Introduction

The cryptocurrency asset reserves exchanges have gained importance. Constantly in the cryptocurrency market, the scam related to the FTX exchange has not been forgotten.

Contrary to appearances, this bankruptcy had not only bad consequences for the investor market.

Of course, many people lost their fortune in life, and there was a sentiment of depression in the market.

Let’s look at this from the positive side of this bankruptcy.

First, there was a market clearing of toxic assets, there was a market bottom, and …

What is most significant in this article is the so-called PoR (“Proof of Reserves”). What means cryptocurrency reserves of exchanges that support cryptocurrency trading.

That’s what most of them are about today.

Term Proof of Reserves

In cryptocurrency, reserves usually refer to assets held by a company. That can be used for a variety of purposes, including fully covering customer deposits.

Proof of Reserves (PoR) is a term that describes an independent audit. It is checked whether the audited party has sufficient reserves. Those reserves secure all its clients’ balances on the exchange.

In the case of PoR of digital assets (cryptocurrencies), this means that the auditor verifies the assets in the chain. Those assets held by the company are at least 100% compatible with the assets of the clients. Only then we can talk about right asset balance at the time of the audit.

Thanks to this, clients of the exchange know that the company is liquid enough. For withdrawals funds are available to customers.

Funds should not be kept on the exchange, but outside it. The best way to do this is with a ‘cold wallet’ or a ledger.

Money on Exchange

The exchange itself should only be used to make transactions – buy or sell. After the transaction, you must send the funds to an external source.

The example of FTX perfectly illustrates what can happen to your funds.

Abuse of exchanges occurs practically on a daily basis. As a consequence, It is wise not to have money in the exchange.

Real Cryptocurrency Asset Reserves for Exchanges

PoR is proof of trust in the exchange for its clients. The customer can cryptographically verify whether his account balance is included in the PoR.

Provide transparency to clients regarding the availability and support of funds.

Customer balance reserves on reputable cryptocurrency exchanges are backed 1 to 1. This means 100% or more. Which is a new standard of security and transparency in the world of finance. The world of cryptocurrencies is the precursor of this type of reserve.

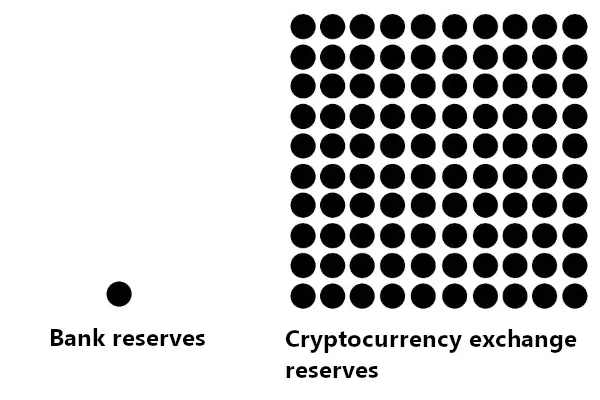

In the traditional world of banking, central bank reserves must be at least 1%.

The central bank is unable to disburse funds to all its customers. A lot of cash it functions only digitally and is not backed up by reserves.

How ironic it is to define cryptocurrency exchanges as dangerous. Cryptocurrencies, on the other hand, are attributed to the dubious quality and impractical assets. Another irony.

However, I’ve gone a bit off-topic…

Why Are Cryptocurrency Asset Reserves so Important?

Reserves of cash or other assets are actually collateral for customer deposits.

The client has full access to verification of funds on the exchange of which he is a client.

Larger reserves are also evidence of the trust of a large number of customers in the institution that holds reserves.

The larger the reserves, the greater the credibility of the company or cryptocurrency exchange. The high liquidity of capital on the exchange also allows for more efficient trading. What more, constant access to the withdrawal of digital assets.

Cryptocurrency reserves are crucial for choosing the exchange on which we want to make transactions.

The entire process of depositing, trading, and withdrawing must be continuous, reliable, and accessible. It could happen by anyone with internet access.

This contributes to the advantage of cryptocurrencies over traditional means of payment.

