Introduction

Of course, navigating the complex world of crypto investment can be challenging for newcomers. In this case cryptocurrency ETF come into live.

In this article, I indeed will explore the benefits of cryptocurrency ETF.

Then, telling you how they can make investing in digital assets easier and more accessible.

Benefits of Cryptocurrency ETF

Firstly, cryptocurrency etf, or exchange-traded fund, are investment vehicles. So, they allow investors to gain exposure to the cryptocurrency market without directly owning the underlying assets.

These funds are particularly designed to track the performance of a specific cryptocurrency index.

Such as Bitcoin or Ethereum, and enable investors to buy and sell shares on traditional stock exchanges.

What’s more, one of the key benefits of crypto ETFs is that they provide diversification.

You doing this indeed by investing in an ETF that tracks a cryptocurrency index.

Investors can gain exposure to multiple digital assets, especially. Overall, without the need to individually purchase and manage each coin.

This diversification helps spread risk and can potentially mitigate the impact of volatility in the crypto market, indeed.

Another advantage of cryptocurrency ETFs is their ease of use.

Unlike directly investing in cryptocurrencies, where investors need to set up digital wallets and navigate complex exchanges. Investing in ETFs is as simple as buying shares of a stock, however.

This accessibility makes cryptocurrency ETF an attractive option for investors, so to say.

Especially for someone, who are new to the crypto space or prefer a more streamlined investment process.

Of course, benefits are obvious. Besides ease of use you have comfort of just loading money into eft.

Don’t take me wrong, because if you really want to you can manage eft and withdraw money, but then …

You need understand when is the best time to do it.

Of course, this type of index is very convenient and works on the invest-and-forget basis.

Obviously, it’s in line with the holding philosophy (HODL) commonly known in the cryptocurrency world.

Are you one of the cryptocurrency holders indeed?

If so, you should also consider the ETF index for cryptocurrencies.

Types of Cryptocurrency ETF

There are several types of cryptocurrency ETFs, so they are available in the market.

Each with its own unique features and investment strategies, particularly. The most common types include following.

Single-Asset Cryptocurrency ETF

In fact, these ETFs track the performance of a single cryptocurrency. Such as Bitcoin or Ethereum.

They are ideal for investors who want exposure to a specific digital asset and believe in its long-term potential, surely.

Multi-Asset Cryptocurrency ETF

Overall, these ETFs provide exposure to a diversified portfolio of cryptocurrencies.

They are designed to track a basket of digital assets, in fact.

Offering investors broad market coverage and then reducing the risk associated with investing in a single cryptocurrency.

Inverse Cryptocurrency ETF

Unlike traditional ETFs, inverse cryptocurrency ETFs aim to profit from declines in the value of the underlying cryptocurrency. These ETFs are suitable for investors who want to hedge against market downturns or speculate on the price movements of cryptocurrencies, indeed.

Different types of etfs related to cryptocurrencies give you much bigger opportunities to invest, so it is your choice.

On the market there are quite a lot of options, and soon there will be etfs fully covered only in cryptocurrencies.

Invest in Cryptocurrency ETF

Investing in cryptocurrency ETFs is a straightforward process, so here are the steps to get started.

Choose a Reliable Brokerage

Firstly, select a reputable brokerage that offers access to cryptocurrency ETF.

Further, ensure that the brokerage is regulated and offers a user-friendly platform for trading ETFs.

Open an Account

Secondly, sign up for an account with the chosen brokerage. Then, provide the required information and complete the verification process.

Fund Your Account

Thirdly, deposit funds into your brokerage account using a preferred payment method.

Research and Select ETF

Conduct thorough research on available cryptocurrency ETF, indeed.

Fourthly, consider factors such as the fund’s track record, expense ratio, and underlying assets.

Select ETFs that align with your investment goals and risk tolerance, also.

Place Your Order

Once you have chosen the desired cryptocurrency ETF, place your order through the brokerage platform.

Specify the number of shares you wish to purchase and review the order details before finalizing.

Monitor Your Investment

Overall, keep track of your cryptocurrency ETF investments and stay updated on market trends.

Regularly review your portfolio’s performance and further make adjustments if necessary.

6 steps explaining how to invest in cryptocurrency etfs, but theory it’s ones and another is practise. In fact, understand how psychology works on the market and discipline is much more important than any other part of investment.

Advantages of Investing

Investing in cryptocurrency ETF offers several following advantages over direct investment in digital assets.

Some of the key benefits read below, indeed.

Diversification

Firstly, cryptocurrency ETF provide exposure to a variety of digital assets.

Reducing the risk associated with investing in a single cryptocurrency then.

Finally, this diversification helps protect your investment from the volatility of individual coins.

