Introduction

Cryptocurrencies have taken the financial world by storm, and more people are looking to build the best crypto portfolio. I’ve seen the crypto market grow and change, with new coins and tokens popping up all the time. It’s exciting, but it can also be overwhelming. That’s why you need to know about how to make a smart and diverse crypto portfolio.

I am going to cover some key points to help you create a strong crypto portfolio.

First, I’ll look at what market caps mean in the crypto world. Then, we’ll discuss the 80/20 rule and how it applies to crypto. I’ll also explore different types of cryptocurrencies and how to mix them up in your portfolio.

Lastly, I’ll talk about how to keep your portfolio balanced over time. By the end, you’ll have a better idea of how to build a crypto portfolio that works for you.

Please read it and leave comment!

What are Crypto Market Caps?

When we talk about the best crypto portfolio, it’s crucial to understand market caps.

Market cap is a way to measure how big a cryptocurrency is in the market. To figure out a coin’s market cap, we multiply the number of coins that exist by the price of one coin. This gives us a good idea of the overall size and value of a cryptocurrency.

Market caps help us compare and rank different cryptocurrencies. They’re like a measuring stick that shows us how important a coin is in the crypto world. Let’s break down the different types of market caps and what they mean for your crypto portfolio.

Large-cap Cryptocurrencies

Large-cap cryptocurrencies are the big players in the crypto market. These are the coins with market caps above $10.00 billion. Think of names like Bitcoin, Ethereum, and Tether. These coins are well-known and have been around for a while.

Investing in large-cap cryptocurrencies can be a good way to build a strong base for your portfolio. They’re often seen as more stable compared to smaller coins. This doesn’t mean they don’t go up and down in price, but they tend to be less wild in their movements.

Many people choose to hold onto large-cap cryptocurrencies for a long time. This strategy is often called “hodling” in the crypto world. The idea is that these big coins have a good track record and are more likely to stick around in the long run.

Mid-cap Cryptocurrencies

Mid-cap cryptocurrencies fall in the middle range. Their market caps are usually between $1.00 billion and $10.00 billion. Some examples are Polygon, Cardano, and Litecoin.

These coins can be interesting for your portfolio because they offer a mix of stability and growth potential. They’re not as big as the large-caps, but they’re not tiny either. This means they might have more room to grow, but they also come with more risk.

When looking at mid-cap cryptocurrencies, it’s important to do your homework. Look into what the project does, who’s behind it, and how it’s being used. These coins can offer good opportunities, but you need to be careful and pick wisely.

Small-cap Cryptocurrencies

Small-cap cryptocurrencies have market caps under $1.00 billion. These are the smaller players in the crypto world. They can be new projects or coins that haven’t caught on yet.

Investing in small-cap cryptocurrencies is riskier, but it can also lead to bigger rewards. These coins can have big price swings, both up and down. A small change in the market can have a big effect on their price.

When you’re thinking about adding small-cap cryptocurrencies to your portfolio, be ready for a wild ride. These investments are more like betting on potential than investing in something stable. It’s important to only invest what you can afford to lose in these riskier coins.

To make a diverse crypto portfolio, you might want to mix these different types of cryptocurrencies. You could have some large-caps for stability, some mid-caps for growth potential, and maybe a small amount in small-caps if you’re feeling adventurous. This way, you’re spreading out your risk while still giving yourself a chance for good returns.

Remember, the crypto market changes fast. A coin that’s small today could become big tomorrow, or a big coin could lose value quickly.

That’s why it’s important to keep an eye on your investments and be ready to make changes when needed.

The 80/20 Rule for Crypto Portfolio

When we talk about building the best crypto portfolio, the 80/20 rule is a smart way to think about how to spread out our investments.

This rule, also known as the Pareto Principle, suggests that 80% of the results come from 20% of the causes. In the crypto world, we can use this idea to help us make better choices about where to put our money.

Let’s break down how we can use the 80/20 rule to create a strong and diverse crypto portfolio.

Allocating 80% to Established Coins

The first part of the 80/20 rule for crypto is to put most of our money into well-known, established cryptocurrencies. This means about 80% of our investment should go into the big players in the crypto market.

When we talk about established coins, we’re mostly looking at large-cap cryptocurrencies. These are the coins that have been around for a while and have proven themselves in the market. Bitcoin and Ethereum are great examples of these kinds of coins.

