Introduction

Cryptocurrency markets are known for their volatility, and altcoin season is a prime example of this dynamic. During altcoin season, many alternative cryptocurrencies outperform Bitcoin, offering investors a chance to make significant gains.

Understanding when altcoin season is happening and how to profit from it can be a game-changer for crypto traders and enthusiasts.

This article will explore the cyclical nature of crypto markets and how to identify altcoin season. It will also look at tools like the altcoin season index that help track market trends.

Additionally, it will discuss investment strategies for making the most of altcoin season. By the end, readers will have a better grasp of how to navigate and potentially benefit from these market cycles.

Please enjoy your reading and leave a comment!

The Cyclical Nature of Crypto Markets

Crypto markets are known for their cyclical nature, with distinct patterns of growth and decline. These cycles are driven by various factors, including investor sentiment, market adoption, and technological advancements.

Understanding these cycles is crucial for investors to make informed decisions and navigate the volatile crypto landscape.

Bitcoin Cycles

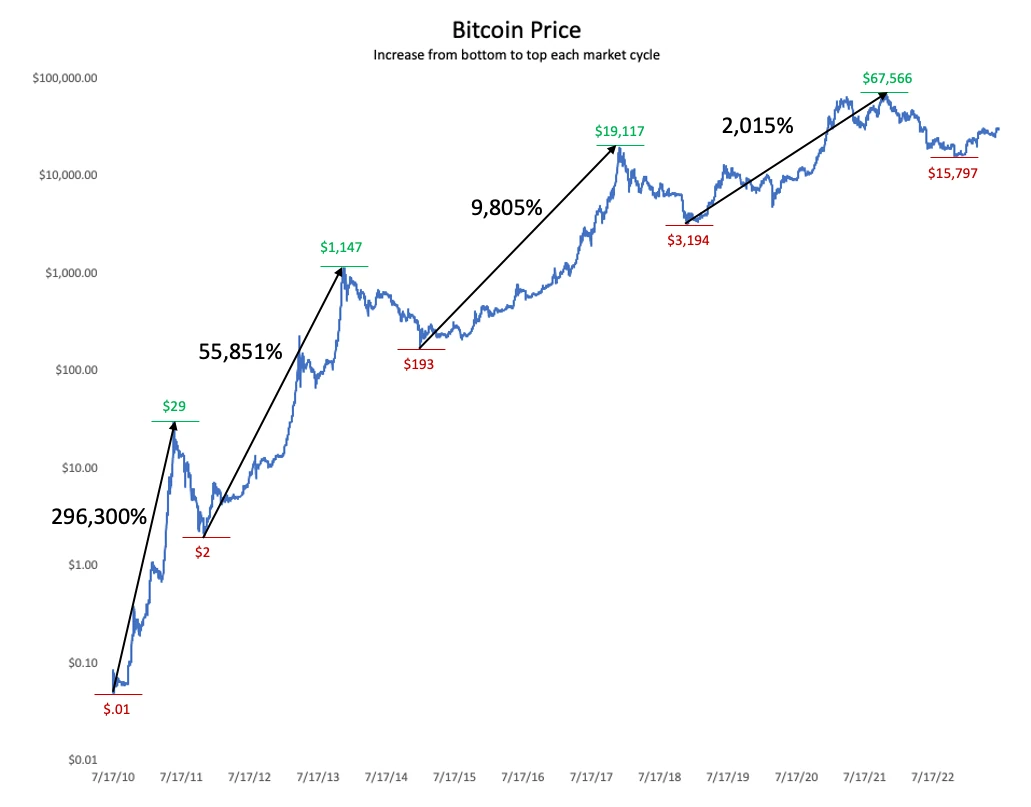

Bitcoin, the largest cryptocurrency by market cap, plays a central role in shaping market cycles. Its price movements often set the tone for the entire crypto market. Bitcoin cycles typically consist of four phases:

- Accumulation: This phase occurs after a market bottom, with prices at their lowest. Savvy investors start buying, anticipating future increases.

- Uptrend (Bull Market): Prices begin to rise, fueled by increasing investor interest and positive news. This phase can start gradually but often gains momentum as more investors join in.

