Introduction

Binance Coin (BNB) is a popular cryptocurrency that has been gaining traction among investors. However, not all investors are aware of the importance of fundamental analysis when it comes to investing in Binance Coin.

Undoubtedly, fundamental analysis is a crucial tool for any investor. So as it provides, insights into the factors that influence its value.

By understanding the underlying fundamentals of Binance Coin, investors can make informed decisions about when to buy and sell it. They maximizing their profits in the process, indeed.

In this article, we’ll explore why fundamental analysis is so important when it comes to investing in Binance Coin. How it can help you make the most of your investments.

Understanding Fundamental Analysis

Fundamental analysis is a method of analysing an asset’s intrinsic value in reality. Of course, you examining its underlying economic and financial factors. So it involves studying the asset’s financial statements, industry trends, market conditions.

Other relevant information to identify the asset’s true value, indeed. In this case, Binance Coin and its fundamental analysis involves examining the cryptocurrency’s underlying factors. Such as its use cases, adoption, competition, and future potential.

Fundamental analysis is a very important part of any research indeed.

It is so necessary to conduct a solid analysis to be fully convinced of the investment.

Difficult periods for investments will come, because they always do.

In fact, a properly conducted analysis will allow you to be confident in your investment.

Understanding Binance Coin

Firstly, Binance Coin, initially launched in 2017, is an integral part of the Binance ecosystem. It serves various functions, including but not limited to payment for transaction fees on the Binance exchange.

Participating in token sales on the Binance Launchpad, then accessing various features and services within the Binance platform. With a limited supply of 200 million coins, BNB has seen significant adoption. Of course, it has become a prominent player in the cryptocurrency space.

Importance of Fundamental Analysis

Fundamental analysis is particularly important in the cryptocurrency market. Prices can be highly volatile and influenced by a wide range of factors. By conducting fundamental analysis, investors can gain a deeper understanding of the underlying factors.

Factors that drive the value of a cryptocurrency, and make more informed investment decisions. In the case of Binance Coin, fundamental analysis can help investors identify the factors that are driving its growth. As well as potential risks that could lead to a decline in value.

Key Factors to Consider

When conducting fundamental analysis on Binance Coin, there are several key factors to consider.

These include market analysis and trends, BNB’s use cases and adoption, the Binance ecosystem.

Competitor analysis, and future potential and growth opportunities are mentions as well.

Beside that, taking in consideration regulatory and industry factors is important.

Binance Coin Market Analysis and Trends

One of the key factors to consider when conducting fundamental analysis on Binance Coin is market analysis and trends. This involves examining the current market conditions and trends to identify potential opportunities and risks.

For example, if the cryptocurrency market is experiencing a bull run. Then Binance Coin may experience significant growth as investors flock to the platform. Alternatively, if the market is experiencing a downturn, Binance Coin may be more likely to experience a decline in value.

