Introduction

The remarkable rise of Bitcoin and other cryptocurrencies transform our thinking about money, transactions and finances in general. But, before adoption will take place there need to be solve one huge problem – scalability of Bitcoin and another cryptocurrencies.

Let me explain you that the ability to process an ever-increasing volume of transactions efficiently and securely is essential. Only then, long-term viability and mainstream acceptance of cryptocurrencies can be possible!

In this article I would like to write about Bitcoin scalability problem, challenges and solutions for problems of layer-1 and layer-2.

Enjoy your reading, because after reading this article you would know about the biggest challenges what facing cryptocurrency industry at all.

Of course, bitcoin is not any different…

Scalability Dilemma

At the heart of Bitcoin scalability lies a fundamental trade-off known as the “blockchain trilemma“. This concept suggests that blockchain can only optimize two out of the three essential characteristics: decentralization, security, and scalability.

Improving one aspect often comes at the expense of the others. Overall, presenting a complex challenge for developers and researchers.

Bitcoin’s current design, which relies on the Proof of Work (PoW) consensus mechanism, exemplifies this dilemma. While PoW has proven to be a robust and secure foundation, it comes with inherent limitations in terms of transactions throughput. Let me explain what I mean.

The Bitcoin network can only process around 7 to 10 transactions per second (TPS). Huh! It’s far behind thousands of TPS. By the way, I have written article about Bitcoin and Visa. Please take a look there. By now, I come back to topic.

As a consequence it leads to network congestion, delayed transaction confirmations, and escalating fees!

Without any doubt, addressing these scalability challenges is crucial for blockchain technology. For sure, before those problems will be not solved blockchain won’t be viable alternative to traditional financial systems.

Consensus Mechanisms and Scalability

The choice of consensus mechanism plays a pivotal role in determining a blockchain network’s scalability.

Proof of Work (PoW) provide security and decentralization for the network, but Bitcoin scalability has significant transaction limitations.

As an answer to those limitations there were created another consensus mechanisms. I will briefly write a few words about them.

Proof of Stake (PoS)

It’s one of the first alternatives to PoW, offering the potential to enhance scalability without compromising security and decentralization.

In a PoS system, validators are selected based on the amount of cryptocurrency they hold, rather than the computational power they contribute.

Of course, Ethereum project is the best example of this consensus.

In a matter of fact, Ethereum is the first one project with PoS consensus mechanism.

At the beginning falsely compared with Bitcoin, but it’s completely different approach. Interestingly, Ethereum had PoW consensus at first (using Bitcoin scalability consensus mechanism)! A few years later project change it for PoS.

Delegated Proof of Stake (DPoS)

Another innovative consensus mechanism is Delegated Proof of Stake (DPoS). In this consensus mechanism, token holders elect a limited number of trusted nodes, known as “delegates”. Then, they validate transactions and create blocks.

Finally, this approach can lead to faster transactions confirmations and higher throughput compared to PoW and PoS.

Projects like EOS and Tron using this consensus mechanism.

Indeed, EOS is very well-known in cryptocurrency space. In moment of writing project was listed on 90th place in Coingecko. Not so bad!

In case of Tron project is on 13th place in case of market capitalization. One of the most important factors that you should take in consideration during investment.

At least, in my opinion.

Byzantine Fault Tolerance (BFT)

This consensus mechanism addresses the challenge of maintaining network integrity even in the presence of malicious actors.

Faster transactions and higher throughput are in a voting-based approach. This consensus is great fit for applications with rapid confirmation times.

Projects with Byzantine Fault Tolerance are Tendermint, Hyperledger Fabric, or Cosmos.

After knowing little bit about consensus mechanisms it’s time to face problems of blockchain layers.

If you never heard about Cosmos then for sure you are new in the cryptocurrency market. Cosmos is innovative not only in case of consensus mechanism, but in many different ways.

I am writing little bit later about interoperability and Cosmos plays there very significant role.

