Introduction

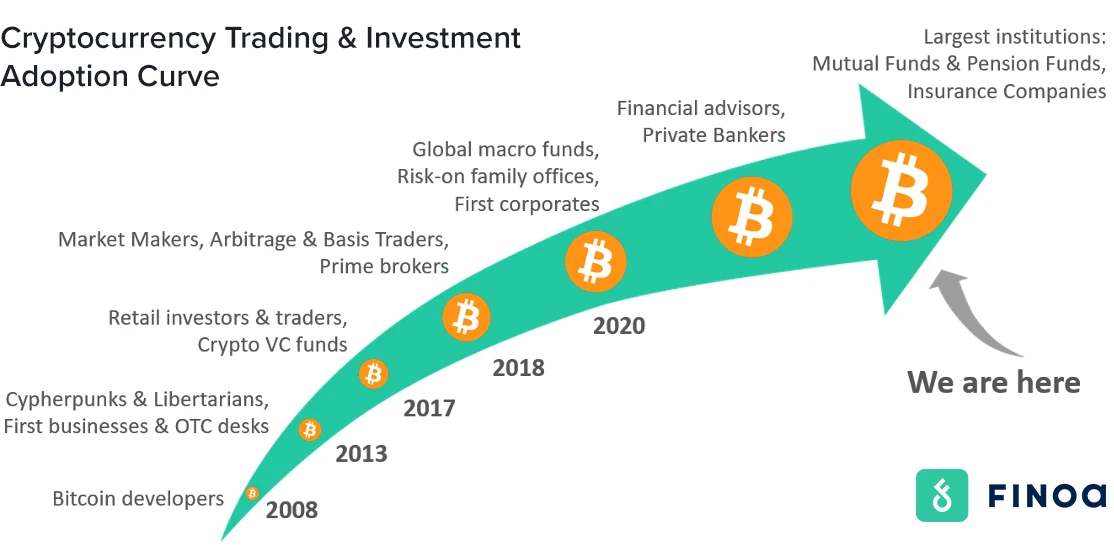

As a matter of fact, we’re seeing move from the fringes to the crypto mainstream. This shift is changing how we think about money and invest.

Blockchain technology, which powers cryptocurrencies, is now being used in ways that go beyond just digital cash. It’s exciting to see how this tech is shaking things up in finance and beyond.

I’ll look at some key areas where crypto is growing. I’ll check out the new crypto ETFs that are making it easier for everyday investors to get involved. I also explore how businesses are using crypto for more than just trading. Plus, I see how big companies and banks are jumping on board, driving growth in the crypto space.

Lastly, I’ll talk about the rules and laws around crypto, and what the future might hold for this game-changing technology.

Please read it and comment it!

The Rise of Cryptocurrency ETFs

What are Crypto ETFs?

Cryptocurrency Exchange-Traded Funds (ETFs) are investment products that track the price of digital currencies. These funds allow investors to gain exposure to crypto without directly owning or managing the assets.

Just like traditional ETFs, crypto ETFs trade on regular stock exchanges, making them accessible through standard brokerage accounts.

The most significant development in this space has been the approval of spot Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) in January 2024. These ETFs directly hold Bitcoin, providing investors with a regulated way to invest in the cryptocurrency through their brokerage accounts.

This move has brought crypto mainstream, offering a bridge between traditional finance and the digital asset world.

Impact on Mainstream Adoption

The introduction of crypto ETFs has had a substantial impact on mainstream adoption.

By providing a familiar investment vehicle, these ETFs have made it easier for both retail and institutional investors to enter the crypto market. This has led to increased trading volumes and liquidity, further solidifying cryptocurrency’s place in the financial landscape.

Moreover, the regulatory oversight that comes with ETFs has enhanced investor confidence. The SEC’s approval of these products signals a growing recognition of digital assets as a legitimate investment class. This regulatory clarity has paved the way for broader acceptance of blockchain technology and its applications in finance.

Key Players in the ETF Space

Several major financial institutions have entered the crypto ETF space.

Companies like Fidelity, BlackRock, and Invesco have launched their own Bitcoin ETFs, bringing their expertise and reputation to the crypto market. These established players are competing alongside crypto-native firms, creating a diverse and competitive landscape for investors.

But, it’s not the end. Financial institution adoption will progress as a matter of time. You can be sure about it.

Use Cases Beyond Speculation

Everyday Purchases

We’re seeing crypto go mainstream as more businesses accept it for everyday purchases.

