goal of your tracking system is to provide actionable insights. Regularly review and adjust your setup to ensure it’s giving you the most valuable information for your trading or investment strategy.

Making Sense of Whale Moves

Common whale strategies

Crypto whales have a big impact on the market. They often use different strategies to make the most of their large holdings. One common approach is accumulation. This is when whales buy large amounts of a cryptocurrency, often during market downturns. They do this to increase their holdings at lower prices.

Another strategy is distribution. This is when whales sell off parts of their holdings. They might do this to take profits or to influence the market. Whales sometimes use a mix of buying and selling to create artificial demand or selling pressure.

Some whales focus on long-term holding, while others engage in short-term trades. They often concentrate on popular cryptocurrencies like Bitcoin and Ethereum. Their actions can cause significant price swings, especially when they move large amounts of coins.

Red flags in whale activity

While tracking whale moves can be helpful, it’s important to watch for red flags. One warning sign is when there’s a sudden increase in exchange inflows. This could mean whales are preparing to sell large amounts of cryptocurrency.

Another red flag is when multiple whales start selling at the same time. This could signal a loss of confidence in the market. It’s also concerning if a single whale controls a very large portion of a cryptocurrency’s supply. This can make the market more vulnerable to manipulation.

Pump-and-dump schemes are another danger. In these schemes, whales might buy a lot of a cryptocurrency to drive up the price. Then, they sell quickly for a profit, causing the price to crash. This can hurt smaller investors who bought at the higher prices.

Turning whale data into action

To use whale data effectively, it’s important to have the right tools. Blockchain explorers and on-chain analysis services can help track whale wallets and their transactions. These tools can show you when large amounts of cryptocurrency are moving.

When you see whale activity, try to understand the context. Are they moving coins to exchanges, which might mean they’re planning to sell? Or are they moving coins to personal wallets, which could mean they plan to hold?

It’s also helpful to look at overall trends. Are more whales buying or selling? This can give you an idea of where the market might be heading. But remember, no single whale’s actions should determine your whole strategy.

Lastly, don’t forget to consider other market factors alongside whale data. Things like news events, overall market trends, and your own investment goals are all important. Whale watching is just one tool in your crypto toolkit.

Conclusion

Keeping an eye on big crypto moves can really help you understand the market better. Use a whale tracker and then you can see when large amounts of coins are moving around. This info can give you clues about what might happen next in the crypto world. It’s like having a special tool to peek into what the big players are doing.

On this point I leave you with the message: “Watch the whales in the crypto market. These often have access to a greater amount of knowledge that is necessary when making key decisions.”

Leave a Reply

You must be logged in to post a comment.