Why put so much into these big coins?

Well, they tend to be more stable compared to smaller, newer coins. This doesn’t mean their prices don’t go up and down – they do – but they’re less likely to disappear overnight or lose all their value suddenly.

Investing in these established coins gives our portfolio a strong base. It’s like building a house with a solid foundation. Even if the crypto market gets shaky, these coins are more likely to weather the storm.

Here’s a simple way to think about it: If we have $1000 to invest, about $800 would go into these big, established coins. This approach helps us manage our risk while still being part of the exciting crypto world.

The 20% for Higher Risk-Reward

Now, let’s talk about the other 20% of our portfolio. This is where we can be a bit more adventurous and look for bigger potential rewards.

This 20% is for investing in mid-cap and small-cap cryptocurrencies. These are coins that aren’t as big or well-known as Bitcoin or Ethereum, but they might have a lot of room to grow.

Why take this risk?

Well, these smaller coins can sometimes give us much bigger returns. A small coin that takes off can see its value go up many times over. Of course, the flip side is that these coins can also lose value quickly.

When we’re picking coins for this 20%, it’s super important to do our homework. We need to look closely at what the project does, who’s behind it, and how it might be used in the future. It’s not just about picking any small coin – we want to find ones that have real potential.

Here are some tips for this riskier part of our portfolio:

- Look for coins with interesting technology or solutions to real problems.

- Check out the team behind the project – do they have a good track record?

- See if the coin is getting attention from other investors or big companies.

- Don’t put all of this 20% into just one coin – spread it out a bit.

Remember, we’re only using a small part of our total investment for these riskier bets. If we lose some or all of this 20%, it won’t wipe out our whole portfolio.

By using the 80/20 rule, we’re giving ourselves a chance to make big gains with that 20%, while keeping most of our investment safer in the bigger, more established coins.

This approach to building the best crypto portfolio helps us balance the exciting potential of crypto with smart risk management.

It’s a way to be part of the crypto revolution without putting all our eggs in one basket.

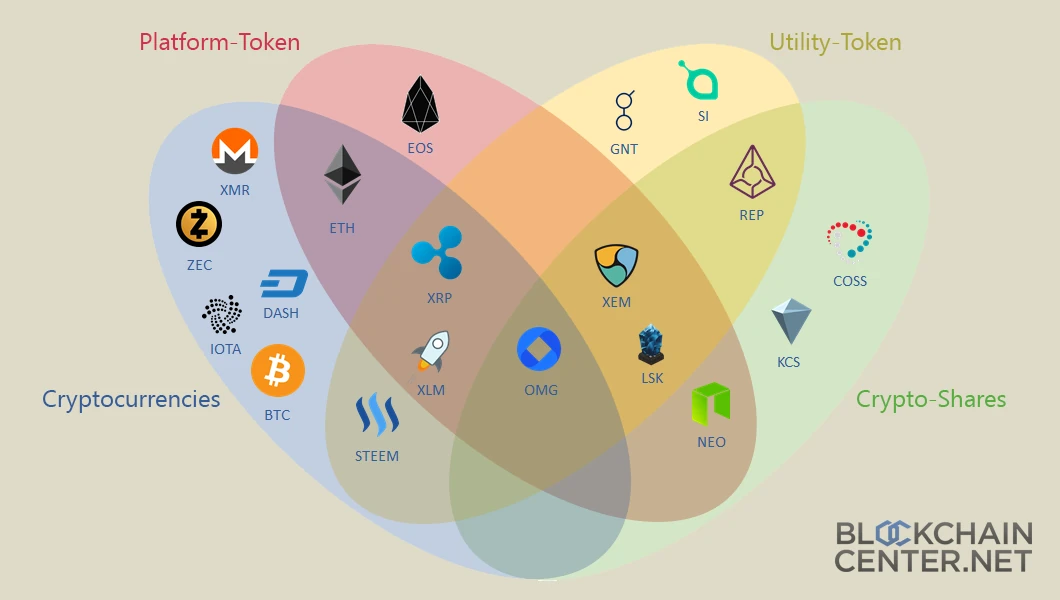

Diversifying Across Crypto Categories

When you’re building the best crypto portfolio, it’s smart to spread our investments across different types of cryptocurrencies.

This approach helps us manage risk and gives us a chance to benefit from various parts of the crypto market. Let’s look at some main categories of cryptocurrencies we can include in our portfolio.

