Are We at the Bottom of Cryptocurrency Market?

The market of digital assets is going through hard times. The never-ending drama continues.

First, it was time for the algorithmic stablecoin Terra LUNA, then Celsius – a digital asset lending company, and finally FTX – a company that at the time of bankruptcy was the leading crypto exchange on the market in terms of volume. Are we at the bottom of cryptocurrency market?

All these events in the market of cryptocurrencies indicate only one thing. The market is bad (is it the bottom of the market), but can it get any worse?

What Did All These Bankruptcies Have in Common?

Unfortunately, all these bankruptcies are connected by one person Sam Bankman! You can see poor management of reserves, find fault with LUNA’s algorithmic peg (just bypass the program, i.e. find its weaknesses), or too risky ways to multiply capital.

Let’s move on to the merits, i.e. the character that led to the fall of all these companies. So, the FTX company alone had over 300 sub-companies, which proves that it was a colossus with feet of clay. Many respected businessmen were involved in the investment in FTX, including Mr. Wonderful himself – Kevin O’Leary.

Large companies and banks invested in FTX –

Softbank, Sequoia Capital, Ontario Teachers Pension Plan, Temasek, and Circle, made the investment even more credible.

If Banks Invest, What Can Go Wrong ?

Bankman himself used risky leverage with his client’s funds.

In this way, he tried to multiply the invested capital. Unfortunately, things didn’t go his way. He has lost millions of dollars due to the wrong operations.

Having no choice, he had to play against the market by forcing Luna to capitalize. Playing for declines brought results, but did not allow him to fully get out of debt from previous transactions.

This is how Luna went bankrupt, but to quickly recover the rest of the debt, he decided to short market, i.e. play for declines against Celsius. Having a huge capital of customers who deposited their money in the FTT coin (the FTX coin) had a large amount of money.

Without a doubt, he used the money to drive down Celsius’s stock price, and the market itself went into a panic.

It was enough to cause an avalanche, raise media anxiety among investors and wait.

How Do We Know It ?

I must admit that this type of behavior on the market is nothing new.

However, the scale of this scam is huge.

Sam Bankman’s connections with people from the world of finance give food for thought.

Several questions arise:

a) Did Sam plan all these scams ?

b) Who helped or advised Sam ?

c) Is Sam a victim of the more influential financial people around him ?

d) Are the regulations on the cryptocurrency market not to be a consequence of the wave of bankruptcies many companies ralated to cryptocurrency ?

e) Was it a classic scam ?

f) Are we at a bottom of cryptocurrency market ?

Could It Get Any Worse – Potential 2 Scenarios?

The bankruptcy of FTX led to a situation of an avalanche of bankruptcies of companies that were closely related to it. This, in turn, leads to the cleansing of the market of toxic and poorly managed companies.

The consequence of this is the fall in the value of Bitcoin itself and the complete capitulation of investors who looking at the situation, ran away from risky assets.

In this case, it is Bitcoin.

Massive sales bring Bitcoin prices to the bottom.

What should be added is that the ATH peak was about a year ago (what mean we are at the bottom of cryptocurrency market). The bear market itself lasts roughly 48 to 72 weeks. The conclusions are as follows:

Only two worse scenarios could come true:

1) The Fall of Tether

2) The Collapse of Coinbase or Worse, Binance

The second scenario is unrealistic, so to speak, impossible. However, in the market of crypto, you have to take into account the worst-case scenarios to protect your capital.

Particularly, the collapse of Coinbase had tragic consequences for the digital market assets. Then, the trust level would drop to zero.

Moreover, Binance itself, if it went bankrupt, it could be said that it is a “new era” of cryptocurrencies. The market itself would go back a few years I suppose.

The first scenario is feasible.

All this is thanks to a speculative attack on Tether, which, despite the first place in terms of market capitulation, has an uncertain reputation.

By the way, its direct rival USD Coin wants to have the crown. The fight is always for the first place, and the rules of the game in this case are dirty and ruthless.

It’s the Bottom Cryptocurrency Market or We’re Close

Assessing the situation on the market, it can be said that we are very close to the bottom or at the bottom.

