Introduction

Indeed, the world of finance and payments is developing rapidly. So fast that sometimes it’s hard to understand, but with this development came cryptocurrencies. Obviously, it’s crucial to understand the differences and similarities between cryptocurrencies and digital payment systems. In this in-depth analysis, firstly I will explore the details of Bitcoin and Visa payments.

Then I will compare their advantages and disadvantages, security and privacy features. Further, I will write about transaction speed, fees, adoption rates and global reach. So by the end of this article, you will have a clear understanding of the strengths and weaknesses of both. It will become clear to you how they shape the future of payments.

Bitcoin and Visa Payments

In fact, Bitcoin, the pioneering cryptocurrency, was created in 2009. What’s more by Satoshi Nakamoto.

To this day, it is not known who the person or group of people with this nickname is, in general. Of course, this cryptocurrency operates on a decentralized network without the need for an intermediary. Besides, writing based on the revolutionary blockchain technology for recording transactions. Something more about transactions in the Bitcoin network, surely?

These transactions are carried out directly between users, in fact.

Write in a little more detail, so providing a level of anonymity and autonomy that traditional banking systems cannot offer.

Visa, on the other hand, is a global payment technology company. Apparently, who hasn’t heard of Visa? Further, who hasn’t used electronic transfers to transfer funds? Probably no one.

Meanwhile, Visa operates on a centralized network of financial institutions, where it is widely accepted by merchants and businesses around the world.

Bitcoin’s appeal lies in its decentralization and elimination of intermediaries,surely. Particularly, it’s enabling by peer-to-peer transactions without the need for a trusted third party. Visa, on the other hand, offers convenience and widespread acceptance. In truth, its network handles a large number of transactions every second.

While Bitcoin aims to revolutionize the financial landscape, Visa has built a reliable and efficient electronic payment infrastructure on a global scale.

Understanding the fundamental differences in how Bitcoin and Visa work is crucial to understanding the broader context of their advantages and disadvantages, but about it just in seconds.

Advantages of Bitcoin Payments

Firstly, Bitcoin offers some distinct advantages. Including decentralization, low transaction fees and also borderless transactions. Its decentralized nature means it is not controlled by any single entity, undoubtedly. This makes it immune to government manipulation and interference, certainly.

Additionally, Bitcoin transactions typically have lower fees compared to traditional banking and payment systems. Which is especially important in the case of international transfers.

Secondly, Bitcoin’s borderless nature allows users to send and receive funds across geographic borders. So, there are no currency conversions or currency exchange fees.

However, Bitcoin also has its disadvantages. Price volatility and scalability issues challenge widespread societal adoption, indeed. Bitcoin’s fluctuating value makes it a less stable store of value compared to traditional fiat currencies.

Moreover, the scalability debate surrounding Bitcoin has raised concerns about its ability to efficiently handle large numbers of transactions.