Payment Tokens

Payment tokens are like digital cash. They’re made to be used for buying and selling things without needing banks or other middlemen.

Bitcoin is the most famous payment token, but there are others like Litecoin and Bitcoin Cash. These tokens usually aim to be faster or have lower fees than Bitcoin.

Including payment tokens in our portfolio can be a good idea because they’re often well-known and have been around for a while. They might be more stable than newer, smaller coins. However, remember that their prices can still go up and down a lot.

Platform Tokens

Platform tokens are used on specific blockchain networks. They help these networks run smoothly and let people use different services on them. Ethereum is a big example of a platform token. These tokens are important because they support many other crypto projects and apps.

Adding platform tokens to our portfolio can give us a stake in the growth of blockchain technology. As more people use these platforms, the value of their tokens might go up.

Utility Tokens

Utility tokens are special because they let us use specific services or products within a blockchain system. For example, we might use a utility token to pay fees on a network or to join in a project’s funding.

Including utility tokens in our portfolio can be exciting because they’re often linked to new and innovative projects.

However, it’s important to research these tokens carefully. We need to understand what they’re used for and if people are likely to need them in the future.

Stablecoins

Stablecoins are different from other cryptocurrencies because their value is tied to something else, usually a regular currency like the US dollar. This makes their price more stable, which is why they’re called “stablecoins.”

Having some stablecoins in our portfolio can be a smart move. They give us a safe place to park our money when other cryptocurrencies are going up and down in price. They’re also useful for trading other cryptocurrencies.

By spreading our investments across these different types of tokens, we’re creating a more diverse crypto portfolio. This approach can help protect us if one part of the crypto market isn’t doing well. It also gives us the chance to benefit from growth in different areas of the crypto world.

Remember, the crypto market changes fast.

What’s popular or valuable today might not be tomorrow. That’s why it’s important to keep learning about different types of cryptocurrencies and to think carefully about how much of our portfolio we want to put into each type.

Rebalancing Your Crypto Portfolio

The cryptocurrency market has exploded in popularity, leaving many investors wondering how to construct an optimal crypto portfolio. With new coins and tokens constantly emerging, the landscape can seem overwhelming. However, by following some key principles, you can create a diversified and resilient cryptocurrency investment strategy.

This guide will explore essential concepts for building a strong crypto portfolio.

I’ll examine the importance of market capitalization, discuss applying the 80/20 rule to crypto investing, review different categories of cryptocurrencies to include, and cover how to maintain balance through regular portfolio rebalancing.

By the end, you’ll have a framework for developing a cryptocurrency portfolio tailored to your goals and risk tolerance.

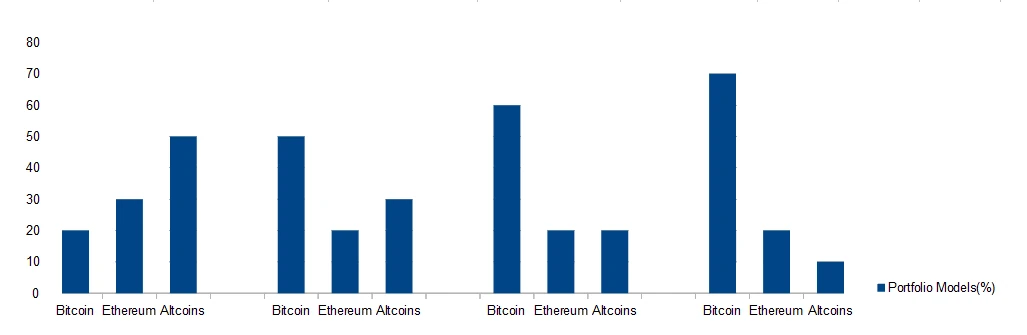

Another Crypto Portfolio Rules

In this subsections I would like to write little bit about another crypto portfolio rules.

Obviously, rule 80/20 is just one of them. Just in the moment I will show you very interesting examples how exchanges diversify their crypto portfolio.

I am really thing it’s very helpful examples that rule 80/20 is just starting point, but this is definitely not the only way to diversify.

Above picture present 4 models. From left to right there are less risky. I am mean by that, where altcoins have bigger part in whole portfolio. For sure, crypto portfolio on the left (Bitcoin – 20%, Ethereum – 30%, Altcoins – 50%) is more risky than portfolio on the right (Bitcoin – 70%, Ethereum – 20%, Altcoins – 10%)! With risk is more reward, but also more difficult times and enormous volatility.

