Introduction

The world of cryptocurrency has been captivated by the meteoric rise and volatile nature of Bitcoin, indeed. Moreover, movements of Bitcoin price have been the subject of intense scrutiny. How many with analysts and experts offering a wide range of predictions and forecasts? Exactly, a lot.

In this comprehensive article, I am exploring the intricate factors that shape Bitcoin’s price trajectory. Then the insights and projections shared by industry luminaries, respected financial institutions, and visionary thinkers.

At first, from the revolutionary “Nakamoto Portfolio” strategy to the thought-provoking musings of Hal Finney and another thinkers.

Let’s enjoy your reading!

The Nakamoto Portfolio Theory

The “Nakamoto Portfolio Theory” is a ground-breaking framework. This framework that helps investors understand the impact of Bitcoin as an emerging asset within a diversified portfolio.

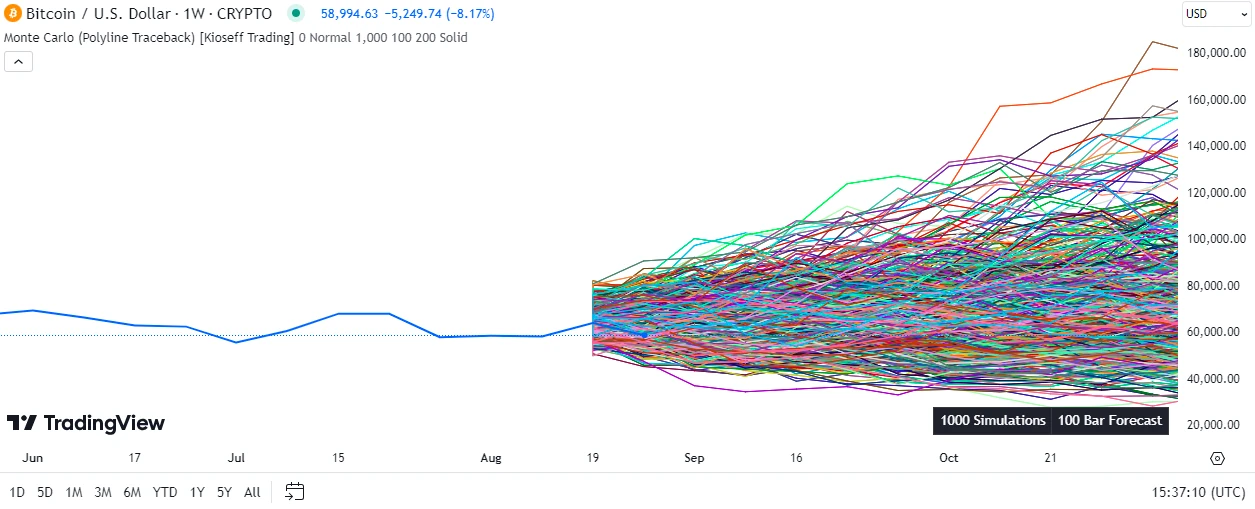

By harnessing the power of historical data and Monte Carlo simulations, this innovative approach offers a unique glimpse into the potential price movements of the world’s first cryptocurrency.

Simulating Bitcoin’s Future Prices

Using historical data as a guiding principle, the Nakamoto Portfolio Monte Carlo strategy runs simulations to forecast Bitcoin’s one-year returns. These simulations reveal a wide range of possible outcomes, showcasing the inherent volatility and unpredictability that characterize the cryptocurrency market.

Uncovering the Probability Distribution

The results of the Nakamoto Portfolio Monte Carlo simulation paint a fascinating picture. While the average expected price in one year stands at an impressive $144,000! This figure alone doesn’t tell the whole story. The true power of this approach lies in the probability distribution of the simulated outcomes.

Remarkably, 77% of the simulations yield positive returns, underscoring the potential for substantial gains.

However, the range of outcomes is staggering, with the best-case scenario reaching a staggering $901,000 per Bitcoin. While the worst-case scenario plummets to a mere $6,500.

On the picture you can see only 1000 Simulations in 5 years time frame. In this case the biggest price is about $180,000 and the lowest one is about $10,000. Always remember, it’s only simulation.

