Introduction

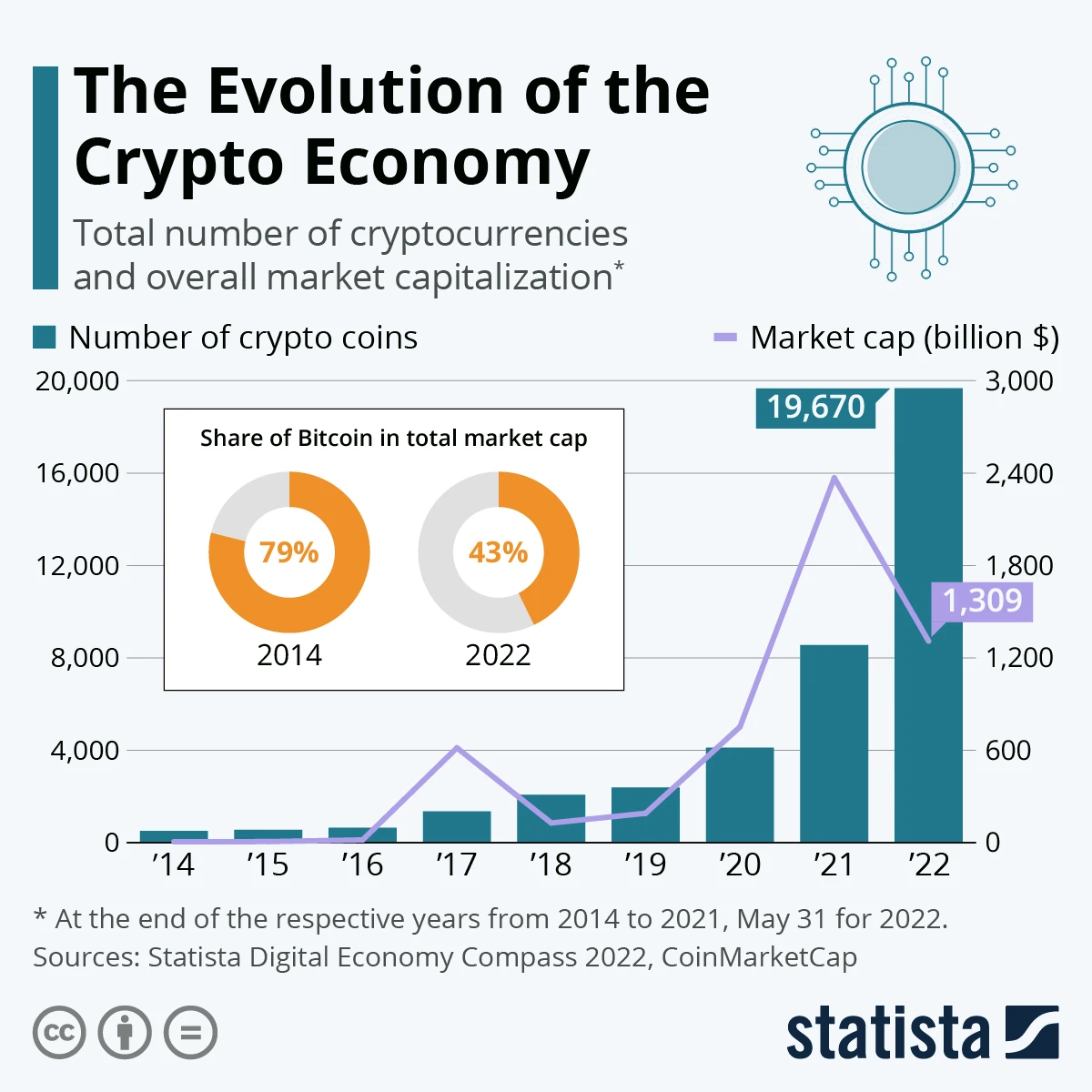

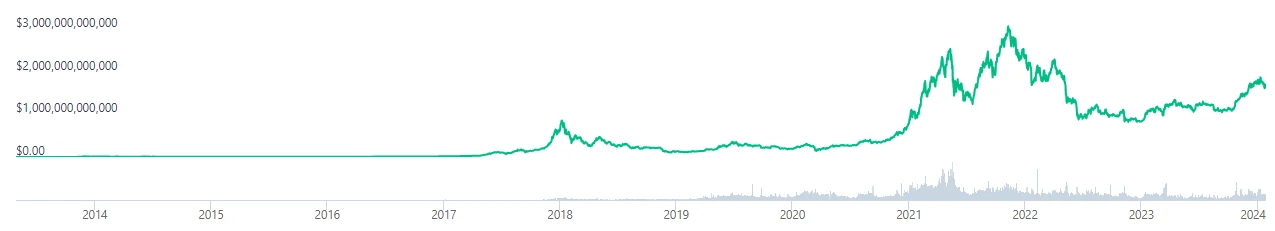

The cryptocurrency market is largely correlated with the price of Bitcoin, indeed. There’s not so much point beating around the bush here. From the beginning, Bitcoin accounted for at least 40% of the total market.

