Introduction

Indeed, investors are constantly seeking new avenues to diversify their portfolios and maximize returns. Without a doubt, two investment assets that have gained significant popularity in recent years are bitcoin and gold.

Bitcoin, refers to digital or virtual currency that use cryptography for security, in fact.

At the same time, gold has been a traditional store of value for centuries and is considered a safe-haven asset.

In this article, I will explore the differences between bitcoin and gold, but will not stop there.

Then, I will analyze their historical performance, weigh the pros and cons of investing in each. Finally, I explore the factors to consider when choosing between the two.

It’s really exciting, isn’t it?

Differences Between Bitcoin and Gold

Bitcoin and gold may both be investment assets, but they possess distinct characteristics that set them apart.

Bitcoin, being a digital currency, operates on blockchain technology, which enables secure and decentralized transactions. It offers the potential for high returns, driven by its volatility and the rapid growth of the blockchain industry.

Gold, on the other hand, is a tangible asset that has stood the test of time. It is often seen as a safe-haven during times of economic uncertainty, as it holds intrinsic value and is not subject to the same volatility as bitcoin.

Understanding these differences is crucial for investors to make informed decisions based on their risk appetite and investment goals.

Without a doubt, Bitcoin and gold constitute a different asset class.

Both of these assets are a good way to diversify your investment portfolio, but more on that later.

One could say that cryptocurrencies are for risk-takers, but… not entirely.

Either way, the risk is much higher than with gold. Bad investment assumptions in both cases can lead to zero or significant reduction of capital.

Historical Performance of Bitcoin and Gold

Firstly, to assess the performance of bitcoin and gold, it is essential to look at their historical data.

Bitcoin, with its relatively short existence, has experienced significant price fluctuations, as a matter of fact. Bitcoin, the most well-known cryptocurrency, has witnessed both meteoric rises and sharp declines.

Its value surged to unprecedented heights in 2017, only to experience a subsequent crash.

Gold, on the contrary, has maintained a relatively stable value over the centuries. It has served as a hedge against inflation and currency devaluation, preserving wealth for generations.

While bitcoin may offer the potential for higher returns, it also carries a higher level of risk compared to gold.

