Introduction

As the world becomes more digital, the financial industry is no exception. Cryptocurrency has emerged as a popular investment option for individuals and businesses alike. However, what about the traditional financial institutions? Are banks investing in cryptocurrency as well?

In this article, I will explore the rise of cryptocurrency adoption in the banking sector.

Then, the number of banks investing in cryptocurrency, and the potential impact of this trend on the banking industry.

As like always, let’s get start it! Enjoy your reading!

About Cryptocurrencies

Cryptocurrency, such as Bitcoin and Ethereum, has been gaining popularity in recent years.

This digital currency operates independently of a central bank and uses cryptography to secure and verify transactions. The decentralized nature of cryptocurrency makes it attractive to those seeking a more secure and private method of payment and investment.

The rise of cryptocurrency has not gone unnoticed by financial institutions. Many banks and investment firms have started to explore cryptocurrency investments.

However, the path to adoption has not been without its challenges.

In the following sections, I will examine the benefits of cryptocurrency investments for banks, the number of banks investing in cryptocurrency, and the factors influencing their decisions.

Cryptocurrency Investments for Banks

There are several benefits to investing in cryptocurrency for banks.

One of the most significant advantages is the potential for higher returns on investment. Cryptocurrency has been known to experience significant price fluctuations, which can lead to high profits for investors.

Another benefit is the ability to diversify investment portfolios. Cryptocurrency offers a unique asset class that is not correlated with traditional investments such as stocks and bonds. This diversification can help banks manage risk and potentially increase overall returns.

Cryptocurrency investments can also help banks attract new customers. As more individuals and businesses become interested in cryptocurrency, offering investment options in this area can be a competitive advantage for financial institutions.

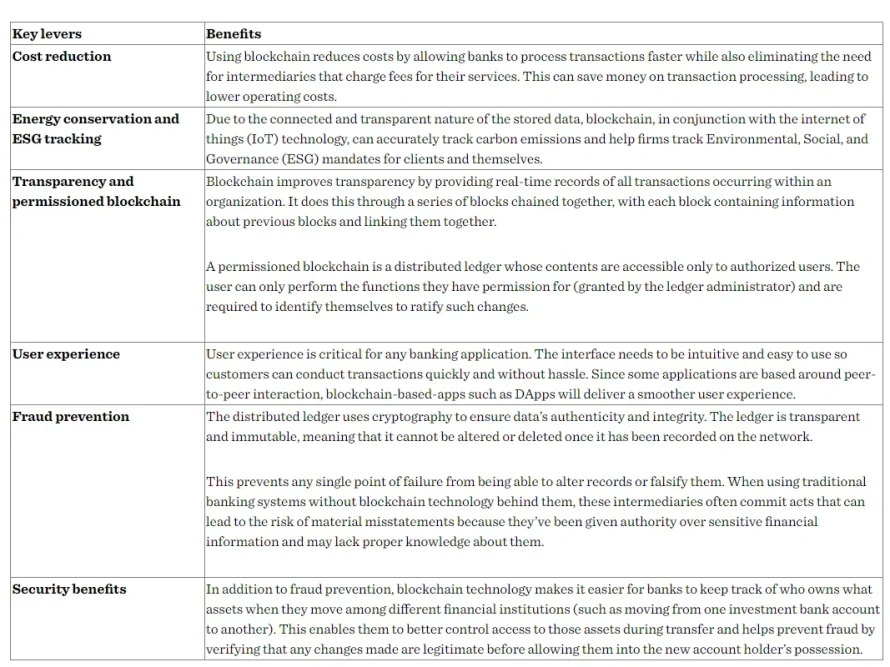

As research by the Everest group shows, banks have many benefits when investing in cryptocurrencies.

It’s hard not to notice it.

Blockchain technology is the future, but the traditional banking system needs time to transform to this fully digital version.

Then blockchain is no longer a choice, but obvious.

Cryptocurrency Adoption in the Banking Sector

Despite the potential benefits, the adoption of cryptocurrency investments in the banking sector has been slow. Many banks are still hesitant to invest in cryptocurrency due to the lack of regulation and uncertainty surrounding this emerging asset class.

However, some banks have started to dip their toes into the cryptocurrency waters.

In 2021, Goldman Sachs announced that it would offer Bitcoin investment products to its wealth management clients. Morgan Stanley also recently announced that it would offer Bitcoin funds to its clients.