Embracing the Unpredictability

The Nakamoto Portfolio Monte Carlo strategy serves as a sobering reminder that forecasting Bitcoin’s price. As the analysis reveals, the returns compared to the volatility are among the best in any asset class.

What a second, but the wide range of possible outcomes highlights the inherent unpredictability of the cryptocurrency market.

Hal Finney’s Visionary Prediction

One visionary thinker stood out with a remarkably bold prediction. Hal Finney, a renowned cryptographer and one of the earliest Bitcoin pioneers.

His envisioned a future where each Bitcoin could be worth a staggering $22 million.

Finney’s Thoughtful Analysis

Finney’s prediction was not merely a speculative guess, but rather the result of a carefully considered analysis. He recognized the potential of Bitcoin as a global payment system.

Then his aligned its value with the collective wealth of the world. In that time he estimated to be in the range of $100 trillion to $300 trillion at the time.

By dividing this vast sum among the limited supply of 21 million Bitcoins…

Finney arrived at his astonishing valuation of $22 million per Bitcoin.

In fact, the rapid growth and adoption of Bitcoin in the years since have lent credibility to his visionary perspective. For sure not in next 5-10 years, but how knows?

In next 20-30 years this price would be possible to achieve.

The Unfolding of Finney’s Vision

As the cryptocurrency landscape has evolved, Finney’s prediction has gained increased attention and relevance.

Many industry experts and analysts now acknowledge the plausibility of Bitcoin reaching such astronomical valuations.

Particularly as the digital asset continues to establish itself as a viable alternative to traditional financial systems.

The ongoing institutional adoption, regulatory developments, and technological advancements within the Bitcoin ecosystem…

All of them have all contributed to the growing belief that Finney’s vision may not so wild.

Indeed, the potential for Bitcoin to reach Finney’s predicted heights becomes increasingly compelling.

Peter Brandt’s Bullish Forecast

Renowned trader and market analyst Peter Brandt has made waves in the cryptocurrency community with his bold predictions for Bitcoin’s future price.

Initially, Brandt had forecasted a peak price of $120,000 for Bitcoin! In a recent update, he has revised his prediction upward. Now targeting a range of $120,000 to $200,000 per Bitcoin by September 2025. Let’s see what will happen!

Brandt’s Technical Analysis

Brandt’s revised forecast is rooted in his meticulous technical analysis of Bitcoin’s market behaviour. He has observed a significant breakthrough, with Bitcoin breaking through the upper boundary of its 15-month trading channel.

A critical development that has reinforced his confidence in the cryptocurrency’s continued growth.

Factors Driving Brandt’s Optimism

Brandt’s optimism is fuelled by several factors. Including the increased institutional adoption of Bitcoin, the potential impact of the upcoming halving event, and the overall macroeconomic landscape.

As more mainstream investors and financial institutions embrace Bitcoin as a viable investment asset… Brandt believes this will drive increased demand and propel the cryptocurrency’s price higher.

Moreover, the programmed reduction in the rate of new Bitcoin creation. Officially, known as the halving event, has historically been a catalyst for significant price appreciation. Brandt’s analysis suggests that this cyclical pattern, combined with the growing institutional interest.

It could propel Bitcoin to new all-time highs in the coming years.

Brandt’s Reputation and Credibility

Peter Brandt’s reputation as a seasoned trader and market analyst lends credibility to his Bitcoin price prediction. With decades of experience under his belt. Brandt’s track record of accurately forecasting market movements in various asset classes adds weight to his bullish outlook on Bitcoin.

Surely, Brandt’s revised prediction of $120,000 to $200,000 per Bitcoin by 2025.

His stands as a testament to the growing confidence and optimism surrounding the future of this digital asset.

Fidelity’s Staggering Forecast

Next, bold and far-reaching prediction by Jurrien Timmer, the Director of Global Macro at Fidelity Investments. He has envisioned the value of a single Bitcoin for $1 billion by the years 2038 to 2040!

Metcalfe’s Law and Bitcoin’s Value

Timmer’s forecast is rooted in the principles of Metcalfe’s Law. This law suggests that the value of a network is proportional to the square of the number of its users.

Applying this concept to Bitcoin, Timmer predicts that the cryptocurrency’s value could reach approximately $1 million per Bitcoin by 2030.

Of course, as the network expands and reaches a critical mass, triggering a “supermajority feedback network effect.”

Fidelity’s Institutional Commitment

Fidelity’s deep involvement in the cryptocurrency space lends credibility to Timmer’s prediction. The financial giant has established Fidelity Digital Assets. A dedicated division focused on developing sophisticated Bitcoin custody solutions and… Of course, catering to the needs of institutional investors.

Fidelity’s strategic investments, such as its $20 million stake in the crypto-mining company Marathon Digital Holdings. Further solidify its commitment to the Bitcoin ecosystem. Additionally, the recent approval of spot Bitcoin ETFs.

Including Fidelity’s own Wise Origin Bitcoin Trust. Next step to way for increased institutional adoption and capital inflows.

Institutional Adoption and Network Effects

Timmer’s forecast hinges on the continued growth of Bitcoin’s user base and the network effects. As more institutional investors, financial institutions, and corporate entities embrace Bitcoin, then… The resulting increase in demand and network activity could drive the price per Bitcoin to Fidelity’s predicted $1 billion mark by the late 2030s.

Fidelity’s deep understanding of the cryptocurrency market and its commitment to the Bitcoin ecosystem lend credence to Timmer’s bold prediction, underscoring the vast potential that lies ahead for the world’s first and most prominent digital asset.

Chamath Palihapitiya’s Ambitious Forecast

Chamath Palihapitiya, a prominent venture capitalist and early Bitcoin investor. He has made waves in the cryptocurrency community with his bold and ambitious price predictions for the digital asset.

Bitcoin as a Global Reserve Currency

Palihapitiya’s perspective on Bitcoin is rooted in its potential to emerge as a global reserve currency, distinct from traditional fiat currencies. He sees Bitcoin’s decentralized nature, scarcity, and robust security features as key attributes that position. So to say, it as a trusted alternative in an era of growing scepticism towards traditional financial systems.

Palihapitiya’s Price Targets

In his predictions, Palihapitiya has set sights on truly staggering price levels for Bitcoin. He forecasts the cryptocurrency could reach $500,000 by October 2025, and potentially even reach the $1 million mark by the years 2040 to 2042.

Factors Driving Palihapitiya’s Optimism

Palihapitiya’s bullish outlook is fuelled by several factors. Including the increasing institutional adoption of Bitcoin, the cryptocurrency’s scarcity and deflationary nature. Finally, its growing acceptance as a hedge against economic uncertainties.

As more corporations, financial institutions, and nation-states recognize Bitcoin’s potential as a store of value and a means of diversification. Palihapitiya believes the influx of capital and the resulting network effects could propel the digital asset to unprecedented heights.

Palihapitiya’s Reputation and Influence

Chamath Palihapitiya’s reputation as a prominent venture capitalist and early Bitcoin proponent lends credibility to his price predictions.

His ability to identify and capitalize on emerging technological trends, coupled with his deep understanding of the cryptocurrency market. He has earned a respected voice in the industry.

Palihapitiya’s bold forecasts have the potential to inspire confidence and drive further adoption among investors. Both institutional and retail, who are seeking exposure to the potential upside of Bitcoin’s future growth.

Max Keiser’s Forecast

Max Keiser, a seasoned financial broadcaster and ardent Bitcoin advocate, has made headlines with his bold prediction that Bitcoin could reach $200,000 per coin by the end of 2024.

Keiser’s Rationale

Keiser’s optimism for Bitcoin’s future price is rooted in his belief that the global economic landscape, marked by excessive debt levels, currency devaluation, and geopolitical uncertainties, creates a favorable environment for the digital asset to thrive.

He argues that traditional fiat currencies are prone to inflationary pressures and political manipulation, making them increasingly unattractive as stores of value. In contrast, Bitcoin’s decentralized nature and limited supply make it a compelling alternative for investors seeking protection against economic volatility.