Liquidity

ETFs are traded on stock exchanges, ensuring high liquidity and the ability to buy or sell shares at any time during market hours. This liquidity provides flexibility and ease of entry and finally, exit for investors.

Regulation and Security

Cryptocurrency ETF are subject to regulatory oversight, providing investors with a certain level of protection, in fact.

Additionally, investing in ETFs eliminates the need to secure and store cryptocurrencies, reducing the risk of theft or loss.

Maybe those advantages convince you to invest, at least some money. Investing looks to me as like long-term run, because it’s very difficult predict what will happen on the market. It’s actually impossible to be always right, indeed. Diversification, not just mean take different cryptocurrencies, then we are not talking about diversification. Different asset classes in portfolio mean diversification, but about it not here today.

Risks and Challenges

While cryptocurrency ETF offer many advantages.

It’s essential to be aware of the risks and challenges associated with these investments indeed.

Some of the key following considerations.

Volatility

While diversification helps mitigate risk, the crypto market is known for its volatility.

Prices of cryptocurrencies can fluctuate dramatically, then impacting the performance of cryptocurrency ETF.

Market Manipulation

The cryptocurrency market is relatively young and less regulated compared to traditional financial markets.

As a result, market manipulation and fraudulent activities can occur, affecting the value of cryptocurrency ETF.

Counterparty Risk

In fact, cryptocurrency ETF rely on third-party custodians to hold the underlying assets.

If the custodian faces operational or security issues it can impact the ETF’s ability to track the cryptocurrency index accurately, surely.

Risk and challanges are everywhere, so don’t be blind on them. Being on the cryptocurrency market without any another expierience in investment can be for you simply to difficult. Price volatility, market manipulations and so on… List going on and on! Reasonable questions is then ask: “why you invest on this market?”

Popular Cryptocurrency ETF

When selecting a cryptocurrency ETF, it’s essential to compare different options based on various factors.

Here are some popular cryptocurrency ETF and their key features, so… take a look below.

Bitcoin ETF

Firstly, tracks the performance of Bitcoin, the largest and most well-known cryptocurrency.

Provides investors with exposure to the price movement of Bitcoin without the need to directly own the digital currency, but …

It’s not clear exposure to cryptocurrency price, because in portfolio of this etf you can find companies in industry, not index of cryptocurrency. Indeed, it plays huge difference.

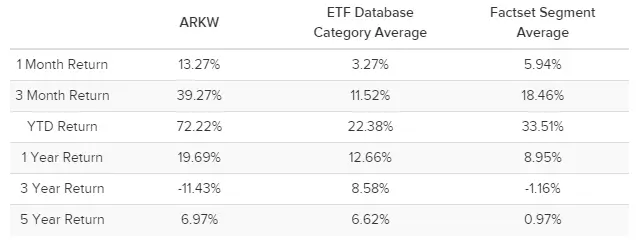

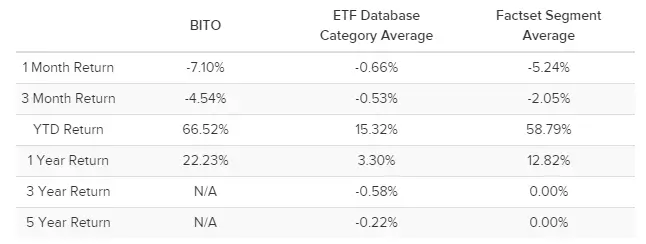

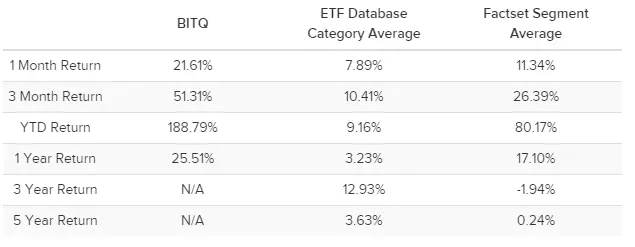

Popular indexes: ARK Next Generation Internet ETF (ARKW), ProShares Bitcoin Strategy ETF (BITO), then Bitwise Crypto Industry Innovators ETF (BITQ)

Ethereum ETF

Designed to track the performance of Ethereum, the second-largest cryptocurrency by market capitalization.

Offers investors the opportunity to gain exposure to the price movement of Ethereum, indeed.

Popular indexes: there are plenty, but their track records not prove any success of investment

Blockchain ETF

Blockchain ETFs have the potential to benefit from the increased adoption and also utilization of blockchain technology.

They are funds that invest in companies involved with the transformation of business applications though development and use of blockchain technology.

Another option, are funds that invest in futures and options pegged to the performance of Bitcoin, Ether and other cryptocurrencies, or in cryptocurrency investment products offered by asset managers like Grayscale or Bitwise.

