Introduction

In truth, bitcoin and the SP 500 are two investment options that have gained significant attention in recent years.

Bitcoin, operates on decentralized digital technology called blockchain, while the SP 500 is a stock market index. Because this index tracks the performance of 500 large companies listed on U.S. exchanges.

In this article, I will explore whether Bitcoin is a wise investment choice over the SP 500, in fact.

So, let’s jump into next section and read some facts, before I tell you the truth.

SP 500 and Cryptocurrency

When it comes to investing, individuals have traditionally turned to stocks, bonds, and other traditional assets.

However, with the rise of cryptocurrency, investors now have an alternative option. Cryptocurrency offers a decentralized and secure way to store and transfer value. It operates independently of any central authority, making it a unique investment choice.

On the other hand, the SP 500 represents a broad market index of large U.S. companies.

It is often used as a benchmark to assess the overall performance of the stock market. Investing in the SP 500 provides exposure to a diversified portfolio of companies across various sectors. Then you receive stability and potential returns.

So what do you think, bitcoin and sp 500 is it wise choice?

Is Cryptocurrency a Good Investment Option?

Whether cryptocurrency is a good investment option depends on various factors.

One of the key considerations is volatility. Cryptocurrency markets are known for their extreme price fluctuations. While this volatility can present opportunities for substantial gains, it also exposes investors to significant risks.

Additionally, the lack of regulation and the potential for fraudulent activities in the cryptocurrency space. Remember when there are not regulation it can make a risky investment. Because regulations make things more in control. Is it good or not?

However, proponents of cryptocurrency argue that it offers unique advantages, such as decentralization and the potential for high returns.

It also provides an opportunity for individuals to participate in a new and evolving technology.

Cryptocurrency can be an investment option for those who have a high-risk tolerance, but you can also develop HODL approach.

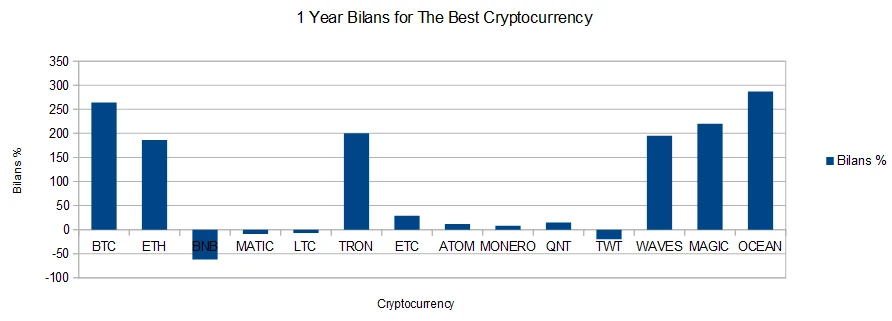

I actually presented the rates of return for 2023, when the market was not in full swing. Most of the selected cryptocurrencies achieved very good rates of return.

Bitcoin, Ethereum and TRON performed best among the largest market capitalizations.

Projects from the more risky category of investments related to artificial intelligence did equally well. Basically, only the OCEAN cryptocurrency did better, but…

Bitcoin is a reliable cryptocurrency and a significantly lower investment risk.

As I mention later, invest depending on your assets, experience, risk you can take and knowledge.

Although I should write about knowledge first.

You can read the entire report on rates of return for 2023 here.

Exploring Cryptocurrency Stocks

Investors interested in cryptocurrency but hesitant to directly invest in digital currencies themselves have the option to invest in cryptocurrency stocks.

These stocks are shares of companies that are involved in the cryptocurrency industry.

They offer a way to indirectly gain exposure to the potential growth of the cryptocurrency market without directly holding digital assets.

Cryptocurrency stocks can include companies involved in mining, trading platforms, and blockchain technology development.

Before investing in cryptocurrency stocks, it is essential to thoroughly research the company’s fundamentals and financials.

It is also crucial to understand the correlation between the company’s stock price and the overall performance of the cryptocurrency market.

Performance of Bitcoin Stocks

Bitcoin, the most well-known cryptocurrency, has seen significant price appreciation since its inception.

This has led to the emergence of bitcoin stocks, which are stocks of companies that have invested in bitcoin or are involved in bitcoin-related activities.

Analyzing the performance of bitcoin stocks can provide insights into the potential returns, in reality. Then, risks associated with investing in cryptocurrency.

Bitcoin stocks have experienced periods of substantial growth, driven by increased adoption and interest in bitcoin.

However, they have also faced significant volatility, mirroring the price fluctuations of bitcoin itself.

