Introduction

Indeed, Bitcoin halving is an event that has been eagerly anticipated by cryptocurrency enthusiasts and investors alike.

In this comprehensive guide, I will dive into the history of Bitcoin halving, at first.

Then, tell you why it is important, and its impact on the crypto market.

I will also explore predictions for the next Bitcoin halving and provide strategies to prepare for this significant event.

So fasten your seatbelts and get ready to dive into the world of cryptocurrency!

Understanding Bitcoin Halving

Firstly, to comprehend the significance of Bitcoin halving, it is crucial to understand how the cryptocurrency functions.

Bitcoin operates on a decentralized network called the blockchain, particularly. Then I need to write, that transactions are recorded and verified by miners.

These miners are rewarded with newly minted Bitcoins for their efforts in maintaining the network’s integritym, in fact.

Bitcoin halving refers to the process of reducing the block reward that miners receive, so…

Approximately every four years, the number of Bitcoins generated per block is cut in half, indeed.

Moreover, this mechanism is an integral part of the Bitcoin protocol and is designed to control the inflation rate of the cryptocurrency.

The reward for mining Bitcoin decreases, and this causes the price of the cryptocurrency itself to increase.

This is really bad, because the mining itself becomes even more difficult every halving. As a consequence, the cryptocurrency’s inflation rate increases, as a matter of fact.

The History of Bitcoin Halving

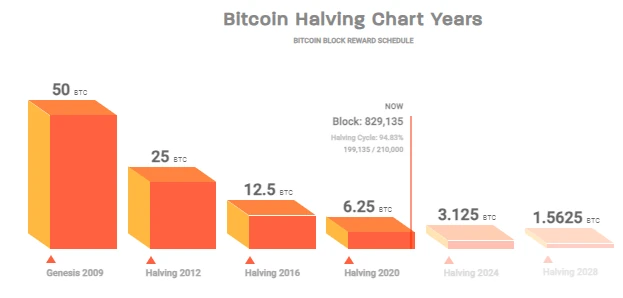

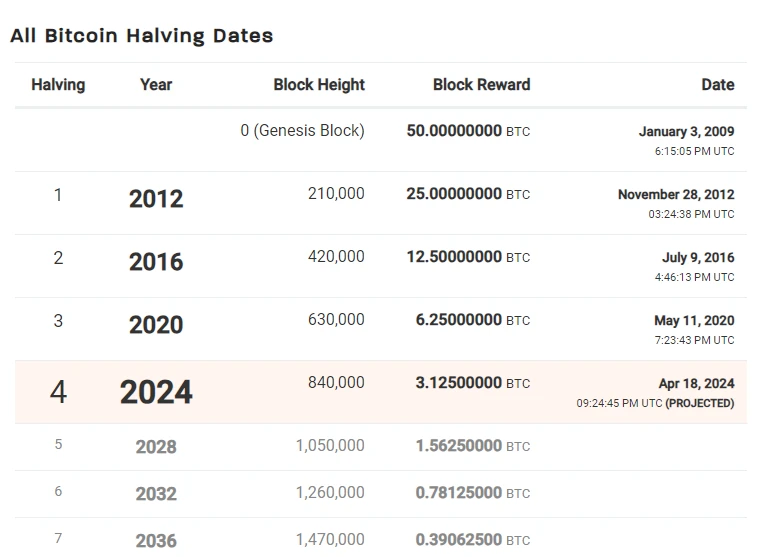

The first Bitcoin halving occurred in 2012, so it’s happen four years after the cryptocurrency’s inception.

During this event, the block reward was reduced from 50 Bitcoins to 25 Bitcoins.

The second halving took place in 2016, then lowering the block reward to 12.5 Bitcoins.

Each halving event has a significant impact on the supply and demand dynamics of Bitcoin, finally leading to price fluctuations and increased market attention.

The conclusion from the chart is as follows.

The number of rewards for mining Bitcoin is decreasing, but the price of the cryptocurrency is increasing.

If you want, reader, calculate how much the price changed after halvings in subsequent cycles. Let me just tell you that I made simplified calculations later in the article.

Why Bitcoin Halving is Important

Bitcoin halving is crucial for maintaining the scarcity and value proposition of the cryptocurrency. By reducing the block reward, the supply of new Bitcoins entering the market decreases.

This scarcity increases the perceived value of existing Bitcoins, driving up their price.

Consequently, this process plays a vital role in the economic stability and long-term viability of the cryptocurrency.

Furthermore, Bitcoin halving events serve as important milestones in the cryptocurrency industry.

They generate a buzz of excitement and anticipation, attracting attention from both seasoned investors and newcomers. The heightened interest often leads to increased trading volumes and market activity, creating opportunities for profit and growth.

The Impact of Bitcoin Halving

The events have historically had a profound impact on the crypto market.

The reduction in block rewards creates a supply shock, as the rate at which new Bitcoins are introduced into circulation decreases. This supply shock, coupled with increased demand, often results in price surges.

During the previous halvings, Bitcoin experienced significant price rallies in the months and years following the events.

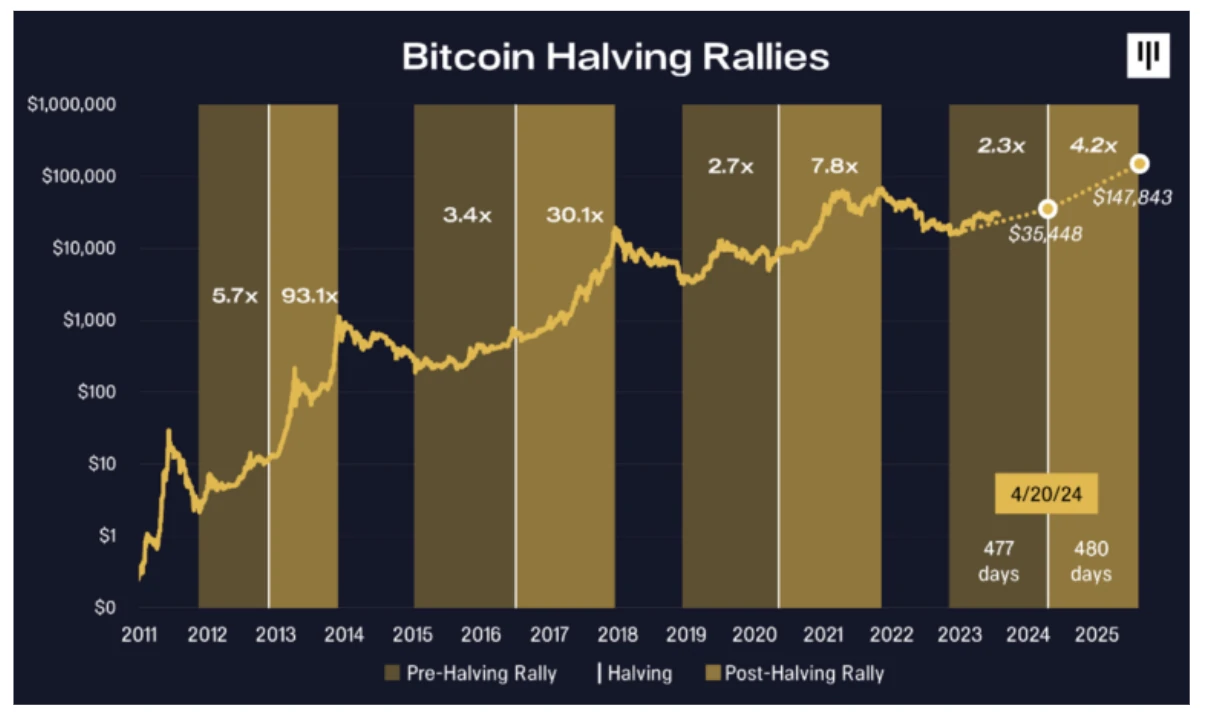

In 2013, the price soared from around $12 to over $1,000 within a year after the first halving.

Similarly, after the second halving in 2016, Bitcoin’s price climbed from approximately $650 to nearly $20,000 by the end of 2017.

Predictions for the Next Bitcoin Halving

The next halving is one of the most anticipated events in the cryptocurrency world.

With each halving, the potential for price appreciation and market disruption increases. While it is impossible to accurately predict the future price movements of Bitcoin, many experts and analysts have shared their predictions.

Some speculate that the next halving could trigger another bull run, driving the price of Bitcoin to new all-time highs.

Others believe that the market has already priced in the halving and that the impact may not be as dramatic. Regardless of the outcome, the next halving is expected to bring heightened volatility and excitement to the crypto market.

What is important is the fact that the next halving is only the 4th halving for Bitcoin.

The halving process itself will end in 2140, so the project has prospects and development assumptions for many years.

The latest halving will be the 33rd halving in a row. Which means that we are still at the beginning of cryptocurrency adoption.

14 years have passed since Bitcoin appeared on the market, but less than 10 years since the first halving.

This is really not much in terms of innovative technologies, and cryptocurrencies are one of them.

When is the Next Bitcoin Halving?

The next halving is scheduled to take place in April 2024.

As the halving events follow a predetermined schedule outlined in the Bitcoin protocol, the exact date and time can be predicted with a high degree of certainty.

This gives investors and traders ample time to prepare and adjust their strategies accordingly.

How to Prepare for Bitcoin Halving

Preparing for this event requires careful consideration and planning. Here are some strategies to help you make the most of this significant event:

Stay Informed

Keep yourself updated with the latest news and developments surrounding Bitcoin and the halving event.

Follow reputable sources and join online communities to engage in discussions and gain valuable insights.

Diversify Your Portfolio

Consider diversifying your cryptocurrency holdings to mitigate risks and take advantage of potential opportunities.

Allocate a portion of your portfolio to Bitcoin while exploring other promising cryptocurrencies.

Set Realistic Expectations

Understand that the halving event does not guarantee immediate price appreciation.