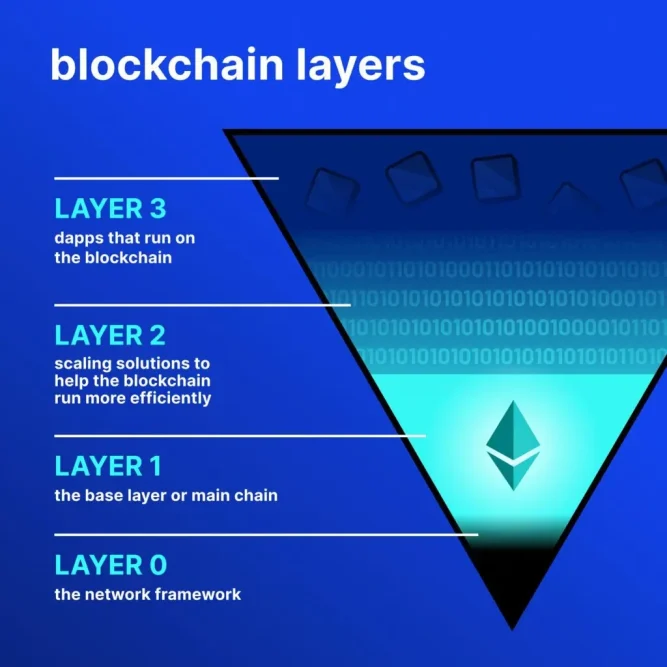

Layer-1 (On-Chain) Scalability Solutions

While advancements in consensus mechanism have contributed to improved scalability, blockchain developers explored on-chain scaling solutions.

Following list showing only some of them tools.

Segregate Witness (SegWit)

SegWit is a protocol upgrade implemented on the Bitcoin network. This solution increase the network’s capacity by separating transactions signature data from the main transaction data. In the same time, freeing up valuable block space. Consequently, block can process more transactions.

Although this upgrade is quite successful it could be not comprehensive long-term solution for the scalability challenge in Bitcoin.

Next solutions is really promising, so let jump into next one.

Sharding

Another layer-1 approach is improving scalability is sharding. What about sharding? This solution dividing the blockchain network into smaller, more manageable data sets known as “shards”.

What happen in one shard? Each shard operates independently, processing its own transactions and smart contracts. In general, allowing for parallel processing and increased overall throughput.

Ethereum already has implemented sharding strategy into own blockchain network.

The only question is: “Is Ethereum scalability better that Bitcoin scalability?”

Hard Forks

In some cases, blockchain networks may resort to hard forks.

Always they are changing fundamentally the underlying protocol. Maybe you don’t know, but Ethereum did hard fork at 2016. After hard fork is increasing block sizes or reducing block creation times. As a result, network in blockchain can process more transactions per second.

In cost of hard fork can be network split and potential disruptions. I mean by this hard fork can be total disaster for community consensus and live of project.

3 solutions of layer-1 are the answer for limitations related to scalability, but there are another solutions as well. Layer-2 have a few of them as well.

Layer-2 (Off-Chain) Scalability Solutions

Blockchain community developed layer-2 approaches to scalability challenges as well. Let’s take a look on them below.

Sidechains

What are sidechains?

I am explain right now. Sidechains are separate blockchain networks that operate in parallel with the main blockchain.

By offloading certain types of transactions to these sidechains, the main network can focus on maintaining security and decentralization. Job for sidechains is to handle the increased throughput requirements. Pretty simple, don’t you think?

As an example of using sidechain-based scaling is Plasma on Ethereum and Parachain on Polkadot. In both solutions network congestions is strongly reduced.