Lightning Network

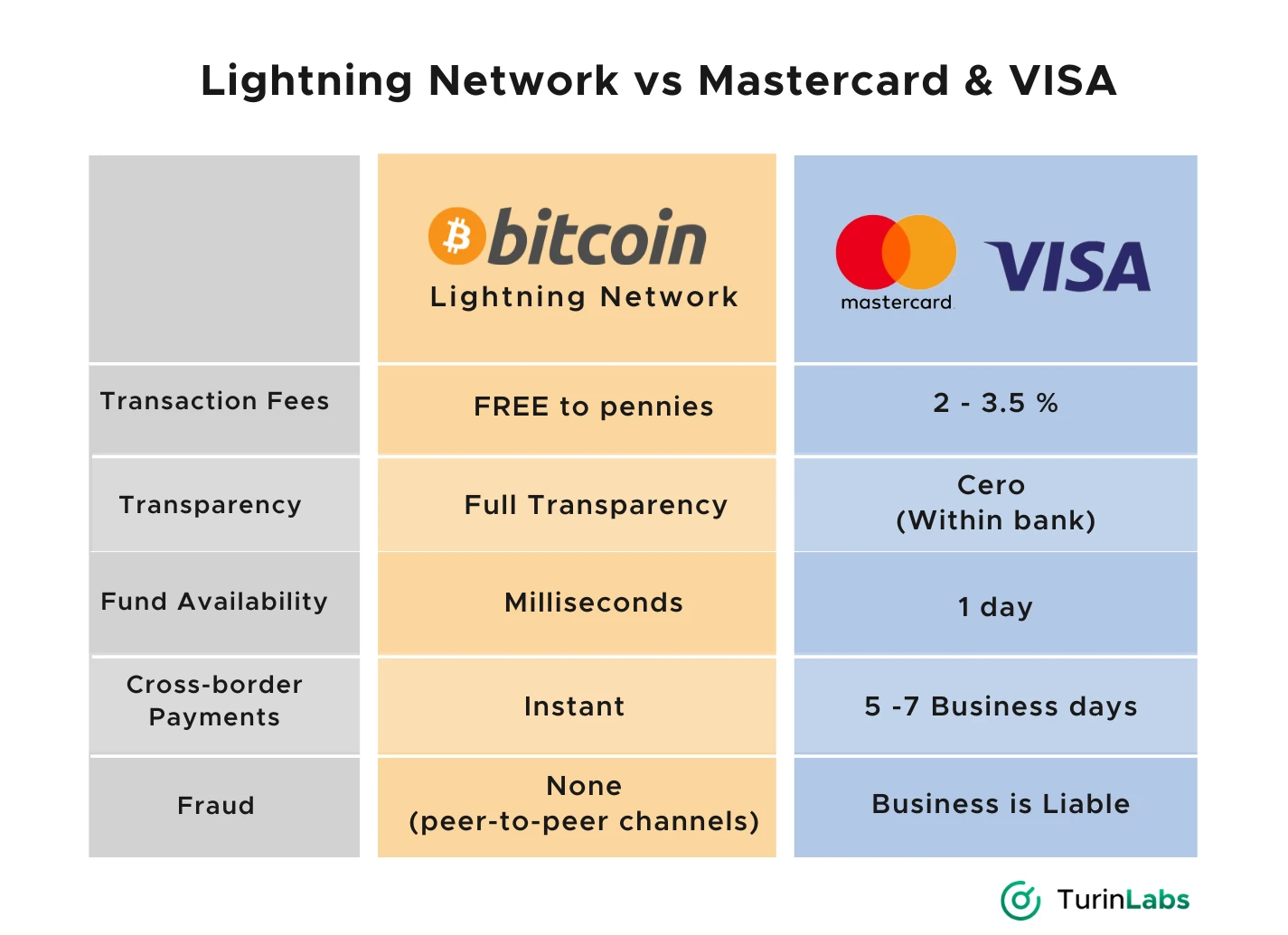

I couldn’t at least mention the Lightning Network. In this article, I use the term Bitcoin network or Lightening Network interchangeably, surely – in both cases it is the same network. Okay, but what about her?

I will not describe it in detail in this article, because it would require a whole article or two.

So for now I will limit myself to the most basic information.

Indeed, lightning-fast blockchain payments without worrying about block confirmation times.

Further, security is enforced by blockchain smart-contracts without creating a on-blockchain transaction for individual payments.

Finally, payment speed measured in milliseconds to seconds.

Advantages of Visa Payments

The advantages of Visa are its widespread acceptance, but also fast transaction processing and solid security.

In fact, this payment system is accepted by millions of merchants around the world.

This in turn creates a convenient and reliable payment option for consumers.