In traditional banking, banks must have approximately 10% of reserves for money issued by the bank, of course. You can easily see that in the case of cryptocurrencies these are 100% reserves, indeed.

Cryptocurrency Asset Reserves

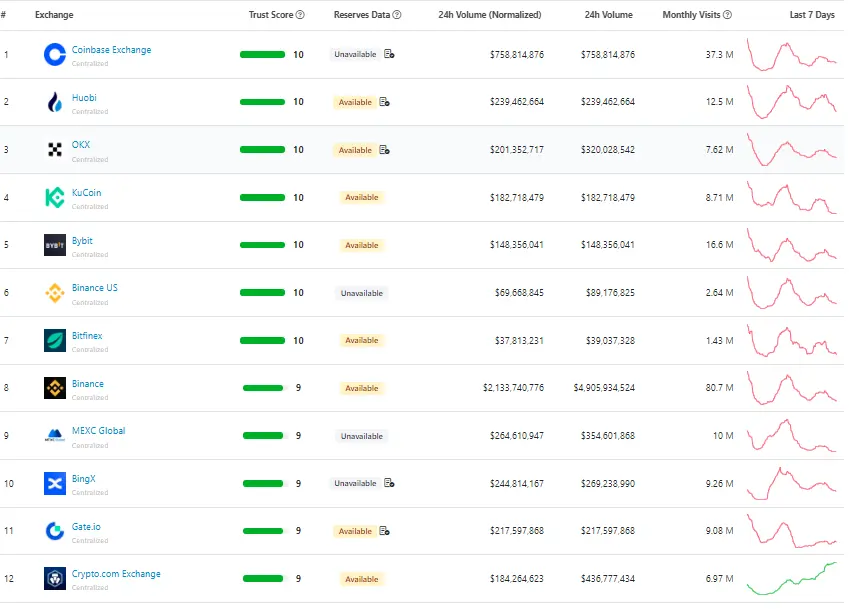

At the beginning, maybe a few words about the largest cryptocurrency exchanges. To select these exchanges, I used the Coingecko.com website.

At this point, due to the greater popularity, I present the reserves of centrally managed exchanges only. About decentralized exchanges another time.

We start…

By the way, I would like to add that the data was taken from the portfolio.nansen.ai website.

The portfolio, of course, changes over time as stocks of the exchange are constantly traded. At the time of writing the article, they were as follows.

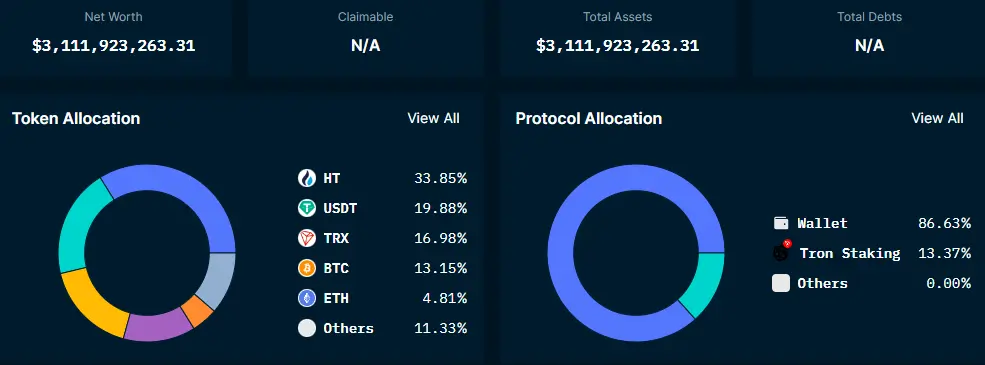

Huobi

BTC and ETH account for only 18.28% of the total reserves, and the token is 33.85% of the reserves.

Data taken from portfolio.nansen.ai during writing article, but now not available anymore.