- Distribution: Prices reach their peak, and early investors start taking profits by selling their holdings. Market activity remains high, but sentiment shifts as knowledgeable investors speculate about a possible downturn.

- Downtrend (Bear Market): Selling pressure overtakes buying pressure, leading to falling prices. This phase can be exacerbated by negative news or events, resulting in further sell-offs.

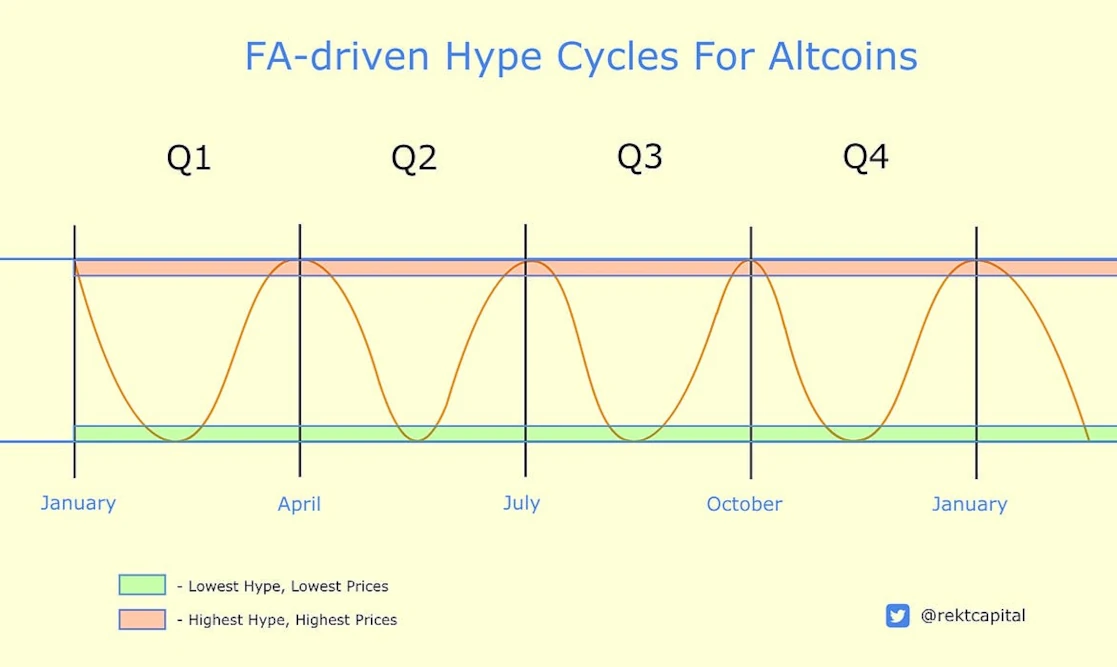

Altcoin Cycles

Altcoin seasons, or “altseasons,” are periods when alternative cryptocurrencies outperform Bitcoin. These cycles often follow Bitcoin’s price movements but can also be influenced by factors specific to individual altcoins. Key characteristics of altcoin cycles include:

- Rapid price increases

- During altseasons, many altcoins experience significant and quick price surges.

- Increased trading volume: Altcoin trading volumes rise as investors seek higher returns.

- Market cap shifts: The total market cap of altcoins increases relative to Bitcoin’s market dominance.

Many investors are looking for higher rates of return on their investments or trades. Altcoins are riskier assets than Bitcoin, but…

They allow you to earn more in certain cycles than on Bitcoin.

From a psychological point of view, greed plays the leading role here.

I don’t blame anyone for looking for a bargain.

Every opportunity also comes with risks, such as scams and pump-and-dump schemes.

Bitcoin and Altcoin Relationship

The relationship between Bitcoin and altcoin movements is complex and often intertwined. Some key observations include:

- Bitcoin as a market leader: Bitcoin’s price movements generally influence the broader crypto market, including altcoins.

- Inverse correlation: During certain periods, a decrease in Bitcoin dominance can lead to an increase in altcoin investments, potentially triggering an altseason.

