Introduction

Indeed, bitcoin have revolutionized the financial landscape, offering a new way to store, transfer, and invest money. Unlike traditional assets bitcoin is digital currency that operate on decentralized networks called blockchain.

Everything start with Bitcoin in 2009, surely. Because, this asset was created by an anonymous person or group using the pseudonym Satoshi Nakamoto. About Bitcoin you can read a lot.

Since the introduction of Bitcoin, thousands of other cryptocurrencies, collectively known as altcoins, have been developed.

Furthermore, each cryptocurrency operates on its own blockchain, with varying features and use cases. Some popular altcoins include Ethereum, Ripple, and Litecoin.

Let’s read more about bitcoin and another assets. Then compare them a bit.

Understanding Traditional Assets

Before delving into the world of bitcoin, it is essential to understand traditional assets. I will write little about their role in the financial ecosystem. Traditional assets encompass a wide range of investment options, including stocks, bonds, real estate, and commodities. These assets have long been the cornerstone of investment portfolios, providing stability and potential returns.

Stocks represent ownership shares in a publicly traded company, allowing investors to profit from the company’s performance and growth. Bonds, on the other hand, are debt instruments issued by governments and corporations to raise capital. Investing in real estate involves buying properties or shares in real estate investment trusts (REITs).

Commodities like gold, oil, and agricultural products are tangible assets that hold intrinsic value. They are often used as hedges against inflation and geopolitical uncertainties. Traditional assets are typically regulated by government authorities and traded on established exchanges.

