What is Bitcoin?

Bitcoin is technological miracle and the first fully decentralized cryptocurrency. We can use bitcoin as payment currency and an asset that holds value. In fact, “cryptocurrency gold” is more than many think. A full understanding of the technology shows how revolutionary this solution is. But about that soon…

Why is Bitcoin a Technological Revolution?

It is difficult to answer this in one sentence. Bitcoin is revolutionary in many ways. Here’s what I mean.

Technological Revolution

Particularly, Bitcoin is the first cryptocurrency implementation available on the Blockchain network. What’s more, The Bitcoin network is highly secure, reliable, and permissionless. Overall it is decentralization of network. Bitcoin has no leader and belongs to all its users.

Social Revolution

Bitcoin is available to everyone. Anyone can own at least part of the most expensive asset in the world. There are no elite circles where premium stocks is available only to the elite.

If you want, you can buy shares, and in 10 years they will probably increase in price by 20 times.

Even with this understanding and knowledge, many people will not decide to do it, because they do not have an investor mentality.

Banking Revolution

Thanks to bitcoin, there is no need for an intermediary in the form of a bank. The banks themselves pretend not to see the danger. The inevitable will happen anyway, i.e. payments in cryptocurrency networks will replace the traditional banking system or will be its main core.

Ideological Revolution

Many people who understand how Bitcoin works realize that it is an ideological revolution. These people voluntarily become ambassadors and investors of this asset.

The author himself was an opponent of Bitcoin until he did not know how it works.

“Gold” of Cryptocurrencies

It is no secret that about 40% of the value of the cryptocurrency market is Bitcoin, indeed. It’s one of the reasons why Bitcoin is technological miracle, but not the only one. The price of Bitcoin itself has a huge impact on the rise or fall of other assets (cryptocurrencies in the market). And the capital itself in the stock market often flows into assets such as Bitcoin at the beginning.

Price Revolution

The price of one Bitcoin is $ 17,180 (at the time of writing the article), during the bear market. Even during a reduction (if we can talk about one at all), it is the most expensive value for one unit of shares on the stock exchange. The price is high, but not the highest…

How is it possible that people buy such expensive stocks? Why they think price will go up even high price?

Carrier of Value

When we look at the price of Bitcoin shares, over the next 10 years, this asset worked great in times of inflation.

Just investing in bitcoin 10 years ago allowed for profits: 5,500,000% (which means an increase of 55,000 times) !!! It should be added that we are in a fairly early stage of cryptocurrency adoption.

Which asset allows rates of return over 10 years by at least 10 times?

For comparison, I will add that the only asset that give you a return of 484% over 10 years was US Nasdaq 100 shares.

The Open-source Revolution

Bitcoin is an open-source project (technological miracle) which developing programmers around the world. Look for official Github repository here.

Everyone can have insight and contribute to the development of Bitcoin. All this is possible when we have sufficiently high competencies.

The main team developing the project cares very much about the quality of the written programming code.

To be sure, Bitcoin is a revolution in several respects.

Bitcoin and Cryptography

The Bitcoin network and the database itself do not use any encryption. As an open, distributed database, blockchain does not require data encryption. All data transferred between Bitcoin nodes is unencrypted to allow strangers to interact on the Bitcoin network.

However, some Bitcoin services require more security and privacy. To securely store private keys, most Bitcoin wallets encrypt their data using a variety of encryption schemes. For example, Bitcoin Core encrypts its wallet using the Advanced Encryption Standard (AES).

This is the same encryption algorithm that the NSA uses for its classified information, and AES is considered extremely secure. To decrypt the Bitcoin Core wallet, the user has to enter their password which is used as the decryption key.

PoW in Bitcoin

The Bitcoin protocol mainly uses SHA-256 for all hashing operations. Most importantly, hashing is in Bitcoin’s Proof-of-Work mechanism. The hash is a large number, and for a miner to upload a block to the network, the block’s hash must be below a certain threshold. Since hashing is a random, unpredictable process, finding the correct hash can only be achieved through intense guesswork.

You can always look into other consensus mechanisms here.