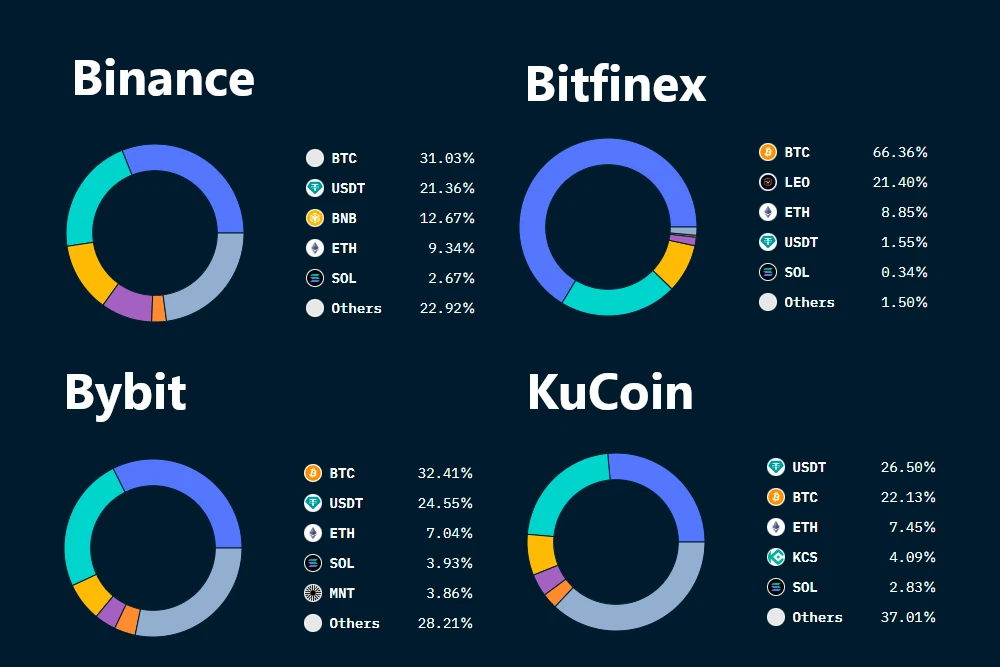

Right now I will switch to 4 another examples. Just take a look below on examples actual exchange portfolios. By the way I have mention about portfolio on exchanges before.

Especially, I took actual reserve portfolios (October 2024) from 4 the most prominent cryptocurrency exchanges. I would love to finally take a look for reserves from Coinbase, but in this moment I could not find portfolio sources. Anyway, I come back to topic.

Binance HODL

Binance hold 40% in Bitcoin and Etheum, then 24.5% in stablecoin Tether. In portfolio there are 2 big capitalization altcoins: Solana and Mantle and they together about 8% portfolio. On the last position is 28.1% another altcoins. As much small, as much bigger ones.

Bitfinex HODL

Bitfinex hodling 66.3% of reserves in Bitcoin and 22.1% in own token – LEO. On the third place is Ethereum with 8.8%. Those 3 together are 96.7% of all assets.

Bybit HODL

In case of Bybit Bitcoin, Ethereum and USDT (64%). Big-cap altcoins are Solana and Mantle (almost 8%). Rest are another altcoins(mix of big, middle and small market caps).

KuCoin HODL

KuCoin hodling 56% in Bitcoin, Ethereum and UDT. KCS and Solana is almost 7%. Interestingly, Kucoin bet on altcoin season, because 37% they have in altcoins.

Diversifying Across Cryptocurrency Categories

A robust crypto portfolio should include exposure to various types of digital assets.

Each category serves different purposes and offers unique benefits. Let’s explore the main cryptocurrency categories and how they can contribute to a well-rounded investment strategy.

Payment Tokens

Payment tokens are designed to function as digital currencies for buying goods and services. Bitcoin, the first and most famous cryptocurrency, falls into this category.

Other examples include Litecoin, Bitcoin Cash, and Monero.

Key features of payment tokens:

- Aim to be a medium of exchange

- Often focus on transaction speed, low fees, or privacy

- May have a fixed or deflationary supply

Including payment tokens in your portfolio provides exposure to the original vision of cryptocurrency as a decentralized form of money. While Bitcoin dominates this category, consider diversifying into other payment tokens with unique features or strong communities.