- Market sentiment spillover: Bullish sentiment in Bitcoin often extends to altcoins, driving overall market growth.

Understanding these cyclical patterns and relationships can help investors identify potential opportunities and manage risks in the ever-evolving cryptocurrency market.

Tools for Tracking Altcoin Season

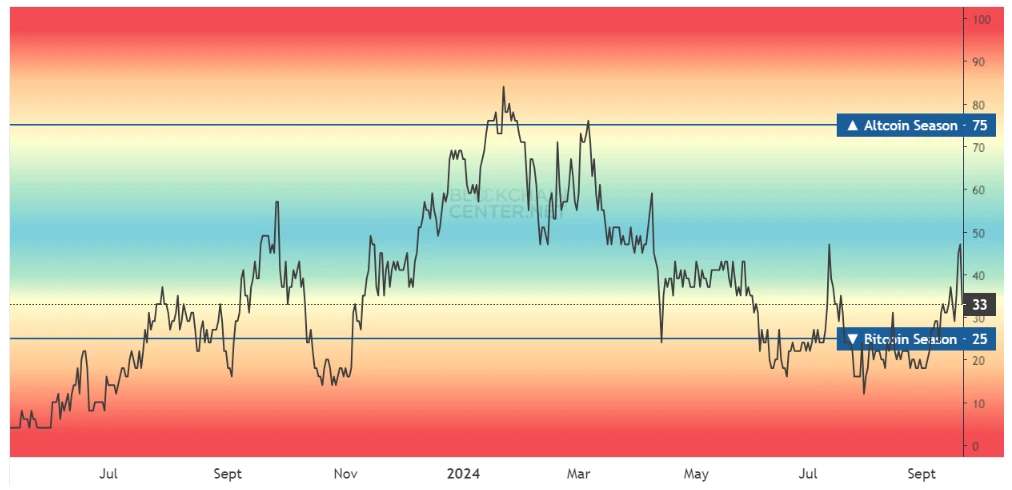

Altcoin Season Index Explained

The altcoin season index is a key tool for tracking market trends. It measures the performance of altcoins compared to Bitcoin over a set period, usually 90 days. This index helps investors spot potential altcoin seasons, which are times when altcoins outperform Bitcoin.

The index looks at the top 50 altcoins and their price movements. If 75% or more of these altcoins do better than Bitcoin, it signals the start of an altcoin season. The index score ranges from 0 to 100. A score of 100 means a strong altcoin season, while a score near 0 shows Bitcoin is dominant.

Using Crypto Analytics Platforms

Crypto analytics platforms offer vital tools for tracking altcoin seasons. These platforms provide real-time data on market trends, helping investors make smart choices. Some key features to look for in these tools include:

- Free versions to test the platform

- Integration with various exchanges and blockchains

- Automatic syncing of transactions

- Tax reporting capabilities

Popular platforms like CoinMarketCap, Coingecko and Token Metrics offer up-to-date info on market cap, trading volumes, and price changes. These details are crucial for spotting market shifts and potential altcoin seasons.

Social Sentiment Analysis Tools

Social sentiment analysis tools track how people feel about cryptocurrencies on social media. These tools can help predict market moves by analyzing what traders are saying online.

Key social sentiment analysis tools include:

- LunarCrush and TheTIE: These track tweets and posts about specific cryptocurrencies.

- NewsWhip and RavenPack: These look at news articles and give them sentiment scores.

- Fear and Greed Index: This measures overall market sentiment on a scale from 0 to 100.

By using these tools together, investors can get a full picture of market sentiment. This can help them spot potential altcoin seasons and make better trading decisions.

Investment Strategies for Altcoin Season

Long-term vs Short-term Approaches

Investors in the altcoin market face a key decision: choosing between long-term and short-term strategies. Long-term approaches involve holding altcoins for extended periods, often years.

This strategy is based on thorough research of the altcoin’s technology, team, and market potential. It aims to capitalize on the overall upward trend and potential substantial gains over time.

Short-term strategies, on the other hand, involve frequent buying and selling to profit from price fluctuations. This approach requires constant market monitoring and quick decision-making. Short-term traders often rely on technical analysis and market trends to maximize profits.

