Introduction

Top hedge funds in crypto is really interesting topic to write about. Any topic related to hedge funds in cryptocurrency industry should bring attention for every investor or enthusiast of crypto. There is a few reasons why.

In this article I will answer on that question. Why we should watching hedge funds in industry, what of them are top of top, some another facts and so on.

As like always please read, comment and share.

Let’s work!

What is Hedge Funds?

At the beginning I write little bit about hedge funds itself. Hedge funds are companies with limited partnership and private investment capital. Invested money are managed by professional fund managers.

What’s important, that hedge funds use different investment strategies. The way how portfolio is managed is active with risk investment strategies. Typically clients of hedge funds are wealthy clients.

Hedge funds are more expensive than conventional investment funds (mutual funds, etfs) and capital is locked for a years before money come back to investor.

When you take in consideration all that, what I have written about hedge funds and Bitcoin cycles then 4-10 years investment make sense. Another case is the cost of management, but about it not in this article.

About Hedge Funds in Crypto

First of all, I have to write little bit about hedge funds in cryptocurrency industry. When we think about hedge funds when almost all the time we think about bigger and well-known financial sectors like real estate, stock market or precious metals markets. Where is some place for cryptocurrencies?

The cryptocurrency market dwarfs other capital markets. Such as real estate, shares or the debt market.

Ok, let’s be clear. Some of the hedge funds made already millions on cryptocurrencies. Some of the projects brought a lot of money for investors. In many cases that what is all about.

You do take a risk, so profits from your investment are higher than on the markets what are more established.

Second of all, hedge funds in crypto growing like growing and becoming more mature cryptocurrency market. Even market of hedge funds could be small, but it isn’t mean it not exists.

Third of all, hedge funds are interested in markets where capital is flowing into. Managers from this companies build different risk related portfolios. In some cases Bitcoin and another cryptocurrencies are on the radar of them.

After this clarification let’s take a look for top hedge funds in cryptocurrency industry.

Top Hedge Funds in Crypto

In this section I write about some big players in the business, but won’t leave you just with that.

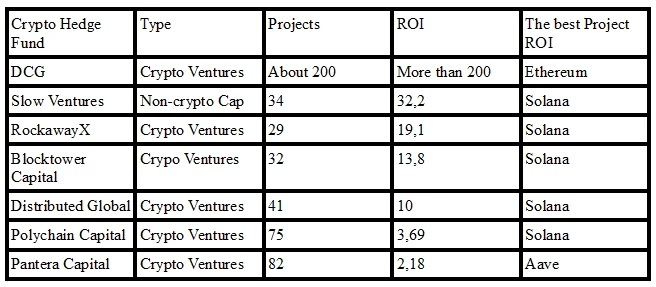

Digital Currency Group (DCG)

At the forefront of the crypto hedge fund industry stands Digital Currency Group (DCG). Founded in 2015, DCG has established itself as a major player in the market, specializing in venture capital investments. They have nearly 200 ventures in its portfolio. DCG has strategically invested in niche-specific companies, including CoinDesk and Grayscale Investments.

Slow Ventures

Another company specialized in digital investments based in San Francisco. They are generalists and invest at the earliest stages and ideas. In their portfolio is about 40 projects.

The most prominent investment are in projects like Solana, Alogrand, Robinhood or Lightening Labs.

RockawayX

It’s a venture capital firm based in London, