Introduction

Indeed, fundraising has become a crucial aspect for blockchain projects. Fundraising in the cryptocurrency for these projects are very important.

Because of that, crypto space constantly seeking innovative ways to raise capital and engage with investors. The cryptocurrency space has witnessed the emergence of various fundraising mechanisms, each with its own unique features and benefits.

In this comprehensive guide, I will explore the four major fundraising mechanisms: Initial Coin Offering (ICO), Security Token Offering (STO), Initial Exchange Offering (IEO), and Initial DEX Offering (IDO).

Then, I will write about the intricacies of each mechanism, highlighting their key characteristics, advantages, and challenges.

Now, let’s dive into each fundraising mechanism and explore their nuances.

Initial Coin Offering (ICO)

Definition and Purpose

An Initial Coin Offering (ICO) is a popular crowdfunding method used by blockchain-based projects to raise funds.

Through an ICO, companies offer their native tokens or cryptocurrencies to the public in exchange for established cryptocurrencies like Bitcoin, Ethereum, or stable coins.

The main purpose of an ICO is to secure capital for the development and growth of the project.

ICO Structure and Process

ICOs typically involve the issuance of utility tokens, which provide access to a specific product or service offered by the project.

The structure and process of an ICO can vary, but it generally follows these steps:

Project Development

The company develops its blockchain-based project, outlining its objectives, features, and roadmap.

Whitepaper Creation

A comprehensive whitepaper is prepared, detailing the project’s technology, tokenomics, use cases, and team members.

Token Sale Announcement

The project announces the upcoming token sale and sets a specific fundraising goal or limit.

Token Distribution

Investors can participate in the ICO by sending established cryptocurrencies to the project’s designated wallet address. In return, they receive the project’s tokens.

Listing on Exchanges

After the ICO, the project aims to list its tokens on various cryptocurrency exchanges to ensure liquidity and trading opportunities.

Advantages and Challenges

ICOs offer several advantages for both project teams and investors.

They provide a decentralized funding mechanism, enabling projects to raise significant capital without relying on traditional financial institutions.

For investors, ICOs present an opportunity to participate in early-stage projects and potentially reap substantial returns on their investments.

However, ICOs also come with challenges. The lack of regulatory oversight has led to fraudulent projects and scams, making it crucial for investors to conduct thorough due diligence before participating in an ICO.

Additionally, the volatility of the cryptocurrency market can impact the value of ICO tokens, posing risks for both investors and projects.

In fact, investing in an ICO can bring huge amounts of return for the investor, but… Exactly. How many such projects have been successful? As I will prove later in the article, ICO-based projects were particularly popular in the initial phase of the cryptocurrency market.

This large number of unrealized projects has contributed to the fact that there are fewer and fewer investors in ICOs.

This is also related to the fact that alternatives such as STO, IEO and IDO have appeared on the cryptocurrency market.

In the next section I will just look at STO projects.

Security Token Offering (STO)

Definition and Purpose

A Security Token Offering (STO) is a fundraising mechanism that involves the issuance of security tokens. Unlike utility tokens in ICOs, security tokens represent ownership rights or assets and are subject to securities regulations.

STOs aim to provide a compliant and regulated approach to fundraising in the cryptocurrency space.

Types of Security Tokens

Security tokens can be categorized into three main types:

Equity Tokens

These tokens represent ownership stakes in a company, similar to traditional stocks. Equity token holders have rights to profits, voting, and decision-making within the company.

Debt Tokens

Debt tokens represent a loan made to the company or project, with interest and repayment terms specified in the token’s smart contract.

Asset-backed Tokens

These tokens are backed by real-world assets such as real estate, commodities, or art. They provide investors with fractional ownership or rights to the underlying assets.

Compliance and Regulations

STOs are subject to securities regulations, including Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. Companies issuing security tokens must comply with the securities laws of the jurisdictions in which they operate, ensuring investor protection and transparency.

STOs offer benefits such as increased investor confidence, improved liquidity through regulated exchanges, and potential access to a larger pool of investors.

However, the compliance requirements and costs associated with STOs can be more burdensome compared to other fundraising mechanisms.