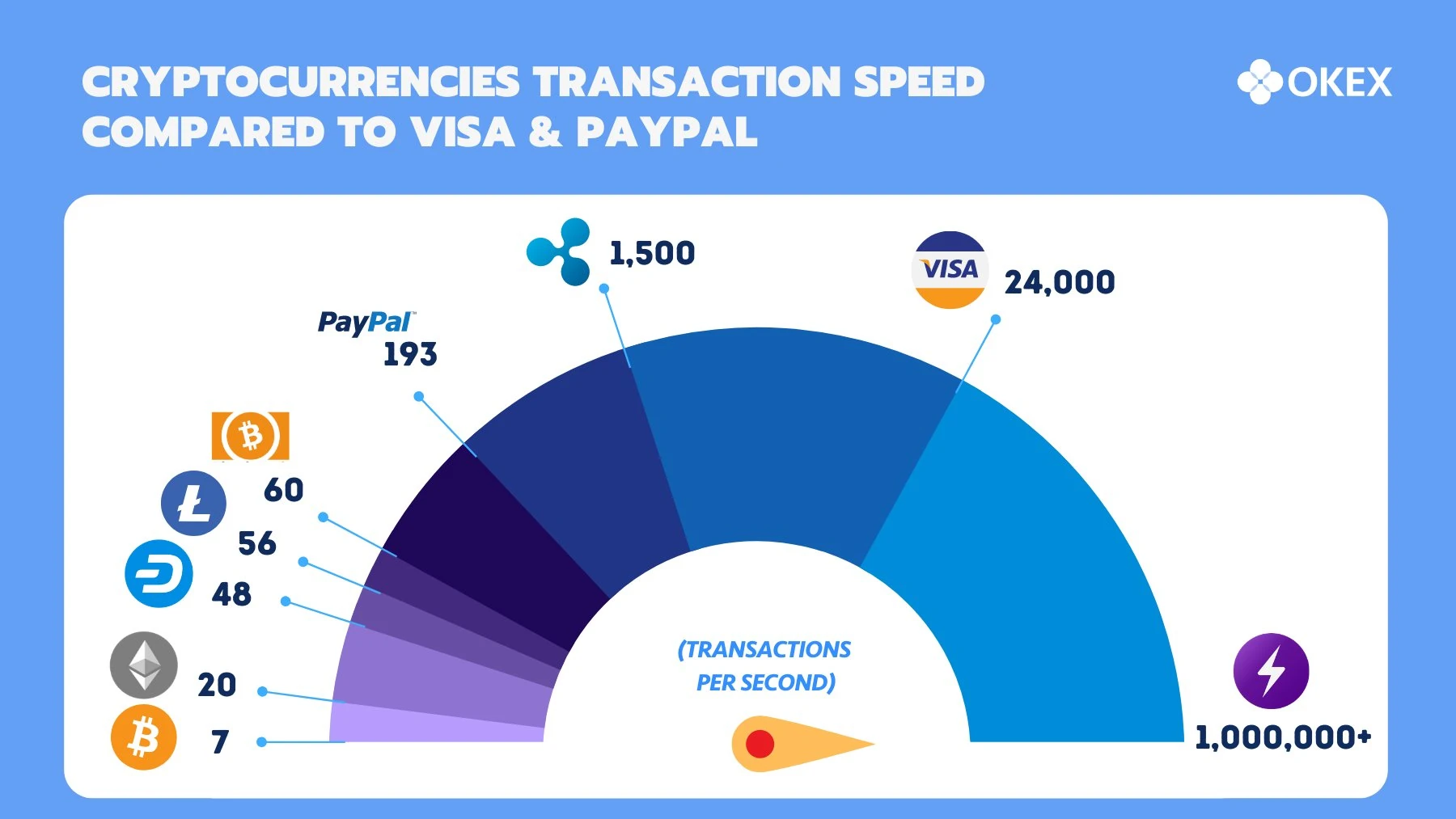

Additionally, Visa transaction processing speed is exceptionally fast.

Currently, it can handle thousands of transactions per second.

Additionally, Visa employs advanced security measures. Such as encryption and fraud detection to protect users from unauthorized transactions and identity theft.

On the other hand, Visa payments incur higher transaction fees. Next, dependence on a centralized authority and potential privacy issues. The fees charged by Visa for processing transactions may be higher compared to Bitcoin.

