Introduction to Crypto Investment Strategies

Investment strategies have become a crucial aspect for individuals looking to make the most out of their digital assets, indeed. The traditional approach of simply holding onto your coins, known as “hodling,” has its limitations, surely! As a matter of fact with crypto market matures, a new strategy has emerged as a powerful alternative – staking crypto.

In this article, I will explore the rise of staking as a crypto investment strategy, also the benefits it offers.

Then, how you can leverage the power of stake crypto to maximize your returns. Let’s get do it!

Understanding Hodling and Its Limitations

Hodling, a term derived from a misspelling of “holding,”. Refers to the practice of buying cryptocurrencies and holding onto them for a long period, regardless of market fluctuations.

While hodling has proven to be profitable during bull markets. But it can be a risky strategy when the market experiences significant downturns.

Additionally, hodling does not generate any passive income, as the value of the coins solely relies on market appreciation. This limitation has led to the exploration of alternative investment strategies, such as staking.

The term HODL is well known among cryptocurrency investors.

The acronym itself defines holding cryptocurrencies for life, which paradoxically is not a foolish idea.

Cryptocurrencies as technology companies as an annuity investment is not that absurd. At least, as an author, I see the sense in it…

The Rise of Staking Crypto Investment Strategy

Staking has gained popularity as a crypto investment strategy due to its ability to generate passive income.

When you stake your coins, you essentially lock them up in a crypto wallet to support the operations of a proof-of-stake (PoS) blockchain network.

In return for your contribution, you receive rewards in the form of additional coins. This process is known as staking, and it allows you to earn a consistent income while still holding onto your assets.

What is Stake Crypto?

Stake crypto refers to the cryptocurrencies that are involved in the staking process.

These cryptocurrencies are designed to operate on proof-of-stake blockchains, where they can be staked to secure the network and validate transactions.

Some popular stake crypto coins include Ethereum (ETH), Cardano (ADA), and Tezos (XTZ).

By staking these coins, you actively participate in the blockchain’s consensus mechanism and earn rewards for your contribution.

Staking cryptocurrencies in a process that involves committing your crypto assets to support a blockchain network and confirm transactions. I don’t thing I should write something more about staking here.

The Benefits of Stake Crypto

Stake crypto offers several benefits that make it an attractive investment strategy.

Firstly, staking provides a consistent source of passive income, allowing you to earn rewards on a regular basis.

Unlike hodling, where you rely solely on market appreciation, staking allows you to generate income even during bear markets.

Secondly, staking helps to secure the blockchain network. By staking your coins, you actively participate in the consensus mechanism, making the network more decentralized and resistant to attacks.

This contributes to the overall stability and security of the blockchain ecosystem.

Lastly, staking provides an opportunity to earn higher returns compared to traditional investment options.

With many stake crypto coins offering annual yields ranging from 5% to 20%, staking can be a lucrative strategy for investors looking to grow their wealth over the long term.

The Shift Towards Ethereum Proof of Stake

One of the most significant developments in the world of staking is the shift towards Ethereum proof of stake (PoS).