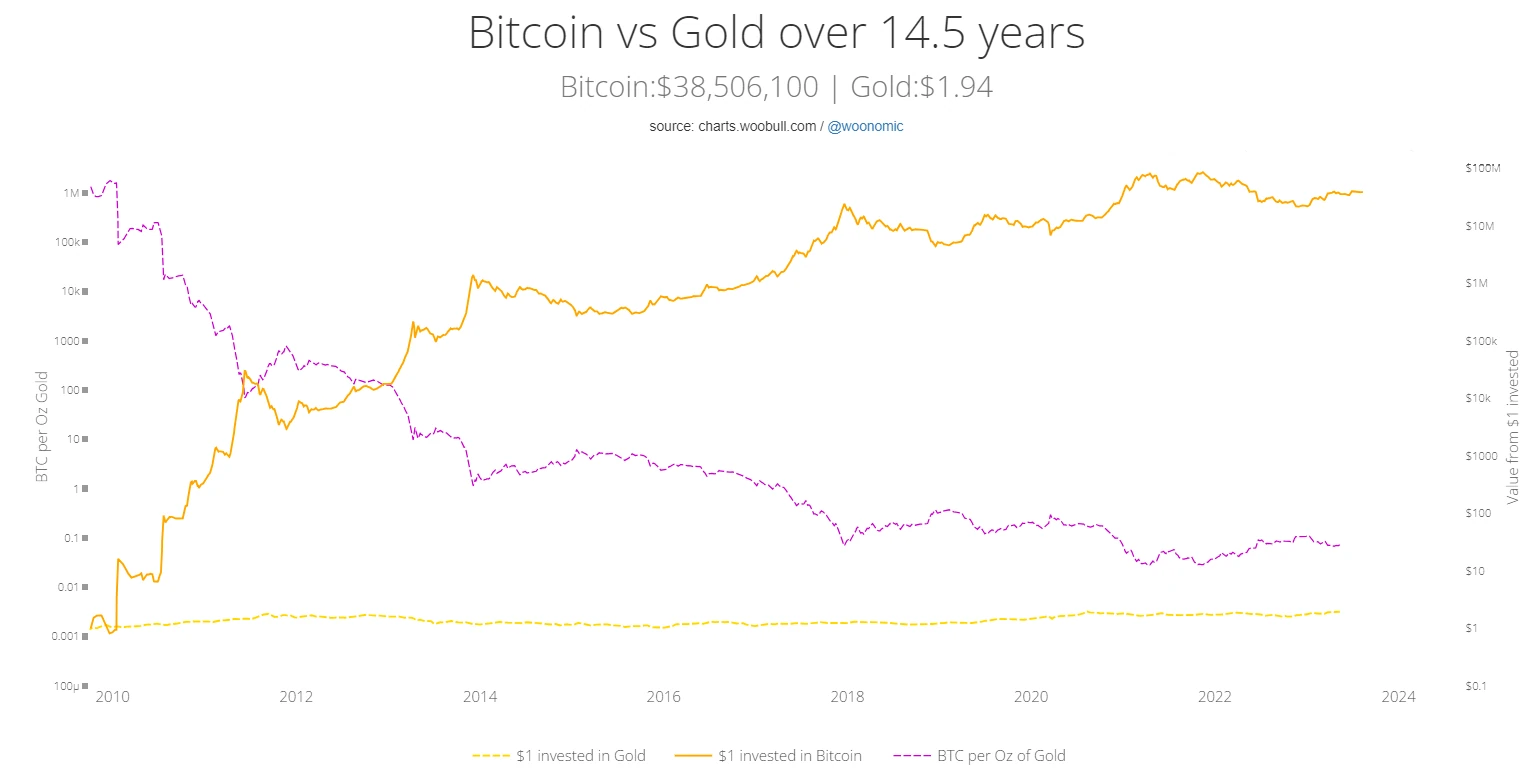

As Willy Woo perfectly demonstrates based on his analyses, you can clearly see how brilliant Bitcoin is as an investment asset.

$1 invested at the beginning of the project brings $38,500 in profit!

In the case of gold, it is almost $2. The investment horizon is 14.5 years.

Anyone who was on the cryptocurrency market at its beginnings or had a friend who learned about Bitcoin is lucky.

The times when Bitcoin cost less than $1 will no longer come back. You can only dream.

Either way, is Bitcoin consistently a good asset to invest in? Is it better to stay invested in gold?

Pros and Cons of Investing in Bitcoin

Investing in bitcoin comes with its own set of advantages and disadvantages.

On the positive side, bitcoin offers the potential for high returns. The rapid growth of the blockchain industry and the increasing adoption of cryptocurrencies by mainstream institutions indicate a promising future.

Additionally, bitcoin provides investors with opportunities for diversification, as there are numerous cryptocurrencies available for investment. However, there are also drawbacks to consider.

The extreme volatility of the crypto market can lead to substantial losses if not managed properly.

Furthermore, the regulatory landscape surrounding cryptocurrencies is still evolving, which may introduce uncertainties and risks for investors.

Pros and Cons of Investing in Gold

Gold has long been regarded as a safe-haven asset, and for good reason.

One of the main advantages of investing in gold is its stability. It has a track record of preserving wealth during times of economic downturns and market volatility.

Gold also serves as a hedge against inflation, as its value tends to rise with the decrease in the purchasing power of fiat currencies.

Moreover, it is a tangible asset that can be held physically, providing a sense of security for investors.

However, gold also has its limitations. It does not offer the same potential for high returns as bitcoin, and its market liquidity may be lower compared to other investment assets.

When Choosing Between Bitcoin and Gold

When deciding between bitcoin and gold as investment assets, several factors need to be taken into account.

