Introduction

As a matter of fact liquidity pools in DeFi have emerged as a powerful tool among this financial world!

They are revolutionizing the way we access and manage financial resources, surely.

A liquidity pool, also known as a pool of liquidity, is a smart contract that allows users to contribute their funds to a common pool.

So, what’s happen next?

Then, they are used to facilitate various financial activities within the DeFi ecosystem.

In today article a few interesting things about liquidity pools, because they are really amazing and important in cryptospace!

Concept of Liquidity Pools

Liquidity pools operate based on the principle of supply and demand.

When users contribute their funds to a liquidity pool, they are essentially supplying liquidity to the market. This liquidity can then be utilized by other users who wish to trade or borrow assets within the DeFi ecosystem.

In return for providing liquidity, participants receive pool tokens that represent their share of the pool. These tokens can later be redeemed for the underlying assets or traded on secondary markets.

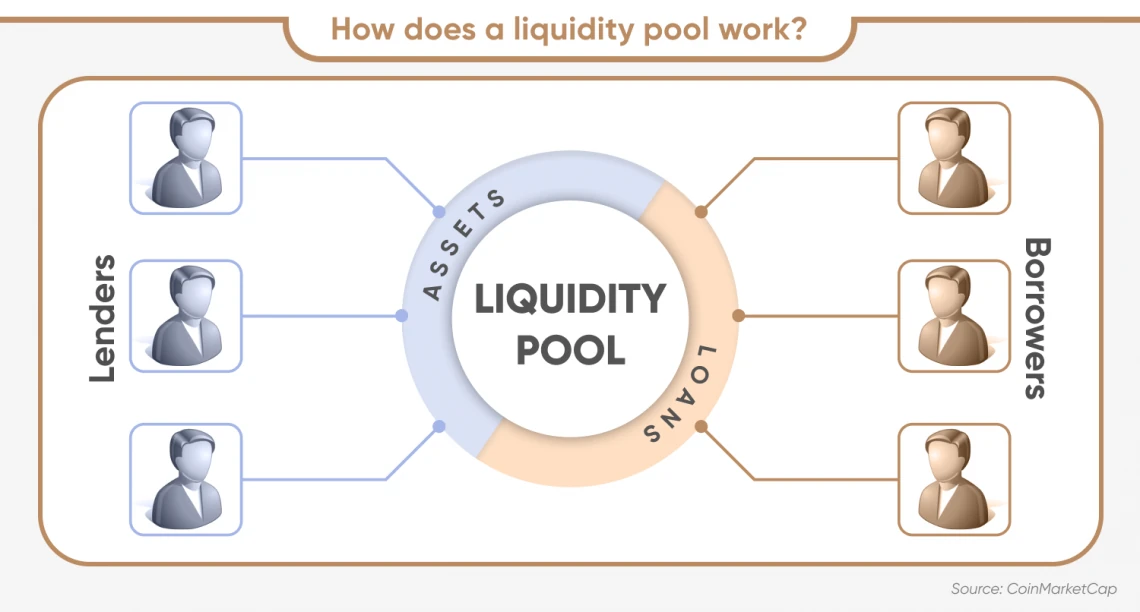

In fact, the whole concept is simple. Liquidity pools are decentralized places of two parties.

Those who lend and those who want to provide capital. In the world of traditional finance, it is the bank (the lender) and its customer.

Due to liquidity pools, banks actually lose their main functionality, which is lending money at interest to their customers.

But will liquidity pools ever gain as much authority as banks?

Benefits of Liquidity Pools in DeFi

Enhance Financial Accessibility

One of the key benefits of liquidity pools in DeFi is the enhanced financial accessibility they provide.

Traditional financial systems often have high barriers to entry, making it difficult for individuals with limited resources to participate.

Liquidity pools, on the other hand, allowing anyone to contribute their funds and earn a share of the pool’s rewards. This opens up opportunities for individuals who were previously excluded from participating in financial markets.

Together empowering them to take control of their own financial future.

Improving Financial Efficiency

Liquidity pools also play a crucial role in improving financial efficiency within the DeFi ecosystem.

By providing a constant supply of assets, liquidity pools ensure that users can always find the liquidity they need to execute their desired transactions. This eliminates the need for order books and matching buyers with sellers, resulting in faster and more efficient trades. Additionally, liquidity pools reduce slippage.

Slippage refers to the difference between the expected price of an asset and the actual price at which the trade is executed.

With higher liquidity, slippage is minimized, allowing users to trade at more favorable prices.