Platform Tokens

Platform tokens power blockchain networks that support decentralized applications (dApps) and smart contracts. Ethereum is the most prominent example, but others include Cardano, Solana, and Polkadot.

Characteristics of platform tokens:

- Enable developers to build and deploy dApps

- Often have native cryptocurrencies used for transaction fees and governance

- Value is tied to the adoption and usage of the platform

Investing in platform tokens allows you to benefit from the growth of blockchain ecosystems. As more developers and users flock to these platforms, demand for their native tokens may increase.

Utility Tokens

Utility tokens provide access to specific products or services within a blockchain ecosystem. They often serve as a form of “crypto fuel” for particular applications or networks.

Examples of utility tokens:

- Chainlink (LINK) is used to pay for oracle services

- Basic Attention Token (BAT) is rewarding users for viewing ads in the Brave browser

- Filecoin (FIL) is used to pay for decentralized file storage

Including utility tokens in your portfolio can provide exposure to specific blockchain use cases and applications. Research the underlying projects carefully to understand the token’s utility and potential demand.

Stablecoins

Stablecoins are cryptocurrencies designed to maintain a stable value, usually pegged to a fiat currency like the US dollar. Popular stablecoins include Tether (USDT), USD Coin (USDC), and Dai (DAI).

Key features of stablecoins:

- Aim to minimize price volatility

- Often backed by reserves of fiat currency or other assets

- Useful for trading, storing value, and as a hedge against market volatility

While stablecoins may not offer significant price appreciation, they play a crucial role in a balanced crypto portfolio.

They provide a safe haven during market downturns and can be used to quickly take advantage of trading opportunities.

Governance Tokens

Governance tokens give holders voting rights in decentralized autonomous organizations (DAOs) or blockchain protocols. Examples include Uniswap (UNI), Aave (AAVE), and Compound (COMP).

Characteristics of governance tokens:

- Allow holders to participate in decision-making processes

- Often provide additional benefits like fee sharing or staking rewards

- Value may be tied to the success and adoption of the associated protocol

Including governance tokens in your portfolio allows you to participate in the decentralized governance of blockchain projects. This category often overlaps with DeFi (decentralized finance) tokens, which can offer attractive yields through staking or liquidity provision.

Privacy Coins

Privacy coins focus on providing anonymous or untraceable transactions. Examples include Monero (XMR), Zcash (ZEC), and Dash (DASH).

Key features of privacy coins:

- Emphasize transaction privacy and fungibility

- Often use advanced cryptographic techniques like zero-knowledge proofs

- May face regulatory challenges due to their anonymous nature

While privacy coins can be controversial, they represent an important aspect of cryptocurrency technology. Including a small allocation to privacy coins can diversify your portfolio and provide exposure to this niche but passionate segment of the crypto market.

By diversifying across these different categories, you create a well-rounded crypto portfolio that captures various aspects of blockchain technology and its applications. This approach helps spread risk and allows you to benefit from growth in different sectors of the crypto ecosystem.

Remember to regularly review and adjust your allocations based on market conditions, project developments, and your evolving investment goals. The crypto space moves quickly, and staying informed is key to maintaining a balanced and effective portfolio.