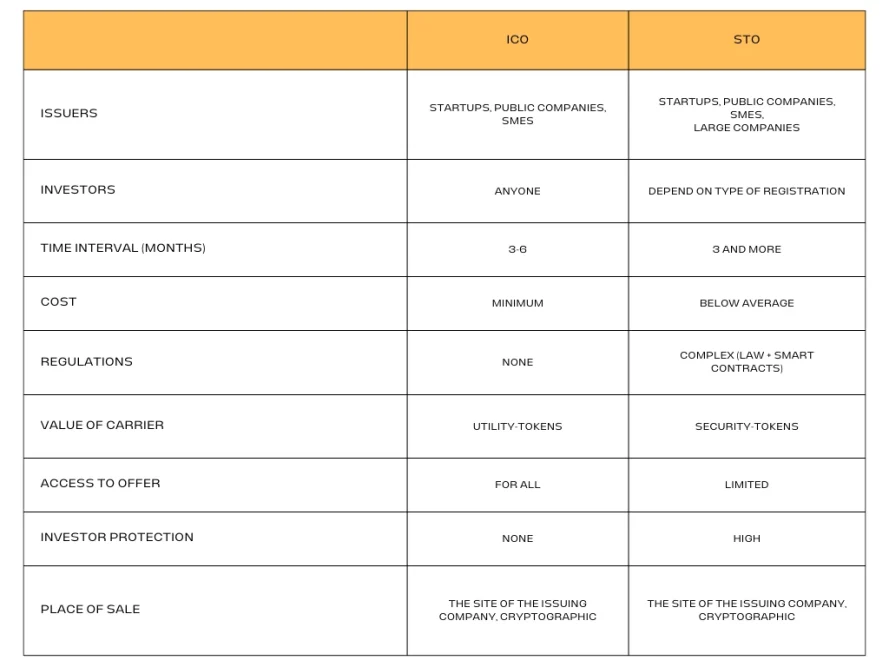

When comparing ICO and STO, several very important issues can be noticed.

Firstly, investors are protected by legal regulations and the smart contract itself.

Secondly, in the case of STO, these are securities assets that are actually covered by tangible things. Such as stocks, bonds, funds or real estate.

Thirdly, the fundamental difference is limited access to the offer, i.e. the offer is limited in time or in a different form.

Initial Exchange Offering (IEO)

Definition and Purpose

An Initial Exchange Offering (IEO) is a fundraising method conducted on a centralized cryptocurrency exchange.

In an IEO, the exchange acts as an intermediary, facilitating the token sale and listing process. IEOs provide projects with immediate access to a large user base and trading liquidity.

IEO Process and Benefits

The process of an IEO typically involves the following steps:

Project Selection

The exchange carefully evaluates and selects projects based on their viability, team, technology, and compliance with exchange requirements.

Due Diligence

The exchange conducts thorough due diligence on the project, reducing the risk of scams and fraudulent activities.

Token Sale

The exchange launches the token sale on its platform, allowing users to purchase the project’s tokens directly from the exchange.

Listing and Trading

Upon completion of the token sale, the exchange lists the tokens, enabling immediate trading and liquidity for investors.

IEOs offer benefits such as increased trust and credibility for the project, as the exchange vets and verifies the project before listing.

They also provide investors with a user-friendly and secure platform to participate in token sales.

