Introduction

Today I take a look at the 10 largest centralized cryptocurrency exchange review by volume in the last 24 hours (Valentine’s Day 2023). Then, taking the opportunity, I will look at their reserves.

Finally, It is also good to compare the state of reserves from a few months ago and the current state. There may be some conclusions.

Let’s start and get to work!

Overview of Cryptocurrency Exchanges

The list of the largest cryptocurrencies in terms of volume is as follows:

Binance

Exchange Binance is one of the largest and most popular cryptocurrency exchanges in the world, indeed. Surely, it was founded in 2017 and is based in Malta. Particularly, Binance supports a wide range of cryptocurrencies, including Bitcoin , Ethereum , and many others.

It is also known for its fast transaction processing times, low fees, and 24/7 customer support. Binance also offers its users a mobile app for trading on the go.

Coinbase

Second the biggest is Coinbase. It is one of the largest and most trusted cryptocurrency exchanges in the world, for sure.

In fact, it was founded in 2012 and is based in San Francisco, California. What’s more, Coinbase supports a limited number of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

Obviously, the platform is known for its user-friendly interface and is a great choice for beginners. It also offers insured storage for its users, which means that their funds are protected in the event of a hack.

Kraken

Next is, Kraken as a well-established cryptocurrency exchange that has been in operation since 2011. It is based in San Francisco and supports a wide range of cryptocurrencies, so including Bitcoin, Ethereum, and many others.

Especially, Kraken is known for its low fees and is a popular choice among advanced traders. It also offers 24/7 customer support and a mobile app for trading on the go.

KuCoin

Forth exchange, KuCoin is a Hong Kong-based cryptocurrency exchange that was founded in 2017, indeed. It has quickly become one of the leading players in the cryptocurrency space, as well. It’s also known for its fast transaction processing times, low fees, and user-friendly interface.

Surely, KuCoin supports a wide range of cryptocurrencies, including Bitcoin, Ethereum, and many others.

What’s more, the platform also offers a mobile app for trading on the go, making it convenient for users to access their portfolios and execute trades from anywhere.

In addition, KuCoin has a robust security infrastructure, with multiple layers of protection in place to keep user funds safe.

Bitfinex

Next is, Bitfinex as a cryptocurrency exchange that was founded in 2012, inded. It’s based in Hong Kong cryptocurrency exchange. It has grown to become one of the largest and most popular cryptocurrency exchanges in the world, surely. Exchange offering a wide range of trading options and features to its users, indeed.

Bitfinex supports a variety of cryptocurrencies, including Bitcoin, Ethereum, and many others. It’s known for its fast transaction processing times and low fees. The platform also offers margin trading, allowing users to trade with leverage and potentially earn higher profits.

In addition, Bitfinex has a robust security infrastructure, with multiple layers of protection in place to keep user funds safe.

Bitstamp

On the sixth place, Bitstamp is a European-based cryptocurrency exchange that has been in operation since 2011. Furthermore, it supports a limited number of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. What’s more, Bitstamp is known for its high level of security and is a popular choice among institutional investors. The platform also offers a mobile app for trading on the go.

OKX

In fact, OKEx is a popular cryptocurrency exchange that was founded in 2014. It is based in Malta and supports a wide range of cryptocurrencies. Including Bitcoin, Ethereum, and many others. Furthermore, OKEx is known for its fast transaction processing times and low fees. The platform also offers a mobile app for trading on the go.

Binance.US

8th place for Binance US, is a subsidiary of Binance. Obviously, one of the largest and most popular cryptocurrency exchanges in the world. Binance US was launched in 2019 and is based in San Francisco, California.

The platform is designed specifically for users in the United States and offers a wide range of trading options and features to its users.

Bybit

Before the last, Bybit is a cryptocurrency derivatives exchange that was founded in 2018 and is headquartered in Singapore.

The platform offers a wide range of trading options, including futures and perpetual contracts, indeed. Additionally, is known for its fast transaction processing times and low fees.

Gemini

Lastly, Gemini is a cryptocurrency exchange and custodian that was founded in 2014 by the Winklevoss twins, Cameron and Tyler Winklevoss.

The exchange is headquartered in New York City and is known for its strong security measures, but not only. It has user-friendly interface, and regulatory compliance, too.

Gemini is one of the few exchanges that has obtained a New York BitLicense. Surely, it allows them to operate as a fully regulated cryptocurrency exchange in the state of New York.

Surely, among all the cryptocurrency exchanges mentioned, Binance, KuCoin, Bitfinex, OKX and Bybit deserve special attention. So, I will explain this thesis in the next part of cryptocurrency exchange review.

Exchanges and Their Reserves

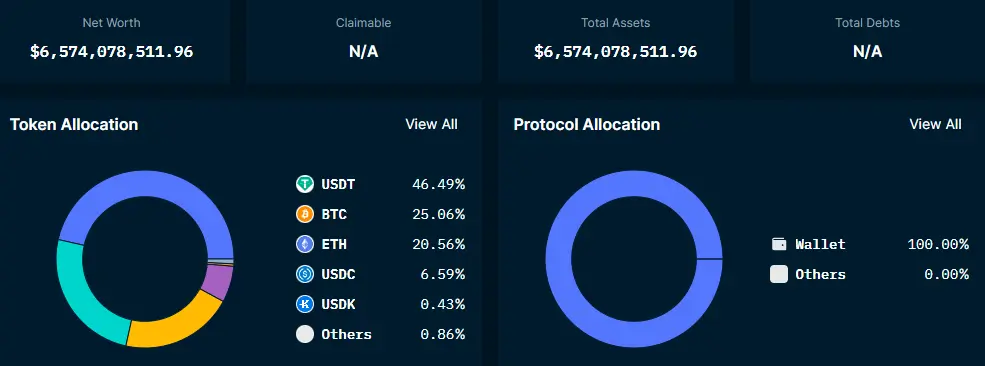

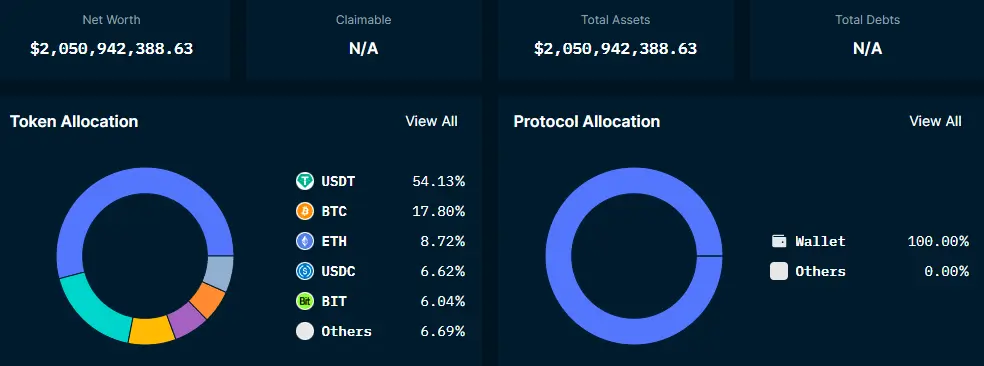

In this part of the article, I look at exchanges and their cryptocurrency reserves. Without a doubt, the safest assets on stock exchanges are Bitcoin, Ethereum and the stablecoins, Tether and Binance stablecoin.

Surely, Binance holds 27% of relatively less safe assets in its reserves.

In the case of cryptocurrency exchanges such as Coinbase, Kraken, Bitstamp or Gemini, it was not possible to obtain reserve data. Surely, the lack of transparency raises doubts about the credibility of these exchanges.

KuCoin’s reserves include 40% less safe assets, indeed.

Among Bitfinex reserves, there is a similar situation as in the case of KuCoin, indeed. So, What I mean by that, here is 40% less safe assets.

When it comes to OKX reserves, less than 2% of the reserves are safe assets. This reserve policy deserves special attention.

Finally, I looked at Bybit’s reserves and saw that there are less than 13% of safe assets on the stock exchange.

Author Conclusions

I would be rather invest or trade on transparent exchange. In my opinion, hidding data or being not transparent is always proof something wrong in the business.

All those exchanges with status of the biggest volume trading during 24 hours not fully deserve it.

In my opinion a lot of what play a role here was marketing, but not clear and transparent data.

Digits will show you everything if you really want to dig enough.

Of course, there could be argument against and tell that politics of company is different. It could protect company against speculations on security assets of company, but …

Why some of companies simply show what’s going on and another hidding own assets. Without a doubt, cryptocurrency exchange review it could be difficult write something objective about those exchanges.

Strange, but I don’t need to understand everything. Watch out guys where you trade!

Where are the Headquarters of Exchanges?

Many may wonder why show the headquarters in this cryptocurrency exchange review. So, there is one reason. In fact, places where cryptocurrency exchanges are located are the most friendly places for the cryptocurrency industry.

Many exchange founders choose this place over any other for this important reason.

Let’s see if this author conclusion is right.

So let’s take a look at these places.

Binance – after a few headquarter changes is difficult to write.

Coinbase – 1 year ago it was San Fransico, but right now 52 % of employees working remote. It gives Coinbase status of no headquarter.

Kraken – as like in Coinbase example it was San Fransico, California, but … there is a rumours about moving out from California. Everything because SEC decisions about forbig staking cryptocurrencies and fines payment.

Finally, they want to be no headquarter, but it will take some time. KuCoin – they are based in Victoria, Seychelles, indeed.

Then, Bitfinex – headquarter is registered in the British Virgin Islands. After that, Bitstamp – their location for main office is in Lodon, United Kingdom. Then, OKX – there is not exactly mention where year are in Seychelles. Binance.US – you can find their headquarted in Palo Alto, California, United States. Before the last, Bybit – It has headquarter in Singapore. Finally, Gemini – they are based in New York.

Many changes of headquarters of the biggest cryptocurrencies exchanges is only proof of difficulties related to regulations. Most of the time CEOs of exchanges chose the most friendly country for growing their exchange. In one case it is direction into remote job.

What is the Future of Cryptocurrency Exchanges?

It is difficult to predict the future of cryptocurrency exchanges, as the cryptocurrency industry is constantly evolving and new technologies and platforms are emerging all the time.

However, based on current trends and developments, there are a few potential directions that cryptocurrency exchanges may take in the future:

DEX

Decentralized exchanges (DEXs): Decentralized exchanges are platforms that allow users to trade cryptocurrencies without the need for a central authority. They use blockchain technology to create a peer-to-peer network, where users can trade directly with one another.

In the future, DEXs may become more popular as they offer greater security, privacy, and control over funds compared to centralized exchanges.

Automated Trading

Automated trading algorithms are becoming increasingly popular among traders, as they allow for faster and more efficient trades.

In the future, cryptocurrency exchanges may integrate more advanced trading algorithms, which can provide traders with real-time market insights and help them make more informed decisions.

Regulatory Compliance

As cryptocurrencies gain more mainstream adoption, there is likely to be increased regulatory scrutiny of the industry. This could lead to greater compliance requirements for cryptocurrency exchanges, which may impact their operations and business models.

Security Measures

Security remains a top concern for cryptocurrency exchanges, and it is likely that exchanges will continue to invest in more advanced security measures to protect users’ assets and information.

Expansion

Expansion into new markets: Cryptocurrency exchanges are likely to continue expanding into new markets, as more and more people around the world adopt cryptocurrencies as a form of investment and payment.

These are just a few of the potential directions that cryptocurrency exchanges may take in the future. Cryptocurrency exchange review could be your map for the future.

As the industry continues to evolve and mature, it will be interesting to see how these trends play out and what new innovations emerge.

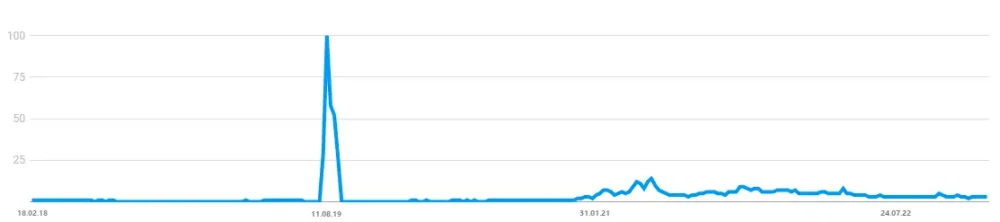

Let’s take a look for Google Trends for 10 most popular exchanges.

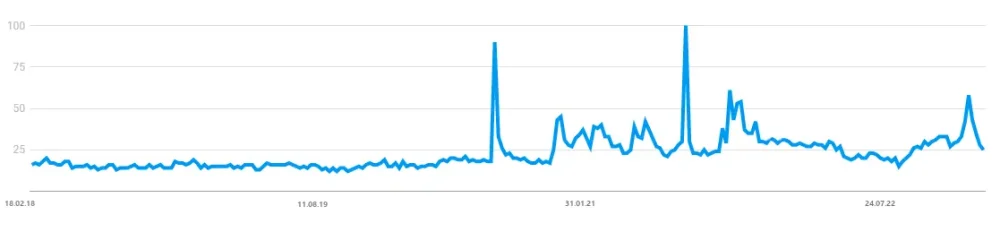

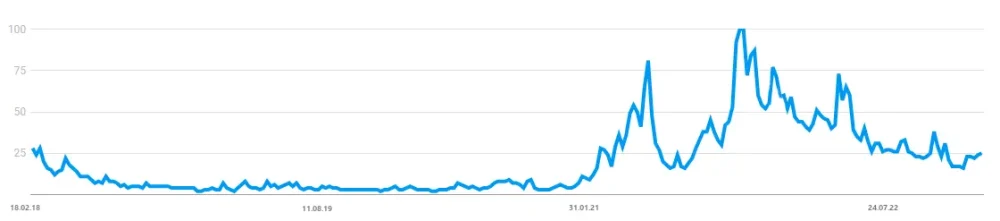

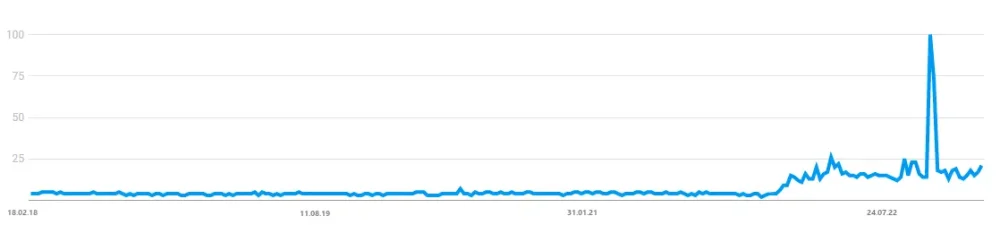

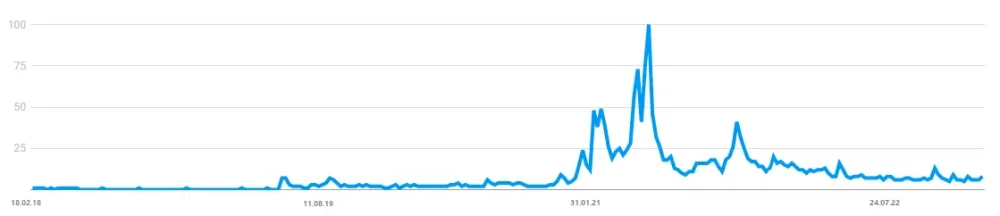

Binance, Coinbase, Kraken, KuCoin, Bitfinex

In the case of Binance, the period of August 2019 deserves special attention, when a lot of users searched for Binance on Google.

Later, the interest was not so significant.

Great interest in Coinbase can be seen from the beginning of 2021. Then, a period of a very strong boom in the cryptocurrency market began.

Google searches for Kraken were particularly intense in the second half of 2020. Regardless of peaks of interest, searches for the term are constantly increasing.

Searches for KuCoin were particularly intense during the strong recent bull market in 2021.

The search term Bitfinex is distinguished from other cryptocurrency exchange names. Interest in stock exchanges has been going on for a period longer than 2018 and remains at a relatively high level.