Especially when it comes to international payments.

Additionally, Visa’s centralized nature means that transactions are subject to the regulations and policies of financial institutions and governments. Which raises questions about privacy and data control.

Security Comparison

When it comes to security and privacy, Bitcoin and Visa have different approaches.

in fact, Bitcoin’s blockchain technology provides a high level of security.

Particularly to say, the cryptographic principles underlying Bitcoin transactions make it resistant to fraud and hacking attempts.

Moreover, Bitcoin offers a certain level of privacy as users can conduct transactions without revealing their personal information.

All these forms are not related to the technology itself, but to the manipulations of third parties.

Visa, on the other hand, prioritizes security with its centralized network and sophisticated fraud detection mechanisms. The use of real-time encryption and monitoring systems increases the security of Visa transactions.

However, this centralized approach also raises data privacy concerns. Specifically, your financial information is stored and managed by financial institutions and payment processors.

A well-executed attack on a server can result in a huge data leak. Access to user accounts and their transfer details is open!

Transaction Speed and Fees

Transaction speed and fees are key factors when assessing the effectiveness of payment systems.

Bitcoin transactions are known for variability in processing times, depending on network congestion and also mining fees.

While some Bitcoin transactions can be confirmed within minutes, others may experience delays during peak usage periods. Bitcoin transaction fees are generally lower compared to traditional banking systems.

Especially in the case of international transfers. Which I mentioned earlier.

Visa, on the other hand, excels in transaction speed, allowing it to process thousands of transactions per second. Visa’s network infrastructure and advanced technologies enable quick authorization and settlement of payments.

However, the convenience of fast transactions comes with higher fees. Especially for cross-border payments and commercial transactions.

While Visa is faster than the Mastercard system, it cannot compare to the Lightening Network.

The Lightening Network itself was created to make transactions using Bitcoin faster, as a matter of fact. Besides makes Bitcoin more competitive with traditional payment systems.

As you can see, the difference in transactions per second on the Bitcoin Lightening Network is staggering. Visa as a competitor has no chance in this case.

Adoption of Bitcoin and Visa

The adoption and global reach of Bitcoin and Visa reflects their impact on the digital payments landscape.

Bitcoin’s adoption was driven by its appeal to people seeking financial independence and the potential for investment gains. Although the overall adoption of Bitcoin for everyday transactions is still evolving.

Its presence as a digital asset and payment alternative continues to grow.

On the other hand, Visa has achieved unparalleled global reach, and its payments network is accepted by businesses and merchants in almost every country.

The widespread adoption of Visa as a payment method reflects its seamless integration with traditional financial infrastructure. Which makes it the dominant player in the global payments industry.

Moreover, the Visa payment system cooperates in integrating Bitcoin payments in various types of transactions. Currently, you can pay in 40 countries using this integration.

Will Bitcoin catch up with Visa?