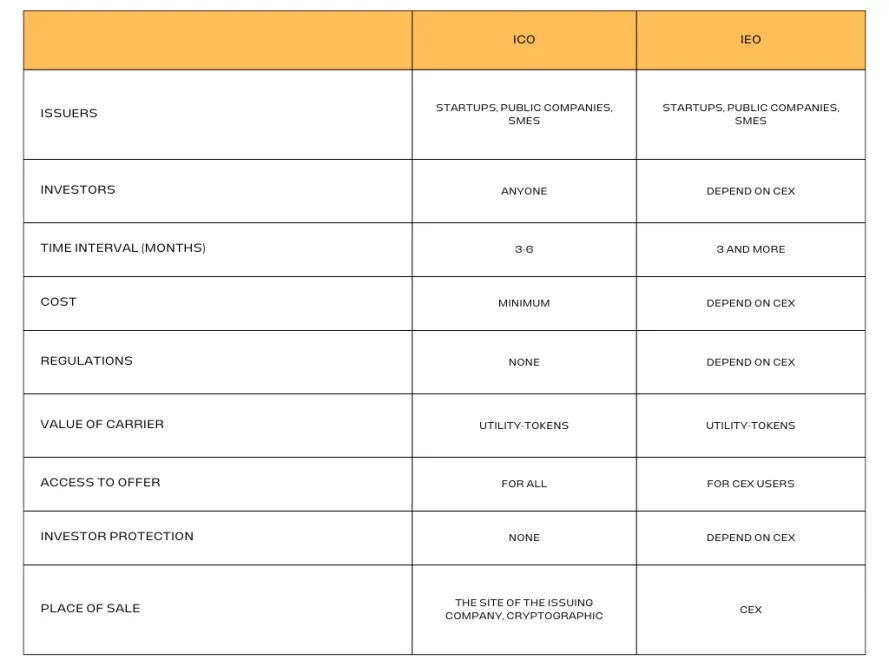

The difference between ICO and IEO is quite significant.

In the case of IEO, CEX is responsible for the marketing and distribution of the project.

If the project is listed on a reputable cryptocurrency exchange, it must have gone through a procedure that checks the project in many aspects.

Which makes it a safer investment than ICO projects. In these (ICO) there is a lot of freedom and at the same time a potential for scams.

Initial DEX Offering (IDO)

Definition and Purpose

An Initial DEX Offering (IDO) is a fundraising mechanism conducted on decentralized exchanges (DEXs).

Unlike IEOs, which rely on centralized exchanges, IDOs take advantage of the decentralized nature of DEXs to raise funds and distribute tokens directly to investors.

IDO Process and Benefits

The process of an IDO typically involves the following steps:

Liquidity Pool Creation

The project creates a liquidity pool on a DEX by providing popular cryptocurrencies such as Bitcoin or Ethereum.

Token Sale Announcement

The project announces the IDO and opens it up to investors who can contribute to the liquidity pool and receive the project’s tokens in return.

Token Distribution

Investors can participate in the IDO by connecting their web3 wallet to the DEX platform and contributing to the liquidity pool. Tokens are distributed automatically based on the contribution.

Trading and Liquidity

After the IDO, the tokens are immediately tradable on the DEX, providing liquidity and trading opportunities for investors.

IDO offers several benefits, including decentralization, immediate liquidity, and lower entry barriers for both projects and investors.

However, the lack of regulatory oversight and potential for market manipulation are challenges that need to be considered.

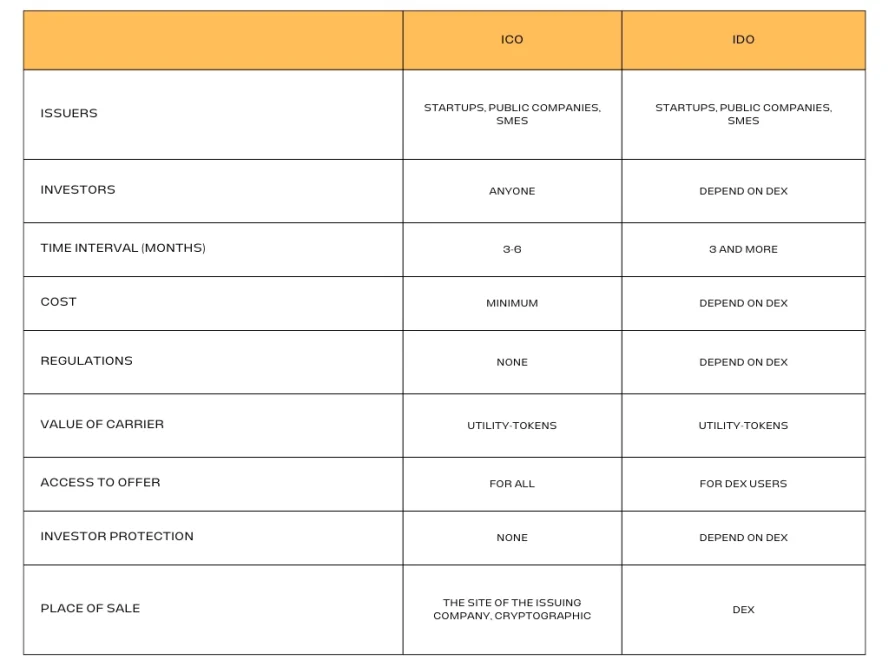

In the case of ICO and IDO, it is similar to the comparison between ICO and IEO, as I described.

