How Did it All Start?

In the beginning, I will write that all the information presented is my opinion and cannot be taken literally. Anyway, in this article, I want to determine how FTX’s bankruptcy, which was a huge ftx scam, could have happened (author’s opinion).

Here we go.

FTX opened its operations in May 2019 during the beginning of the uptrend. This was the period right after the end of the “bear market” lasting the whole of 2018. A great time to start a new business. The economic conditions, i.e. the so-called “macro” conditions, were very favorable for the development and growth of the company.

New enthusiasm on the market, a very large number of investors, and many celebrities advertising the company.

What could go wrong?

Prepare for Scam

From the perspective of an early investor, it is very difficult to determine whether a given venture can be successful or not. This is the problem of every investor at the early stage of the project.

As investors, we bear the risk, but when the project is successful, we collect a deserved remuneration in the form of a several-fold return on the invested capital.

Many projects are very well run like professional start-ups with prospects.

It is even more difficult to realize that we are dealing with a scam.

Getting to know someone on a project will often give us the best insight into what’s going on.

Of course, when it is a trusted person. But who has friends in the projects he invests in?

Fraud Scheme

Fraud and manipulation are nothing new in the stock market. In the early days, the financial markets were full of hustlers and liars. Their only action was to encourage people to buy shares. Often, actions of mediocre quality and collecting commissions from the sale of “stock exchange papers”, with which you could really wipe your ass.

The seller was not interested in the buyer’s losses. For him, the most important was the profit from the sale transaction. This is how the film “The Wolf of Wall Street” was created.

A similar “Pump and Dump” scam scheme works almost every time:

Creating Groups that Promote Fraud

A very famous way to create an insider group is to form a “Pump and Dump” group.

“Pump and Dump” groups are all sorts of semi-private channels like Slack and Telegram that allow users to plan in peace away from the public.

You can sometimes see their ads on more public channels like Reddit, but generally, insiders don’t promote themselves at this stage yet. During this time, they buy the selected currency at a low price.

Promotion

When enough currency or cryptocurrency is collected from the market, the active promotion of the product begins. They start promoting the cryptocurrency saying that this technology has real potential, it has facilities that no other has, and… the price is starting to rise!

Users outside the original group start to see the token and buy it. As the price stays low, you don’t need much activity to raise it quickly.

Increasing the price in a short time is possible only in cryptocurrencies with a low market capitalization, below 10 million dollars!

The risk of investing in such a cryptocurrency is really very high.

Sale

Finally, the right time has come for insiders to liquidate their assets by selling quietly while still telling others to buy. After a group of insiders gains 10 times their investment, they often just disappear and the market keeps buying.

Then the price falls as fast as it rose. Many of those who bought at the top will be left with declining cryptocurrencies. They are the real targets of the insiders. They bought back the cryptocurrency 10 times more expensive, which is actually worthless. And after such a pattern of rising and falling, the currency will rarely rise again.

If we are dealing with a project that is constantly being developed and its prospects are promising, it’s half the trouble. You can freeze capital.

When we succumb to the mechanisms of the crowd and invest in a product we do not know, we may remain in a catastrophic situation.

What Similarities to FTX?

Looking at the situation of FTX scam, one could get the impression that it is a healthy developing start-up, which after 3 years turned into a colossus with clay legs. The company had close to 300 sub-companies when it filed for bankruptcy.

Perhaps it is this exponential increase in such a short time that should cause concern.

What did FTX have to do with the “Pump and Dump” scheme?

As you can see in retrospect, there are several similarities. Maybe it wasn’t a typical scam of this type, because here we are dealing with huge corporate breaches reminiscent of those of Bernie Madoff in the lead role.

Barnie Madoff

Barnie Madoff was very well-known in case of scamming in financial sector, indeed.

Either way, during the bull market, stock prices kept rising, and the media and celebrities encouraged people to buy.

People who had shared for several years were certainly selling shares around the ATH (All-Time-High).

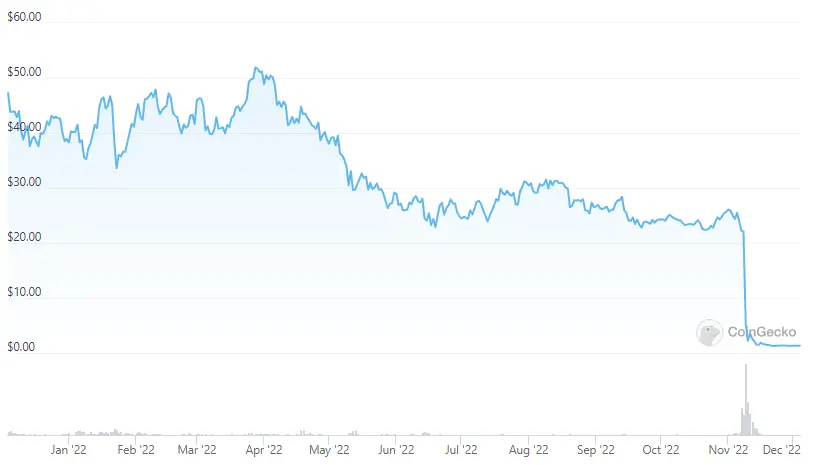

Minimum price: $1.15 (September 6, 2019) – the beginning of the bull market

Maximum price: $84.18 (September 9, 2021) – end of the bull market

Current price: $1.32 (November 11, 2022) – Bankruptcy begins

Price pumping and programming were typical of the “Pump and Dump” scam, but the failure of the project was determined by reprehensible management decisions and risk in the company. But that’s not all. The whole scheme of creating exchange tokens – FTT was one big scam.