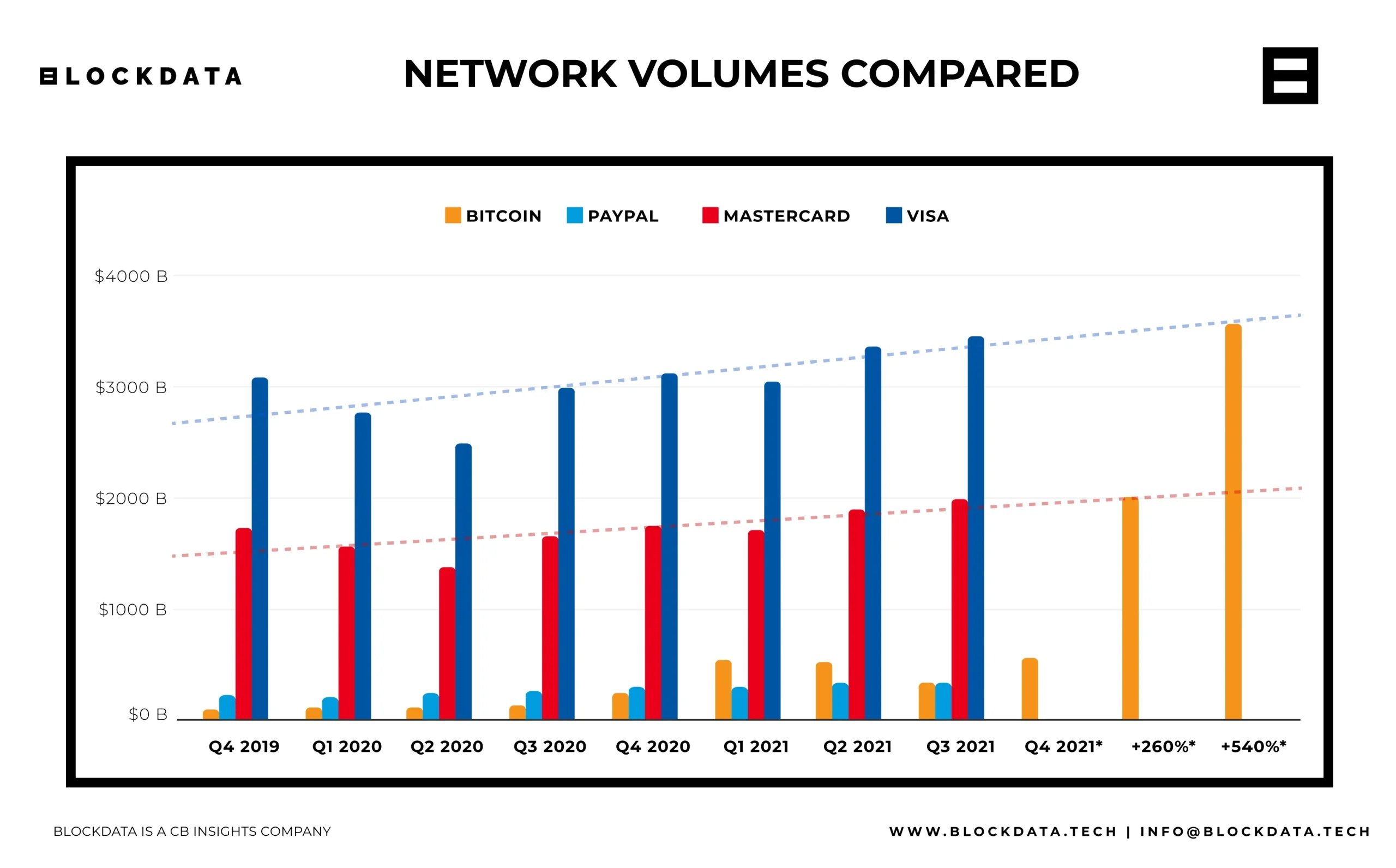

Since 2019, the number of transactions paid via Bitcoin and PayPal has been growing regularly.

In the case of Visa, the number of transactions is also increasing regularly. I would like to remind you that it is a global leader among electronic payment systems.

The company has been in existence since 1958, so this is no surprise.

The second largest electronic payments company, Mastercard, has been on the market for almost as long. Here we are talking about 1966.

Transactions made using Mastercard do not grow as dynamically as those made using PayPal and Bitcoin.

The latter two payment systems have been in operation since 1998 and 2010. What may be surprising, at the end of 2021, the amount of transactions using Bitcoin and PayPal became equal.

Well, we’re talking about over ten years of difference in the payments market.

The Bitcoin project is constantly developing and adoption is progressing.

Exponential growth may occur within 5 – 10 years. Then it will also be possible to fully compare the Bitcoin payment system with Mastercard.

I think Visa will maintain its leadership position over the next 10 years. All this is due to adaptation to changes and cooperation with more modern technologies. Such as Bitcoin.