Firstly, risk tolerance plays a crucial role. Bitcoin, being highly volatile, requires investors who are comfortable with the potential for large swings in value.

On the other hand, gold provides stability and is better suited for risk-averse individuals.

Secondly, investment goals and time horizon should be considered. If an investor is seeking short-term gains and is willing to take on higher risks, bitcoin may be more suitable.

However, for long-term wealth preservation and stability, gold may be the preferred choice.

Lastly, the regulatory environment and market conditions should be carefully analyzed to gauge the potential risks and opportunities associated with each investment asset.

Comparing the Volatility of Bitcoin and Gold

Volatility is a crucial aspect to consider when comparing bitcoin and gold.

Bitcoin, known for their price volatility, can experience rapid and substantial price swings within short periods. This volatility can be attributed to various factors such as market sentiment, regulatory announcements, and technological advancements.

Gold, however, is relatively stable and does not exhibit the same level of volatility as bitcoin. While some investors may embrace the high-risk, high-reward nature of bitcoin, others may prefer the stability and predictability of gold.

Understanding the volatility of each asset class is essential for investors to align their investment strategies with their risk appetite.

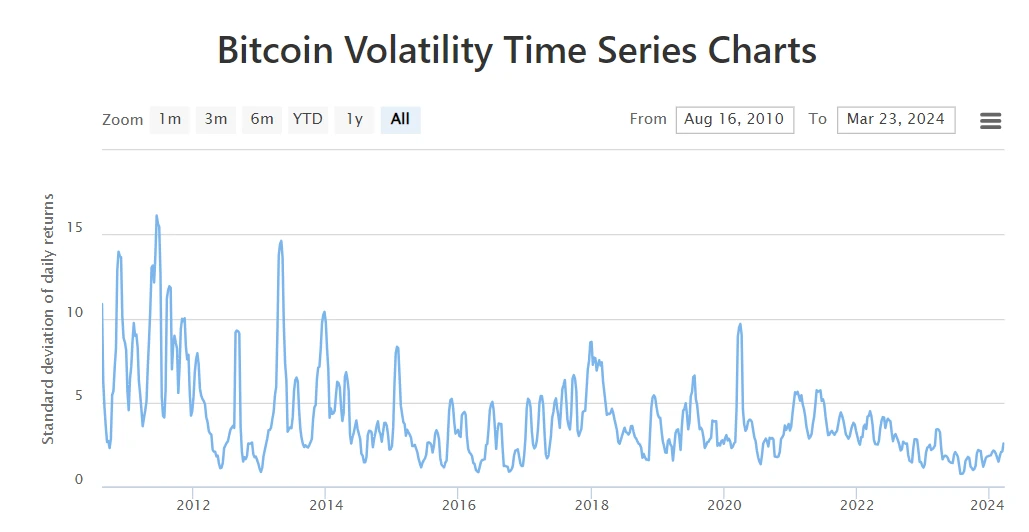

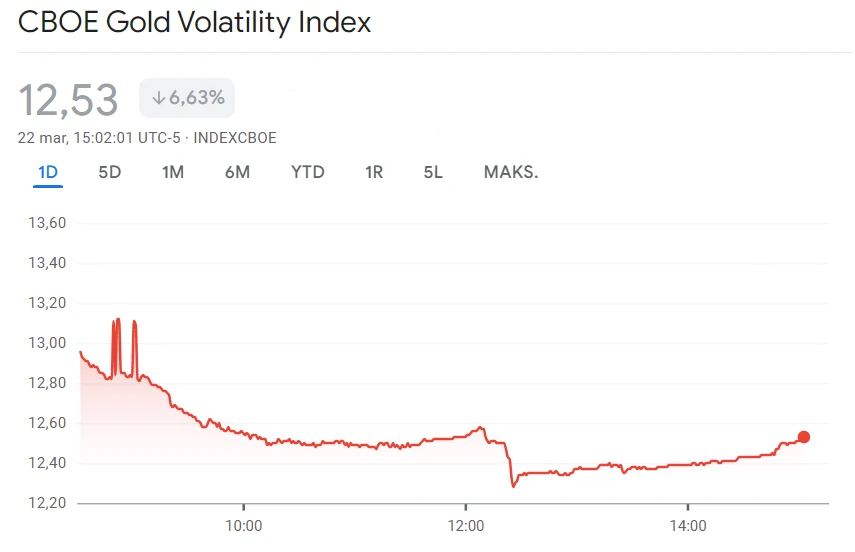

Bitcoin is a highly volatile asset. The index shows this perfectly.

The price volatility of this asset can fluctuate by 15% of the price during the day. As the market matures, price volatility decreases.