Popular indexes: Amplify Transformational Data Sharing ETF (BLOK), Bitwise Crypto Industry Innovators ETF (BITQ), Global X Blockchain ETF (BKCH) and so on

Altcoin ETF

in fact, they provides exposure to a diversified portfolio of alternative cryptocurrencies, excluding Bitcoin and Ethereum.

Offers investors the chance to invest in up-and-coming digital assets with growth potential, surely.

Popular indexes: Similar situation like in case of Ethereum ETF.

Many options, but they are new on the market.

In fact, some of the most popular crypto efts available on the investment market. Such as Bitfocin etf, etherum etf, blockchain etf and son on. Particularly they give access to invest in cryptocurrency by etfs, but they are not fully covered by cryptocurrency. In their portfolio are companies in cryptocurrency industry, but not clear etfs on particular cryptocurrency. For example, in case Bitcoin efts it would be fully covered etf in bitcoin cryptocurrency. Just to be clear, due to this cases we are not have this kind of situation.

Successful Cryptocurrency ETF Investing

To enhance your chances of success when investing in cryptocurrency ETF, consider the following tips.

Do Your Research

Thoroughly research the cryptocurrency market, ETFs, and the underlying assets before making any investment decisions.

Stay updated on industry trends, news, and then regulatory developments.

Set Realistic Expectations

At first, understand that the crypto market is highly volatile, and prices can fluctuate rapidly.

Set realistic expectations for returns and be prepared for potential market downturns, particularly.

Diversify Your Portfolio

Spread your investment across different cryptocurrency ETF to reduce risk.

Diversification can help protect your investment and increase the potential for long-term returns.

Indeed to be succesful in investment in etf is the best first do research.

Then, set realistic expectations as a part of strategy.

But don’t remember be realistic, because only then your chances growing. Finally, diversify your portfolio.

Updates on Cryptocurrency ETF

Staying informed about the latest developments in the cryptocurrency ETF space is crucial for successful investing, in fact.

Here are some following resources to consider.

Crypto News Websites

Regularly visit reputable crypto news websites to stay updated on market trends, surely. Then, regulatory changes, and new cryptocurrency ETF offerings.

Financial News Platforms

Keep an eye on financial news platforms that cover cryptocurrency markets.

These platforms often provide insights and analysis on the performance of cryptocurrency ETF.

Online Forums and Communities

Engage with online forums and communities dedicated to cryptocurrency investing, in fact.

Participate in discussions, so ask questions, and learn from experienced investors.

ETF or Own Management?

Trying to answer this question, it is worth checking first what results the ETF index can do for us, surely.

To do this, I looked at the 3 most popular Bitcoin indices: ARK Next Generation Internet ETF (ARKW), ProShares Bitcoin Strategy ETF (BITO), and finally Bitwise Crypto Industry Innovators ETF (BITQ).

Note

It should be added that these are not indices that invest purely in cryptocurrency assets, but companies related to the cryptocurrency industry.

Without a doubt, the difference is significant!

Of course, these are not etfs that have exposure to the price of Bitcoin covered by the cryptocurrency itself.

The investment market is considering this type of etfs and applications from several companies have already been submitted, but …

Particularly, such etfs are not discussed in this article. Just to be precise, so that there are no misunderstandings.

Here are the results.

ARKW

This ETF over the last 3 years would lose -11.43% of the total investment, and the 5-year investment would end up with a profit of nearly 7%.

Mediocre results for one of the most popular Bitcoin ETFs available on the market, indeed.

It is true that the cryptocurrency and Bitcoin markets have been in a bear market in the last year, but …

The results are really poor.

BITO

What about the next Bitcoin ETF, so did this one do much better in 3 to 5 years?

Ultimately, I am writing about such a period, because the investment should cover at least such a period of time.

This index has no history for this period of time, which means that it was not offered until 3 years ago.

Oh well. I wouldn’t invest.

BITQ

Another index that doesn’t have a long enough track record.

Two indexes shown of large investment firms opened Bitcoin ETF indices when the market was in a bear market.

This is the best time for this type of investment, because the price will continue to grow until the end of the bull market.

The ETF ARKW index itself lost in 3 years and gained 7% in 5 years, in fact. Therefore, inflation in the US is 2-3% over 5 years.

Adjusted for inflation, this index is also a loss.

Conclusion

Cryptocurrency ETF offer a convenient and also accessible way for investors to gain exposure to the digital asset market.

With their diversification benefits, ease of use, and regulatory oversight, crypto ETFs can make crypto investing easier and more secure, at first.

However, it’s essential to understand the risks associated with this asset class and conduct thorough research before making any investment decisions.

In addition, I presented 3 great sources of Bitcoin ETFs. Then I showed what results these 3 ETFs can produce for us.

Leave a Reply

You must be logged in to post a comment.