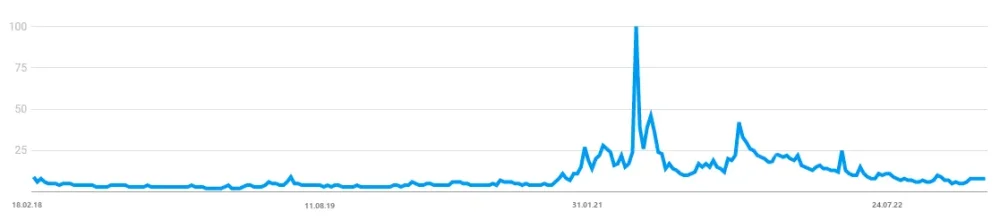

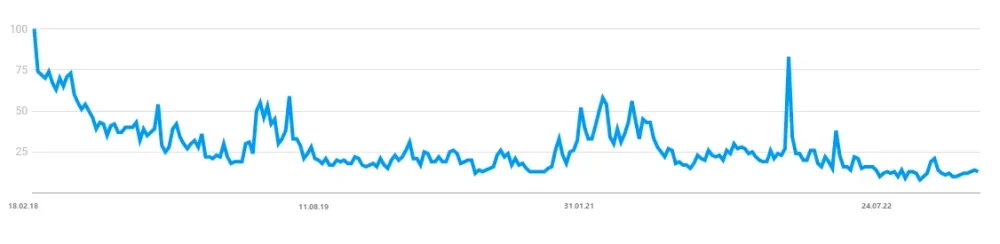

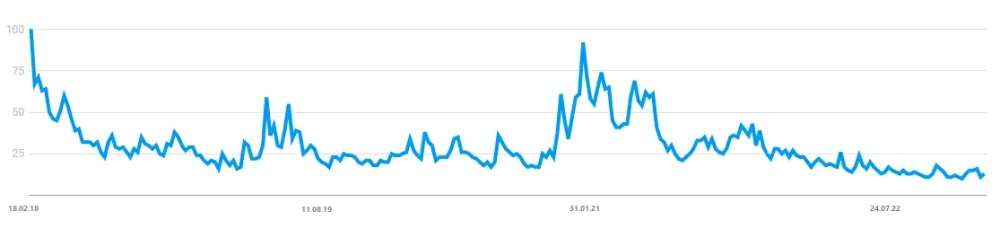

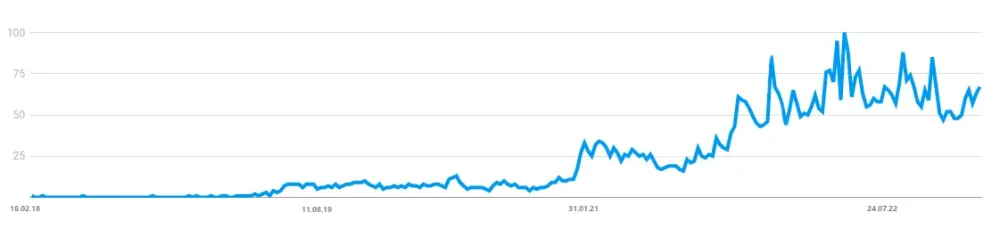

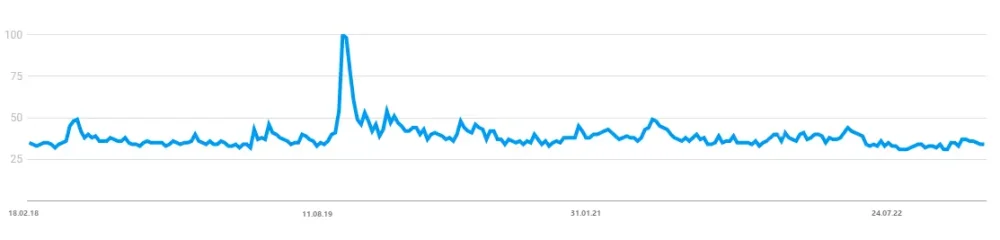

Bitstamp, OKX, Binance Us, Bybit, Gemini

A similar situation when searching for the Bitstamp word as in the case of the Bitfinex exchange.

Another searched word in Google is OKX. OKX has been attracting interest since mid-2021.