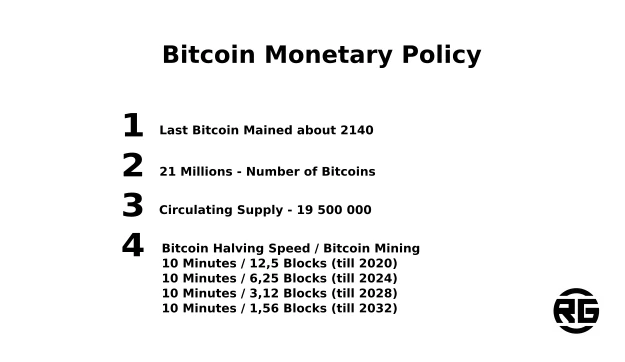

Bitcoin Monetary Policy

Since the number of bitcoins created each time a user discovers a new block – the block reward – is halved based on a fixed block interval. The average time it takes to discover a block can vary depending on mining power and network difficulty. The exact time, where the block reward will be halved, may also vary. As such, the timing of the last Bitcoin will also vary and is subject to assumption-based speculation.

If the mining power had remained constant since the first Bitcoin was mined. The last Bitcoin (technological miracle) would have been mined somewhere around October 8, 2140. Due to the general increase in mining power over time starting from block 367,500 – assuming that the mining power remained constant from that block to forward – the last bitcoin will be mined on May 7, 2140.

Because it is very difficult to predict how mining energy will evolve in the future – i.e. whether technological advances will continue to accelerate equipment or whether mining will hit a technological wall; or whether faster methods of calculating SHA2 will be discovered – determining the exact date or even year of this event is difficult.

The total number of bitcoins, as mentioned earlier, has an asymptote of 21 million, due to a side effect of the blockchain’s data structure – specifically, the transaction output integer storage type, this exact value would be 20,999,999.9769 bitcoins. If this technical limitation is corrected by increasing the field size, the total will still approach a maximum of 21 million.

Indeed, Bitcoin has its own monetary policy, which is inviolable. Don’t let yourself be convinced otherwise.

Transaction Security

It is protecting by 256-bit SHA hash functions. The same level of security that banks, military, and virtual private networks (VPNs) use to encrypt their systems. But unlike encryption, which can be decrypted, SHA hash functions. They provide a unique fingerprint for each transaction that cannot be reconstructed.

In other words, blockchain cryptography is used to sign data with a unique, indestructible identifier. What’s more other participants in the network can verify using the same cryptographic algorithm.

Bitcoin as a Carrier of Value

Like fiat currency, Bitcoin (or most cryptocurrencies) is not covering by any gold or silver. Therefore it has no intrinsic value. The value of any currency is derived from the support of the state and the trust people place in the government. Therefore, for any money to be established as a value exchange within the network. The network must have confidence in it, regardless of who (or what) supports it.

This is where Bitcoin – technological miracle gains value. The trust that millions of people have placed in the cryptocurrency in a completely thrustless environment determines the value of the cryptocurrency. Millions of miners and traders collectively are active participants in the Bitcoin network. They trust the world’s largest cryptocurrency and decide its price solely based on supply and demand.

The price of Bitcoin progressively increases as the number of available cryptocurrencies decreases. The current price is governed by the free market laws of supply and demand.

Become One of the Bitcoin Miners?

In many ways, bitcoin mining is comparable to gold mining. Cryptocurrency mining (in the case of Bitcoin) is a computer operation that creates new Bitcoins and tracks the transactions and ownership of the cryptocurrency. Bitcoin and gold mining are energy-intensive and can bring significant financial benefits.

Therefore, you can mine BTC to earn/reward. Some BTC miners build Bitcoin mining pools by pooling their efforts with other miners. Groups of miners who work together are more likely to win rewards and share the profits. In addition, mining pool members pay a fee to be part of the pool.

If you’re not focused on money, you might want to mine Bitcoin if you enjoy playing with computers and learning about this new technology. For example, by setting up bitcoin mining, you can learn how your computer and blockchain-based networks are performing.

Is bitcoin mining worth it?

To find the answer to the above question, do a cost-benefit analysis (using online calculators) to see if bitcoin mining is worth your effort. Cost-benefit analysis is a systematic method used by organizations to determine which actions to take and which to avoid.

First, determine if you want to invest the required initial capital in hardware and determine the future value of Bitcoin and the difficulty level before committing your resources. It is also very important to research the difficulty specific to the cryptocurrency you want to mine to see if the mining operation would be lucrative.

When both Bitcoin prices and the difficulty of mining decrease, it usually means that fewer miners are mining BTC and it is easier to acquire BTC. Nevertheless, expect more miners to compete for less BTC as Bitcoin prices and mining difficulties increase.