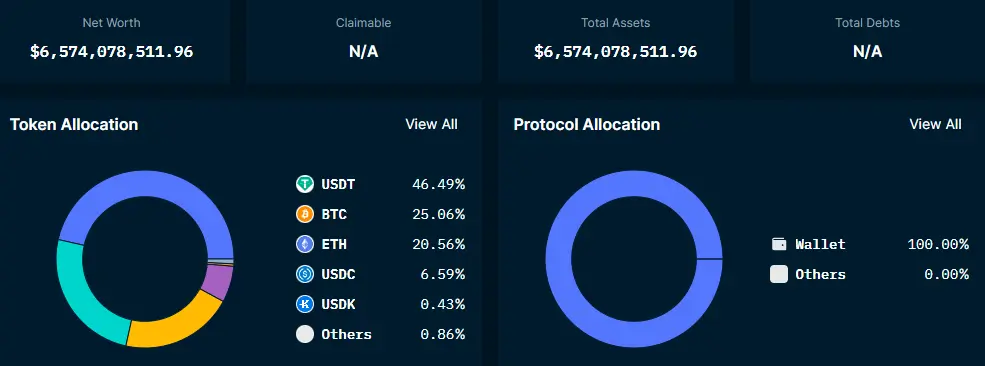

OKX

BTC and ETH account for 45.62% of the total reserves, and the token is not in reserves.

Explore: OKX reserve portfolio

KuCoin

BTC and ETH account for only 18.68% of the total reserves, and the token is 17.55%.

Explore: KuCoin reserve portfolio

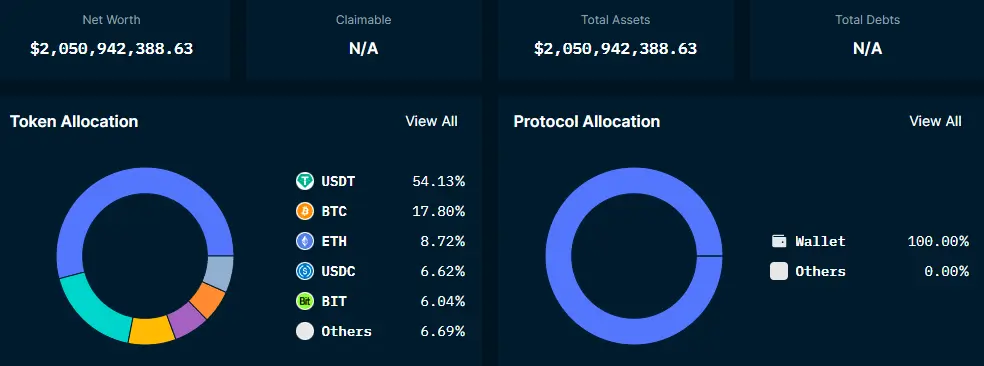

Bybit

BTC and ETH account for only 26.52% of the total reserves, the token is 6.04%.

Explore: Bybit reserve portfolio

Bitfinex

BTC and ETH account for 59.89% of the total reserves, and the token LEO is 35.60%.

Explore: Bitfinex reserve portfolio

Binance

BTC and ETH are 24.11% of the total reserves, and the token is 10.12%.

Explore: Binance reserve portfolio

Gate.io

BTC and ETH account for 29.44% of the total reserves, and the company token is 20.85%.

Explore: Gate.io reserve portfolio

Crypto.com

BTC and ETH account for 44.5% of the total reserves, and the company’s token is 4.12%.

Explore: Crypto.com reserve portfolio

About Bitcoin Reserves

Bitcoin is the gold of cryptocurrencies, and I think it’s right to think of bitcoin as the reserve of cryptocurrency exchanges.

Bitcoin is the safest asset available in the cryptocurrency market. Hence the conclusion:

Bitcoin reserves alone cannot ensure that there will be no scam.

The model of the company’s operation, issuing its tokens and the founders must be transparent. Then the likelihood of fraud decreases.

I’m about to explain how bitcoin reserves on the world’s largest stock exchanges have changed over the last 3 years.