This is, in fact, why Bitcoin’s price has such a large impact on the market.

More about the cryptocurrency market in a moment, because there is something to write about.

Understanding the Cryptocurrency Market

The cryptocurrency market is a surely global marketplace where cryptocurrencies are bought and sold. It functions similarly to traditional stock exchanges, with buyers and sellers trading cryptocurrencies based on their perceived value.

However, the cryptocurrency market operates 24/7, unlike traditional stock exchanges that have fixed trading hours.

One of the key traits that define the cryptocurrency market is its high volatility, indeed.

Prices of cryptocurrencies can fluctuate wildly within short periods of time, presenting both opportunities and risks for investors. This volatility is driven by several factors, surely. Including market demand, investor sentiment, also regulatory developments, and technological advancements.

Although, people who are market insiders see price volatility, they see it as an opportunity.

There is no denying that price volatility is high, but this is all due to the maturity of the market.

Much can be written about the cryptocurrency market, but it is a new investment sector.

The cryptocurrency and blockchain industry is innovative, so investment itself comes down to investing in technology companies dedicated to the modern finance sector. Interesting, in fact, isn’t it?

Moreover, all this is available to anyone with Internet access every day of the week.

Key Traits of Cryptocurrency Market

In order to understand the dynamics of the cryptocurrency market, it is important to explore the key traits that define this digital economy.

One of the most significant traits is decentralization, surely. Unlike traditional financial systems that are controlled by centralized institutions, cryptocurrencies operate on a decentralized network of computers.

This decentralization ensures that no single entity has control over the entire network, so making it resistant to censorship and manipulation.

Another key trait of the cryptocurrency market is transparency. Overall, transactions on the blockchain are recorded and can be viewed by anyone, ensuring transparency and accountability.

This transparency has the potential to revolutionize industries such as supply chain management and finance, as it eliminates the need for intermediaries and reduces the risk of fraud.

Exploring the Top Cryptocurrencies

The cryptocurrency market is home to a wide range of digital currencies, each with its own unique features and uses.

Firstly, Bitcoin, the most well-known cryptocurrency, remains the dominant player in the market with a market capitalization that exceeds that of most countries’ currencies.

Secondly, Ethereum, the cryptocurrency, introduced the concept of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code.

Other notable cryptocurrencies include Ripple, which aims to revolutionize cross-border payments, and Litecoin, which offers faster transaction confirmation times compared to Bitcoin.

Finally, these top cryptocurrencies have attracted significant attention from investors and have contributed to the growth and development of the cryptocurrency market.

In fact, the three most popular cryptocurrencies are Bitcoin, Ethereum and Ripple.

However, we cannot ignore Tether as a stablecoin and Binance Coin as the token of the largest cryptocurrency exchange, Binance. Apart from that, the top ten includes Solana (a direct competitor of Ethereum), USDC (a competitor of Tether), but …

It’s not everything.

The last places in the lead are taken by Lido Staked Ether, Cardano and Avalanche.

What not to write, these 10 cryptocurrencies with various uses are the most popular.

Moreover, they are also the safest choice for investment, but is this what cryptocurrency investors are looking for?

CoinMarketCap in the Cryptocurrency Market

CoinMarketCap is a popular website that provides real-time data and information about the cryptocurrency market.

It tracks the prices, market capitalization, trading volumes, and other key metrics of thousands of cryptocurrencies. CoinMarketCap plays a crucial role in the cryptocurrency market by providing investors with the necessary information to make informed decisions.

Investors can use CoinMarketCap to research and analyze different cryptocurrencies, compare their performance, and track market trends.

The platform also provides historical data, charts, and graphs that help investors understand the historical price movements of cryptocurrencies.

CoinMarketCap has become an indispensable tool for anyone interested in the cryptocurrency market.

Over these nearly 10 years, the cryptocurrency market has changed dramatically.

CoinmarketCap is an excellent source of information, but not the only one. Coingecko and Coinpaprika are other cryptocurrency market analytics sites.

But let me come back to the topic. As you can see, at the beginning Bitcoin accounted for as much as 80% of the entire market, after 10 years it is still a significant 40%.

As of this writing, there are 8800 cryptocurrencies available on the market.

The year 2022 was a strong bear market due to which many projects went bankrupt.

The market has been cleared of over 11,500 projects. Which means that nearly 55% of all projects disappeared from the market. That must be saying something, right?