Use Cases

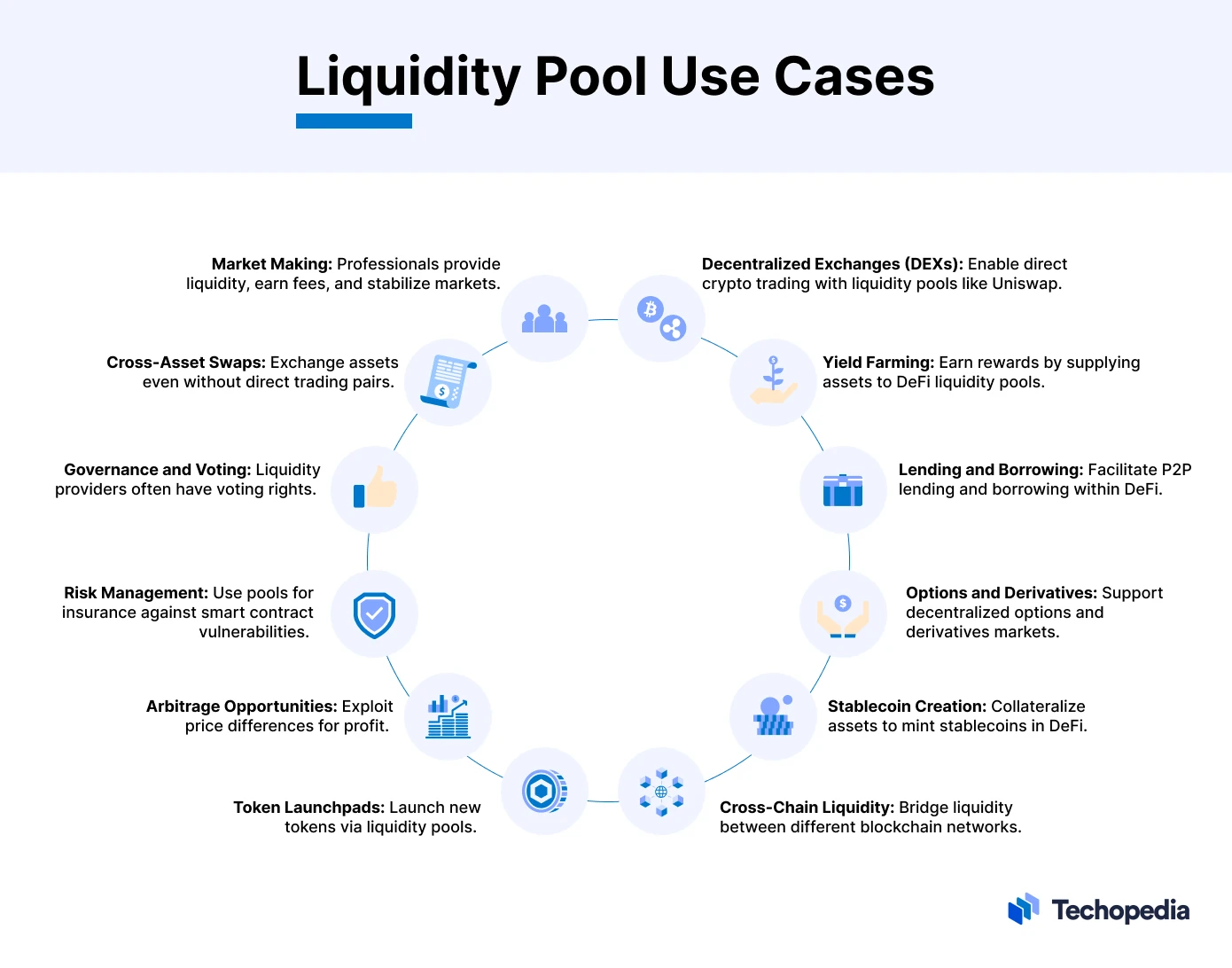

Indeed, liquidity pools have a wide range of applications. In particular, we are talking about the world of cryptocurrencies, because that is where they find their application.

Could the world of cryptocurrencies exist just as well without them?

The answer is yes. These were created as a later creation on the market.

At the beginning, the cryptocurrency market had problems with capital liquidity and today such problems may also happen, but…

Due to liquidity pools, such situations almost do not occur.

It is worth looking at the graphics to fully understand how important liquidity pools are. For now and for the further development of the market.

Many cryptocurrencies have been created in the market to provide pools of liquidity in the market.

As you can easily see, they are an important part of the DeFi market and world.

You can also not shake the impression that thanks to them there is no limit that cryptocurrencies create.