While historical trends suggest positive outcomes, the market is unpredictable. Set realistic expectations and avoid making impulsive investment decisions.

Investing During Bitcoin Halving

Investing during Bitcoin halving requires a strategic approach to maximize potential returns. Here are a few strategies to consider:

HODL

The term “HODL” refers to holding onto your Bitcoin assets for the long term, regardless of short-term price fluctuations.

This strategy is based on the belief that Bitcoin’s value will continue to appreciate over time, especially after the halving event.

Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the asset’s price.

This strategy helps to mitigate the impact of market volatility and allows you to accumulate Bitcoin over time.

Take Advantage of Volatility

Bitcoin halving often leads to increased price volatility.

Traders can capitalize on short-term price movements by implementing strategies such as swing trading or day trading.

However, it is important to note that trading comes with its own risks and requires a deep understanding of market dynamics.

Bitcoin Price in 2025

Every halving, the price of Bitcoin increases dynamically. This is all due to the smaller mining reward for the so-called cryptocurrency miners.

Every halving the price increases, but its growth weakens.

The first time the increase was almost 93 times, the second time 30 times, and the third time almost 8 times. Indeed, the next price increase should be 3.5 to 4.5 times!

Which would mean that the price at the peak will be close to $145k for one Bitcoin.

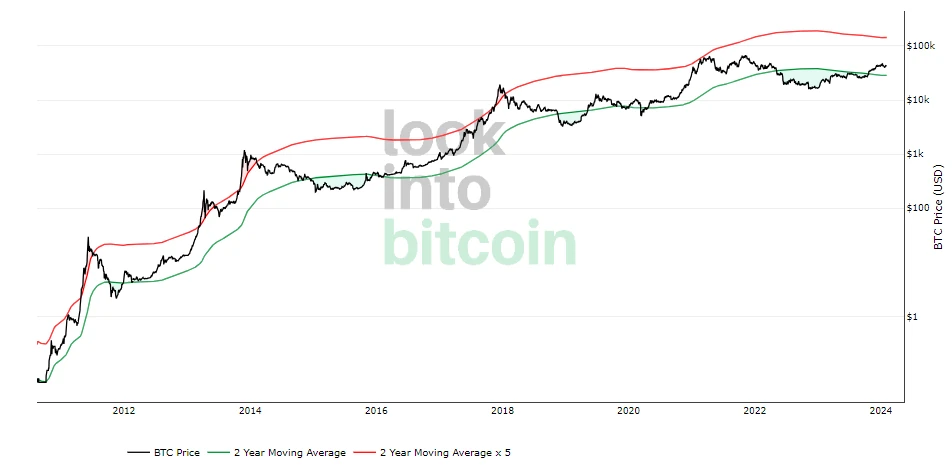

Moreover, these calculations are also consistent with the 2-year average price model.

In fact, Look into Bitcoin is one of the best websites describing Bitcoin behavior.

On this website you can find a lot of charts describing behavior in the Bitcoin blockchain.

Onchain analysis is a very helpful tool for any cryptocurrency data analyst. Now I will use one of the charts.

Bitcoin: Bitcoin Investor Tool: 2-Year MA Multiplier is one of the most basic and at the same time the best tools available for global Bitcoin price analysis.

You can undoubtedly use more complex tools to analyze the Bitcoin price.

My observation confirms that the price bottoms and peaks of Bitcoin are perfectly reflected on the chart.

When the price approaches 2 x 5 average price, we are close to ending the bull market in cryptocurrencies.

If the price falls below the 2-year price average, we are certainly in a bear market.

Interestingly, when you look at prices in previous bull and bear markets on the cryptocurrency market, you will notice that the bear markets lasted almost 1 year.

Exactly like clockwork, great cyclicality. It’s strange!

Bitcoin Halving FAQs

What happens after Bitcoin halving?

After Bitcoin halving, the block reward is reduced, which effectively slows down the rate at which new Bitcoins are introduced into circulation. This reduction in supply, coupled with potential increased demand, can lead to price appreciation.

How many Bitcoin halvings will occur?

According to the Bitcoin protocol, a total of 32 halvings will occur until the maximum supply of 21 million Bitcoins is reached.

Can Bitcoin halving result in a price crash?

While Bitcoin halving historically has led to price rallies, there is always a possibility of price corrections or temporary downturns. The market is influenced by various factors, and it is essential to consider the overall market conditions.

Conclusion

Bitcoin halving is an event that holds immense importance for the cryptocurrency market, surely.

As we have explored in this guide, understanding the history, then significance, and potential impact of Bitcoin halving is essential for investors and enthusiasts.

While the future is unpredictable, the next Bitcoin halving is expected to bring excitement and opportunities to the crypto market. By staying informed, diversifying portfolios, further employing strategic investment strategies, individuals can position themselves to make the most of this significant event.

So, buckle up and get ready to witness the biggest crypto event of the year – Bitcoin halving!

Leave a Reply

You must be logged in to post a comment.