This means that new capital will slowly start flowing into the market. It’s impossible to know exactly when this will happen, as many investors lost a lot of money during the bear market.

The level of trust is constantly low. The scale of fear still dominates, although the Fear and Greed metrics do not fully show it (these metrics are only a guide, but do not fully reciprocate the market sentiment).

In my opinion, 22/100 is too optimistic.

I would rather give a rating close to 10. Fear is ubiquitous.

We still do not know what the consequences of further bankruptcies due to FTX will be.

Private investors are constantly waiting for the bottom of the market. But is it worth waiting until the last moment? Not.

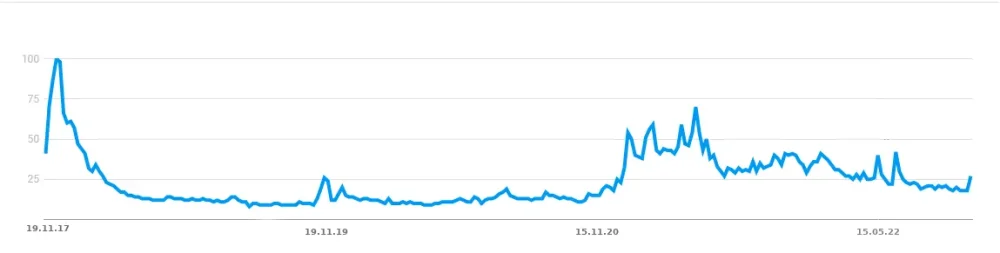

Another indicator of the bottom of the bear market is Google Trends with a search for Bitcoin.

In the case of bear market peaks, the trend charts of this tool have always turned out to be accurate almost to the day, unless the bottom of the bear market is not so precisely determined.

Either way, you can see an uptrend in Google searches, and that’s usually the end of the bear market as well. Let’s look at the chart.

Google Search

From the graph, it can be concluded that we have an upward trend in interest. However, if we expect a strong uptrend, we may be disappointed.

Probably 2023 will be the year when large investors will constantly accumulate capital, but the real bull market will return at the end or beginning of 2024. Such conclusions can at least be drawn by observing the previous bull market.

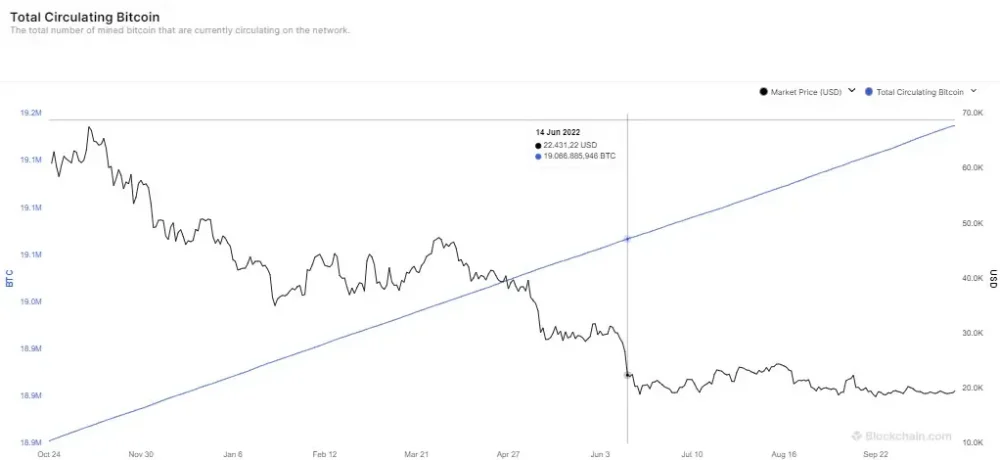

Anyway, it’s not worth waiting until the end of 2023 with shopping. Here I paste a chart showing how the bigger players behave when the price of Bitcoin was falling.

With the fall in Bitcoin prices, its availability decreased proportionately, so it was constantly being bought it’s an asset. Low prices are an opportunity and a falling price attracts even more experienced investors, institutional investors, or private investors with knowledge about bottom of cryptocurrency market, at first.