State Channels

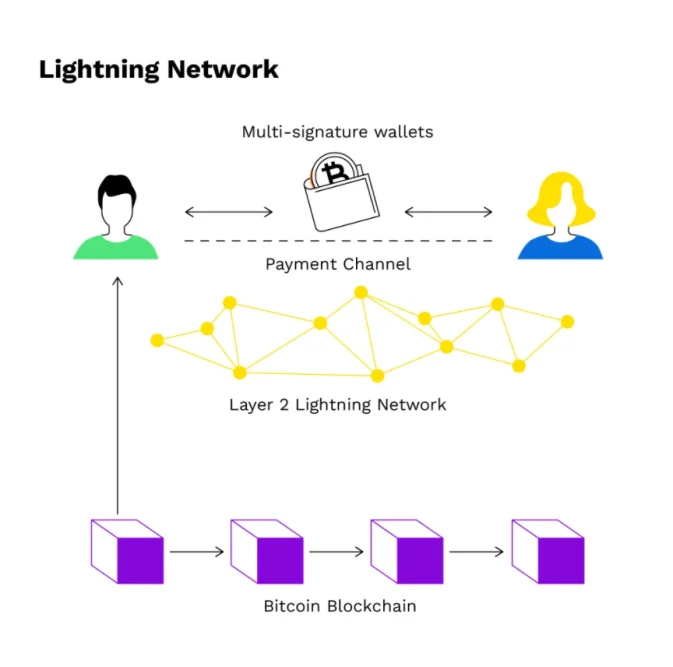

Ok, so what next? State channels are another layer-2 scaling solution. They using off-chain transactions between users. Obviously, constant interaction with main main blockchain is not necessary. I tell you what special is about this solution?

By establishing secure, direct communication channels between parties, state channels can enable rapid, low-cost transactions.

One of the examples build on top of the Bitcoin blockchain is the Lightening Network. This network offering near-instant, low-fee transactions through its network of interconnected payment channels.

Nested Blockchains

Nested blockchains leverage the main blockchain. Another name is hierarchical blockchain architecture. They leverage the main blockchain to establish parameters for a larger interconnected network of secondary chains.

When transactions are executed across there secondary chains, then nested blockchains can improve scalability. In the same time security and decentralization isn’t concern.

This approach enables the efficient processing of a wide range of use cases. Pretty interesting solution.

Solutions of layer-2 can be very good use cases for scalable problems of blockchain networks.

I have mentioned only 3 solutions in layer-2, but they can be very successfully implemented.

Bitcoin’s Lightening Network is great example how main blockchain can be improved. To be honest there is any another blockchain network what has transactions speed and network congestions similar to Lightening Network.

Ok enough about scalability of layers, and Bitcoin scalability itself. Is there any another scalability options?

Interoperability and Blockchain Ecosystems

For fully unlock potential of decentralized technologies integration and communication between different blockchain platforms are essential.

There are protocols like Polkadot, Cosmos and so on. So, what they really do?

They exchange of data and assets across disparate chains. Then, enabling cross-chain compatibility and contribute to the overall scalability of the blockchain ecosystem.

They allowing various networks to work together and leverage their respective strengths.

Moreover, interoperability opens up new avenue for innovation. Because developers can build applications that seamlessly integrate and leverage the capabilities of multiple blockchain networks.

The Road Ahead

As like article show there is no single, universal solution for scalability problem. It’s always matter of concern balance security, decentralization and scalability.

I guess it’s still will be.

In article I have presented layer-1 and layer-2 scaling strategies. Each offer unique approaches to addressing the scalability dilemma. In the future those solutions will be developed and there will be new ones.

I have also mention about interoperability solutions, because they will play crucial role in cryptocurrency world.

Of course, they will push blockchain industry to even more scalable and accessible future.

Ultimately, the successful resolution of the scalability challenge will push adoption further. Cryptocurrencies will be widespread adopted at some point in the future. Be sure about it.

Conclusion

In summary, the scalability challenge in Bitcoin and other cryptocurrencies is a complex and multifaceted issue. Bitcoin community have found great solutions for Bitcoin scalability problem and implemented Lightening Network.

Beside that, blockchain community answer for problems of layer-1 and layer-2 with great solutions presented in the article. Further, many entrepreneurs looking for new consensus mechanisms to approach scalability problem even better.

Blockchain trilemma is common problem of cryptocurrencies and their widespread adoption. New solutions will brings more communities to cryptocurrency world. Problem of scalability will be always matter of challenge in cryptocurrency community, you can be sure about it.

Finally, I leave you with message: “Bitcoin solved pretty well scalability problem, so why would you think it won’t happen in case of other cryptocurrencies?”

Leave a Reply

You must be logged in to post a comment.