BNB Price Analysis in Depth

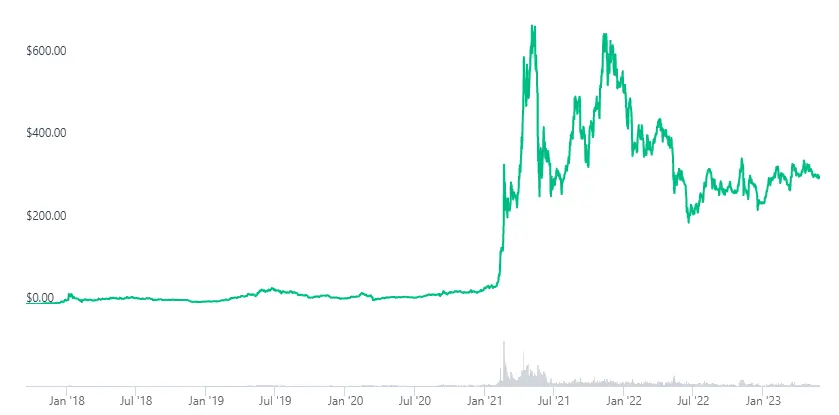

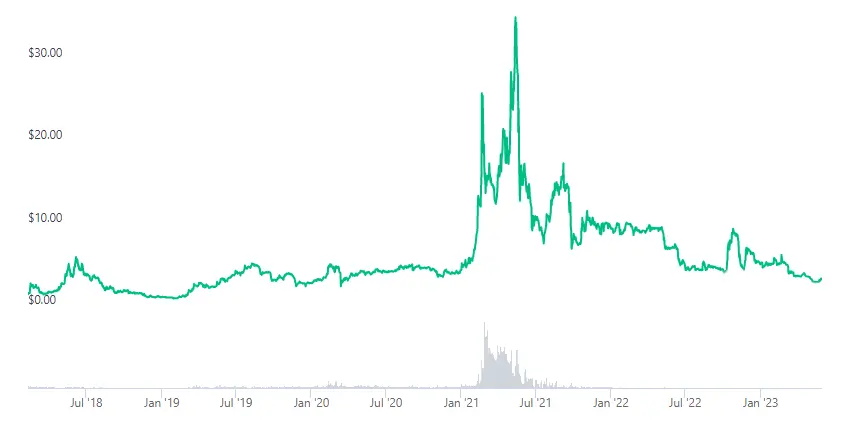

For Binance Coin, complete historical trend analysis cannot be done. In the case of the BNB cryptocurrency, you can only analyze the short rally of the end of 2017.

Next, the bear market, full rally in next bull market and the last year bear market. Let’s take a look closer what’s happen then.

Since June 2022, the price of Binance Coin has been in an upward trend.

After attaching the coin, the price rose to around $25. The end of the cryptocurrency boom coincided with the peak of the bull market in the entire market.

After that, the price of the cryptocurrency dropped to around $5 in almost a month. Down 80% of the price from the high.

In the case of cryptocurrencies, this is nothing unusual. The market did not have a large pool of liquidity, and thus price manipulation is easier.

What Happened After That?

For the next 2 years, the price fluctuated between $5 and $25. The beginning of 2021 is the return of a strong bull market. The price in nearly 5 months soared to 686 dollars at the peak of the bull market. So we’re talking about an increase of 22 to 25 times.

The next bearish time is a drop to around $200. A 70% drop is not a bad result. For many cryptocurrencies, the bear market of late 2021 and mid-2022 was a very difficult time for the cryptocurrency market. Many of them have fallen by 90 – 99%. The cryptocurrency market has been massacred. Many investors or traders have lost a lot of money.

Today we are halfway through 2023 and the price of BNB is steadily increasing. It is true that there are no spectacular increases, but still … The price is $ 313. Which from the bottom means an increase of about 56% in a year. Not bad ! It should be added that we are no longer in the bull market.

What Can be Deduced?

Binance Coin has achieved huge increases in 5 years. It is the cryptocurrency of the largest exchange among all cryptocurrencies.

Investing in BNB has a solid foundation in price trend analysis. In this case, a period of 3 – 5 years is the time that we should spend minimally on investments.

Token Utility and Use Cases

Fundamental analysis also involves understanding the utility and use cases of Binance Coin. As the Binance ecosystem expands, BNB continues to find utility in various applications. Such as payment for trading fees, participation in token sales, accessing premium services, and staking for rewards.

Evaluating the growth and adoption of these use cases can provide valuable insights into the potential demand and value of BNB.

Binance Exchange Ecosystem

The success and growth of Binance Coin are closely tied to the expansion and adoption of the Binance exchange. Fundamental analysis involves assessing the exchange’s performance, user base, trading volume, and strategic initiatives.

By analyzing Binance’s financial statements, user metrics, and market positioning, investors can gauge the potential impact on the demand and utility of BNB.

BNB Smart Chain and BNB Beacon Chain

BNB Smart Chain and BNB Beacon Chain are two integral components of the Binance ecosystem. They are designed to provide enhanced functionality and scalability to the Binance Coin (BNB) blockchain.

Binance Coin Smart Chain

It is blockchain platform developed by Binance – BNB Smart Chain, designed to facilitate the creation and execution of decentralized applications (DApps) and smart contracts. It operates as a parallel chain to the Binance Chain, allowing for fast and low-cost transactions with a high degree of compatibility with the Ethereum Virtual Machine (EVM).

BNB Smart Chain utilizes a Proof-of-Stake (PoS) consensus mechanism, where participants can stake BNB to become validators and contribute to block production and network security. This approach enables faster block times and higher transaction throughput compared to traditional Proof-of-Work (PoW) blockchains.

Additionally, BNB Smart Chain incorporates cross-chain compatibility, enabling interoperability with other blockchains and facilitating the transfer of assets between different networks.

BNB Beacon Chain

On the other hand, BNB Beacon Chain is a crucial component of the Binance ecosystem that serves as the backbone of Binance Chain’s security and consensus mechanism. It is based on the Ethereum 2.0 framework and utilizes the Beacon Chain, which acts as a coordination layer for multiple shard chains.

The Beacon Chain employs the Proof-of-Stake (PoS) consensus mechanism, enabling validators to secure the network by staking BNB tokens and participating in block validation. BNB Beacon Chain plays a vital role in maintaining the security and integrity of the Binance Chain ecosystem by finalizing transactions, managing consensus, and coordinating communication between the different shard chains.