Factors Influencing Cryptocurrency Prices

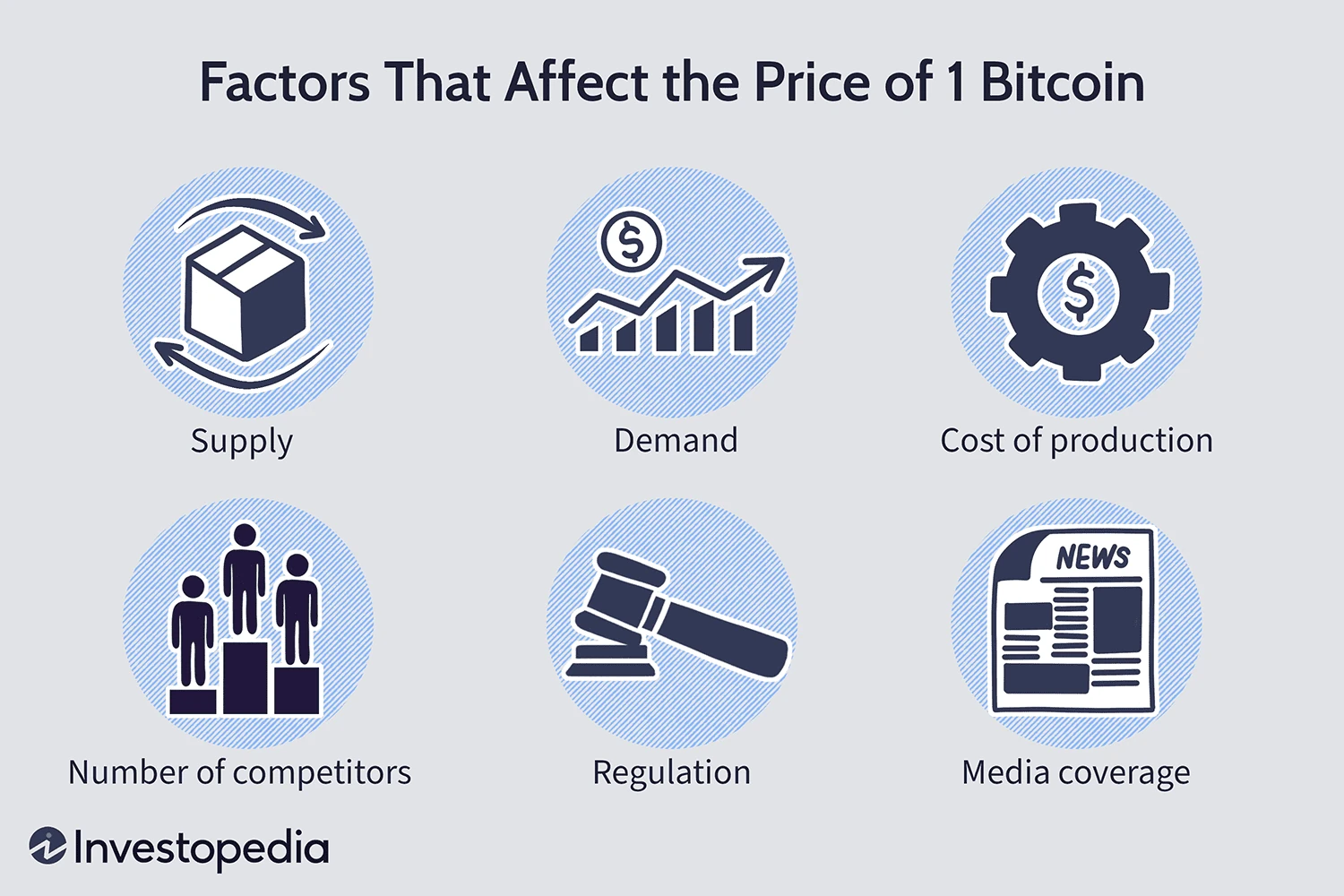

The prices of cryptocurrencies are influenced by a multitude of factors, both internal and external.

One of the primary factors is market demand, without a doubt. When there is high demand for a particular cryptocurrency, its price tends to increase.

Conversely, when demand decreases, the price may decline. Market demand is driven by factors such as investor sentiment, technological advancements, regulatory developments, and macroeconomic conditions.

Another factor that influences cryptocurrency prices is media coverage.

Positive or negative news about cryptocurrencies can have a significant impact on their prices.

For example, news of a major partnership or adoption by a big-name company can cause a surge in prices, while news of a security breach or regulatory crackdown can lead to a sharp decline.

Bitcoin is the cryptocurrency that has the greatest impact on the entire market.

Many different factors influence its price. Of all these, the most important is supply and demand. Interest in the project must constantly increase and there are appropriate media for this.

The project itself, without development, may not meet technological and market expectations.

When I write this, I mean network security, transaction speed, payment flexibility around the world and adoption.