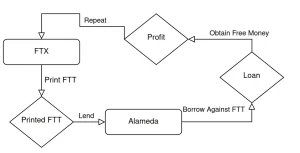

Particularly, model of creating FTT tokens was like money laundering process. So, printed FTT tokens were hedge in Alameda Research and then they were borrowed against FTT token in traditional banking. Dollars from bank it was money created from air and it was clear profit for FTX exchange.

FTT Creating Coin

The FTX company (cryptocurrency exchange) issued FTT tokens that could be used to pay on the exchange.

The token was lent to Alameda, founded by Sam Bankman. One of the owners of FTX was also Sam Bankman. FTX then lent the tokens to Alameda, and Alameda traded the market down against FTT and its long-term investors.

This is how Alemeda generated profits from playing on the market, whose share price was managed by itself.

The unlimited number of FTX tokens gave it this power.

Alameda traded on declines outside its own exchange. She then took profits in digital dollars (Tether) and reinvested them in FTX.

This model could continue indefinitely.

Well thought out scam!!!

I don’t think anyone has any doubts about that.

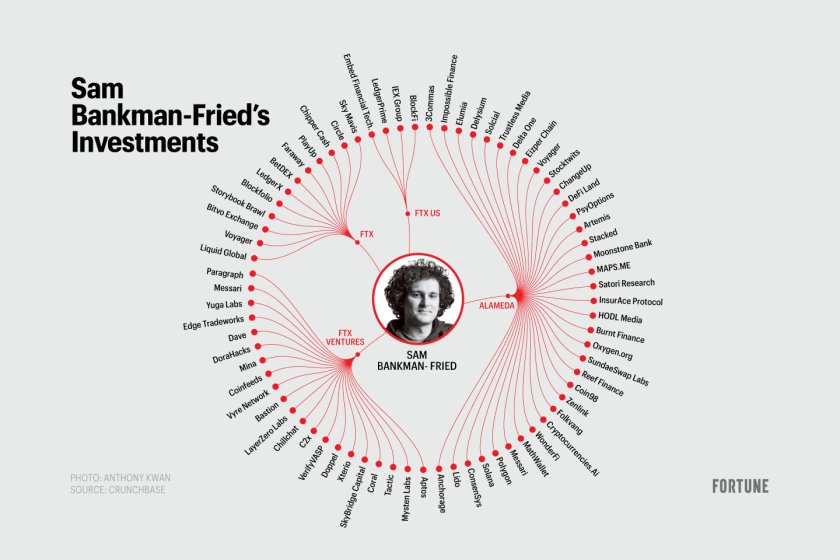

What Investments has FTX Made?

“FTX scam” made various investments, thanks to which it wanted to multiply its capital.

An image of Sam’s investments you can see below.

Those more interested in his investments are referred to in other literature. I am just mentioning about 2 cryptocurrencies Solana and Polygon.

Who is Really to Blame?

In this whole situation, the blame for the failure of the project rests with its leaders, i.e. its founders.

They were responsible for the management and development of the company. The whole business model, which was a great deception was created by them.

There are recordings in the media in which Sam is referred to not as a fraud, but as a person who does not have corporate control.

How to determine the leverage of FTX’s positions with the deposits of its clients’ exchange?

What was generating profits through Alameda?

What consequences do entrepreneurs expect when they commit fraud?

These are just some of the questions that arise while writing this article.

What’s Next for the Market?

After the wave of FTX bankruptcy, depression and anxiety prevailed in the cryptocurrency market.

All negative emotions accumulated. This event may be a symbolic determination of the market bottom in a bearish trend.

Of course, there will be a wave of lowering the share price of several or several hundred companies with which the FTX exchange has cooperated.

It should be added that since November 2021 we have been in a bearish trend. The stock prices of cryptocurrency companies continued to fall until the expected moment.

This moment is the stabilization of share prices after a wave of bankruptcies of poorly managed companies.

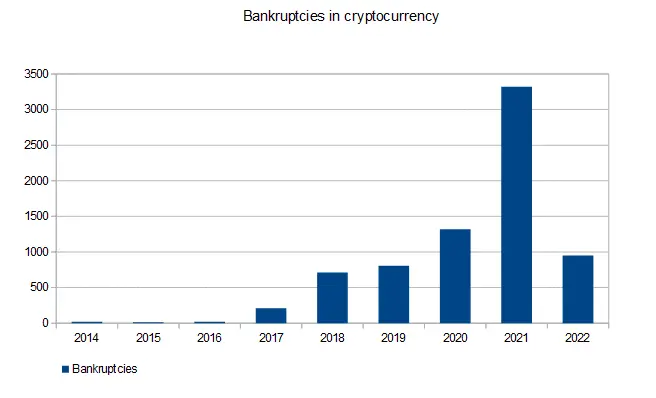

The Coingecko report shows that in 2021 alone, 3,322 cryptocurrency projects failed.