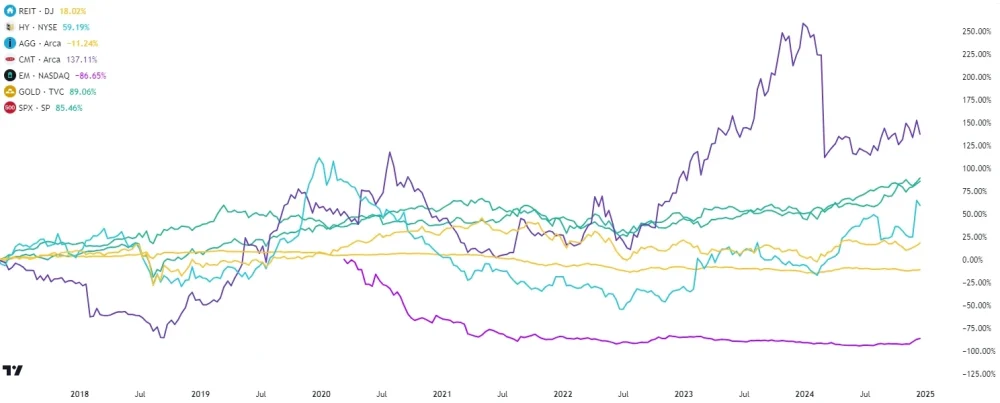

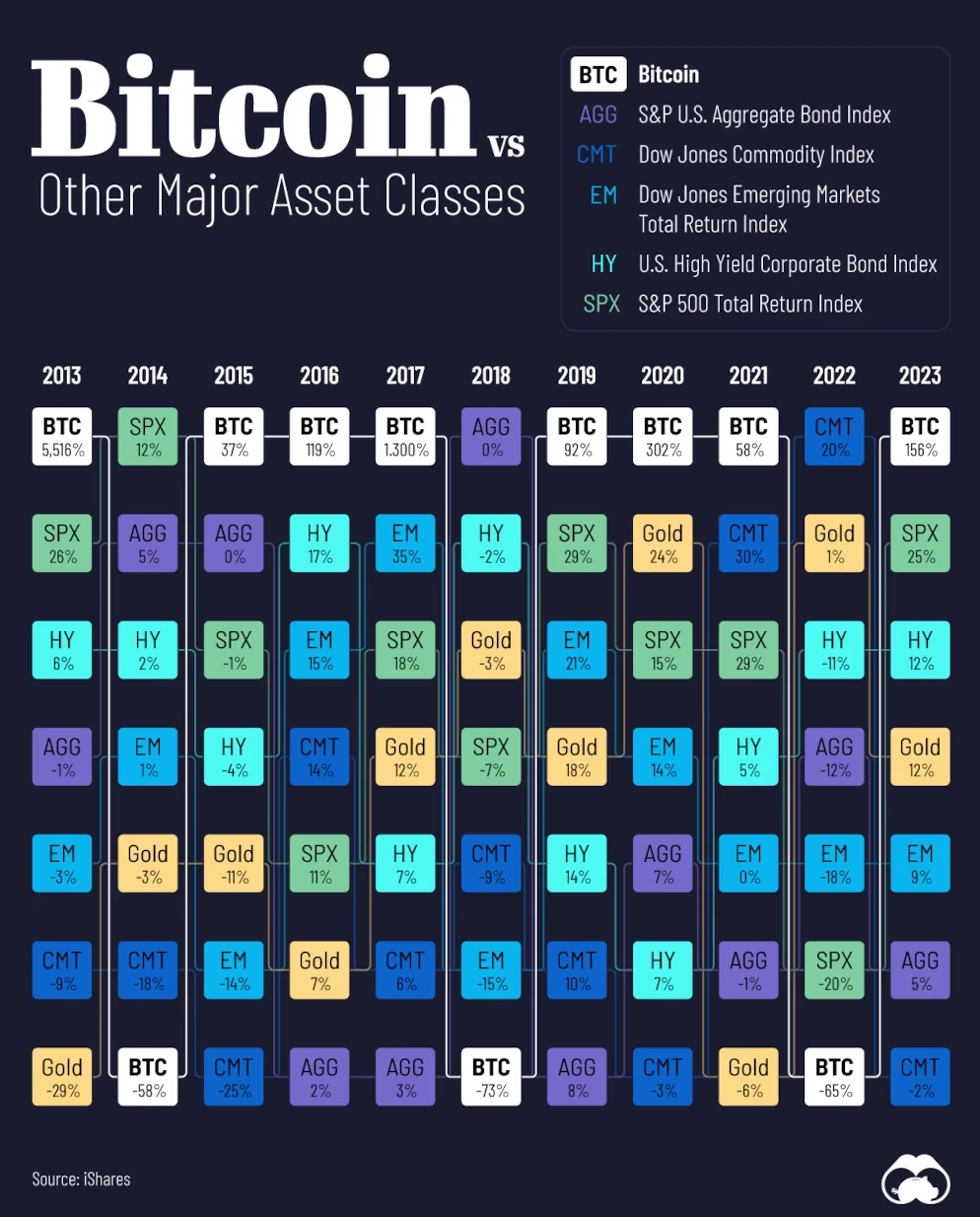

Indeed, over the last 5 years, 4 indices have performed really well.

They were CMT, gold, SPX and HY, respectively.

Let me just remind you that CMT stands for Down Jones Commodity Index.

Gold is the gold index, SPX is the S&P 500 Total Return Index, and HY is the U.S. High Yield Corporate Bond Index.

However, I have not yet presented what rates of return could be obtained with bitcoin, because more on that in a moment.

Bitcoin and Traditional Assets

Now that we have a basic understanding of bitcoin and traditional assets. Then, let’s compare their key characteristics and analyze their potential as investment vehicles.

One significant difference between bitcoin and traditional assets is their underlying technology. Bitcoin operate on blockchain technology, offering transparency, immutability, and security. Traditional assets, on the other hand, rely on centralized systems and intermediaries, which can be prone to manipulation and fraud.

In terms of liquidity, traditional assets have a long-established market with high trading volumes. It making it easy to buy and sell.

In case of Bitcoin is similar, but less well-known cryptocurrencies can have problem with it.

However, liquidity in the cryptocurrency market has been improving over time.

Another aspect to consider is volatility. Bitcoin is notorious for its price volatility, with significant price swings occurring in short periods. Traditional assets, while not immune to market fluctuations, generally exhibit more stable price behavior. This volatility can present both opportunities and risks for investors and traders.

The Rise of Bitcoin

Bitcoin, the first and most well-known cryptocurrency, has experienced a remarkable rise in popularity and value since its inception.

