Introduction

Cryptocurrency has gained immense popularity in recent years, and with its rise, the need for reliable and secure crypto exchanges has become crucial. Binance, one of the leading exchanges in the market, offers a comprehensive platform for users. You can buy, sell, and trade a wide range of cryptocurrencies. In this guide, I will explore Binance and delve into the world of centralized exchanges (CEX) to understand how they work.

Difference between CEX and DEX

Before we dive into Binance, it’s important to understand the fundamental difference between centralized exchanges (CEX) and decentralized exchanges (DEX). While both facilitate cryptocurrency trading, they operate in distinct ways. CEX, like Binance, rely on a centralized authority to manage transactions, provide liquidity, and ensure security.

On the other hand, DEX operates on a peer-to-peer network without intermediaries, giving users more control over their funds. Now that you have a clear distinction, let’s explore Coinbase and Binance in more details.

What is Coinbase ?

Before I explore Binance, it’s worth mentioning another popular crypto exchange – Coinbase. Coinbase is a San Francisco-based exchange that allows users to buy, sell, and store various cryptocurrencies. It provides a user-friendly interface, making it an ideal platform for beginners.

Coinbase operates as a centralized exchange, similar to Binance. Users can create an account, link their bank accounts or credit cards, and start trading cryptocurrencies. Coinbase also offers a digital wallet for storing cryptocurrencies securely.

However, it’s important to note that Coinbase has a limited selection of cryptocurrencies compared to Binance.

Exploring Binance Features and Functions

Now that we have a basic understanding of crypto exchanges and Coinbase, let’s explore Binance in depth. Binance offers a wide range of features and functions that cater to both novice and experienced traders.

One of the key features of Binance is its extensive selection of cryptocurrencies. With over 200 cryptocurrencies available for trading, Binance provides users with a diverse portfolio to choose from.

Additionally, Binance offers advanced trading options such as margin trading and futures trading. Allowing experienced traders to leverage their positions and potentially increase their profits.

Account Creation and Verification in Binance

To start trading on Binance, you’ll need to create an account and complete the verification process. The account creation process is straightforward and can be completed in a few simple steps.

Visit the Binance website and click on the “Register” button. Enter your email address and create a strong password. Once you’ve completed the registration, you’ll receive a confirmation email.

Click on the link provided to verify your email address. After verifying your email, you’ll need to complete the KYC (Know Your Customer) verification process. This involves providing personal information and uploading relevant identification documents. Once your account is verified, you can start trading on Binance.

It’s much more simple than you think.

Navigating the Binance Platform

Now that your account is set up, let’s explore the Binance platform and its various features. The Binance interface is intuitive and user-friendly, making it easy for both beginners and experienced traders to navigate.

The main dashboard provides an overview of your account balance, recent transactions, and market trends. To initiate a trade, click on the “Trade” tab and select the cryptocurrency pair you wish to trade.

Binance supports various order types, including market orders, limit orders, and stop-limit orders. Once you’ve placed your order, you can track its progress in the “Open Orders” section. Binance also allows users to deposit and withdraw funds in a seamless manner. Simply click on the “Wallet” tab and select the appropriate cryptocurrency. You’ll be provided with a deposit address to send funds to or a withdrawal address to transfer your funds to an external wallet.

Binance vs Coinbase

Now that I have explored Binance in detail, let’s compare it with Coinbase to understand the key differences between the two exchanges. While both exchanges offer a range of cryptocurrencies for trading, Binance has a more extensive selection compared to Coinbase. Binance also provides advanced trading options such as margin trading and futures trading, which are not available on Coinbase.

In terms of fees, Binance offers competitive rates, with fees ranging from 0.1% to 0.2% per transaction. Coinbase, on the other hand, has higher fees, with rates varying based on the trading volume. It’s important to consider your trading preferences and needs when choosing between Binance and Coinbase.

Exploring Other Popular Crypto Exchanges

While Binance and Coinbase are well-known exchanges, there are several other popular crypto exchanges worth exploring. One such exchange is KuCoin, which offers a wide range of cryptocurrencies and advanced trading features. KuCoin also has its native token, KuCoin Shares (KCS), which provides additional benefits to users.

Other notable exchanges include Kraken, Bitstamp, and Bittrex. Each exchange has its own unique features and fee structure, so it’s essential to research and compare before making a decision. By now on, let’s come back to the biggest cryptocurrency exchanges centrally managed.

The Biggest Cryptocurrency CEX

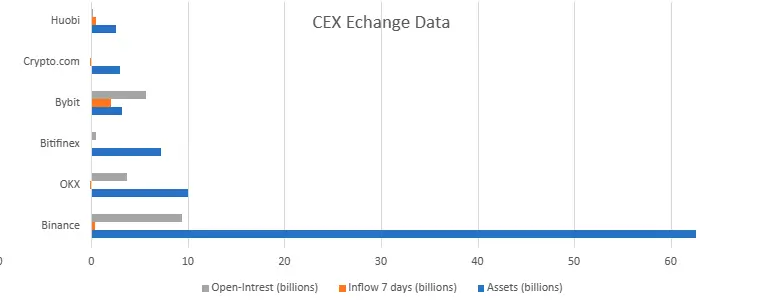

The largest cryptocurrency exchanges are those that have the largest amount of capital in reserves, but not only. Other factors are also important, such as capital turnover and the size of open positions. I will not describe here how many clients this or that exchange has, because access to this data is limited.