The Future of Payments Bitcoin and Visa

Surely, competition between Bitcoin and Visa will shape the evolution of digital transactions. In fact, Bitcoin’s decentralized and disruptive nature challenges the traditional financial system. Particularly, by offering an alternative model for peer-to-peer transactions and asset storage. So, its potential to revolutionize cross-border payments and financial inclusion.

On the other hand, Visa’s established infrastructure and global network position. Without a doubt, it’s as a powerful force in the payments industry. The focus on innovations such as the exploration of blockchain technology and digital currencies demonstrates a proactive approach to adapting to the changing payments landscape.

Visa’s commitment to improving the payment experience and responding to emerging trends underscores its determination to remain at the forefront of electronic payments. Please pay attention to the actions of Visa management.

The president of this company notices changes in the payment system and adapts to them. An example is this strategy to facilitate payments via Bitcoin, among others. Well, more on that in a moment.

Integrating Bitcoin and Visa Payments

The integration of Bitcoin and Visa payments creates opportunities for synergy and innovation in the payments ecosystem. Although Bitcoin and Visa operate on different principles, initiatives are emerging to bridge the gap between traditional payment systems and cryptocurrencies.

Some financial services providers and financial technology companies are exploring solutions. These are solutions that will enable users to seamlessly convert and spend Bitcoins via the Visa network. Creating a bridge between the digital and traditional financial spheres. What more could you want?

By integrating Bitcoin and Visa payments, users can potentially benefit from the benefits of both systems. While taking advantage of Bitcoin’s decentralized nature and Visa’s widespread acceptance.

This integration also paves the way for advances in cross-border transactions and financial accessibility. While meeting the evolving needs of consumers and businesses in a rapidly changing digital economy.

Case Studies

Examining real-world case studies of successful Bitcoin and Visa payment implementations provides valuable insights into the practical applications of these payment systems, surely.

From online merchants accepting Bitcoin as a form of payment to global companies using Visa payment solutions to ensure seamless transactions.

These case studies illustrate the diverse ways in which both payment methods are used in the marketplace. A notable example is the adoption of Bitcoin by some e-commerce platforms, allowing customers to make purchases using the cryptocurrency.

This demonstrates the growing acceptance of Bitcoin as a legal payment option in the retail sector.

On the other hand, Visa’s collaboration with technology companies and financial institutions has resulted in innovative payment solutions that meet the changing needs of consumers and businesses.

Bitcoin and Visa in Numbers

As in every article, I try to present numbers that confirm the theses.

To the extent that I have different opinions, the numbers confirm or disprove them.

Numbers say more than a thousand words! So let’s get to work. Some facts about Bitcoin and Visa payments.

In this case, I will once again refer to the Lightning Network as the Bitcoin network.

Surely you can easily see, the Lightening Network is already a competitive network for Visa.

As you probably already know, Visa is the leader in electronic payments, in fact. In terms of transaction volume alone, Visa has incomparably more transactions in this moment. But…

Exactly. Visa has been on the market for nearly 55 years, and Lightening Network since 2015.

The first transactions were carried out in 2019. Moreover, it is a very young and modern technology. As well as Bitcoin itself.

In the last picture, other cryptocurrencies were also taken into account.

Of course, what I mean here is the transaction speed per second.

Only Ripple can compete with the PayPal and Visa payment systems.

The Lightning Network itself has no competition in this respect. So do you have any doubts about the innovation of this solution?

Conclusion

In conclusion, the comparative analysis of Bitcoin and Visa payments reveals the distinct characteristics of these two payment systems.

While Bitcoin offers decentralization, lower fees, and borderless transactions, Visa provides widespread acceptance, rapid transaction processing, and robust security measures.

Understanding the strengths and also weaknesses of each system is essential. Then the integration of Bitcoin and Visa presents opportunities for innovation and collaboration.

Whether it’s leveraging the benefits of Bitcoin’s decentralized nature or harnessing Visa’s global reach, the synergy between these payment methods has the potential to shape the future of finance and payments on a global scale.

Leave a Reply

You must be logged in to post a comment.