Initially dismissed by skeptics, Bitcoin has proven its resilience and disruptive potential. Let’s explore some key factors that have contributed to the rise of Bitcoin.

One of the main reasons for Bitcoin’s success is its decentralized nature. Unlike traditional currencies that are controlled by central banks, Bitcoin operates on a peer-to-peer network, giving users full control over their funds. This decentralization resonates with individuals seeking financial sovereignty and privacy.

Additionally, Bitcoin’s limited supply and the process of mining new coins have contributed to its value appreciation. Bitcoin has a maximum supply of 21 million coins, making it a scarce asset. As more people adopt Bitcoin, the demand increases, driving its price up.

Bitcoin has also gained attention as an alternative investment and hedging tool. During times of economic uncertainty, some investors turn to Bitcoin as a safe haven asset. Its decentralized nature and the absence of correlation with traditional markets make it an appealing diversification option.

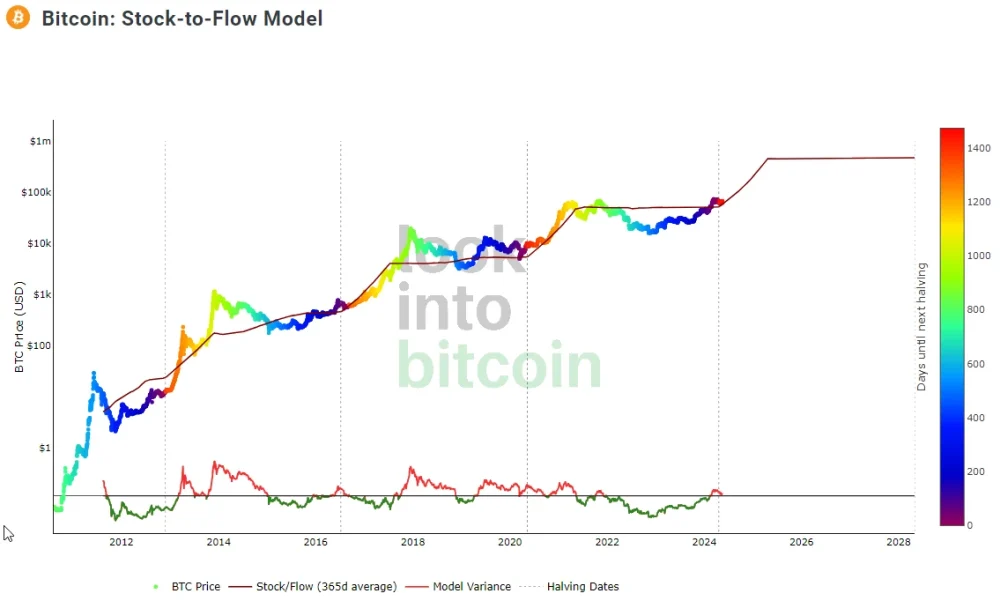

First of all, bitcoin faithfully imitates the stock to flow model, i.e. the demand and supply model of this asset on the market.

Secondly, remember that this is just a model. These are only intended to approximate reality.

Thirdly, if psychological factors are additionally taken into account, it is difficult to determine how wrong the model will be in presenting the price of bitcoin in this and subsequent bull markets.

Benefits of Investing in Bitcoin

Investing in bitcoin offers several advantages that traditional assets may not provide. Let’s explore some of the key benefits that attract investors to the cryptocurrency market.

Firstly, bitcoin offer the potential for significant returns. The volatile nature of the market allows for substantial price appreciation in short periods. Investors who enter the market at the right time can see their investments multiply multiple times over.

Secondly, investing in bitcoin provides access to decentralized and in the same time, global market.

Traditional assets are often subject to regional restrictions and regulations, limiting investment opportunities. Bitcoin, on the other hand, can be traded globally, allowing investors to diversify their portfolios and tap into emerging markets.

Another advantage is the ease of entry into the cryptocurrency market.

Unlike traditional assets that often require large capital investments or complex procedures, bitcoin can be bought and sold with minimal barriers. This accessibility has democratized investing, opening up opportunities for individuals who were previously excluded from traditional financial markets.

