Introduction

It’s time to explain what is THORChain and what is going on in this project. Exactly, in this article, I will write about what is this all project about, unique features, competition, ecosystem and price. Finally, I wrap up all this things with conclusion.

Let’s get into job.

Please read, share and comment!

What is THORChain

First of all, THORChain is a ground-breaking cross-chain decentralized protocol that allows native swaps between different blockchains. It’s built on the Cosmos software development kit (SDK). THORChain serves as a Layer 1 cross-chain decentralized exchange (DEX) that facilitates the exchange of assets across disparate blockchains in a non-custodial manner.

Second of all, I will jump into some details how project works.

How does THORChain work?

The Role of Automated Market Makers

To understand THORChain’s significance, it’s essential to grasp the concept of automated market makers (AMMs) and liquidity providers (LPs). AMMs are decentralized exchanges that pool liquidity from users and utilize algorithms to price the assets within the pool. LPs, on the other hand, are network participants who deposit their assets into these pools, earning rewards in return. These rewards are generated from the fees incurred by swappers, who utilize the pools to exchange assets.

THORChain’s unique proposition lies in its ability to provide deep liquidity, low transaction fees, and 100% uptime across multiple blockchain networks. Unlike traditional AMMs that operate within a single blockchain network, THORChain enables native swaps between different chains, eliminating the need for wrapped assets and central intermediaries.

Back to THORChain

THORChain’s innovative continuous liquidity pool (CLP) model ensures efficient and responsive liquidity provision. The CLP model allows for the continuous pairing of assets with RUNE, regardless of how assets are added or withdrawn from the pools. This mechanism ensures that each pool maintains a 50% pairing with RUNE, enabling seamless asset swaps without the need for users to convert their crypto into or take custody of RUNE.

The CLP liquidity model also enables the THORChain protocol to respond dynamically to fluctuating liquidity demand, providing optimal trading conditions for users. By maintaining a balanced ratio between assets and RUNE in the pools, THORChain ensures fair and transparent pricing without relying on centralized third parties.

ThorChain Unique Features

Let me write a few things about unique features of THORChain project.

Native Cross-Chain Swaps

THORChain allows users to swap native assets across different blockchains — like swapping BTC for ETH — without wrapping the assets. Why it matters? Most DeFi platforms use wrapped tokens (like wBTC), which rely on custodians. THORChain removes that trust assumption by enabling direct swaps.

No Custodians, Truly Decentralized

Assets are never held by any centralized entity. Instead, they’re managed by the THORChain network through Threshold Signature Schemes (TSS), distributing control across multiple nodes.

Multichain Liquidity Pools

Users can provide liquidity using native assets (like real BTC or ETH). Earn yield from swap fees and block rewards — no need to bridge or wrap tokens.

BEPSwap + THORSwap

BEPSwap is early version focused on Binance Chain assets. THORSwap is more complete interface supporting cross-chain functionality for Bitcoin, Ethereum, Atom, Dogecoin, Litecoin and more.

Built on Cosmos SDK

Enables fast finality and high throughput. Interoperability with other Cosmos-based chains via IBC (Inter-Blockchain Communication).

Continuous Liquidity Pools

THORChain uses a slip-based fee model where larger trades cause more slippage and higher fees. This discourages price manipulation and protects liquidity providers (LPs).

Impermanent Loss Protection

Liquidity providers earn protection over time (fully protected after 100 days). Reduces risk of losing funds due to price volatility between paired assets.

RUNE Token Utility

Token is used for security, liquidity and governance. Many different projects use own token for the same reason.

THORChain and Competitors

THORChain is in a pretty unique niche, but it still has some notable competitors, depending on what angle you’re looking from: cross-chain swaps, liquidity provision, or general decentralized exchanges.

In case of native assets and decentralization main opponent is Chainflip in the early stage. In case of decentralization and wrapped tokens are Uniswap and Axelar, but this projects have little different philosophy of trading.

The last competitors are all CEXs in case of trading native assets.

I have mention before that THORChain is in the niche. Technical implementation of this project makes it difficult compete with this project. Probably a good questions is to ask if new customers would be looking all this features what make THORChain special? Decentralization and trading native assets is big deal, but direct or indirect competition is really heavy calibre.