Embracing Volatility as Opportunity

Keiser is known for his unabashed embrace of Bitcoin’s volatility, which he views not as a drawback, but rather as an opportunity for savvy investors. He encourages individuals to capitalize on the cryptocurrency’s price fluctuations, highlighting the potential for significant profits.

Keiser’s Reputation and Influence

Max Keiser’s longstanding involvement in the cryptocurrency space and his reputation as a vocal Bitcoin advocate lend credibility to his price prediction. His unwavering belief in Bitcoin’s potential as a global reserve currency and a hedge against economic instability has made him a prominent figure in the industry.

Keiser’s forecast of $200,000 per Bitcoin by the end of 2024 represents a significant milestone, underscoring the growing confidence in the digital asset’s ability to disrupt traditional financial systems and emerge as a dominant force in the global economy.

Bernstein Analysts’ Optimistic Forecast

Analysts at the renowned research and brokerage firm Bernstein have revised their Bitcoin price target, forecasting that the cryptocurrency could reach nearly $200,000 by the end of 2025.

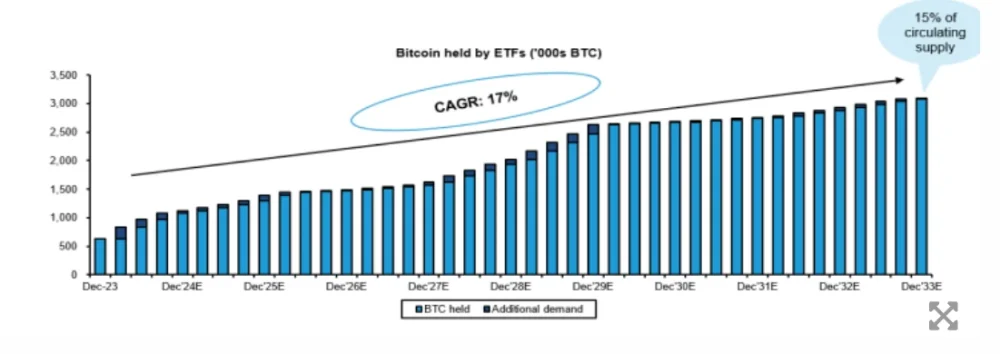

Spot Bitcoin ETFs and Institutional Adoption

Bernstein’s optimistic prediction is primarily driven by the approval and success of spot Bitcoin exchange-traded funds (ETFs) in the United States. The analysts believe that the introduction of these ETFs, which allow investors to gain direct exposure to the underlying Bitcoin, will catalyze significant institutional adoption and capital inflows.

According to Bernstein’s projections, spot Bitcoin ETFs could account for around 7% of the total circulating Bitcoin supply by the end of 2025, and up to 15% by 2033. This anticipated influx of institutional capital is expected to propel Bitcoin’s price to new heights.

Institutional Integrations and Retail Demand

Bernstein’s analysts also highlight the importance of institutional integrations with major wealth management platforms, such as wirehouses and private banks. As these established financial institutions provide their clients with easier access to Bitcoin investments, the analysts believe this will further drive adoption and demand for the digital asset.

Interestingly, the analysts note that currently, nearly 80% of spot Bitcoin ETF flows come from self-directed retail investors, while institutional integrations are still in their early stages. As these institutional channels mature, Bernstein expects the inflows to accelerate, leading to the projected $200,000 per Bitcoin price target by 2025.

Bernstein’s Reputation and Track Record

Bernstein’s reputation as a respected research and brokerage firm lends credibility to its Bitcoin price forecast. The firm’s deep understanding of financial markets and its ability to accurately analyze emerging trends have earned it a reputation for providing insightful and well-researched analysis.

As the cryptocurrency market continues to evolve, Bernstein’s $200,000 per Bitcoin prediction by 2025 serves as a testament to the growing institutional confidence and the transformative potential of this digital asset.

