Introduction

What cryptocurrencies on exchanges ? If you want to make money in this market, or ultimately invest, it’s time to know what assets are available in the cryptocurrency market.

The most basic knowledge is that there are: coins, stablecoins, and NFTs. However, the entire cryptocurrency market is not limited to these three basic examples. Let’s deep dive into categories first.

Division into Categories

I am starting from categories.

The division into categories is the most reasonable division. That allows you to use the knowledge about assets.

It is debatable which category is the best.

Is this due to the use of cryptocurrencies and grouping them in this way?

Or maybe a division into the ecosystem of a given cryptocurrency?

Division by Application

Next one is division on application.

a) Coins – Bitcoin, Ethereum, and the rest,

b) NFT – digital assets stored on the blockchain (CryptoPunks, Bored Ape Yacht Club),

c) DeFi – decentralized finance applications (Lido Stakeed Ether, DAI, Uniswap, Avalanche, Wrapped Bitcoin, Chainlink, and Lido DAO),

d) GameFi – tokens created from the combination of the words game and finance (ApeCoin, ICP, Axie Infinity, The Sandbox).

Afterwards, it’s time to look into bread ecosystem division.

The Division into the Ecosystem

a) Ethereum ecosystem – coins related to the Ethereum cryptocurrency,

b) Smart Contracts platforms (Ethereum, Ethereum Classic, Polygon, BNB),

c) BNB Chain ecosystem – all assets in the BNB chain,

d) stablecoins (Tether, USD Coin, Binance USD),

e) CEX – tokens of centrally managed exchanges (BNB – Binance, OKB – OKX, LEO Token – Bitfinex),

f) meme – tokens based on a comic meme or joke (DogeCoin, Shiba Inu),

g) NFT – NFT tokens,

h) gaming – another name for GameFi,

i) finance – tokens that are fully covered in the US dollar (cUSDC, cETH),

j) sport – tokens related to sport (Flow, Chiliz, fan tokens),

k) wallets – cryptocurrency wallet tokens (Trust Wallet – TWT, SafePal – SFP),

l) fan tokens (fan token) – tokens of sports fans of known teams, industries,

m) DEX – decentralized cryptocurrency exchanges (Uniswap, PancakeSwap, THORChain),

n) Polygon ecosystem – all assets related to Polygon,

o) other – all others not listed.

For a more detailed breakdown, for what cryptocurrencies on exchanges please visit Coingecko.com

Let’s switch into importance of stablecoins.

The Strategic Importance of Stablecoins

Fitst, stablecoins are cryptocurrencies that can be traded like other cryptocurrencies.

In this respect, they are no different from other cryptocurrencies. Like them, they can be stored in a cold wallet or on a ledger.

Stablecoins are tied to some kind of reserve of external assets.

The reserve can be a fiat currency, commodity, gold, or debt instrument such as commercial paper.

Importantly, the company issuing the stablecoin should have reserves equal to the amount of stablecoin in circulation.

As a rule, the stablecoin also mimics the dollar exchange rate.

In digital form, it keeps the value of the dollar and has as few price changes as possible.

Then the level of trust in the stablecoin increases.

More About Stablecoins

Designed for our increasingly global economy, stablecoins theoretically solve several key problems.

Stablecoin users don’t need multiple international bank accounts. They send cryptocurrency to their friends in other countries. You only need one crypto wallet.

Stablecoins enable true peer-to-peer digital transfers. All that without the need for third-party intermediaries to facilitate transactions.

In theory, stablecoins reduce fees, transfer times, and potential privacy breaches.

The peer-to-peer model of stablecoins helps you save money.

We do not deal with handling fees and administrative costs for third-party intermediaries.

Storing and realizing profits in stablecoins allows you to avoid profit tax.

Only the withdrawal of a stablecoin in a fiat currency is subject to tax.

Therefore, stablecoins are a great way to store capital, reinvest and realize more profits. All of this is legal and possible without paying taxes. In this moment I recommend read about cryptocurrency tax havens.

Stablecoins are coins what cryptocurrencies on exchanges need to have.

Stablecoin Choice

You are in the point when you need to choose one of the stablecoins.

There are many different stablecoins on the market.

Choosing which ones to buy, exchange or just use for everyday transactions depends on several factors.

You have to ask yourself:

Is the stablecoin decentralized or centrally managed?

Is it stable and regulated?

What is its capitalization?

Stablecoins backed by fiat currencies are popular. They are as stable as the US Dollar (USD) or other widely accepted currencies. However, tying crypto to federal currency makes fiat-backed cryptocurrencies a target for government regulation and more centralized. And algorithmic stablecoins are the most decentralized option.

There is also the issue of what exactly each currency supports.

For example, not all USD-backed stablecoins (USDT, USDC or BUSD, or others) are backed by the exact 1:1 ratio of dollars to cryptocurrencies.

What is in the reserves varies depending on the entity behind the coin.

The stability of a given stablecoin is determined by the selection of assets for its reserves.

It is safest to choose a stablecoin with a good reputation. It’s not all, it’s good when stablecoin has a large market capitalization, and at the same time a 1:1 reserve coverage.