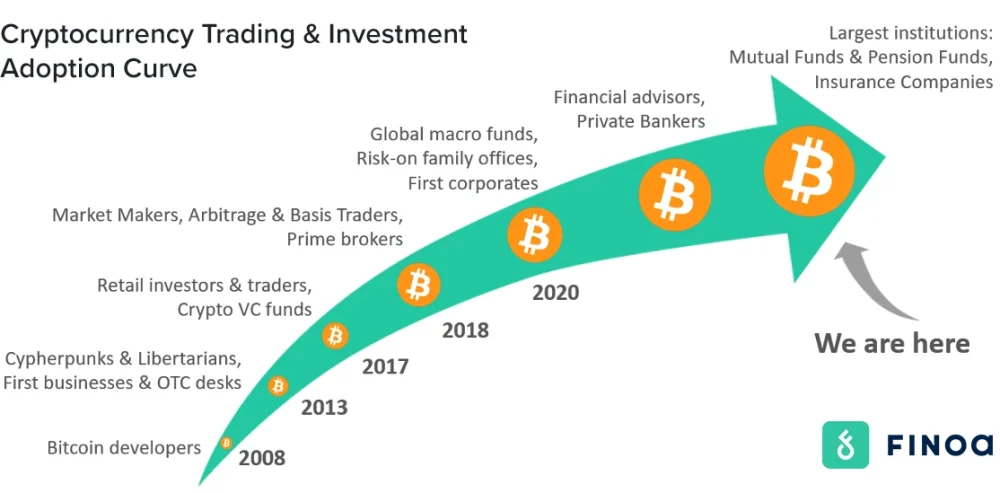

Since the beginning of 2020, banks have been investing intensively in companies related to the blockchain or cryptocurrency industry.

Many central banks are also working on CBDCs, as I mentioned in another article.

2024 is the year in which Bitcoin ETFs were created, which will largely accelerate the adoption of cryptocurrencies and increase the interest of traditional investors in cryptocurrency ETFs.

We’re not really at the end of the graph yet, but I suspect that’s where we’ll end up during the next bull market.

How Many Banks are Investing in Cryptocurrency?

While the number of banks investing in cryptocurrency is still relatively small, it is growing.

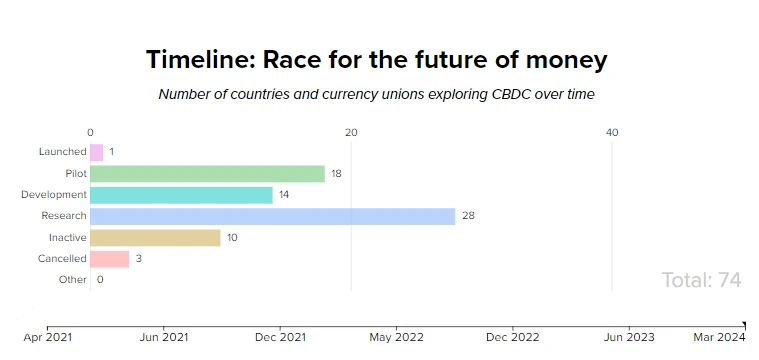

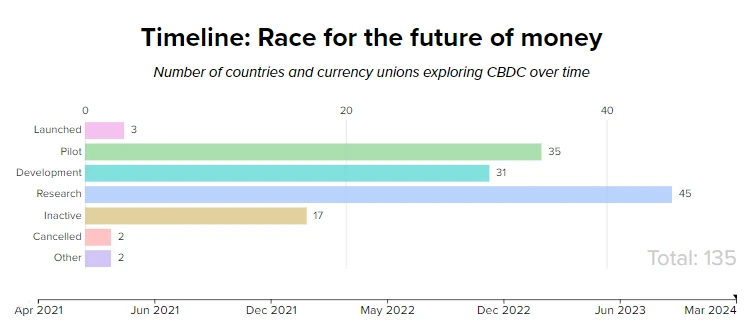

According to a 2021 survey by the Bank for International Settlements, 86% of central banks are researching the potential benefits of central bank digital currencies (CBDCs). CBDCs are digital versions of fiat currency that would be issued and backed by the central bank.

As a reminder, I am attaching two graphics from 2021 and 2024. The difference is huge in the case of involvement in CBDC research.