In another article about Bitcoin and Visa, I explained a little more what I mean at this point.

Risks and Challenges

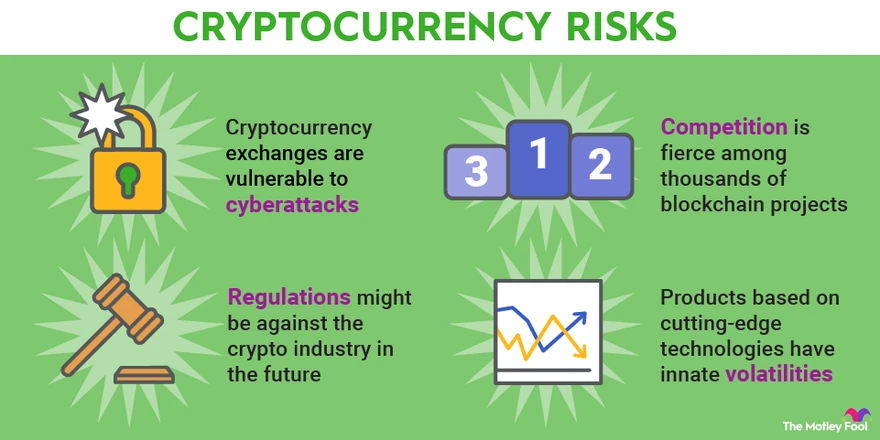

While the cryptocurrency market offers immense potential for growth and profit, it is not without its risks and challenges.

One of the primary risks is the high volatility of cryptocurrency prices, at first. The rapid price fluctuations can result in significant gains or losses for investors, so it making it a highly speculative market.

It is important for investors to understand and manage this risk by diversifying their portfolio and only investing what they can afford to lose, indeed.

Security is another major challenge in the cryptocurrency market.

Due to the decentralized nature of cryptocurrencies, they are vulnerable to cyber attacks and hacking attempts.

Investors must take steps to secure their digital assets, such as using strong passwords, enabling two-factor authentication, and storing their cryptocurrencies in secure hardware wallets.

Tips for Investing in Cryptocurrencies

Investing in cryptocurrencies requires careful consideration and research, surely. Here are some following tips to help investors navigate the cryptocurrency market.

Do thorough research

Before investing in any cryptocurrency, it is important to research and understand its technology, use case, team, and market potential.

Diversify your portfolio

Firstly, investing in multiple cryptocurrencies can help mitigate risk and increase potential returns. Then, it’s advisable to spread investments across different cryptocurrencies with varying levels of risk.

Stay informed

Secondly, keep up-to-date with the latest news, developments, and trends in the cryptocurrency market. Indeed, this will help you make informed decisions and identify potential investment opportunities.

Set realistic expectations

Finally, the cryptocurrency market is highly volatile, and prices can fluctuate rapidly. It is important to set realistic expectations and not invest more than you can afford to lose.

Good tips for investing in cryptocurrencies are research and diversification, obviously.

When investing, you cannot forget about the risk you take.

We are talking here not only about investment risk management, but also about risks related to the projects themselves.

What good is it if you choose good investment strategies when your projects in your portfolio go bankrupt?

The Future of the Cryptocurrency Market

The future of the cryptocurrency market is filled with both promise and uncertainty.

As technology continues to advance and blockchain adoption increases, then cryptocurrencies are likely to become more mainstream. Governments and regulatory bodies are also taking steps to provide a clear legal framework for cryptocurrencies, which could further boost their adoption.

However, challenges such as scalability, energy consumption, and regulatory concerns still need to be addressed.

The cryptocurrency market is constantly evolving, in fact to say. For this reason, it shapes the future of finance and technology.

We are actually in the middle of a bull market, then Bitcoin ETFs have already been approved by the SEC.

Which only means one thing, but only … capital inflow. In the next 2-3 years, the market capitalization of cryptocurrencies will certainly reach new heights.

So far, we have peaked at nearly $3 trillion on the market. Within 2-3 years, the market may reach 4-5 trillion, as a matter of fact.

These are assumptions that are conservative, but… I do not include the huge group of traditional investors who will transfer part of their investments to Bitcoin and Ethereum ETFs, especially.

The capitalization peak will also influence the amount of capital outflow. Finally, after a bull market there always comes a bear market.

If the bear market was so big, I expect the next one to be even bigger.

Taking this into account, we should evacuate the market as soon as possible when we achieve our own investment goals.

Conclusion

The cryptocurrency market has transformed the way we think about money and finance, surely.

Overall, decentralized nature, transparency, and potential for innovation, cryptocurrencies have the power to disrupt traditional financial systems.

However, investing in cryptocurrencies comes with risks and challenges that require careful consideration.

Leave a Reply

You must be logged in to post a comment.