The case of the LUNA stablecoin strongly undermined the reputation of stablecoins, but no wonder.

LUNA in the markets was not covered in its reserves.

By the way, about LUNA case I will write whole post another time.

Choosing such a stablecoin is naive. Unless we want to speculate.

When you know what cryptocurrencies on exchanges then speculation windows is open for you.

I do not recommend it, but knowlegde is everything.

Market Analysis

Market analysis is a very broad topic. There are many ways to analyze the market. As well as conclusions can be significantly different.

The whole situation on the market is very well illustrated once again by Coingecko.com.

Let’s analyze graph by graph what can be deduced from them. After that, we will take a look what cryptocurrencies on exchanges are the most important.

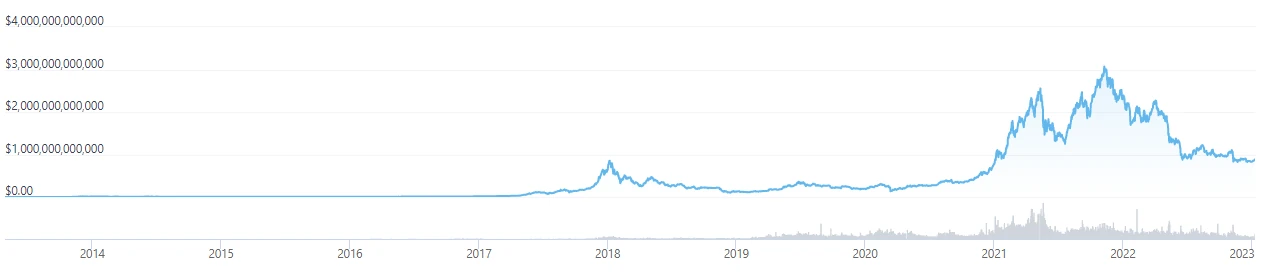

Indeed, market capitalization for whole market is constantly growing what you can easily see.

The peaks in the chart always determine the maximum amount of capital in the market. Then the prices of assets such as Bitcoin have their maximum price. Bitcoin reached maximum prices:

in December 2017 and November 2021. The charts of the maximum capitalization peaks almost coincide with the maximum Bitcoin prices in the two previous bull markets.

According to technical analysis, the tops of the previous bull market are the bottom of the next bull market.

This rule does not always turn out to be 100 % correct, but …

In the case of the cryptocurrency market, it works perfectly.

The recent bull market was also a head and shoulders pattern, which always marks the arrival of a bull market for technical analysts.

Right after the second arm is formed the market began to shrink, and capital was depleted at an extremely rapid rate. As it always is with a bear market.

What the chart does not show very clearly is that the maximum capital of the cryptocurrency market was more than 3 trillion $!

Market Capitalization Conclusions

The capital on the cryptocurrency market in the next bull market will exceed 3 trillion $!

By how much?

It’s hard to determine, but if the growth continues to increase steadily, it should be no less than 6 trillion $ around the bull market (conservative approach).

The price of Bitcoin at the next peak of the bull market will be close to 90,000 $ or 100,000 $!

In the case of the cryptocurrency market, technical analysis is a fairly good representation of market sentiment if we observe the market from the perspective of an observer.

Many technical analysts use this type of analysis to make money in the market daily.

I confirm this with my own experience on the market. Technical analysis is helpful but inconsistent in many cases.

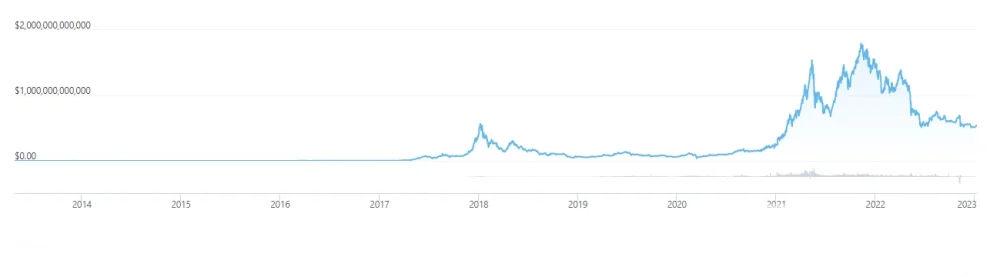

In the case of altcoins, we see that 2017 was a breakthrough year. More capital has entered the altcoin market.

What should be even more precisely defined – there is Bitcoin and all the rest are altcoins.