In that the responsibility for the project’s success lies with DEX.

Comparison Fundraising Mechanisms

Key Differences and Similarities

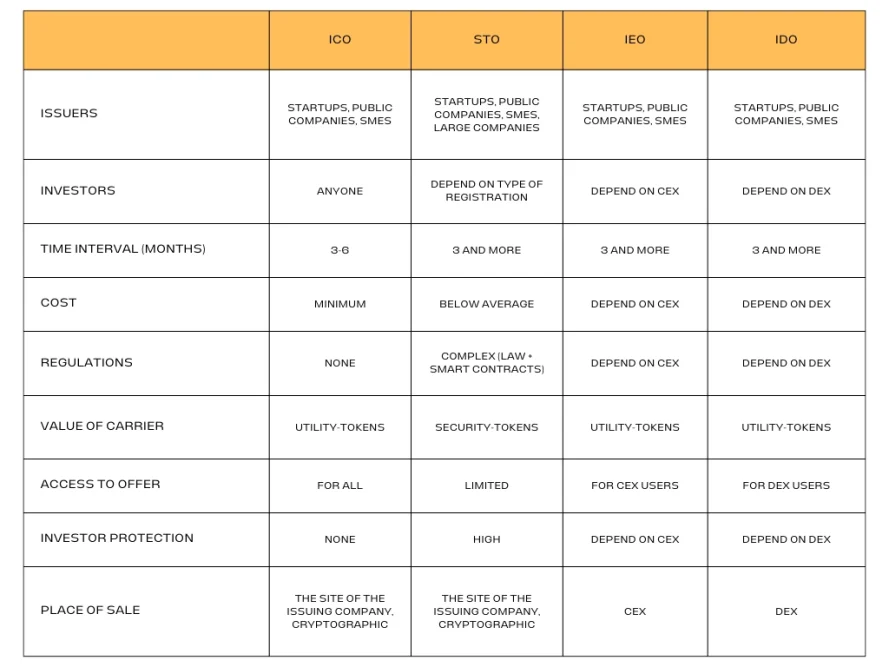

While ICOs, STOs, IEOs, and IDOs are all fundraising mechanisms in the cryptocurrency space, they differ in several aspects:

Regulatory Compliance

ICOs often lack regulatory oversight, while STOs are subject to securities regulations. IEOs and IDOs fall somewhere in between, with varying degrees of compliance requirements.

Fundraising Structure

ICOs and IDOs allow projects to raise funds directly from investors, while IEOs involve a centralized exchange as an intermediary. STOs combine elements of both traditional securities offerings and blockchain technology.

Investor Protection

STOs provide increased investor protection through compliance with securities laws. ICOs and IDOs carry higher risks, as they are less regulated and prone to scams.

Despite these differences, all fundraising mechanisms aim to provide capital for blockchain projects and offer opportunities for investors to participate in the growth of innovative technologies.

Choosing a Fundraising Mechanism

When selecting a fundraising mechanism, project teams should consider the following factors:

Compliance

Understand the regulatory requirements and compliance obligations associated with each fundraising mechanism.

Target Investors

Identify the target investor base and determine which mechanism is best suited to reach and engage with them.

Token Characteristics

Assess the nature of the token being issued and determine if it aligns with the goals and objectives of the project.

Exchange Listing

Evaluate the potential for listing the tokens on reputable exchanges to ensure liquidity and trading opportunities for investors.

Project Stage and Goals

Consider the stage of the project, funding requirements, and long-term goals to determine the most appropriate fundraising mechanism.

These 4 fundraising models are the most popular in the cryptocurrency world.

In the initial phase of the market, there was a lot of willfulness, which resulted in a large number of scams and projects that ended in failure.

ICO, which is known for its lack of restrictions, is famous for its huge risk, but also unlimited access.

In the following years, projects such as IEO and IDO began to appear on the cryptocurrency market.