Arbitrage, creating new tokens, risk management. These are just a small sampling of the uses of liquidity pools.

It must be admitted that thanks to liquidity pools, the cryptocurrency market has become much more interesting.

Different Types of Liquidity Pools

There are various types of liquidity pools in the DeFi space.

Because honestly writing, they are each with its own unique characteristics and use cases.

One of the most common types is the automated market maker (AMM) pool. They are used by decentralized exchanges (DEXs) to facilitate trading. In an AMM pool, the price of an asset is determined algorithmically based on the ratio of assets in the pool.

Another type of liquidity pool is the lending pool. There users can deposit their assets and earn interest by lending them to other users.

These lending pools are the backbone of decentralized lending platforms. Of course, those platforms providing borrowers with access to capital and lenders with a passive income stream.

Major cryptocurrency exchanges are also Liquidity Pools, but not exclusively.

Even before them, Dark Pools appeared on financial markets, but I will return to the cryptocurrency market.

After centrally managed exchanges, decentralized exchanges with AMMs in the main role were created.

Ultimately, due to various blockchains, there was a need to create liquidity pools between them. So they are so-called Cross-chain Liquidity Pools.

Participating in a Liquidity Pool

While liquidity pools offer a range of benefits, but … Indeed, it is important for participants to consider certain key factors before jumping in.

One such factor is the impermanent loss, which refers to the potential loss of value that liquidity providers may experience due to fluctuations in the prices of the assets in the pool.

It is also crucial to assess the reputation and security of the platform hosting the liquidity pool, as there have been instances of hacks and exploits in the DeFi space.

Additionally, participants should carefully evaluate the fees associated with participating in a liquidity pool, as these fees can impact the overall profitability of the investment.

Risks Associated with Liquidity Pools

Like any investment, liquidity pools come with their own set of challenges and risks.

One common challenge is the potential for a rug pull, where the creators of a liquidity pool exit with the funds contributed by participants. To mitigate this risk, it is essential to conduct thorough due diligence and only participate in liquidity pools with a proven track record and a strong community of users.

Another risk to consider is the volatility of the underlying assets in the pool. If the value of these assets drastically decreases, participants may experience significant losses.

It is therefore important to carefully assess the risks associated with the assets in the pool before making any investments.

Managing Liquidity Pool Investments

It is important to follow some best practices, because only then you can maximize your benefits.

One such practice is diversification, which involves spreading your investments across multiple liquidity pools to reduce the impact of any potential losses.

It is also crucial to stay informed about the latest developments in the DeFi space and monitor the performance of the liquidity pools you are participating in.

Additionally, regularly reassessing your investment strategy and adjusting your allocations based on market conditions can help optimize your returns.

Have you heard of projects like SushiSwap, Uniswap, Raydium, or Balancer before?

Recently, Uniswap has been hit the most due to the SEC.

This is not the first attack of this type. Until recently, there were cases involving Binance, Coinbase and Ripple.

The only question is who’s next in line?

Liquidity Pools Investments

Of course, when your investment achieves the expected results, it’s time to take profits.

Uniswap can serve as a liquidation pool in this case.

It doesn’t have to be a typical HODL investment, but another thing is here imporant.

Especially, a constant product formula keeps the values of liquidity pools relative to each other.

The typical formula is x*y = k, where k is the constant, and x and y are assets.

The concept of decentralized finance becomes much more tangible with liquidity pools.

A centralized exchange requires many people to keep liquidity stable and execute trades.

Liquidity pools can keep a market from becoming illiquid. It does this even with a smaller volume of traders.

The Future of Liquidity Pools in DeFi

As the DeFi ecosystem continues to expand and evolve, liquidity pools are expected to play an increasingly important role.

Surely, with the rise of new DeFi protocols and innovations, I can expect to see the new types of liquidity pools. But, then they will catering to specific use cases and asset classes, in reality.

Furthermore, advancements in technology are likely to improve the efficiency and scalability of liquidity pools.

In the future it will making them even more accessible and user-friendly, first and foremost.

Conclusion

Without a doubt liquidity pools have revolutionized the world of decentralized finance by enhancing financial accessibility and efficiency.

Participants in liquidity pools contribute to the liquidity of the DeFi ecosystem, then enabling seamless and efficient financial transactions.

While liquidity pools offer numerous benefits! It is important for participants to carefully consider the risks and challenges associated with these investments, in fact.

Individuals can navigate the world of liquidity pools and unlock the potential of DeFi to transform the traditional financial system, so join them as well.

Leave a Reply

You must be logged in to post a comment.