Investing in Bitcoin

While investing in bitcoin can be lucrative, but it is crucial to understand and manage the risks and challenges. Let’s examine some of the key risks that investors should be aware of.

First and foremost, the cryptocurrency market is highly volatile. Prices can fluctuate dramatically within short periods, leading to significant gains or losses. This volatility can be attributed to various factors, including market sentiment, regulatory developments, and technological advancements.

Another risk is the prevalence of scams and fraudulent activities in the cryptocurrency space. Due to the decentralized nature of bitcoin and the lack of regulatory oversight. It is essential to conduct thorough research and exercise caution when investing in lesser-known cryptocurrencies or participating in initial coin offerings (ICOs).

Regulatory uncertainty is another challenge faced by the cryptocurrency market. Governments around the world are still grappling with how to regulate and classify cryptocurrencies. Regulatory actions or statements can have a significant impact on the market, leading to price volatility and uncertainty.

Predictions for Bitcoin

The cryptocurrency market has witnessed significant trends and developments over the years, shaping its future trajectory. Let’s explore some of the notable market trends and predictions for cryptocurrencies.

One prominent trend is the institutional adoption of cryptocurrencies. Traditional financial institutions, such as banks and asset management firms, are recognizing the potential of cryptocurrencies and blockchain technology. This institutional involvement is expected to bring more liquidity and stability to the market.

Another trend is the integration of cryptocurrencies into mainstream payment systems. Several companies and platforms now accept cryptocurrencies as a form of payment, enhancing their utility and acceptance. This trend is likely to continue as cryptocurrencies become more widely recognized as a legitimate means of exchange.

In terms of predictions, many experts believe that cryptocurrencies will continue to gain prominence and value in the coming years. The growing interest from institutional investors and the increasing adoption of cryptocurrencies by individuals and businesses are expected to drive the market forward. However, it is important to note that the market is still relatively young and unpredictable, making it essential to approach investments with caution.

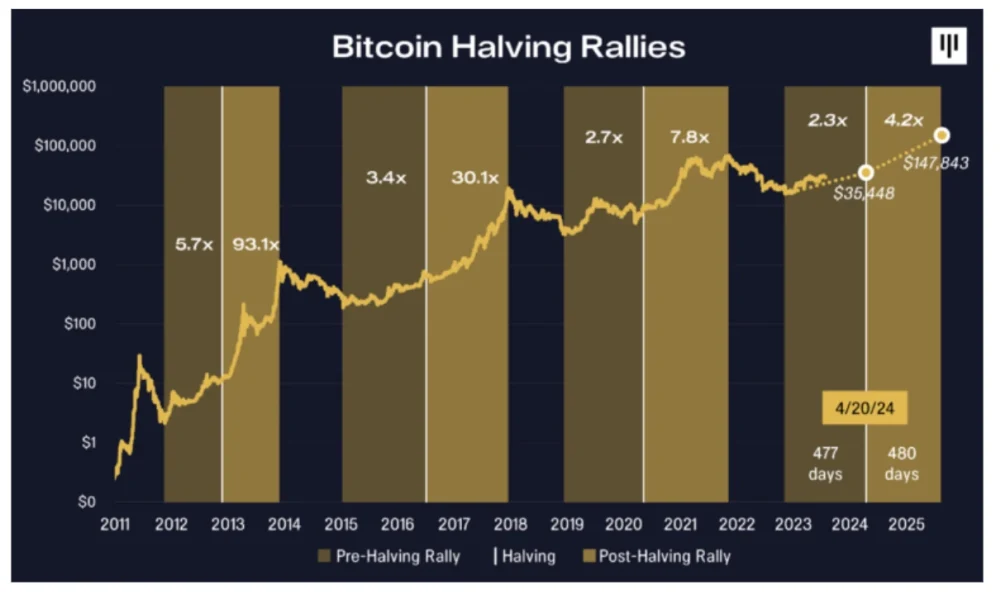

In total, a month ago we witnessed 4 halvings on Bitcoin. This bull market is a bit different than the previous ones.