It’s 2021 here

And 2024, the involvement of central banks in CBDC

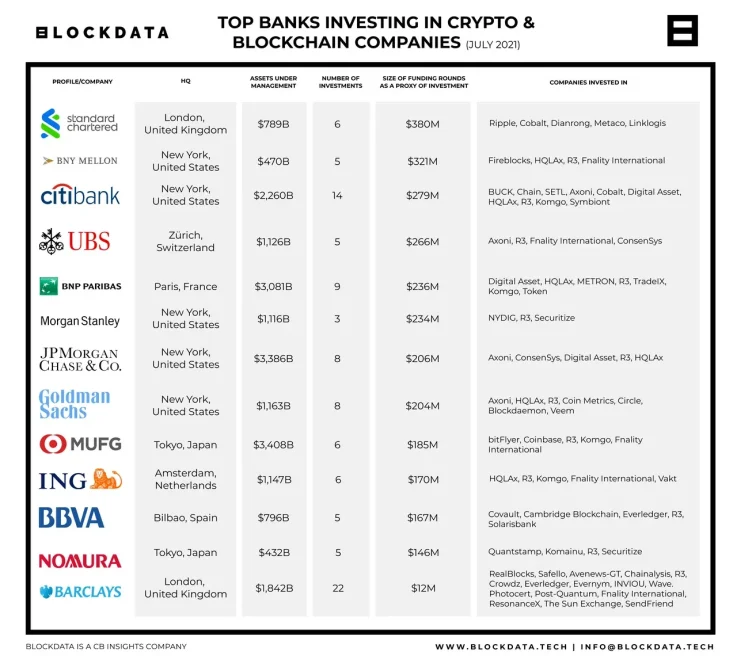

In addition, a growing number of commercial banks are investing in cryptocurrency. According to a 2021 report by Chainalysis, 55 banks have invested in cryptocurrency-related companies or funds. This includes both traditional banks and digital-first banks.

Year 2021

Some of the notable banks investing in cryptocurrency include Standard Chartered, BNY Mellon, Citi Bank, UBS, Morgan Stanley, JPMorgan, which has invested in blockchain technology, and BBVA, which has invested in a cryptocurrency trading platform.

Let’s look at the investment amounts in projects related to the cryptocurrency industry. Let me remind you that it was 2021, when there was a very strong bull market for Bitcoin on the cryptocurrency market.

In 2022, the market collapsed, but did this mean the end of investment. Of course not…

Well, why not buy Bitcoin at a lower price. Exactly. Why?

Year 2022

We are in 2022 and there is a bear market in the cryptocurrency market.

Media around the world are talking about the end of cryptocurrencies and Bitcoin.

At that time, I observed the whole situation and was present on the market. In May or June I expected the market to bottom.

I took into account the pessimism of investors, a large media campaign, the low price of Bitcoin (at that time compared to today), and several other macroeconomic factors such as the start of the war in Ukraine and so on.

As it turned out, the Bitcoin price bottomed in November, and on this occasion I decided to start writing a blog.

What you can see in the entry whether we have the market bottom of November 17, 2022.

Well, this time I wasn’t wrong.

Year 2024

In the case of 2024, data is not easy to find anywhere.

What I mean here is factual data on the amounts invested by banks in blockchain technology.

As in the case of 2021 and 2022.

Either way, from November 2022, the price of Bitcoin increases and the validity of institutional investors’ investments in the crypto industry is confirmed.

During my search, I came across several reports on general data about the state of cryptocurrencies in the world, but these data were not satisfactory enough for me. Therefore, I will not present them here.

Why Banks Decide to Invest in Cryptocurrency

While some banks are starting to invest in cryptocurrency, others remain hesitant. There are several factors that influence banks’ decisions to invest in cryptocurrency.

One of the primary factors is the regulatory environment. Cryptocurrency is not yet fully regulated in many countries, which can make it difficult for financial institutions to navigate the legal landscape.

Another factor is the volatility of cryptocurrency prices. While high volatility can lead to high profits, it can also lead to significant losses. Banks must weigh the potential gains against the potential risks when considering cryptocurrency investments.

Finally, the reputational risk associated with cryptocurrency investments is another factor that banks must consider. Cryptocurrency is still viewed by some as a speculative investment and may be perceived negatively by some customers.

Ultimately, many of the benefits of using cryptocurrencies were presented by me in the previous section. At the same time, this part largely answers the question of why banks invest in cryptocurrencies.

Banks Problems in Crypto Investments

In addition to the factors influencing banks’ decisions to invest in cryptocurrency, there are also several challenges that banks face in adopting cryptocurrency investments.

One of the main challenges is the lack of infrastructure for cryptocurrency investments. Banks must have the necessary technology and expertise to securely store and manage cryptocurrency investments.