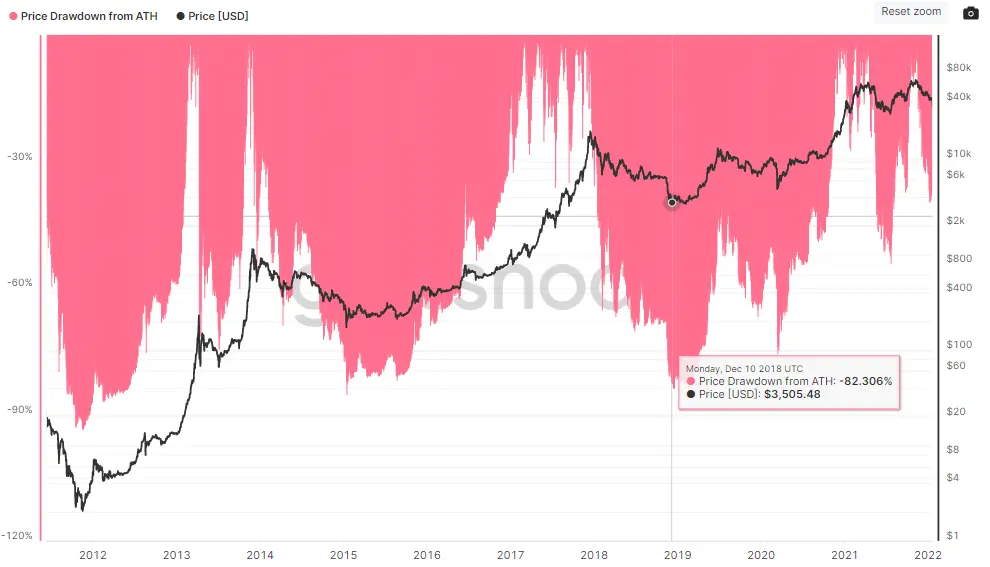

What Were the Other Bear Markets And When Did They Bottom?

When we go back in time to previous years, we will see that the bear markets (bottom of cryptocurrency market) were even more spectacular.

18 – 11 – 2011 (down from ATH: 93.569%)

05 – 06 – 2013 (down from ATH: 74.069%)

14 – 01 – 2015 (down from ATH: 85.188%)

14 – 12 – 2018 (down from ATH: 83.661%)

12 – 03 – 2019 (down from ATH: 75.465%)

10 – 11 – 2022 (down from ATH: about 75%)

In fact, with hindsight, I can write that the bottom of the market in 2022 was on November 10.

The price reached around $15,700 per Bitcoin unit.

It was a loss of approximately 75% from the peak, and the bear market itself lasted almost exactly a year.

Is the Bottom of the Crypto Market So Scary?

If you have managed your capital well, the bottom of cryptocurrency market is the best time to get rich. Those who are consistent in their strategy and patient are always rewarded.

You can be a trader in the market or an investor – it depends on which style of earning suits you better. About the advantages and disadvantages of both another time.

Either way, with capital in cash or stablecoins (you should be careful with these, as you can see), you can buy assets at strong discounts when the market is overworked. Which unambiguously means capitulations and all the worst emotions that dominate during the bottom of the bear market (when bottom of cryptocurrency market happen).

What Lessons Can Be Learned From This Bear Cryptocurrency Market?

Firstly, it is worth investing only in assets that have proven to work fundamentally. Don’t give in to the pressure of the crowd, because it never leads to anything good.

You should protect your capital to keep your losses to a minimum, surely. Overall, this principle is valid and universal.

So, after 2% of your capital in losses moving to stablecoins. Not sitting in assets that depreciate due to a downtrend.

Buy cheap assets during a bear market. You have to wait at least a year from the top of the bull market (ATH) to the bottom of the cryptocurrency market.

Invest your capital that you can lose or freeze for several years, especially.

Remember that when buying cryptocurrency you do not have to go to Fiat. As long as you can afford a lot of nerves and emotional war that will fill you after watching the declines.

Falling Bitcoin prices are an opportunity and the biggest players in the market are taking advantage of it as a matter of fact.

Finally, fear and greed are two separate poles that can make a lot of money in the market. Mastering one’s emotions in extreme situations lead to victory on the market, indeed.

Leave a Reply

You must be logged in to post a comment.