Interestingly, more people were interested in the term Binance US than in searching for the word Binance itself. This can be concluded from comparing the graphics of both words.

The search for Bybit continues to grow. Interestingly, even during the bear market, the word is still very intensively searched for.

The last word I looked at was Gemini. Constant interest at a relatively average level, with particular interest during the peak of the bull market.

Which Exchange is Right for Me?

It always depend from your trading or investing style. Before you choose right exchange set your trading goals, do the lesson about security of exchanes and basic stuff about trading itself.

10 the biggest exchanges from list it could be for you good hint where you should start explore.

One more thing…

Author didn’t give very detail describtion for one reason. You need to do your lesson, because only then you can select the best option for yourself.

Anyway, Binance is author decision. What will be yours find by yourself or do your own cryptocurrency exchange review. Besides in 2023 there were a lot bad opinions from customers about Okx exchange. Please take this in consideration during secting cryptocurrency you need.

Risks Related to Exchanges

Cryptocurrency exchanges are still a relatively new and evolving industry, and as such, they are associated with several risks that investors should be aware of:

Security Risks

Cryptocurrency exchanges hold large amounts of assets, making them attractive targets for hackers. In the past, there have been several high-profile hacks of exchanges, resulting in the loss of millions of dollars’ worth of cryptocurrencies.

Investors should only use exchanges that have a strong security track record and implement measures such as two-factor authentication, multi-sig technology, and insurance.

Market Risks

Cryptocurrency prices are highly volatile, and the value of a particular asset can fluctuate rapidly and unpredictably.

This can result in large losses for investors, especially if they are not well-informed about the risks involved.

Regulatory Risks

Cryptocurrencies and exchanges are not yet fully regulated, and the regulatory environment is constantly evolving.

This can result in sudden changes in the legal and regulatory framework, which could impact the operations of exchanges and the value of cryptocurrencies.

Liquidity Risks

Cryptocurrency exchanges may not always have enough buyers and sellers to match all the orders placed on their platforms. This can result in delays in executing trades or difficulty in selling or buying a particular asset.

Operational Risks

Cryptocurrency exchanges are complex and technical platforms, and even minor technical issues can result in significant downtime and impact on users’ ability to access their funds.

It is important for investors to carefully consider these risks and to only invest in cryptocurrencies and use exchanges that they fully understand and are comfortable with. Cryptocurrency exchange review should be your guider.

Additionally, it is recommended to diversify investments, not to keep all assets on exchanges and to educate oneself on the cryptocurrency market and its risks.

Risk Related to CEX Exchanges

Of course, keeping money on the stock exchange carries many dangers. One of them is bankruptcy or defraudation of money.

Some Basic Rules

It’s rather difficult give you all the best advice if you don’t know to much about trading or investing.

Even this in consideration there are a few hints:

a) don’t hold money or cryptos on exchanges,

b) do cryptocurrency exchange review before trading or investing,

c) trade only money which you can freeze for at least 5 years,

d) never choose only one asset basket,

e) learn about risk management,

f) trading with leverage is only for more experienced traders,

g) use traing rule with maximal 2 – 5 % risk for one trade,

h) stop-loss is powerful tool,

i) learn about mechanisms on exchanges. They are there, not everything is random,

j) If you want learn more risky trading use for it small amounts of money,

k) The best teacher for trading is own experience and real money on the market.

Summary

Finally, it’s time to write something about cryptocurrency exchange review. The biggest cryptocurrency exchanges always looking for the best places for growing their businesses and there establish offices. Regulations problem have influence on market, exchanges, assets and so on.

Exchanges of crypto with lack of transparency are more risky to trade on them. You can give any argument you want, but as consequence of it, clients are less secure than in case of transparent exchanges. It’s should be basic rule for all institutions or companies in crypto.

Examples of scam like FTX (which was the biggest one) is only proof of this conception.

As a consequence, some of exchanges became transparent, and… some of them not.

In opinion of author not transparent exchanges are more risky to put your investment or trade on them.

Another point is, popularity in google search and future of those exchanges. I would recommend to take a closer look to those graphs and compare them with exchanges reserves.

It should be good starting point for choosing the best exchange for you.

Leave a Reply

You must be logged in to post a comment.