It’s time to get down to business and present data to determine which exchange is the largest.

As you can see, the largest exchange without comparison is Binance. Interestingly, the sum of the rest of the assets of all the other 5 exchanges (not including Coinbase) is smaller than the Bianance exchange. The Coinbase exchange is not transparent in providing data on asset reserves, as well as other data that authenticates this exchange.

Not so long ago, the topic of transparency was very much discussed due to the collapse of the FTX exchange from the USA. More on this in the following subsections.

As much as, metrics like open-intrest and inflow in 7 days are comperable. In case of assets there is not discussion about dominance amount exchanges.

Exploring Crypto Exchanges Popularity

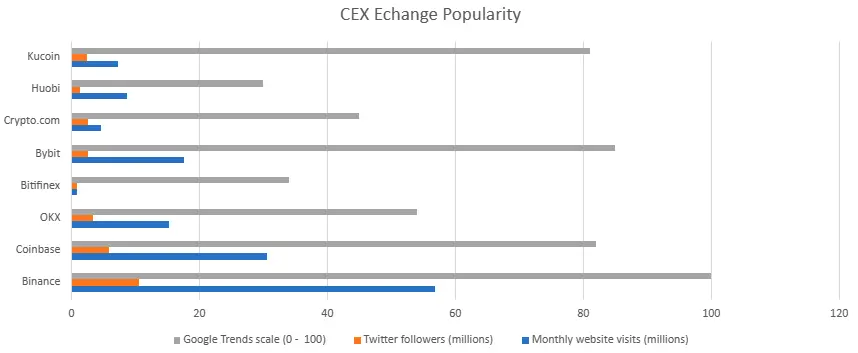

In this subsection I will write a bit about the popularity of cryptocurrency exchanges. This metric is somewhat relative, but when trying to answer this question, I look at 3 important points: how many users visit the exchange’s homepage in a month, Twitter followers and Google Trends for a given exchange. I will limit myself to 8 exchanges here: Binance, Coinbase, OKX, Bitfinex, Bybit, Crypto.com, Huobi and Kucoin .

Binance in case of popularity (google trends, twitter followers and monthly website visits) again the best.

CEX Reserves a few Words

I have already written a fairly extensive article about cryptocurrency reserves of exchanges.

By reading this article, you can deduce a lot and realize how the largest cryptocurrency exchanges really manage their reserves. This lesson is invaluable. I don’t think so, because you can see how to manage huge capital in different periods of demand and supply of cryptocurrencies.

I especially encourage you to watch (I do) these exchanges during the bear market. The transition period between the bear market and the bull market, and during the bull market. Someday I’ll write an article about it.

CEX Bankruptcy in the Last 10 Years

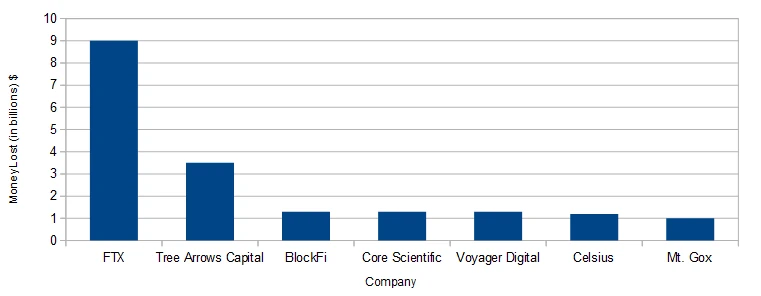

One of the most important bankruptcies in recent years in the world of cryptocurrencies belonged to the CEX – FTX exchange.

The amazing fact is that it was a centrally managed exchange, i.e. CEX. I wrote about the details of this bankruptcy in another article. Let me just mention that the company’s operating model itself was a model doomed to failure.

How else to define it when you issue your own tokens that are not covered by any other asset.

I had an allusion about the public debt of the largest countries in the world. I do not know why.

The number of people who lost money because of this “investment of a lifetime” was huge. Private investors, institutional investors, and so much more.

Year 2022 it was one of the worst years in case of bankruptsy in cryptocurrency industry. As a consequence exchange FTX went bankrupt, but not only.

Tips For Using Binance Effectively

To make the most of your trading experience on Binance and other crypto exchanges, here are some valuable tips:

a) Research and understand the cryptocurrencies you plan to trade.

b) Keep track of market trends and news to make informed trading decisions.

c) Implement proper risk management strategies to protect your investments.

d) Use two-factor authentication (2FA) to secure your account.

e) Consider using a hardware wallet for storing your cryptocurrencies securely.

By following these tips, you can enhance your trading experience and mitigate potential risks.

Choosing the Right Crypto Exchange

In conclusion, Binance offers a comprehensive platform for trading cryptocurrencies, with a wide selection of coins and advanced trading options.

However, it’s essential to consider your trading preferences, needs, and the fees associated with each exchange before making a decision. Coinbase and KuCoin are also popular exchanges worth exploring.

By understanding the features and functions of different exchanges, you can choose the one that best suits your trading goals. Happy trading!

Leave a Reply

You must be logged in to post a comment.