Both BNB Smart Chain and BNB Beacon Chain contribute to the overall growth and utility of the Binance ecosystem. BNB Smart Chain provides a scalable and developer-friendly environment for building decentralized applications, while BNB Beacon Chain ensures the security and decentralization of the Binance Chain by employing a robust PoS consensus mechanism.

Together, they enhance the functionality and expand the possibilities for users and developers within the Binance ecosystem, fostering innovation and driving the adoption of blockchain technology.

Market Positioning and Competition

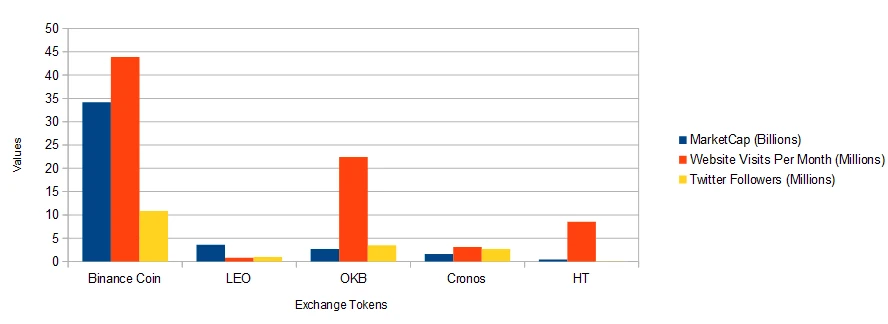

Analyzing Binance Coin’s competitive landscape is crucial for understanding its potential growth. Fundamental analysis involves assessing other similar projects and cryptocurrencies, identifying their strengths and weaknesses, and comparing them to BNB. This analysis helps investors gauge BNB’s market positioning and potential advantages, enabling them to make informed investment decisions.

Binance Coin faces competition from other cryptocurrencies, such as Ethereum and Bitcoin, as well as other exchanges, such as Coinbase and Kraken. By examining the strengths and weaknesses of Binance Coin’s competitors, investors can gain insights into the cryptocurrency’s potential for growth and adoption.

The Binance exchange token has the highest capitalization, popularity and applicability.

All this is due to the dominance of the Binance exchange.

Additionally, it is worth noting that the market cap of LEO and OKB stands out from other exchanges

(I do not include Binance Coin).

In fact, OKB has a track record of page visits per month.

Which is also a positive aspect for this token and the exchange.

Another Exchanges Competition Prices

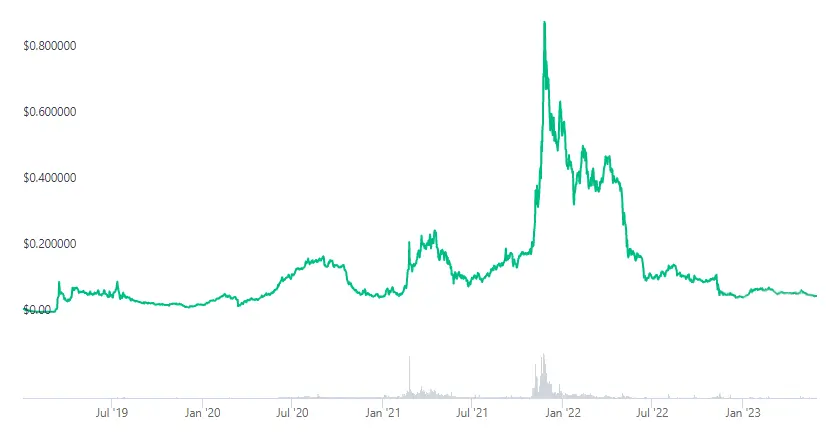

LEO (LEO)

LEO Token is the native cryptocurrency of the Bitfinex exchange. It operates on the Ethereum blockchain as an ERC-20 token. LEO Token was created by iFinex, the parent company of Bitfinex. Exchange provide various benefits and functionalities within the Bitfinex ecosystem.

It offers users reduced trading fees, access to exclusive. Users can participate in token sales and initial exchange offerings (IEOs). LEO Token’s value is closely tied to the success and growth of the Bitfinex exchange.

The price of the LEO token reached its peak at the beginning of 2022.

Then, capital from this token flowed out for the next year.

It is true that it was a more difficult period for the entire cryptocurrency market,

but the token price bravely defended itself. From the peak of $7.60 to the bottom of $3.30 per unit, the difference is astonishing. Of course, if you take into account the cryptocurrency market.

For me, this is a proof of good sentiment and trust in the exchange token.

The stock exchange itself looks good compared to the competition.