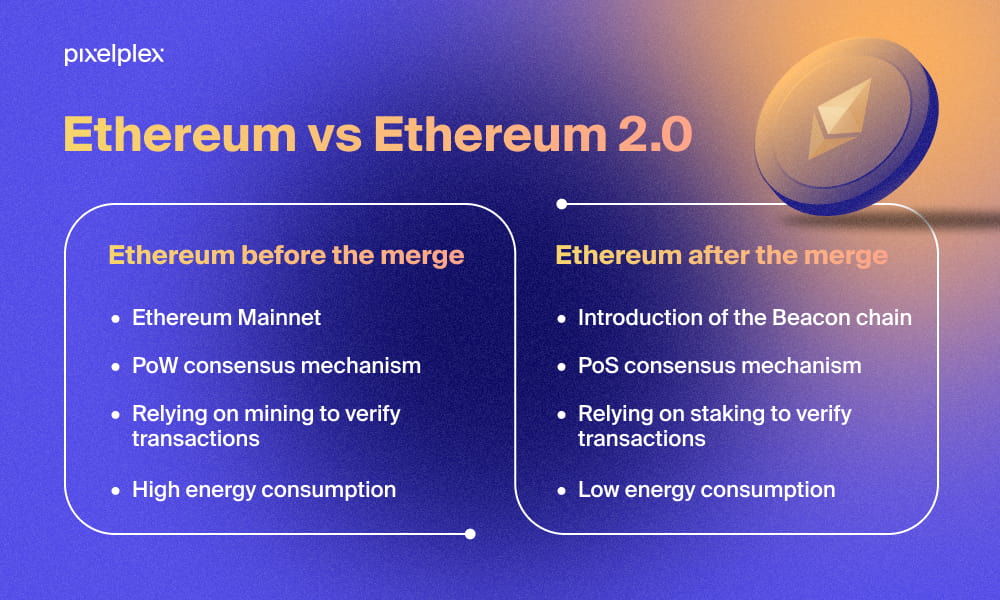

Ethereum, the second-largest cryptocurrency by market capitalization, is currently undergoing a transition from its existing proof-of-work (PoW) consensus mechanism to a PoS model known as Ethereum 2.0. This shift aims to address scalability and energy consumption issues, making Ethereum more efficient and sustainable.

Before Ethereum 2.0

Once Ethereum completes its transition to PoS, investors will have the opportunity to stake their ETH and earn rewards for securing the network.

This shift towards Ethereum PoS is expected to attract a significant amount of capital into staking, further solidifying it as a mainstream investment strategy.

After Ethereum 2.0

Ethereum 2.0 refers to a set of updates that aimed to resolve issues surrounding limited scalability, speed, and the limitations of the Proof of Work consensus mechanism of the Ethereum network. But it’s take time and it’ll be taken in phases.

I will definitely return to this topic in another article. Meanwhile, today I’m only touching the surface of the topic with cryptocurrency staking.

Changes related to the transition to Ethereum 2.0 are very important for the development of the cryptocurrency and its ecosystem.

The idea is to change the consensus mechanism, rely more on staking and reduce energy costs. These changes make Ethereum an even more attractive cryptocurrency with practical applications and a huge ecosystem.

How to Get Started with Staking Crypto

To get started with staking, you need to follow a few simple steps.

First, choose a stake crypto coin that aligns with your investment goals and risk tolerance. Conduct thorough research on the project, its team, and its future prospects. Once you have chosen a stake crypto coin, acquire the required amount and transfer it to a supported wallet.

Next, select a reliable staking platform that supports the coin you wish to stake.

Look for platforms that offer competitive staking rewards, have a proven track record, and prioritize the security of your funds. When choosing a platform, consider factors such as user experience, reputation, and fees.

After selecting a staking platform, connect your wallet to the platform and delegate your stake to a validator.

Validators are responsible for validating transactions and securing the network. By delegating your stake to a validator, you contribute to the network’s security and receive a share of the staking rewards.

Right Staking Crypto Platform

Choosing the right staking platform is crucial for a successful staking experience.

When selecting a platform, consider factors such as the platform’s reputation, security measures, user interface, and fees.

Look for platforms with a strong track record, positive user reviews, and a transparent fee structure.

Additionally, consider the platform’s user experience. A user-friendly interface will make it easier for you to monitor your staking rewards, track your earnings, and manage your stake.

Look for platforms that provide detailed statistics and real-time updates to help you make informed decisions.

Lastly, pay attention to the platform’s security measures. Look for platforms that prioritize the safety of user funds by implementing robust security protocols, such as cold storage wallets and multi-factor authentication.

A secure platform will give you peace of mind knowing that your stake crypto coins are well protected.