Another challenge is the lack of standardization in the cryptocurrency market. With so many different cryptocurrencies available, it can be challenging for banks to determine which investments are the most worthwhile.

Finally, the lack of liquidity in the cryptocurrency market can also be a challenge for banks.

Cryptocurrency exchanges may not have the same level of liquidity as traditional exchanges, which can make it difficult for banks to buy and sell cryptocurrency investments.

Crypto Investments in Future

Despite the challenges, the future of cryptocurrency investments in financial institutions looks promising.

As the regulatory environment becomes more clear and infrastructure for cryptocurrency investments improves, more banks are likely to invest in this emerging asset class.

In addition, the rise of CBDCs may also lead to increased adoption of cryptocurrency investments by financial institutions. CBDCs would be issued and backed by central banks, providing a more stable and secure alternative to decentralized cryptocurrencies.

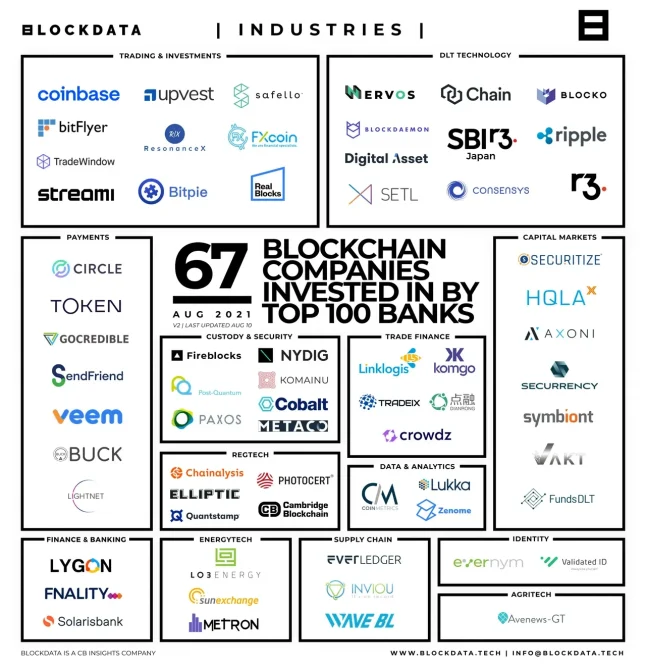

In addition, banks are investing heavily in blockchain-related companies.

Data from 2021 clearly indicate huge interest in 67 companies. In this case, data from Blockdata is also irreplaceable.

In fact, banks around the world are betting very heavily on Coinbase and its surroundings. Why am I not surprised by such massive attacks on the cryptocurrency exchange, Binance.

What is obvious is that USD Coin (from Circle) is also promoted to the first position among stablecoins. Currently it is Tether.

Ripple is also among the favorites, but this has been known for a long time. Ripple was designed to be tightly integrated with the banking system.

However, what is a big surprise to me is the fact that Algorand or Stellar are not on the list. Algoranda, due to CBDC, and Stellar, due to the huge micropayment possibilities and transaction speed.

Regulatory Considerations for Banks

As with any investment, there are regulatory considerations that banks must take into account when investing in cryptocurrency. In many countries, cryptocurrency is not yet fully regulated, which can make it difficult for banks to navigate the legal landscape.

Banks must also comply with anti-money laundering (AML) and know your customer (KYC) regulations when investing in cryptocurrency. This can be challenging given the anonymity of some cryptocurrencies and the lack of standardization in the market.

Regulations in the case of cryptocurrencies are not a bad thing when they protect investors against abuses such as scams or ponzi schemes.

Case Studies

While the number of banks investing in cryptocurrency is still relatively small, there are some success stories.

For example, in 2020, Fidelity launched its Bitcoin investment fund, which has seen significant growth in assets under management.

Another success story is that of the Swiss bank, Sygnum. Sygnum became the first bank to offer cryptocurrency trading and custody services in 2019. In 2020, the bank also launched a digital asset investment platform.

It is impossible not to mention Revolut. This company allows you to buy and sell the most popular crypto assets such as Bitcoin, Ethereum, or Ripple. The operation costs themselves are relatively low for individual users.

Another interesting proposition is Amina bank. This one is also based in Switzerland, in the city of Zug. A well-known cryptocurrency hub in Europe. It stands out as a fintech pioneer in digital banking, especially in integrating cryptocurrency services.