Big names like Microsoft, Home Depot, and Tesla now let customers use digital currencies in their online stores. This shift is opening up new markets of tech-savvy consumers who prefer using crypto.

For shoppers, it means faster transactions, lower fees, and more privacy. Some retailers are even offering crypto debit cards that work just like regular cards but let you spend your digital assets.

Cross-Border Payments

Crypto is making waves in international money transfers too.

Traditional cross-border payments can be slow and expensive, but blockchain technology is changing that. With crypto, we can move money across borders instantly and at a fraction of the cost. This is especially helpful for people in countries with limited access to banking services.

Stablecoins, which are cryptocurrencies pegged to stable assets like the US dollar, are playing a big role here. They’re being used more and more for global trade and remittances.

Decentralized Finance (DeFi)

DeFi is another area where crypto is going mainstream. These blockchain-based financial services are open to anyone with an internet connection. They offer things like lending, borrowing, and earning interest without needing a bank.

DeFi platforms like Aave and Compound let users lend their crypto and earn returns, or borrow against their holdings. This is creating new opportunities for people to grow their wealth and access financial services, especially in places where traditional banking is limited.

Institutional Adoption Driving Growth

We’re seeing a big shift in how big players in finance view crypto. More and more institutions are getting involved, and this is helping to push crypto into the mainstream. Let’s look at how this is happening.

Corporate Treasury Holdings

Companies are starting to add crypto to their balance sheets. This is a big deal because it shows that businesses see value in holding digital assets.

For example, MicroStrategy has made huge investments in Bitcoin, leading the way for other companies. Even Tesla briefly held Bitcoin, though they’ve since sold it. This trend is making crypto seem more legitimate to other businesses and investors.

Investment Firm Offerings

Investment firms are creating new ways for people to get into crypto. They’re launching things like crypto ETFs, which let people invest in digital assets through more traditional means. Big names like Fidelity and BlackRock have jumped in, offering Bitcoin ETFs.

This makes it easier for everyday investors to add crypto to their portfolios without having to deal with the complexities of buying and storing digital assets themselves.

Banking Sector Integration

Banks are starting to embrace crypto too. They’re offering services like crypto custody, where they keep digital assets safe for their customers.

Some banks are even allowing customers to buy and sell crypto through their platforms. This integration is making it more normal for people to think of crypto as just another part of their financial lives.

This institutional adoption has an influence on how people see crypto. It’s helping to bring digital assets into the mainstream and making them seem less risky to average investors.

Future Outlook

Current Regulatory Approaches

We’re seeing a shift in how governments handle crypto.

Many countries are moving from a hands-off approach to creating rules for this new sector. The challenge is to make rules that limit risks without stopping innovation. In the U.S., we’ve seen some progress. The SEC approved the first Bitcoin ETFs in January 2024, bringing crypto into the traditional market. But there’s still a lot of uncertainty. SEC Chairman Gary Gensler has called crypto the “Wild West” and wants more oversight.

Potential Policy Changes

Looking ahead, we might see more rules for stablecoins. The Fed and Treasury have called for stronger regulations in this area. There’s also talk about central bank digital currencies (CBDCs). Many countries are exploring this idea, with some already launching their own digital cash. CBDCs could offer the benefits of crypto without the risks, but they also raise concerns about privacy and centralized power.

Long-Term Adoption Projections

The future of crypto regulation is still unclear, but it’s moving towards mainstream acceptance. We’re likely to see more countries develop comprehensive frameworks for digital assets. This could lead to greater institutional involvement and wider adoption of blockchain technology.

However, the path forward isn’t straight. We’ll need to balance innovation with consumer protection and financial stability. As crypto goes mainstream, the regulatory landscape will continue to evolve, shaping the future of this dynamic sector.

Conclusion

The rise of cryptocurrency from a niche investment to a mainstream financial asset has been nothing short of remarkable. We’ve seen the launch of crypto ETFs, making it easier for everyday investors to get involved.

At the same time, businesses are finding new ways to use digital currencies, from everyday purchases to cross-border payments. This growth has caught the eye of big institutions, driving further adoption and lending credibility to the crypto space.

Looking ahead, the crypto world is set to keep evolving. As governments work on creating clearer rules, we’re likely to see even more big players jump in. This could lead to new and exciting uses for blockchain technology beyond just digital money.

We can be sure about one thing: “Bitcoin won’t stop, because community and infrastructure all around the world is simply amazing. Bitcoin lead another crypto mainstream adoption. You may like it or not, but it’s a matter of fact.”

Leave a Reply

You must be logged in to post a comment.