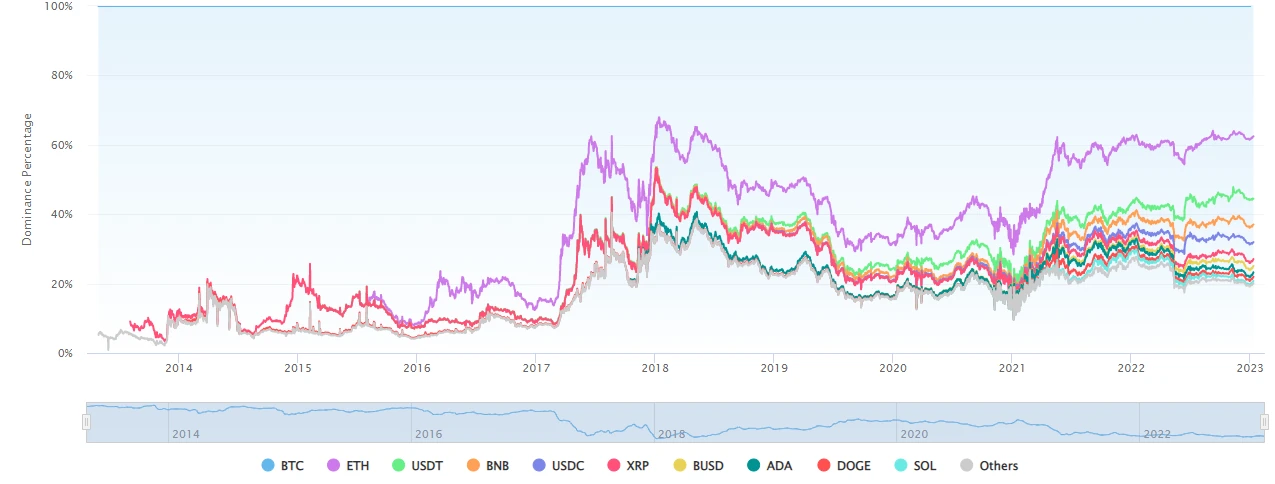

As of 2017, bitcoin at its highest price accounts for 60 % of the total market capitalization. The same was true for 2021.

The market capital in 2021, at its peak, was 1,79 trillion $, which accounted for 60 % of the total market capitalization.

Altcoins Conclusions

The end of the 2017 bull market. Bitcoin: 60 %, the rest 40 %,

The end of the 2021 bull market. Bitcoin: 60 %, the rest 40 %.

When the price of bitcoin reaches 60 % of the total market capitalization, it is safe to say that the bull market is over! This conclusion can be very helpful for any investor or trader.

Since 2016, bitcoin has been losing its dominance in the market.

In January 2016, Bitcoin accounted for 91 % of the total capitalization.

At the end of 2016, it was already 85 %.

Then followed the year 2017, which can be described as a change in investor sentiment.

Bitcoin Conclusions

Bitcoin in June 2017 was equal to 38.6 % of the total capitalization. Since then, the share of “cryptocurrency gold” varies between 32 % and 62 % (the peak of the bull market).

The real explosion of the DeFi market took place at the beginning of 2021 when we can see an exponential increase in capital inflows.

The DeFi market was a strong investment trend in 2021, i.e. during the end of the 2021 bull market. Capital in the market shrank dynamically during the bear market.

What another cryptocurrencies on exchanges without DeFi ?

DeFi Conclusions

Trading during trends is extremely unpredictable, although it can bring huge profits. It should be added that incompetent trading can lead to a disaster.

In retrospect, it can be stated that the largest market capitalization in the DeFi market is:

Lido Staked Ether (STETH), DAI, Uniswap (UNI),

Avalanche (AVAX), Wrapped Bitcoin (WBTC),

Chainlink (LINK), and Lido DAO (LDO).

The stablecoin market cap chart is the same chart that shows Bitcoin’s dominance in the cryptocurrency market.

Stablecoin Conclusions

With the popularization of stablecoins and altcoins, bitcoin accounts for 32 % to 62 % of the total market capitalization. (Conclusion repeated from the previous chart).

Which Crypto is the Most Important?

Taking into account many perspectives, Bitcoin is the safest asset on the cryptocurrency market.

All the most popular cryptocurrencies are relatively safe.

In addition, the top cryptocurrencies in 2023 of the year are the cryptocurrencies that I define as the most important.

While writing this subchapter I didn’t turn out to be too objective, but I presented only what I consider to be the best.

What cryptocurrencies on exchanges ?

Right now should be for you more clear what assets do you have and how important they can be.

Understand the Basics of Trading

To better understand how to profit from transactions, always remember: buy low and sell high. This simple principle in practice is one of the most important fundamentals of trading.

Once you understand the assets you are investing in and the mechanics of the market, you will be an intermediate investor or trader.

Summary

There are assets on exchanges such as coins, stablecoins, NFT, DeFi, or GameFi.

Each of these assets performs a different function that is significant in a given sector.

Next, the most important cryptocurrency is Bitcoin as a carrier of value and means of payment.

The second most important asset in the market is Ethereum. Due to its numerous practical applications, whether in the NFT or DeFi sector.

The cryptocurrency market is constantly evolving and with each boom.

Projects are created that are the basis of new sectors in the industry.

It is difficult to determine what new sectors will be created.

Either way, coins, stablecoins, NFTs, DeFi, and GameFi will continue to grow.

If you know more about what cryptocurrencies are on the exchanges. Then you have high chance to be sucessful on this market. Without this knowlege it’s hard.

The only question is:

what else will the cryptocurrency market surprise us with?

Leave a Reply

You must be logged in to post a comment.