Historical Halving Events

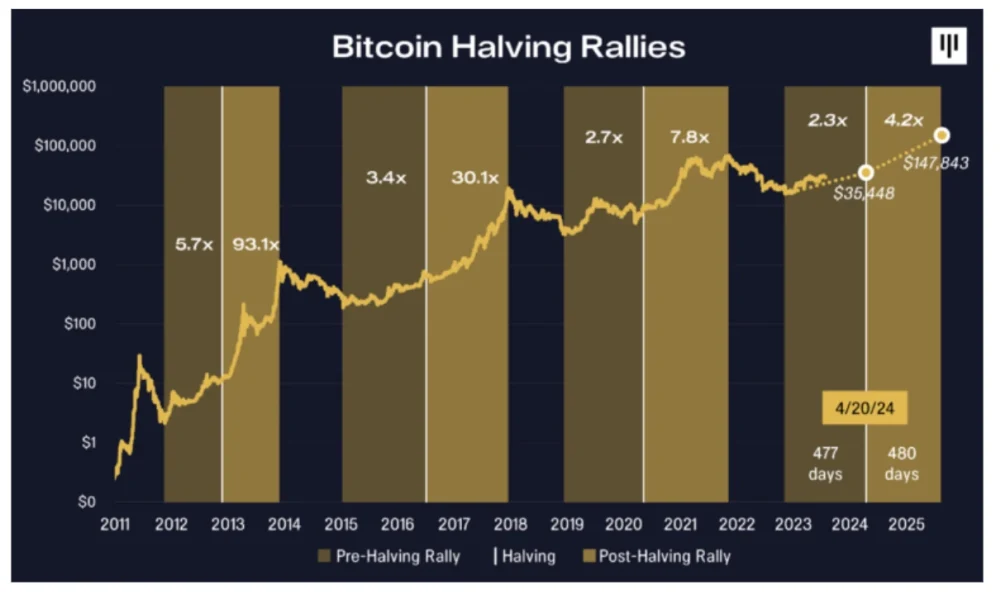

One of the defining features of Bitcoin’s price history has been the periodic halving events. They occur approximately every four years and reduce the rate at which new Bitcoins are created.

Understanding the Halving Cycle

The most recent halving event took place in April 2024. Then the reward for mining a block of Bitcoin decreased from 6.25 BTC per block to 3.125 BTC per block. This programmed reduction in the supply of new Bitcoins has historically been a significant catalyst for price appreciation in the cryptocurrency.

Analyzing Past Halving Events

Examining the price movements surrounding previous halving events provides valuable insights into the potential impact of the 2024 halving. In the year leading up to the 2012 halving, Bitcoin’s price reaching around $1,100 by November 2013.

The 2016 halving was followed by a more gradual price growth. Eventually, Bitcoin reaching its then-all-time high of around $20,000 in December 2017.

The most recent halving in 2020 saw Bitcoin initially stagnate, but… Finally soar to a new record high of nearly $64,000 in April 2021.

Interpreting the Halving’s Impact

While the historical data suggests a potential price increase following a halving event, but…

The extent and timing of the impact can vary. All of that, because some factors such as adoption rate, regulatory environment, macroeconomic conditions, and technological advancements. Generally, all of them can influence Bitcoin’s price trajectory in the post-halving period.

Analysts and experts continue to debate the significance of the halving event. In fact, some of them arguing that the impact may be more aligned with external liquidity cycles… Rather than being a direct trigger for price movements.

Nonetheless, the halving remains a closely watched event that can shape market sentiment and investor behaviour in the cryptocurrency space.

Picture taken from OKX blog easily showing correlation between growing Bitcoin price and 1 year after halving. As far as, last 3 halving always proves that 1 year after halving Bitcoin price is a few times higher than before halving.

Conclusion

In this comprehensive guide I gave you some predictions one of the biggest enthusiasts and supporters of Bitcoin.

Beside that, there were institutional price predictions. What is a good sign! A few years back any bank or investment institution wouldn’t say any word about investment in Bitcoin.

Some of the predictions are on next 2-3 years and some of them are for longer period of time. To be honest, you should think about Bitcoin as investment of HODL, because this asset really revolutionize a lot.

Actually, in this moment Bitcoin change a lot, but maybe you still didn’t see it.

Leave a Reply

You must be logged in to post a comment.