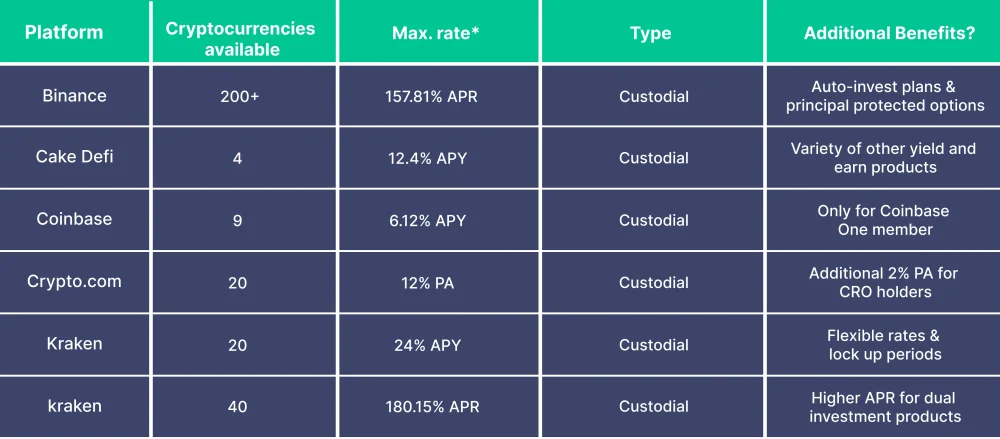

There are undoubtedly many cryptocurrency staking platforms out there.

This is supported by the fact that this is an increasingly popular form of investing among cryptocurrency investors.

As you can see, the best platform is Binance. Binance is also the leader among CEX platforms, which I have already written about.

A selection of 200+ cryptocurrencies and high staking results support the choice of Binance. However, you should not completely forget about other platforms.

Some of them, despite being less popular, can offer an equally good or slightly better offer on Binance.

Maximizing Your Returns Through Staking Crypto

To maximize your returns through stake crypto, there are a few strategies you can employ.

Firstly, consider diversifying your stake across multiple stake crypto coins.

By diversifying your stake, you reduce the risk of being heavily reliant on a single coin or blockchain. This strategy allows you to spread your risk and potentially earn rewards from multiple sources.

Secondly, stay updated with the latest developments in the staking ecosystem. New stake crypto projects are constantly emerging, each with its unique value proposition.

By staying informed, you can identify promising projects early on and stake your coins accordingly. Research the project’s team, roadmap, and partnerships to assess its potential for long-term success.

Lastly, consider compounding your staking rewards. Instead of withdrawing your rewards immediately, reinvest them back into staking.

By compounding your rewards, you can accelerate the growth of your stake over time. This strategy allows you to benefit from the power of compound interest and generate higher returns in the long run.

Risks of Staking Crypto

While stake crypto offers numerous benefits, it is essential to be aware of the risks and considerations associated with this investment strategy.

Firstly, staking involves locking up your coins for a certain period. During this period, you may not have immediate access to your funds. Therefore, consider your liquidity needs and invest an amount that you can afford to lock up.

Secondly, staking rewards are subject to market volatility. The value of stake crypto coins can fluctuate, potentially affecting the overall value of your staked assets.

Be prepared for market volatility and consider a long-term investment horizon to mitigate short-term price fluctuations.

Lastly, consider the security risks associated with staking. While reputable staking platforms take security measures to protect user funds, there is still a risk of hacking or technical vulnerabilities.

Ensure that you choose a platform with a strong security track record and employ additional security measures, such as using a hardware wallet to store your stake crypto coins.

Conclusion

In fact, the shift from hodling to staking represents a significant milestone in the world of crypto investment strategies.

With the ability to generate passive income, secure blockchain networks, and also earn higher returns, stake crypto has become an attractive option for investors.

By understanding the benefits of stake crypto, getting started with staking, and considering the risks involved, you can leverage the power of stake to grow your wealth and navigate the ever-changing crypto landscape.

Leave a Reply

You must be logged in to post a comment.