Introduction to Bitcoin Investing

Bitcoin, the revolutionary cryptocurrency that has taken the world by storm and after time Bitcoin HODL strategy alive.

First of all, Bitcoin become a popular investment choice for individuals seeking to diversify their portfolios and capitalize on the potential for substantial returns.

In fact, Bitcoin offers a unique opportunity for investors to participate in a rapidly growing market with significant profit potential.

However, like any investment, it is crucial to understand the strategies and risks associated with Bitcoin investing.

In this article, I will explore the HODL strategy, its benefits, historical performance, factors to consider before investing, and provide valuable tips for successful Bitcoin investing.

Bitcoin HODL Strategy

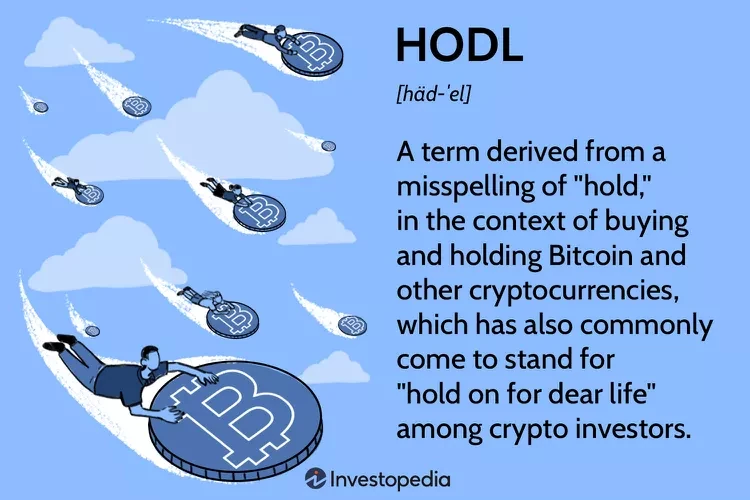

The term “HODL” originated from a misspelling of the word “hold” in a Bitcoin forum post, which soon gained popularity and became synonymous with a long-term investment approach.

The HODL strategy involves buying Bitcoin and holding onto it for an extended period, regardless of short-term market fluctuations.

This strategy is based on the belief that Bitcoin’s value will continue to increase over time, despite temporary price volatility.

By adopting the HODL strategy, investors aim to benefit from the long-term appreciation of Bitcoin, rather than attempting to time the market and make quick profits.

This approach requires patience, discipline, and confidence in the potential of Bitcoin as a store of value and medium of exchange.

While the HODL strategy may not yield immediate returns, it has proven to be a successful investment approach for many Bitcoin enthusiasts.

The term HODL is popular among crypto enthusiasts. Many of them claim that investments like Bitcoin are for life.

It must be admitted that a project such as Bitcoin has not been created before.

And there are several reasons – the first cryptocurrency with huge popularity among fans. Almost like fanaticism.

But that’s not all, because Bitcoin is also a global digital currency, without government control and very fast transactions available 7 days a week. Convinced to invest?

Benefits of the Bitcoin HODL Strategy

The HODL strategy offers several advantages for Bitcoin investors.

Firstly, it allows investors to avoid the stress and emotional rollercoaster of constantly monitoring short-term price movements. By focusing on the long-term potential of Bitcoin, investors can maintain a more rational and objective approach to their investment decisions.

Furthermore, the HODL strategy aligns with the underlying principles of Bitcoin as a decentralized and immutable digital currency. By holding onto Bitcoin for an extended period, investors contribute to the stability and growth of the network, fostering a stronger and more resilient ecosystem.

Another significant benefit of the HODL strategy is the potential for substantial returns. Bitcoin has demonstrated impressive price appreciation over the years, with early adopters reaping enormous profits. By holding onto Bitcoin for the long-term, investors position themselves to capitalize on future price increases, potentially generating life-changing wealth.

Historical Performance of Bitcoin

To fully grasp the potential of the HODL strategy, it is essential to examine the historical performance of Bitcoin.