The year 2022 is slightly better because there are 951 companies.

Indeed, ftx scam happen in 2022, but most of cryptocurrency bankruptcies happen in 2021. Without a doubt, you can notice it on the graph.

The most spectacular bankruptcies on the cryptocurrency market in 2022:

a) FTX

b) Block Fi (a company strongly associated with FTX) – a cryptocurrency lender

c) Three Arrows Capital (3AC) – hedge fund

d) Voyager Digital – cryptocurrency lender

e) Celsius Network – cryptocurrency lender

The bankruptcy of FTX is referred to as one of the most important events of the year due to the negative consequences for the entire market.

In terms of bankruptcies on the cryptocurrency markets, it was 2021!

It should be added that the bankruptcy of FTX has a psychological impact on market confidence.

Thanks to this bankruptcy, there was a process of transparency of reserves on cryptocurrency exchanges around the world. Which should be considered a positive aspect of this whole bankruptcy.

Domino Effect on the Market

The domino effect continues. However, don’t expect it to last forever.

2021 was the most difficult year for the cryptocurrency market in terms of bankruptcies.

The year 2022 is just a consequence of the events of 2021. The media deliberately publicize the bankruptcy of companies such as FTX scam in order to arouse anxiety among investors and lead to their complete capitulation.

Cryptocurrency Market and Investing

Cryptocurrency technology is in its early stages. Many projects fail.

Investing capital in this type of asset is very risky and may end up in bankruptcy, as in the case of FTX scam.

What is amazing is that FTX has actually turned into a corporate company. The crisis in the cryptocurrency market verified how healthy the company’s structures and assets were built.

Due to the revolutionary technology with an uncertain future, it is worth considering a very high-risk factor.

Only investing a small part of the accumulated capital makes sense to invest in cryptocurrencies. Just investing small amounts of money every month in blockchain technology companies seems to be reasonable behaviour.

Of course, when we first research the company we want to invest in.

Due to the unregulated cryptocurrency market, the risk increases.

The example of FTX clearly shows that money should be kept outside the stock exchange on a ledger or cold wallet.

The collapse of another exchange or a hacker attack can always take place. Be careful about it!

Lesson From the FTX Scam

For some, learning after investing in FTX is very painful. Many people have lost their life savings or a significant part of their accumulated capital.

The main mistake was to store capital in the stock market. Stock exchanges and cryptocurrencies themselves have always been attacked by hackers.

This error relates to not knowing how to transfer capital to a ledger or “cold wallet”, laziness or ignorance.

Once again, the victim himself fails.

Of course, I’m not justifying Sam and his handling of clients’ money here, but…

When your money was out of stock, it couldn’t just disappear.

However, this is not the end. Invested capital is exposed to a high risk of loss.

Always invest as much as you can afford to lose and no more.

The example of FTX proves that even a large corporate company can fail in times of crisis. In this case, asset management, the exchange’s criminal model of issuing cryptocurrency, and risk management contributed to the failure of the business. It is good to fundamentally assess the prospects of the entire investment.

Stock Market Manipulation

The stock market has its own rules. FTX scam has own rules.

Institutional investors, banks, and hedge funds dictate the terms and have a large impact on trends in the financial markets. A private investor has no chance against investors with very thick portfolios. Watching the movements of institutional investors is the most effective method of making money in the markets.

Market manipulation has always been there.

Where you can earn money, there are also scammers who will be happy to sell or get your capital.

One of the most popular manipulations or scams is the “Pump and Dump” scheme. We are dealing here with artificial price manipulation. The price reaches very high values in a short time and sales occur.

The people who have joined the price frenzy recently are buying its inflated value.

Massive sales ensue and the price skyrockets. People who bought last lose all or most of their invested capital.

Another manipulation is media encouragement to buy. In the case of a very high price, the hunt is even greater. When the price is occasion, the media write about depression, and crisis and discourage purchases.

Summary

The bankruptcy of FTX is the most important event in the cryptocurrency market in 2022. Let’s be honest it was FTX scam.

There is no doubt that its founders are behind the failure of the enterprise. The very process of generating capital and managing this corporation raises a lot of doubts.

There should be no justification for massive fraud in any way. Those responsible for stealing customer deposits from this exchange should face severe consequences.

In countries where there are laws, you can get fined or go to jail for stealing chocolate. How come the founders of this company are still on the loose?

It is worth drawing conclusions from such projects:

You need to keep your own cryptocurrencies on a “cold wallet” or ledger away from exchanges. You should never show in public your wallet passwords. This unique data affects the security of your investment.

Leave a Reply

You must be logged in to post a comment.