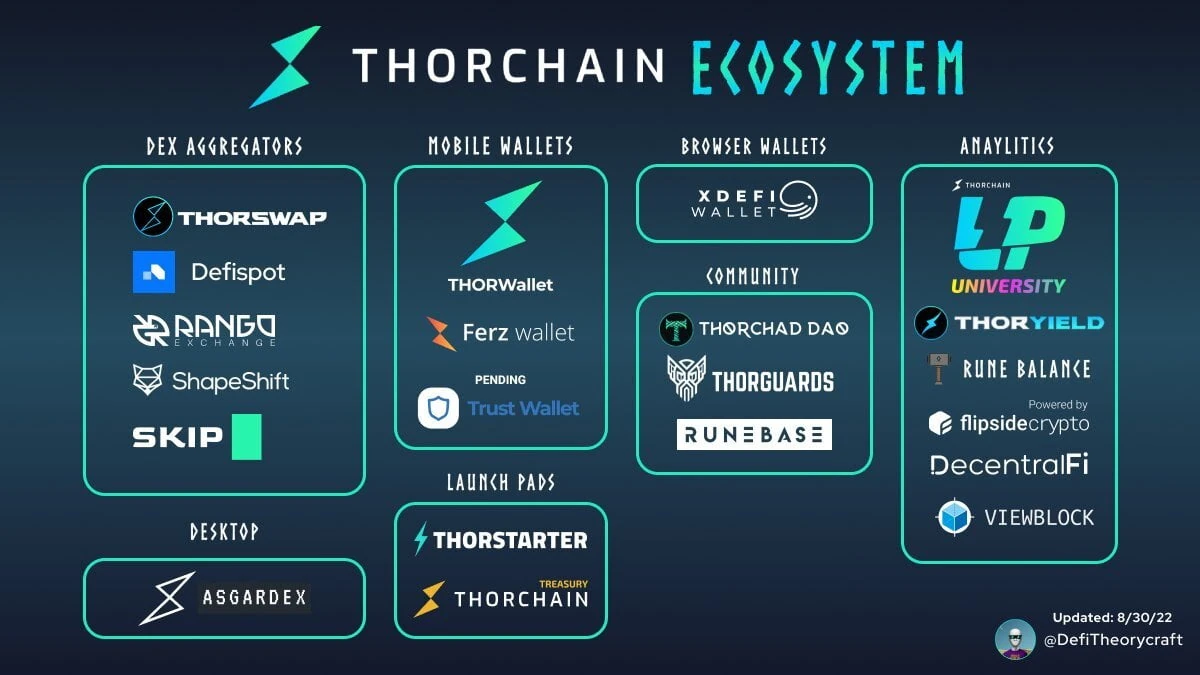

About THORChain Ecosystem

Project ecosystem is growing and right now we can find 77 apps and services into ecosystem. Not so bad.

I won’t write about all the projects into ecosystem, but just write about a few like own Swap – THORSwap, own wallet – THORWallet and Venture DAO – THORSTARTER. For more visit on your own project website.