This does not change the fact that we are somewhere at the beginning of a truly aggressive Bitcoin bull market.

According to analysts, the peak price may reach USD 120,000-140,000 per unit.

It should be added that this is a conservative approach to rates of return.

True dreamers will talk and write about $300-500 thousand per unit, but in this bull market it is unlikely. But next time it’s quite possible.

Bitcoin and Others Crypto

While there are thousands of cryptocurrencies in the market, some have gained significant popularity and recognition. Let’s take a closer look at the most popular cryptocurrencies, starting with Bitcoin.

Bitcoin (BTC)

Bitcoin, often referred to as digital gold, is the first and largest cryptocurrency by market capitalization. It has established itself as the leading digital currency and a store of value. Bitcoin’s decentralized nature and limited supply make it an attractive investment option.

Ethereum (ETH)

Ethereum is a decentralized platform that enables the creation of smart contracts and decentralized applications (dApps). It introduced the concept of programmable blockchain, allowing developers to build and deploy their applications on the Ethereum network. Ethereum’s native cryptocurrency is called Ether.

Ripple (XRP)

Ripple is a digital payment protocol that enables fast, low-cost international money transfers. It aims to revolutionize the traditional banking system by providing real-time settlement and liquidity solutions. XRP is the cryptocurrency used within the Ripple network.

Litecoin (LTC)

Litecoin is often referred to as the silver to Bitcoin’s gold. It was created as a faster and more lightweight alternative to Bitcoin. Litecoin offers faster transaction confirmation times and a different hashing algorithm, making it attractive for everyday transactions.

Bitcoin and Traditional Assets

Bitcoin and traditional assets differ in various aspects, making them unique investment options. Let’s compare Bitcoin with some traditional assets to understand their differences and benefits.

Bitcoin vs. Stocks

Bitcoin and stocks represent different investment philosophies. Stocks represent ownership in a company and provide a share of its profits. Bitcoin, on the other hand, is a purely decentralized digital currency that operates independently of any company or government.

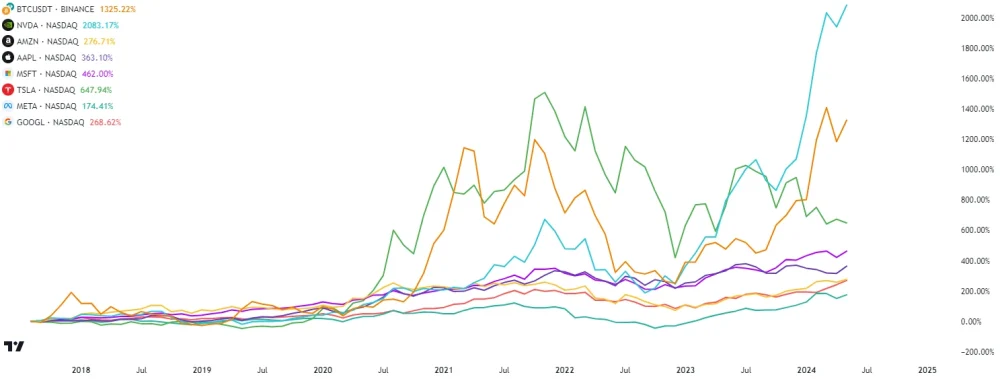

To show competitiveness, I compared the last 5 years of Magnificent 7 with Bitcoin.

Only Nvidia shares, thanks to the boom in artificial intelligence, have surpassed bitcoin’s rates of return.

This statistic is also true for a longer investment window.

By the way, only Tesla shares were in third place. However, it is already losing a lot to Bitcoin and Nvidia itself.

Bitcoin vs. Real Estate

Real estate is a tangible asset that provides rental income and potential capital appreciation. Bitcoin, being a digital asset, does not provide direct rental income. However, it can be a hedge against inflation and a store of value in times of economic uncertainty.