The data was taken from the website: Cryptoquant

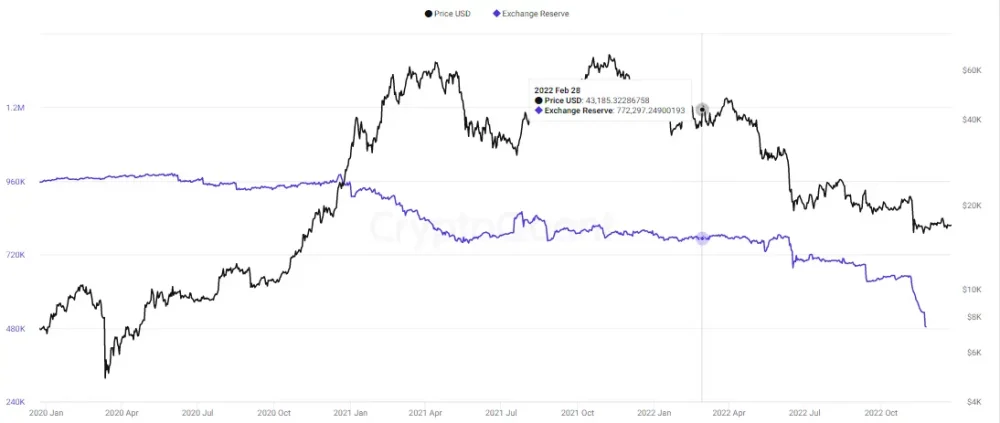

Coinbase

Bitcoin’s reserve level has dropped to 480K. The highest level is 965K bitcoin.

At its peak, bitcoin prices for the reserve were around 787K bitcoin.

Link: Bitcoin reserve Coinbase

Huobi

Bitcoin reserves dropped to 46.2K. The highest level is 407K bitcoin.

At its peak, bitcoin reserve prices were around 61.1K bitcoin.

Link: Bitcoin reserve Huobi

OKX

Bitcoin’s reserve level dropped to 71.7K. The highest level is 147.5K bitcoin.

At its peak, bitcoin reserve prices were around 84K bitcoin.

Link: Bitcoin reserve OKX

KuCoin

Bitcoin’s reserve level dropped to 16.6K. The highest level is 22.4K bitcoin.

At its peak, bitcoin reserve prices were around 13.9K bitcoin.

Link: Bitcoin reserve KuCoin

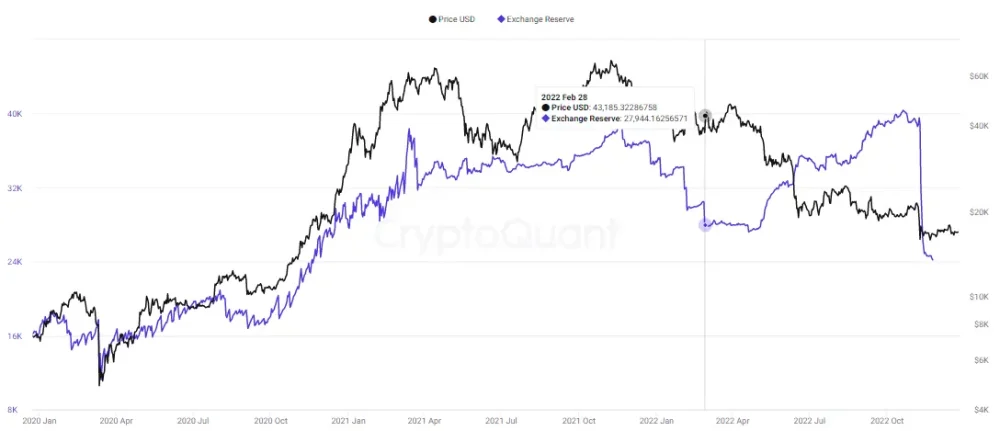

Bybit

Bitcoin reserves dropped to 24.3 K. The highest level is 40.1 K bitcoin.

At its peak, bitcoin reserve prices were around 37.9K bitcoin.

Link: Bitcoin reserve Bybit

Bitfinex

The reserve level of bitcoin is 345.6 K. The highest level is around 355 K of bitcoin.

Falling bitcoin prices have fueled additional bitcoin purchases and increased its reserves.

Link: Bitcoin reserve Bitfinex

Binance

Bitcoin’s reserve level is around 595K, which is the highest level of bitcoin’s reserves.