RUNE Price in Depth

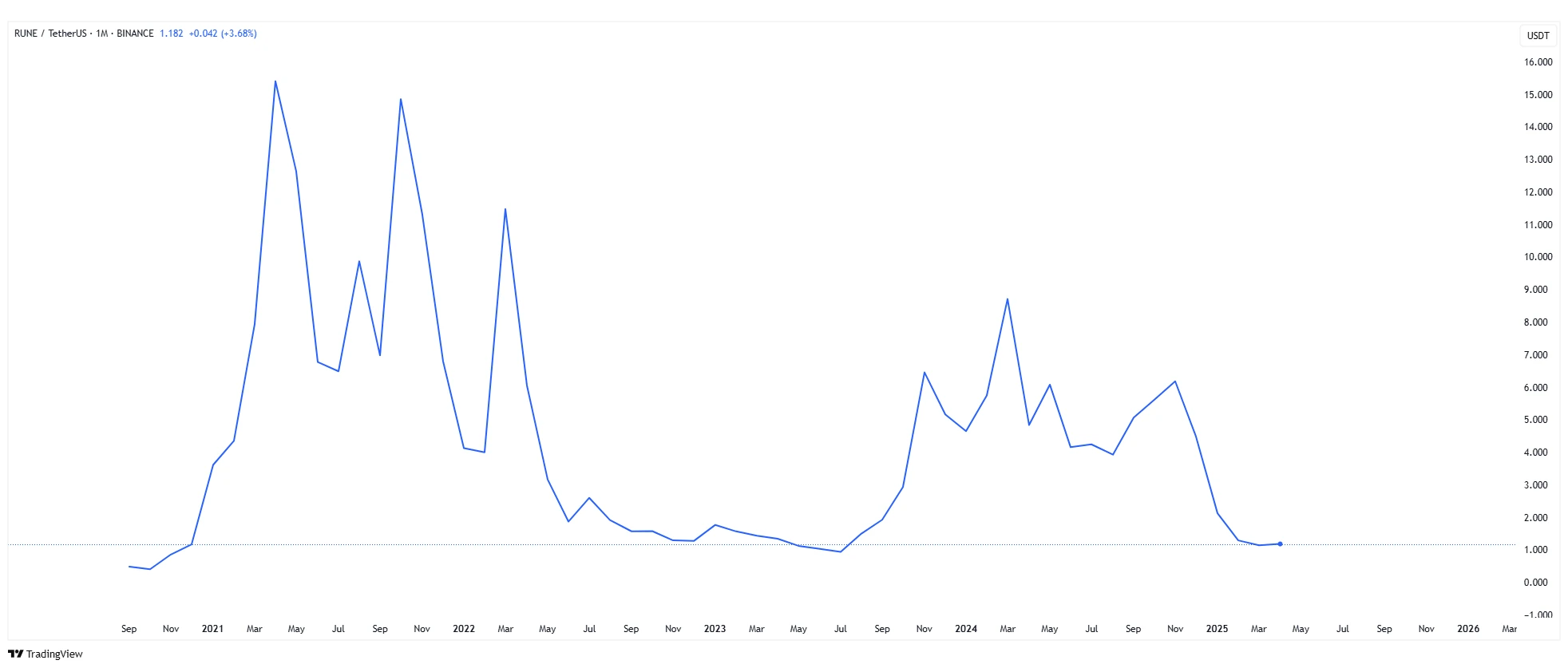

Ok, I am finally on the price of RUNE. You can easily see that capital came to project when it was so called altcoin season.

In the first bull market RUNE price went almost to the sky. Just take a look. It was price $0.1 per unit in march 2020 and in may 2021 it was $20.87 per unit. Price jump in almost one year 200 times! Right now you know why some become cryptocurrency billionaires. For sure it’s possible when you can profit so much. After a first bull market came bear market with huge fall down of price. 2 years price were in down trend. June 2023 it was local bottom with price $0.79 per unit.

As like you see you can really gain a lot, but also a lot lost on cryptocurrency market. Price dropped almost 99.5% from All Time High.

In June 2023 it was local bottom, so it time when capital start to inflow again to project. In march 2024 price reached local high with $10.62 per unit. Not so bad, but rather far away from ATH. During price correction price landed on $3 per unit, but it was not the end.

As a consequence of perturbations on financial market and difficult economic situation on the world price finally bottomed again on $1 per unit.

During writing this article fear and greed index is 32 on 100 and altcoin season – 16 in 100 scale. We are not in the bull market peak for sure. What happen next is rather difficult to estimate.

THORChain Future

Let me explain my point of view by present different perspectives.

First of all, THORChain is on the market over 5 years and from beginning of project price is regularly increasing. 5 years on the cryptocurrency market is quite a lot in comparison to another projects. In the same time, during this 5 years project price raised and felt down many times.

What’s not a big surprise, but price right now is just $1.13 (during writing this article). From All Time High price is almost 95%. It’s quite a lot. Don’t you think? This bull run is different than another and there is a few reasons behind this. One of them, are strong narratives and way to much altcoins on the market. I just try to explain that capital allocation is coming to the biggest projects, leaders of categories or pushed narratives. If there will be more capital for projects like THORChain is very difficult to prejudice.

Second of all, project unique value is swapping between two different cryptocurrency assets. Let me give you example. I just want to change my Bitcoin to Ethereum and it’s easy with THORChain. I don’t have to register or CEX to do it, but just use this project liquidity network, but question is rising:

Do I really need projects like this one and how much important it will be in the future?

It’s rather impossible to answer for this question, but this bull run just give us many examples that L1 networks, new liquidity providers and so on can be taken more in consideration in the future. I don’t write it will happen, but it’s possible.

Ecosystem Power

Finally, ecosystem power. I would like to write a few words about this ecosystem, because it’s very important to mention about it. In a lot of cases ecosystem network drives the project adaptation mechanism. Without adoption project simply die.

In case of THORChain ecosystem is stable growing. According to project website we can find 77 apps and services into this ecosystem. Pretty nice. Not awesome, but still it’s quite a lot.

Conclusion

It’s time for conclusion. THORChain is unique project and after 5 years we have one one direct opponent in the niche.

Let’s be honest, swapping native cryptocurrency assets is very easy on many CEXs. If you want to you can use DEXs as well if you looking for decentralization.

Ecosystem of THORChain is growing, but it is not skyrocketing ecosystem and probably it will be niche for long time. I would write being in the cryptocurrency niche can be a blessing or a burden.

Finally, price perspective telling me that this project give opportunity to gain in the longer perspective or just at the end of bull market. At least, I can write it after research from last bull market, but next one can be totally different.

Leave a Reply

You must be logged in to post a comment.