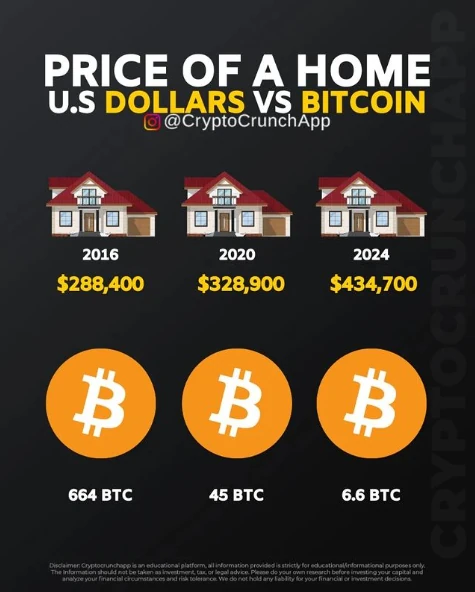

In 2016, approximately 660 Bitcoins were needed to buy real estate in the United States.

After almost 8 years, 6.6 Bitcoins are needed to realize the dream of buying your own property.

Let us remember, however, that the peak of the bull market is still ahead of us.

Bitcoin vs. Bonds

Bonds are fixed-income instruments that pay periodic interest to investors. Bitcoin does not provide a fixed income stream but offers the potential for price appreciation. Bitcoin’s limited supply and decentralized nature differentiate it from bonds.

In the case of bonds, I won’t use any graphics because they have had little to no returns for the last few years.

All this is due to the lack of people willing to invest in such assets.

The debt of the world’s leading economies has reached dangerously high levels!

Bitcoin vs. Gold

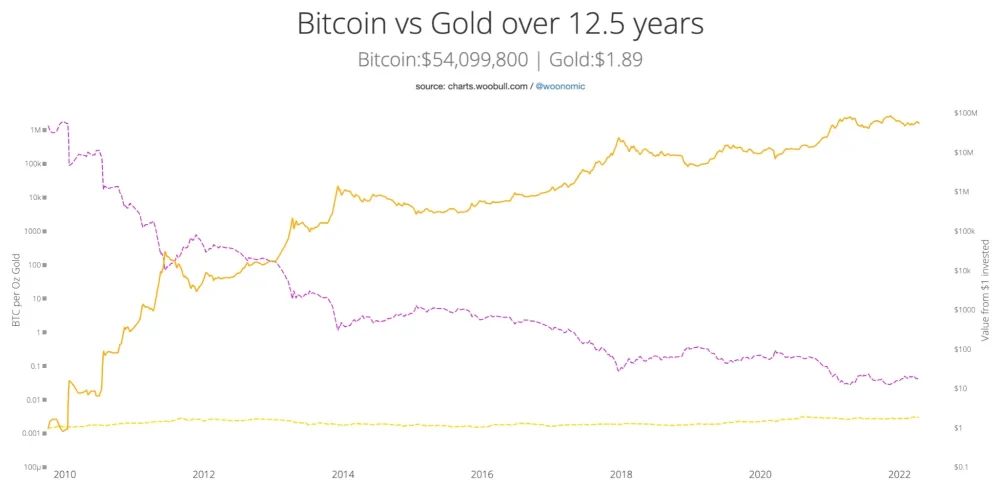

Both Bitcoin and gold can be considered as stores of value and hedges against inflation. However, Bitcoin offers additional advantages such as ease of transfer, divisibility, and the ability to be stored digitally. Gold, on the other hand, has a long history as a physical store of value.

This halving was very important in case of inflation of bitcoin asset.

Bitcoin has become the number one asset in terms of inflation. Gold lost its first place status.

In fact, if there is a bear market in the crypto market, Bitcoin loses compared to other popular indices.

In 2013, the SPX index performed best, in 2018 it was the AGG index, and in 2022 it was the CMT index.

Any other years, Bitcoin returns were the highest.

Over the next 2 years, it will be difficult to find an asset that behaves similarly to Bitcoin.

Conclusion

In conclusion, cryptocurrencies have emerged as a powerful force in the financial world, offering unique advantages and challenges.

In fact, traditional assets, with their long-established track record and stability, continue to play a significant role in investment portfolios. The future of bitcoin and traditional assets is likely to be intertwined, with both coexisting and complementing each other.

Leave a Reply

You must be logged in to post a comment.