One of the latest proposals that we present is SBI Holdings based in Tokyo, Japan. Japan is famous for many innovative technological solutions, but in this case we are talking about crypto solutions. What more can be written about SBI Group is that it is a fintech powerhouse bridging traditional finance and cryptocurrency.

Coinbase Institutional Survey

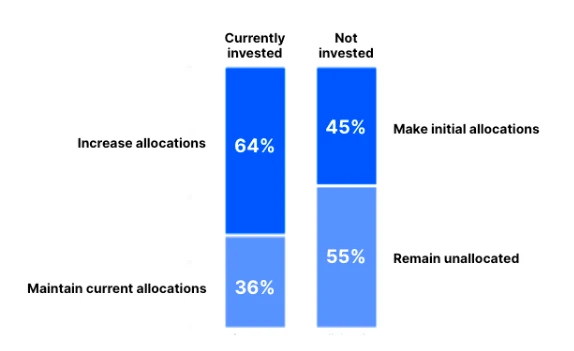

To confirm the great interest in investing in cryptocurrencies among institutional investors, I will present several graphics from Coinbase.

Actually, a survey intended for clients such as banks or financial institutions.

Thinking about the next three years, do you anticipate the percentage of your assets invested in cryptocurrency to increase, decrease, or stay the same?

As many can see, there is a strong upward trend among institutional investors.

This trend will probably be maintained for longer, but the question itself concerned the next 3 years.

The moment to ask the question was the Bitcoin market in a bull trend.

Theoretically, according to Bitcoin cycles, the market should remain in an upward trend until the end of 2025. But let’s wait and see what happens.

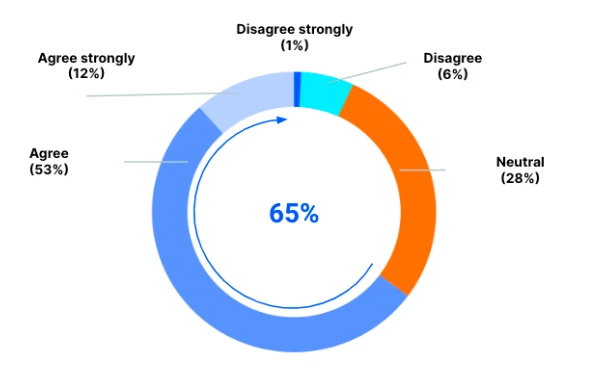

Cryptocurrencies are likely to become an investment vehicle used widely by institutional investors within 3-5 years.

Once again, the answer is affirmative. If I’m not surprised, are you?

65% respond positively when Bitcoin is in an upward trend.

So why not make part of your portfolio (for example the 5%) with cryptocurrencies?

But it’s time to look further at the next questions, which were equally interesting.

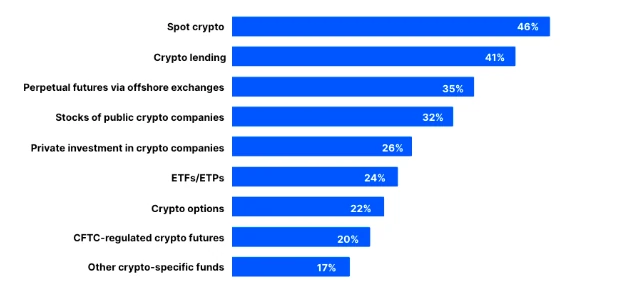

Which of the following do you consider to be the main reasons to invest in digital assets?

Crypto spot comes first and is undoubtedly the safest way to invest in crypto.

Lending and futures carry much more risks. I won’t write about these today, but there are many of them.

There were many more questions in the survey, but I will not mention all of them here.

Of course, you can read the whole thing on the Coinbase website.

Conclusion

In conclusion, the rise of cryptocurrency investments in financial institutions is an emerging trend that is likely to continue. While the number of banks investing in cryptocurrency is still relatively small, it is growing. As the regulatory environment becomes more clear and infrastructure for cryptocurrency investments improves, more banks are likely to invest in this emerging asset class.

The potential impact of cryptocurrency investments on the banking industry is significant. Cryptocurrency offers a unique asset class that can help banks diversify their investment portfolios and potentially increase returns.

Since 2020, a strong trend of investing in CBDC has been observed, but that is not all. Banks are investing in cryptocurrencies such as Bitcoin and Ethereum to diversify their portfolio.

Moreover, many banks notice the great interest of customers in investing in cryptocurrencies. Which makes them offer services related to investing in cryptocurrency EFT or funds related to cryptocurrency assets.

Leave a Reply

You must be logged in to post a comment.