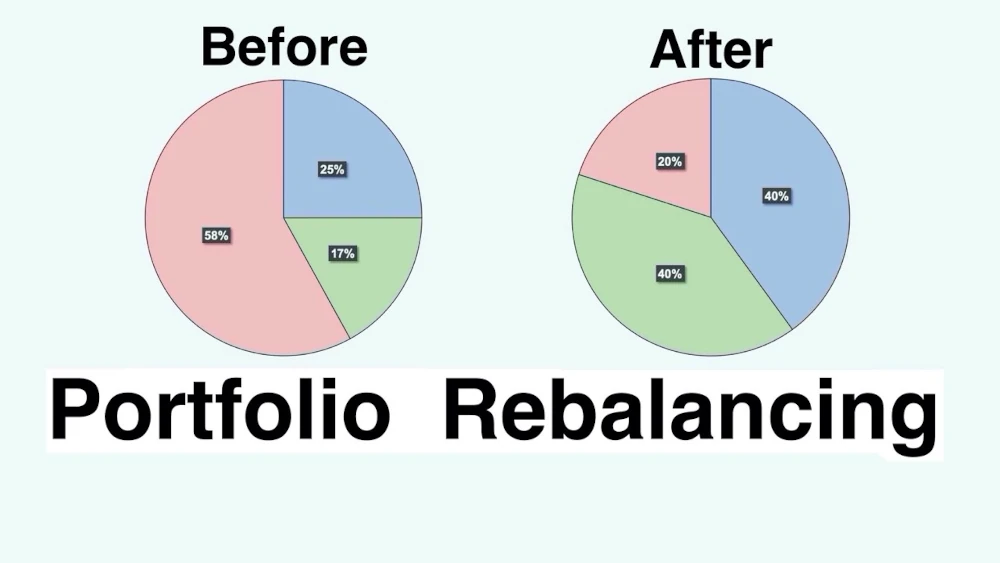

Rebalancing Your Crypto Portfolio

Creating a diverse cryptocurrency portfolio is just the first step. To maintain an optimal asset allocation and manage risk effectively, regular portfolio rebalancing is crucial.

Rebalancing involves adjusting your holdings to realign with your target allocations, ensuring your investment strategy stays on track despite market fluctuations.

Why Rebalance Your Crypto Portfolio?

- Cryptocurrencies are highly volatile. Without rebalancing, a significant price increase in one asset could skew your portfolio, potentially exposing you to more risk than intended.

- Rebalancing helps preserve the benefits of diversification by preventing overexposure to any single asset or category.

- Rebalancing allows you to systematically “buy low and sell high” by trimming positions that have grown and adding to those that have decreased.

- As your investment objectives evolve, rebalancing ensures your portfolio reflects your current risk tolerance and financial goals.

How Often Should You Rebalance?

The frequency of rebalancing depends on several factors:

- In highly volatile periods, more frequent rebalancing may be necessary.

- Larger portfolios may require more frequent attention.

- Consider how much time you can dedicate to portfolio management.

- Frequent trading can incur fees, which should be weighed against the benefits of rebalancing.

Common rebalancing strategies include:

- Adjust your portfolio at set intervals (e.g., quarterly or semi-annually).

- Rebalance when an asset’s allocation drifts beyond a predetermined percentage (e.g., 5% from the target).

- A combination of both approaches.

Effective Crypto Portfolio Rebalancing

- Before rebalancing, reassess your target portfolio allocation. Ensure it still aligns with your investment goals and risk tolerance.

- Calculate the current percentage allocation of each asset in your portfolio.

- Compare your current allocations to your target allocations to identify which assets need adjustment.

- Determine which assets to buy or sell to bring your portfolio back in line with your targets.

- Make the necessary transactions to rebalance your portfolio. Consider using limit orders to get better prices and reduce the impact of short-term price fluctuations.

- Document your rebalancing actions and review the results. This information can be valuable for future decision-making.

Considerations for Crypto Portfolio

- In some jurisdictions, selling cryptocurrencies may trigger taxable events. Consider the tax consequences of your rebalancing actions.

- Be aware of overall market trends and sentiment when rebalancing. During extreme market conditions, it may be prudent to wait for stability before making significant changes.

- Use rebalancing as an opportunity to reassess your holdings. Consider replacing underperforming assets with new, promising projects that align with your investment strategy.

- If you’re participating in staking or yield farming, factor in lock-up periods and potential rewards when planning your rebalancing strategy.

- For significant rebalancing actions, consider using a dollar-cost averaging approach to spread out your trades over time.

- Explore portfolio tracking and rebalancing tools designed for cryptocurrencies. These can simplify the process and help you make data-driven decisions.

By implementing a consistent rebalancing strategy, you can maintain a well-diversified crypto portfolio that aligns with your investment goals. Regular rebalancing helps manage risk and capitalize on market movements.

Of course, ensure your portfolio remains optimized for long-term growth in the dynamic world of cryptocurrencies.

Conclusion

In fact, you can have different approaches to building a cryptocurrency portfolio.

Through the article, I recommend using the 80/20 rule, which is quite widely used.

If you have more experience and knowledge of financial markets, you can use completely riskier strategies.

Beside that, I have written about another portfolio rules what give you full picture about proportions of big-cap and altcoins in the portfolio.

Take into account the risk and profit you can achieve.

I leave you with one last question: “Will taking too much risk in the market pay off?”

Leave a Reply

You must be logged in to post a comment.