These are distributed via DEX or CEX. In both cases, the security of investments is based on the regulations applicable to them. These are regulations allowing the project to be made public on the stock exchange.

As for STO projects, they are security assets.

They are actually covered by tangible assets and are also distributed via the website of the company that issues them.

Security in this case is also greater than in the case of ICO projects.

Trends and Future Outlook

Evolving Regulatory Landscape

As the cryptocurrency industry continues to mature, regulatory bodies around the world are increasingly focusing on creating frameworks to govern fundraising mechanisms.

This evolving regulatory landscape aims to protect investors and promote transparency in the cryptocurrency space.

Projects should stay updated on regulatory developments to ensure compliance and maintain investor confidence.

Integration of DeFi and Fundraising

Decentralized Finance (DeFi) has gained significant traction in the cryptocurrency space, offering innovative financial solutions without intermediaries.

The integration of DeFi concepts with fundraising mechanisms is an emerging trend, enabling projects to leverage decentralized lending, borrowing, and token swapping protocols to enhance fundraising efficiency and create new opportunities for investors.

Fundraising in Cryptocurrency Facts

In this section, I will write some facts about data-driven projects themselves.

By collecting some facts related to fundraising in the cryptocurrency sector, you can draw some very valuable conclusions. Moreover, fundraising changes its form and evolves along with the entire cryptocurrency market.

Let’s look at some facts related to cryptocurrency fundraising.

Crypto Funds and Investors

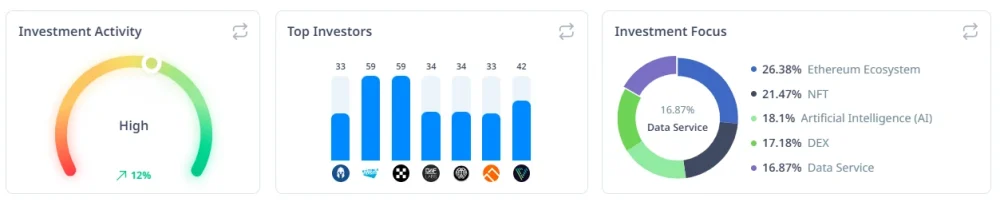

Compared to the last 12 months, investor activity increased by 12%.

This does not mean that there is still enthusiasm among investors.

The sentiment remains optimistic, especially since we are in the middle of a bull market in the cryptocurrency market.

The most active Venture Capitals include The Spartan Group, Binance Labs and Galaxy.

And in the case of projects, the most investment is in the Ethereum and NFT ecosystem.

Third place is taken by AI projects, the explosion of which can be observed thanks to projects such as ChatGPT.

Fund Raising Activity

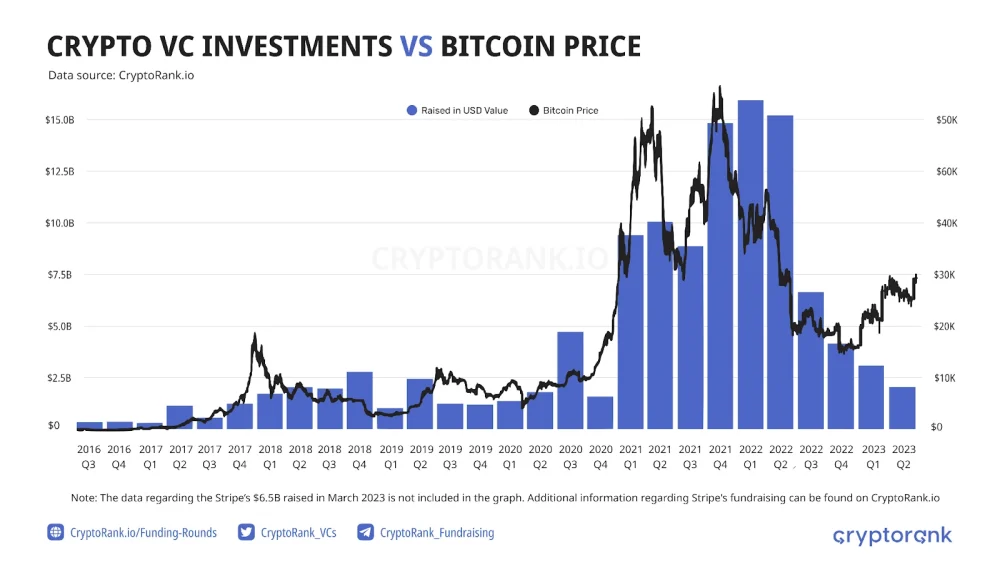

In fact, the chart shows a larger amount of invested capital in the period from January 2021 to June 2022.