Binance has a constant policy of buying bitcoin, regardless of price changes.

Link: Bitcoin reserve Binance

Gate.io

Bitcoin’s reserve level dropped to 11.5K. The highest level is 9.6K bitcoin.

At its peak, reserve bitcoin prices were around 7.5K bitcoin.

Link: Bitcoin reserve Gate.io

Reserves and Stock Market Stability

Reserves are not a 100% guarantee of stock market stability. In any case, funds may be stolen by its founders or by third parties. The best example of such action is the case of FTX fraud or hacking attacks on many blockchains.

The exchange’s reserves can be cryptographically verified at any time. We know that deposited amounts are in the correct amount and place.

The stock exchange should play a trading role. This means that a transaction is made on it. The effect of the transaction is transferred to the external wallet (of course, if the transaction has ended with a profit).

FTX Example

FTX example is a scam in the world of cryptocurrencies but centralized finance. In addition, the wrong model and the cooperation of two companies – FTX and Alameda Research, raised a lot of doubts.

Customer deposits have also been used to trade with high risk without their consent.

There have been multiple breaches with FTX: lack of corporate control, use of client funds for risk trading purposes, and many more.

The FTX exchange, which was centralized, had many problems with risk management and insufficient reserves. One of the reasons for filing for bankruptcy was insufficient reserve funds in the event of a mass withdrawal of customers.

In this case, the FTX exchange maintained reserves at the level of traditional financial institutions such as banks. When customers older than a few media information started withdrawing funds, it was too late …

Bankruptcy was inevitable. Owner Sam, it turns out, has withdrawn a large chunk of customer funds. Where? This is not known.

He allegedly lost all these funds, but the investigation did not confirm this.

Access to blockchain servers will show what the facts were.

I expect, however, that a traditional scam has taken place here.

Cryptocurrency Asset Reserves and Tokens

Cryptocurrency tokens were introduced to facilitate transactions on exchanges.

Let’s look again at what part of the largest exchanges are their tokens (in percent):

a) Coinbase – no data

b) Huobi – HT (33.85 %)

c) OKX – zero reserves in OKcoin

d) KuCoin – KCS (17.55 %)

e) ByBit – BIT (6.84 %)

f) Bitfinex – LEO (35.60 %)

g) Binance – BNB (10.12 %)

h) Gate.io – GT (20.85 %)

i) Crypto.com – CRO (4.12 %)

Having too many tokens functioning as exchange reserves is risky.

The stock exchange may cease its activity overnight. Such tokens can lose value almost overnight.

These tokens are issued by central institutions, i.e. centrally managed cryptocurrency exchanges.

Various reasons may end the operation of the entire exchange, and such tokens will lose their value.

Conclusion

Cryptocurrency asset reserves exchanges are the new standard of transparency and security of customer deposits. In exchanges that have 100% of their clients’ reserves, withdrawals are possible at any time.

In the traditional world of banking, cash reserves are no less than 1% and often no more than 10%. Only in the case of riskier assets do reserves represent a higher percentage.

Too much share of cryptocurrency exchange tokens in the total reserves is not safe for its customers. I would avoid exchanges where tokens have too much share, i.e. more than 30 – 40%.

Bitcoin reserves on exchanges reflect the sentiment in the cryptocurrency market. A good practice is to constantly buy bitcoin to your own reserves, despite the constantly falling price until recently. The low price of bitcoin is a buying opportunity for both institutional and private investors.

Bitcoin is gold for cryptocurrencies. As is the case with banks in a traditional monetary system, increasing gold stocks has a positive effect on credibility.

Taking this into account, cryptocurrency exchanges – OKX, KuCoin, Bybit, Bitfinex, and Binance have the best bitcoin reserve policy.

Due to the large share of proprietary tokens, Bitfinex and Huobi exchanges are less reliable but trustworthy.

The Coinbase exchange has been reducing its bitcoin holdings by more than half in the last 3 years.

As for Crypto.com resources, I am not able to accurately determine how bitcoin reserves changed due to the lack of data.

Leave a Reply

You must be logged in to post a comment.