Some Interesting Facts About Bitcoin

a) The creator of bitcoin is a group or one person identifying themselves as Satoshi Nakamoto,

b) Satoshi owns about 1,000,000 BTC,

c) nearly 900 bitcoins are mined daily, but this number may change with the change in technology,

d) On February 1, 2011, bitcoin cost exactly $1,

e) The highest bitcoin price was on November 10, 2021, and it was $ 69,044.77,

f) Bitcoin accounts for 36.5% of the total market capitalization of cryptocurrencies (as of December 10, 2022),

g) Bitcoin is technological miracle and no one controls its price. The price is affected by various economic factors such as media influence, the number of miners and mining costs, regulations on the cryptocurrency market, and others

Price Analysis in Depth

Bitcoin is the benchmark cryptocurrency in the cryptocurrency market.

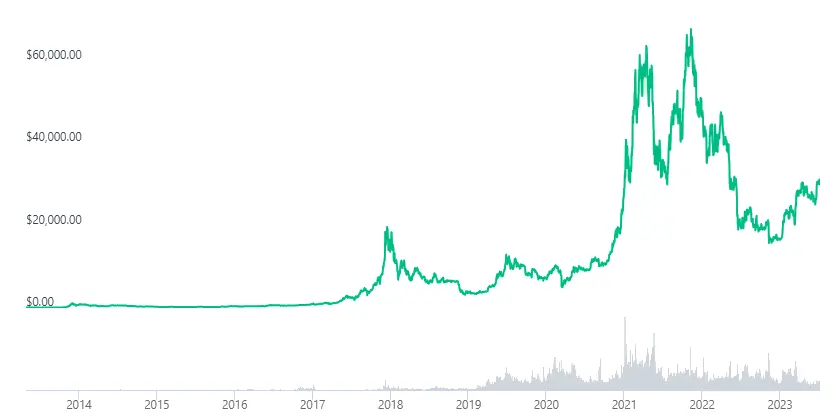

Halving cycles (more on that another time) have a big impact on the price of Bitcoin.

The Bitcoin price has had 4 bulls so far. One bull market took place before the first halving.

However, I will limit myself to the last 2 bull markets in my analysis. Why ? The reasoning is quite obvious. Due to the most visible historical price changes in the graphics.

Just add that the first two bull markets were also interesting and worth discussing, but I will limit myself to the last two. The reason has been presented a moment ago.

I will go to the price analysis.

3th Bull Market

3 This bull market really starts in early 2015. The price of Bitcoin was around $205. In early 2017, this price rose to about $3,000 per unit during the bull market.

It is easy to calculate that the price increase was about 15 times.

The biggest price increases could be observed during the last 3 months of the bull market.

4th Bull Market

The 4th bull market is the last bull market that took place on the price of bitcoin.

The beginning of this bull market took place in December 2018. The bottom of the previous cycle and the beginning of the next one is around $3,300 per unit.

This time the price peak took place in November 2021. The price is approximately $69,000 per unit. Price increase by 21 times in nearly 3 years.

Pretty good !!

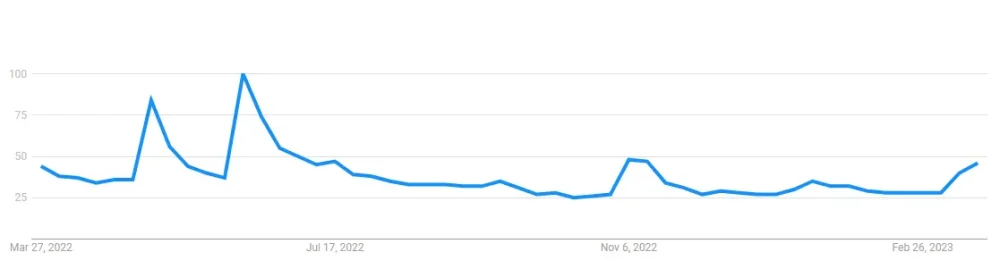

Bitcoin Mania

Mania on Bitcoin continues. Certainly, bitcoin is unique in many ways.

Many people, together with the author, after understanding how it works, became his fan. Bitcoin mania will continue. This mania will be continuing, because it’s design – a public project available to anyone with the Internet. Craziness about Bitcoin is in its early stages, but in 10 to 15 years it will turn into a widely used technology. It’s hard not to agree with the uniqueness of this project, and thus its price.

Of course, there is greater interest in bitcoin when the herd laws apply. You can be sure that we are then close to the end of the bitcoin bull market.

Summary

Bitcoin is a technological miracle because of its unique design. The entire project is available to anyone with the Internet.

A common project unites many programmers around the world in the idea of freedom. True freedom starts with money, and bitcoin in this case represents a digital currency.

People developing “digital gold” is not a passing trend, but a real revolution. It’s good to take a closer look at it before it’s too late.

Leave a Reply

You must be logged in to post a comment.