Changes in the price of gold are much smaller than those of bitcoin. Today you can observe a 6.63% price change.

This does not mean that gold is a perfect investment.

It is a steadily growing asset with solid foundations. It is also treated as a safe haven by central banks around the world.

Bitcoin and Gold Efficiency

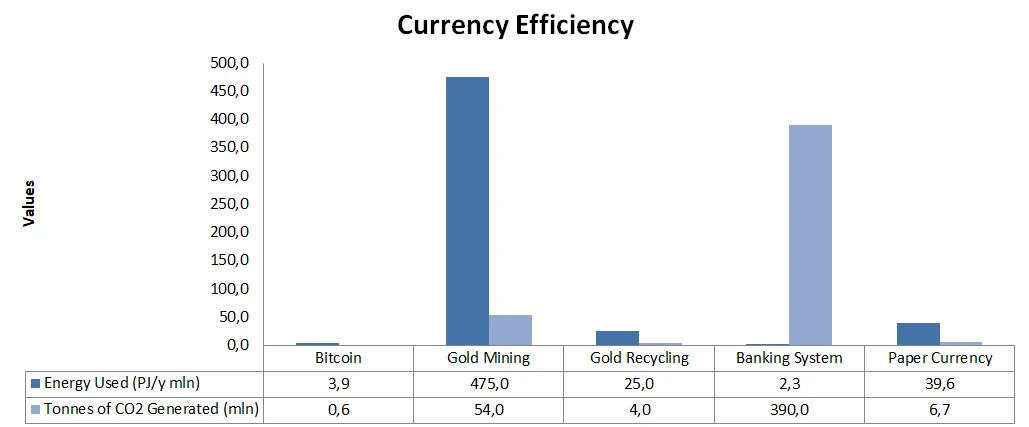

In this paragraph, I decided to write a few words about the effectiveness of the currency.

I based my conclusions on research conducted by the Research Gate website.

Although the data comes from 2020, not much has changed in favor of gold since then. For the rest, take a look at the graphics I generated based on the data.

Bitcoin both uses less energy than gold and… It is less harmful to the environment.

The issues of carbon dioxide released into the atmosphere by industry are very topical.

Bitcoin emits less carbon dioxide than mining gold or producing paper for money. I won’t comment on the banking system itself.

The Role of Diversification

Diversification is a fundamental principle of investment portfolio management.

By spreading investments across different asset classes, investors can reduce the overall risk of their portfolios.

Both bitcoin and gold can play a role in diversification.

Bitcoin offers the potential for high returns and low correlation with traditional assets, making it an attractive addition to a diversified portfolio.

Gold, usually, acts as a hedge against market volatility and can provide stability during economic downturns. Including both bitcoin and gold in a portfolio can help mitigate risks and capture potential opportunities in different market conditions.

Diversification in investments is very important and there is no point in even discussing it, at first.

However, there are many approaches an investor can take.