Both strategies have their merits. Long-term investments offer stability and potential growth over time, while short-term investments can yield quick profits but come with higher risks due to market volatility.

Dollar-Cost Averaging in Altcoins

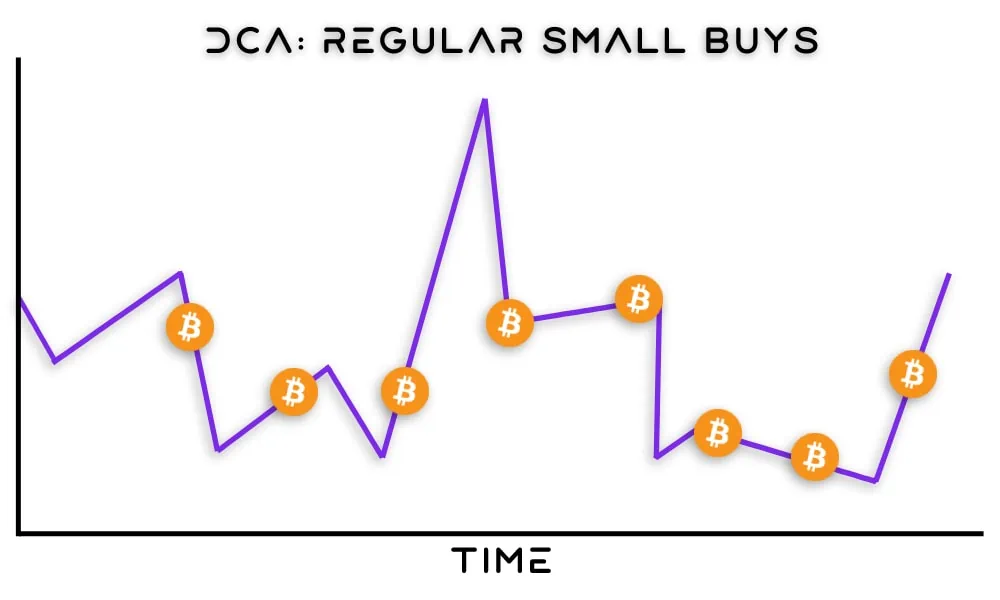

Dollar-cost averaging (DCA) is a simple yet effective strategy for altcoin investments.

It involves investing a fixed amount of money in altcoins at regular intervals, regardless of the current price. This approach helps reduce the impact of market volatility on the overall investment.

DCA can be particularly useful during altcoin season. By consistently investing, investors can potentially lower their average purchase price over time. This strategy also takes some of the emotion out of investment decisions, providing opportunities for greater returns in the long run.

Balancing Risk and Reward

Altcoin season presents both enticing rewards and inherent risks. The potential for substantial gains is significant, with some altcoins experiencing triple-digit percentage increases in short periods.

However, these high rewards come with increased risks.

To balance risk and reward, investors should:

- Diversify their altcoin investments to spread risk across different projects.

- Conduct thorough research on each altcoin before investing.

- Set clear investment goals and risk tolerance levels.

- Use stop-loss orders to limit potential losses.

- Stay informed about market trends and regulatory developments.

By carefully considering these factors and implementing a well-thought-out strategy, investors can navigate altcoin season more effectively, potentially maximizing rewards while managing risks.

Conclusion

In summary, navigating the crypto market’s cyclical nature and identifying altcoin seasons can be a game-changer for investors. By using tools like the altcoin season index and social sentiment analysis, traders can spot potential opportunities and make informed decisions. Balancing long-term and short-term strategies, along with careful risk management, is key to making the most of these market cycles.

Ultimately, success in the crypto market hinges on staying informed, adapting to market shifts, and having a well-thought-out investment plan.

While altcoin seasons offer exciting prospects for gains, it’s crucial to approach them with caution and thorough research. By combining market knowledge with smart strategies, investors can position themselves to benefit from the unique opportunities that altcoin seasons present in the ever-changing world of cryptocurrencies.

Leave a Reply

You must be logged in to post a comment.