Investors considering investing in bitcoin stocks should carefully evaluate the company’s business model, financial health, and the overall market sentiment towards bitcoin.

Besides you can consider bitcoin ETFs as you investment approach. Both, companies from sector or cryptocurrency itself, indeed.

Really it happen in this year that cryptocurrency ETFs are available for so called traditional investors.

About last case I will write seperate article another time, because it is a lot to write about.

Before you will notice what is better bitcoin or sp 500 investment little bit think about it.

Cryptocurrency and SP 500 Performance

In fact, to assess whether cryptocurrency is a wise investment choice over the SP 500, it is important to compare their respective performances.

The SP 500 has historically delivered consistent returns over the long term, offering investors stability and the potential for gradual growth. On the other hand, cryptocurrency has shown the potential for rapid and substantial gains, but it is also prone to significant price corrections.

In recent years, cryptocurrency has outperformed the SP 500 in terms of percentage gains.

However, it is worth noting that cryptocurrency’s performance is often driven by speculative market sentiment. In case of SP 500’s performance is backed by the underlying fundamentals of the companies it represents.

Investors should consider their investment goals, risk tolerance, and time horizon when deciding between cryptocurrency and the SP 500.

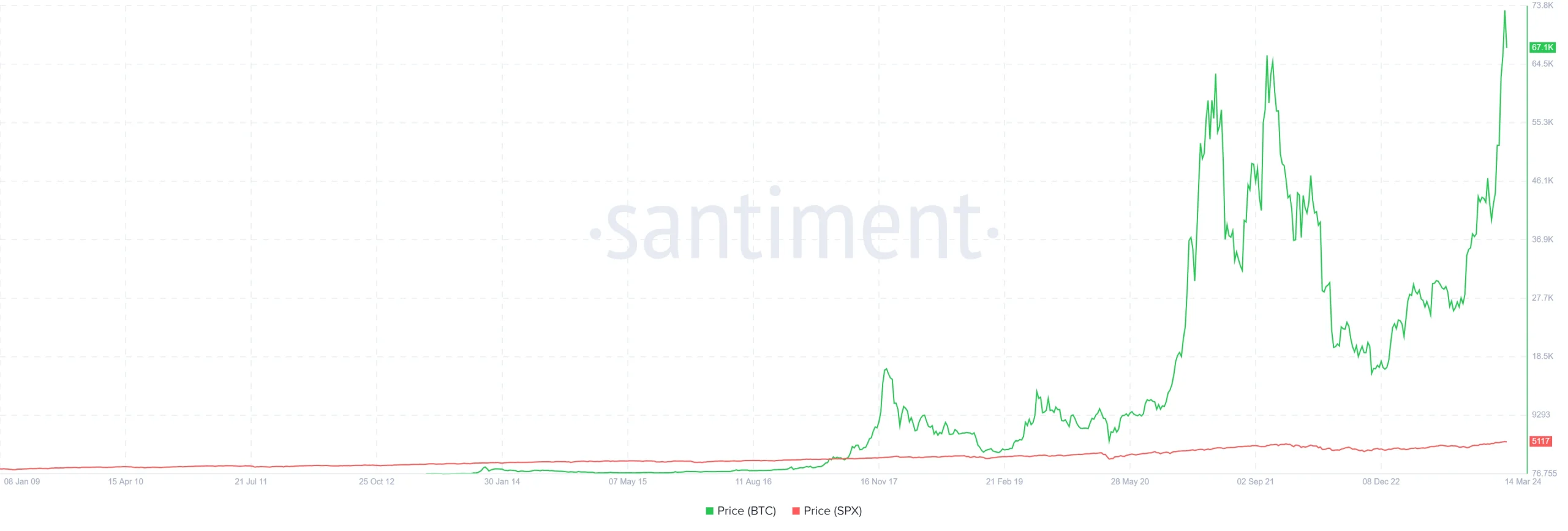

Indeed, the comparison of the rate of return between Bitcoin and the SP500 (SPX index) shows how fantastic Bitcoin investement is.

I don’t want to be misunderstood because SP500 represents the 500 best companies in the world’s largest economy.

The rates of return on SP 500 are on average 10% every year over the course of 10 years. It’s always a good investment!

However, if you can keep your cool, know the cryptocurrency market and the Bitcoin project, you suddenly realize…

Bitcoin is an investment for years and a huge opportunity. Is it Bitcoin better investment than SP 500 index?

Decide alone.

Bitcoin and SP500 and Gold in 10 Years

Not everyone will benefit from it, but young generations open to new technologies will certainly!