Since its inception in 2009, Bitcoin has experienced significant price fluctuations but has consistently exhibited an upward trend. In the early years, Bitcoin’s value was relatively low, with prices reaching only a few cents.

However, as the cryptocurrency gained mainstream attention and adoption, its value skyrocketed.

The most notable price surge occurred in 2017, when Bitcoin reached an all-time high of nearly $20,000.

While the subsequent market correction resulted in a temporary decline, Bitcoin has since recovered and continues to show strong growth potential. As of writing, Bitcoin is valued at over $50,000, highlighting its remarkable long-term performance.

It is important to note that Bitcoin’s historical performance does not guarantee future returns.

The cryptocurrency market is highly volatile and subject to various external factors that can affect prices.

However, by adopting the HODL strategy and understanding the underlying fundamentals of Bitcoin, investors can position themselves for potential long-term gains.

The deflationary nature of Bitcoin means that the price constantly increases.

What halving can be seen very well. Anyone who doesn’t see this is at a loss, but the numbers speak for themselves.

It is true that with halving the price increase decreases, but … you can still earn ore on this asset than on gold, silver or shares.

Of course, there are periods when the asset performs slightly worse, but more on that in another article.

Factors to Consider Before Investing in Bitcoin

Before embarking on a Bitcoin investment journey, it is crucial to consider several factors that can impact your investment strategy.

Firstly, it is important to assess your risk tolerance. Bitcoin is a highly volatile asset, and its value can fluctuate dramatically within short periods. If you are risk-averse and cannot tolerate significant price swings, Bitcoin may not be the right investment for you.

Additionally, conducting thorough research and staying informed about the latest developments in the cryptocurrency market is essential. Understanding the regulatory landscape, technological advancements, and market trends can help you make informed investment decisions and mitigate potential risks.

Furthermore, evaluating the security measures of the Bitcoin exchange or wallet you choose is paramount. As cryptocurrencies operate on a decentralized network, the responsibility of safeguarding your Bitcoin lies primarily with you. Implementing robust security measures, such as multi-factor authentication and storing your Bitcoin in cold storage wallets, can help protect your investment from potential hacks or cyber threats.

Before investing in Bitcoin, you should know many facts about this asset.

Without basic knowledge, investing is like jumping into a moving train.

Additionally, the volatility of the cryptocurrency market itself is unbearable for many investors.

If you are a beginner, even more so. Therefore, first of all, I encourage you to read the article about the basics of cryptocurrencies.

Creating a Bitcoin Investment Plan

To maximize your chances of success in Bitcoin investing, it is crucial to create a well-defined investment plan. Start by setting clear investment goals, such as the desired return on investment and the time horizon for achieving those goals. This will help guide your decision-making process and keep you focused on your long-term objectives.

Diversification is another key aspect to consider when creating a Bitcoin investment plan. While Bitcoin itself is a diversification from traditional asset classes, consider allocating a portion of your investment portfolio to other cryptocurrencies or investment vehicles. This can help mitigate potential risks and take advantage of different market opportunities.

Regularly reviewing and rebalancing your Bitcoin investment portfolio is also essential.

As the cryptocurrency market evolves and new opportunities emerge, it is important to adjust your investment strategy accordingly.

Stay informed about market trends, evaluate the performance of your investments, and make informed decisions based on your investment plan.

Without a plan, it is difficult to achieve success. Not only in investments.

Especially when writing about a market such as the cryptocurrency market.

Where there is high volatility, considerable immaturity of the market and the investors themselves, many scam projects and innovation…

Tips for Successful Bitcoin Investing

Successful Bitcoin investing requires a combination of knowledge, discipline, and strategic thinking. Here are some valuable tips to enhance your chances of success:

Educate yourself

Stay informed about the fundamentals of Bitcoin, blockchain technology, and the cryptocurrency market. Understanding the underlying principles and trends will help you make informed investment decisions.