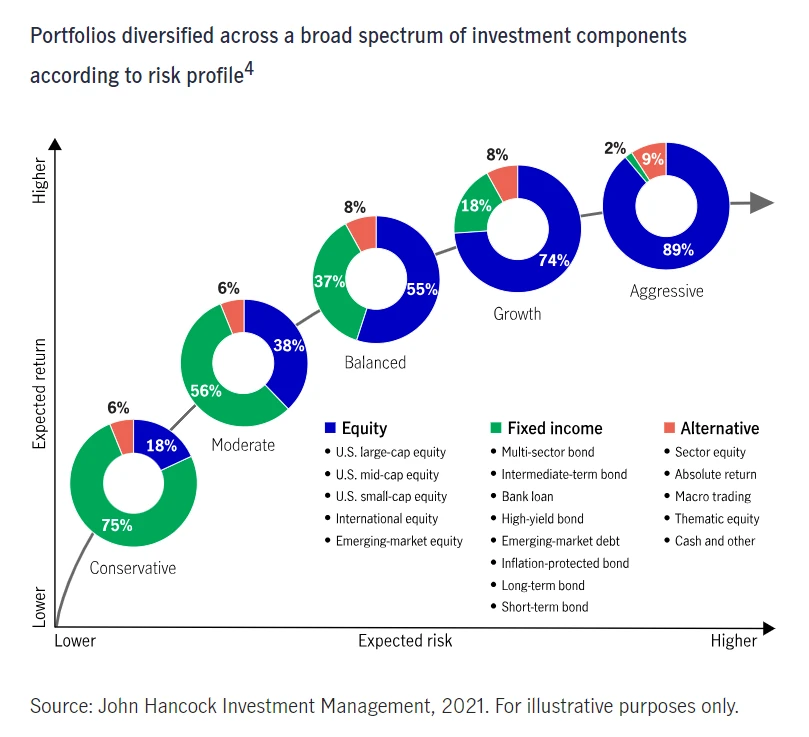

The graphics show the entire spectrum. From a conservative investor to an aggressive investor, but…

What is important, reader, is to observe one thing…

Various asset classes should be included in your portfolio.

Finally, cryptocurrencies and gold should be classified in the Alternative category. Also, do not attach such exact importance to the percentage division of assets in the graphics.

Your approach may be completely different. The graphic is provided only to show portfolio diversification.

Expert Opinions on Bitcoin vs Gold

Experts in the investment industry have varying opinions on the battle between bitcoin and gold.

Some argue that bitcoin represents the future of finance, with its potential to disrupt traditional banking systems and revolutionize transactions.

They believe that the blockchain technology behind bitcoin will transform industries and create new investment opportunities.

Others, however, caution against the risks associated with bitcoin and crypto, citing its volatility and regulatory uncertainties.

They argue that gold, with its long-standing history and stability, will continue to be a valuable asset for wealth preservation.

Ultimately, the choice between bitcoin and gold depends on individual perspectives, risk appetite, and investment objectives.

Regardless of what experts think, you should know for yourself whether Bitcoin or gold is better for you.

Gold means stability and years of history. This destroys part of the financial system on which the dollar was based.

Cryptocurrencies are modern, uncertain, with not many years of proven history.

But does this mean that bitcoin may not be part of the financial system in the future?

In my humble opinion, this only means that…

One asset is older, and this one is trugie, i.e. Bitcoin is the future.

Look at the article again and draw your own conclusions.

As the author, I tried to present the data as objectively as possible so that it would not turn out that I am against gold.

No, I’m not and I never was.

Conclusion

Surely, in the battle between bitcoin and gold, there is no clear winner that reigns supreme.

Both investment assets offer unique advantages and disadvantages, and the choice ultimately depends on individual circumstances.

Bitcoin provides the potential for high returns and diversification opportunities, but it also carries higher risks and uncertainties.

Gold, on the other hand, offers stability and has a proven track record as a safe-haven asset, but it may not yield the same level of returns as bitcoin.

Investors should carefully consider their risk tolerance, investment goals, and the overall market conditions when deciding between bitcoin and gold.

Ultimately, a well-diversified portfolio may include both assets, leveraging the strengths of each to optimize returns and mitigate risks.

Leave a Reply

You must be logged in to post a comment.