Since February 2023, the LEO price has been in an upward trend.

OKB (OKB)

Token OKB is the native cryptocurrency of the OKEx exchange. One of the largest cryptocurrency exchanges globally. It operates on the Ethereum blockchain as an ERC-20 token, although it has plans to launch its own blockchain, OKChain.

Token provides a range of benefits for OKEx users. Including discounted trading fees, access to advanced trading features, and the ability to participate in token sales and initial exchange offerings. OKB Token also plays a role in OKEx’s ecosystem development and governance.

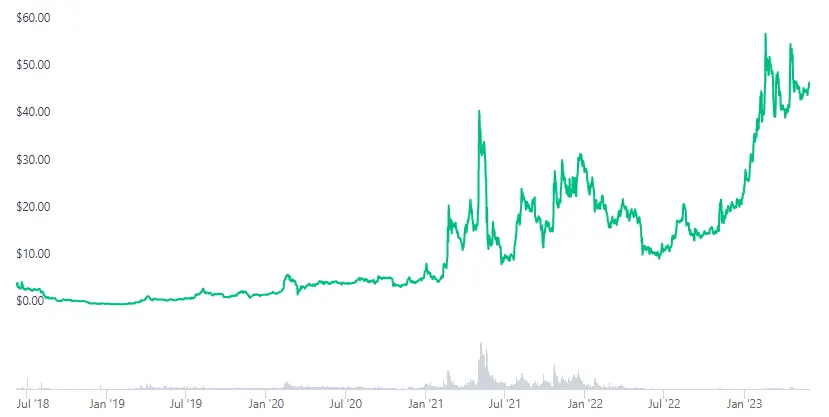

The OKB price, like the Binance Coin price, has been in an upward trend since June 2022.

OKB is constantly increasing its bitcoin reserves and building authority among cryptocurrency exchanges.

As a result of these activities, interest in the exchange token is growing.

The exchange is one of the leading cryptocurrency exchanges in the world.

Cronos (CRO)

Cronos Token is the native cryptocurrency of the Cronos Network. A blockchain platform developed by Crypto.com. The Cronos Network is built on the Cosmos SDK framework. Framework aims to provide developers with a scalable and interoperable platform for building decentralized applications (DApps).

Cronos Token is used for various purposes within the Cronos Network.

Such as paying for transaction fees, staking, and participating in network governance.

It offers developers and users the opportunity to engage with the Cronos ecosystem and contribute to its growth.

Price as of October 2023, the Cronos price has returned to the upward trend. The following months will confirm the trend.

A particularly large upward trend could be observed at the turn of the year.

Not by accident, because Crypto.com was a sponsor of the football championship in Qatar.

Yes, the entire championship was held at the end of the year. This is also no coincidence.

Due to high temperatures in Qatar all year round. Okay, back to the topic.

As Cronos is a Crypto.com token, there is greater interest in the token.

Huobi Token (HT)

Huobi Token is the native cryptocurrency of the Huobi exchange.

It offers benefits such as fee discounts, but not only.

Access to exclusive events, and participation in token sales, in reality as well.

As a competitor exchange token, HT competes with BNB in terms of utility within its respective exchange ecosystem.

The HT price has no visible upward trend. The negative sentiment resulted from the hack of the Huobi exchange.

Either way, this trend will eventually reverse.

The worst-case scenario for this exchange would be further successful attacks on the exchange

and loss of confidence in its security.

Who wants to store and trade (even for a short period) on an exchange where assets can be stolen. Only a fool!

Read more about Cryptocurrency asset reserves for exchanges

Future Potential and Growth

Finally, it’s important to consider the future potential and growth opportunities for Binance Coin. Binance is constantly expanding its ecosystem. Further, introducing new products and services. In fact, it could have a significant impact on the value of Binance Coin.

Additionally, Binance Coin could experience significant growth with demand for decentralized finance growth.

Regulatory and Industry Factors

Fundamental analysis extends beyond the specific cryptocurrency. In fact, it delves into broader regulatory and industry factors. As the cryptocurrency market is influenced by regulatory developments, so … Understanding the legal and regulatory landscape surrounding BNB is essential, indeed.

Additionally, analyzing industry trends and developments … Can provide surely insights into the potential growth and adoption of Binance Coin.

Conclusion

In conclusion, fundamental analysis is a crucial tool for any investor. This analysis can unlock the full potential of Binance Coin. Examining the underlying help investors make more informed investment decisions and maximize their profits.

Consider factors such as market analysis and trends. Then, use cases and adoption. Further, Binance ecosystem, competitor analysis and so on. Overall, it make more informed investment decisions.

Leave a Reply

You must be logged in to post a comment.