Dollar-cost averaging

Instead of investing a lump sum of money at once, consider implementing a dollar-cost averaging strategy. This involves investing a fixed amount of money at regular intervals, regardless of Bitcoin’s price. This strategy helps mitigate the impact of short-term price volatility and allows you to accumulate Bitcoin over time.

Set realistic expectations

While Bitcoin has the potential for significant returns, it is essential to set realistic expectations. Avoid falling into the trap of unrealistic promises and get-rich-quick schemes. Bitcoin investing requires patience and a long-term mindset.

Secure your investment

Implement robust security measures to protect your Bitcoin investment. Use reputable exchanges and wallets, enable two-factor authentication, and consider storing a portion of your Bitcoin in offline cold storage wallets.

Stay disciplined

Emotions can play a significant role in investment decisions. Avoid making impulsive trades based on short-term market movements. Stick to your investment plan and remain disciplined even during periods of market volatility.

Why not follow the tips of a practitioner?

Remember, however, that your investments should be matched best to your financial situation and experience.

There is no point in giving advanced tips to people who are just starting out.

It’s obvious that you need to learn solid basics first.

How do cryptocurrencies work?

Basics of trading on stock exchanges, behavior on financial markets.

But that’s not all – the characteristics of the cryptocurrency market, macroeconomics and risk management.

Additionally, the psychology of investing.

Risks and Challenges in Bitcoin Investment

While Bitcoin presents exciting opportunities for investors, it is essential to be aware of the risks and challenges associated with this investment. The primary risk is the inherent volatility of the cryptocurrency market. Bitcoin’s price can fluctuate dramatically within short periods, and investors must be prepared for potential losses.

Regulatory risks also pose a challenge to Bitcoin investing. As governments around the world grapple with the regulation of cryptocurrencies, changes in laws and regulations can significantly impact the market.

Stay informed about the regulatory landscape and adapt your investment strategy accordingly.

Additionally, the emergence of new technologies and cryptocurrencies can pose competition to Bitcoin. While Bitcoin remains the dominant player in the cryptocurrency market, it is crucial to monitor the developments in the industry and assess potential threats to Bitcoin’s long-term viability.

If you know the risks, you are able to prepare for them and maybe even avoid them.

Either way, knowledge is power. This is an indisputable fact.

The more you know about your own investment, the greater your chances of success.

The risk you take is your personal preference and depends on many factors.

One of them is your current financial status. In the case of Bitcoin, there are also many risks.

Tools for Bitcoin HODL Investors

As a Bitcoin investor, there are several tools and resources available to help you navigate the cryptocurrency market effectively. Some popular resources include:

Bitcoin exchanges

Platforms like Coinbase, Binance, and Kraken allow you to buy, sell, and store Bitcoin securely.

Portfolio trackers

Tools like Blockfolio and CoinStats help you track the performance of your Bitcoin investment portfolio and monitor market trends.

News aggregators

Websites like CoinDesk and Cointelegraph provide up-to-date news and analysis on the cryptocurrency market. They helping you stay informed about the latest developments.

Cryptocurrency wallets

Wallets like Trezor and Ledger provide secure storage for your Bitcoin and other cryptocurrencies. Overall, protecting them from potential hacks or cyber threats.

Conclusion

Investing in Bitcoin can be an exciting and potentially lucrative venture.

By mastering the HODL strategy, investors can position themselves for optimal returns in the long run. The HODL strategy offers numerous benefits, including the ability to avoid short-term market fluctuations, contribute to the stability of the Bitcoin ecosystem, and capitalize on the long-term appreciation of Bitcoin.

However, it is crucial to consider the risks and challenges associated with Bitcoin investing.

Remember, Bitcoin investing requires patience, discipline, and a long-term mindset. As with any investment, it is crucial to make informed decisions, manage risks effectively, and stay vigilant in an evolving market.

Leave a Reply

You must be logged in to post a comment.