At that time, we had a mega bull market for Bitcoin that ended in November 2021.

Until November 2022, the cryptocurrency market was in a bear market.

Let’s look at the next graphic, which will further illustrate how the price of bitcoin was adequate to the activity of VC investors.

VC Investment and Bitcoin Price

I guess now there is no doubt that the rising price of bitcoin stimulates VCs to invest in new cryptocurrency projects.

Interestingly, the bear market period right after the bitcoin peaks is a time of increased investor activity.

But is this the best time to invest?

In my opinion, it was best to invest between Q2 and Q4 of 2022, when the bitcoin price reached its lowest bear market price.

VC Funds by Country

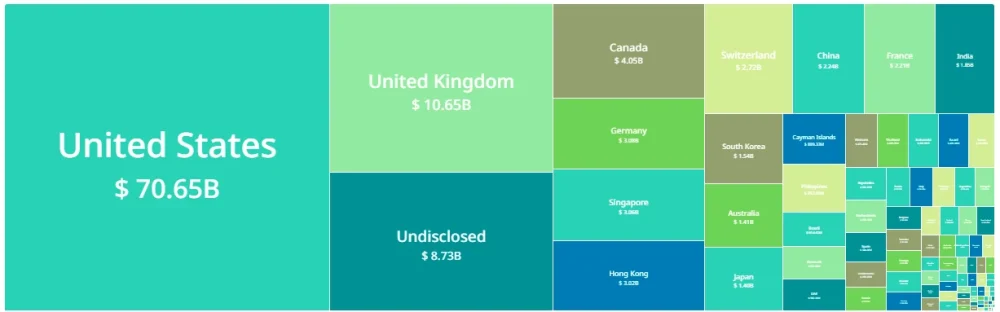

In terms of invested VC capital in the world, the USA is dominant.

Blockchain is certainly a future technology that is changing the world for good.

The US was the first to recognize this potential and will remain a leader on this issue.

What I mean here, of course, is the amount of VC capital invested in blockchain projects.

In a moment you will be able to see which projects have gained the largest amount of capital over the last 2 years.

Public Tokens by Type

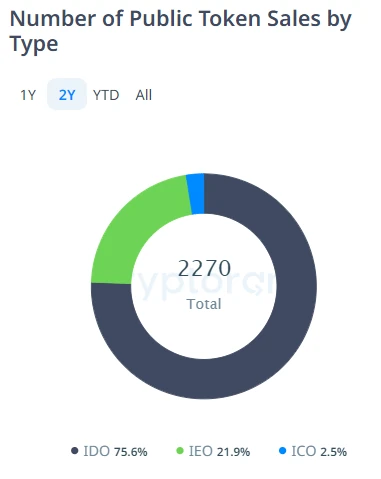

Over the last 2 years, by far the most projects, as many as 75.6%, have been IDO projects (i.e. those listed on decentralized cryptocurrency exchanges).

21.9% are IEO projects, i.e. those listed on CEX, i.e. centrally managed exchanges such as Binance.

ICO, which was popular years ago, accounts for 2.5%.

Which is not surprising, considering the number of failed projects in previous years.

All data was taken from the Cryptorank website.

The website perfectly shows the status of public token investments. If you are interested in such things, I encourage you to visit.

Conclusion

In conclusion, fundraising mechanisms such as ICOs, STOs, IEOs, and IDOs have revolutionized the way blockchain projects raise capital.

Each mechanism offers unique advantages and challenges, catering to different project needs and investor preferences.

When you know the difference between the mechanisms of fundraising in cryptocurrencies, you are able to choose the best method to finance your own project.

Perhaps it will also help you invest and assess the risk of investing in a project whose mechanisms will be more familiar to you.

Leave a Reply

You must be logged in to post a comment.