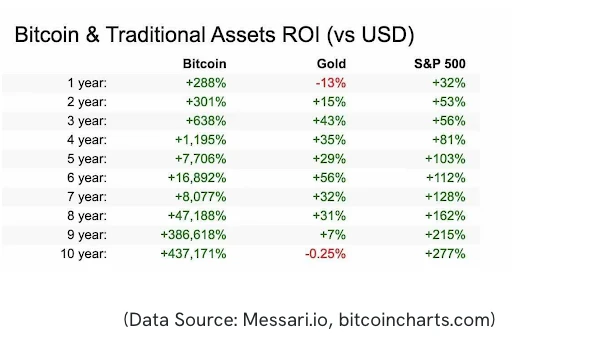

Additionally, I decided to quote this data to make it clear what kind of investment I am talking about. Bitcoin and SP 500 and gold on the chart.

Surely 10 years and the rates of return speak for themselves. Bitcoin is a brilliant investment in this respect, but with the highest risk.

SP 500 and a return rate of 10%, so not so bad and this investment is slightly less risky.

Gold is for those looking for diversification. Gold also has the longest investment history and many central banks invest large amounts of money in gold. Don’t underestimate this asset.

If you look at the numbers, Bitcoin is the winner here, but it is not for everyone.

Risks and Challenges of Investing in Cryptocurrency

Investing in cryptocurrency comes with its fair share of risks and challenges, at first.

One of the primary concerns is the high volatility of cryptocurrency prices, as a matter of fact. This volatility can lead to substantial gains, but it can also result in significant losses.

Additionally, the lack of regulation and oversight in the cryptocurrency market can make it susceptible to fraud and market manipulation.

Investors also face the risk of cybersecurity threats and the potential loss of their digital assets.

Hacks and scams targeting cryptocurrency holders have become increasingly prevalent. It is crucial to take necessary precautions, such as using secure wallets and following best practices for storing and securing digital assets.

To be completely fair, I must encourage you to read the article about cryptocurrency scams.

It is true that cryptocurrencies bring high rates of return, but also huge losses.

The cryptocurrency market is also a place where there are a lot of fraudsters and scams. Read about it in the article what is a Ponzi scheme.

Benefits and Drawbacks of Investing in the SP 500

Without a doubt, investing in the SP 500 offers several benefits.

Firstly, it provides exposure to a diversified portfolio of established companies across various sectors.

Secondly, this diversification helps mitigate individual company risk and provides stability to the investment. Additionally, the SP 500 has a long track record of delivering consistent returns over the long term.

However, investing in the SP 500 also has its drawbacks. The performance of the index is dependent on the overall health of the U.S. economy.

In times of economic downturns, the value of the SP 500 can decline, but…

Additionally, investing in the SP 500 requires a long-term approach, as short-term market fluctuations can impact returns.

Choosing Between Cryptocurrency and the SP 500

When choosing between cryptocurrency and the SP 500, several factors should be taken into account.

Firstly, investors should assess their risk tolerance. Cryptocurrency is a high-risk, high-reward investment, while the SP 500 offers a more stable and predictable return profile.

Additionally, investors should consider their investment goals, time horizon, and the level of knowledge and understanding they have in the respective asset classes.

Another crucial factor is diversification. Combining investments in cryptocurrency, like bitcoin and the SP 500 can provide a balanced portfolio that captures the potential growth of cryptocurrency while benefiting from the stability of the stock market.

Diversification helps spread risk and can help investors achieve a more balanced and resilient investment strategy.

Cryptocurrency as an Investment Choice

Indeed, opinions on whether cryptocurrency is a wise investment choice vary among experts.

Without a doubt, some experts see the potential for significant returns in the cryptocurrency market. While others raise concerns about its volatility and lack of regulation. It is important to gather insights from a variety of sources, because then you are more sure.

Finally, consider both the positive and negative aspects of investing in cryptocurrency.

The truth is always in between in reality.

Experts often advise investors to approach cryptocurrency with caution and to only invest what they can afford to lose. Overall, this approach is helpful in case of huge volatility.

It is also recommended to stay informed about the latest developments in the cryptocurrency market, because then you continuously assess the investment thesis for holding cryptocurrency. Is not the point of confirming the validity of your investments by observing trends and sentiment in general?

Conclusion

In conclusion, the decision to invest in cryptocurrency, especially bitcoin and the SP 500 requires careful consideration. Before you invest better understand the risks and potential rewards. Cryptocurrency offers the potential for high returns but comes with significant volatility and risks, for sure.

The SP 500 provides stability and a long-term track record of delivering consistent returns, in fact.

Investors should assess their risk tolerance, investment goals, and time horizon when deciding between bitcoin and the SP 500.

Leave a Reply

You must be logged in to post a comment.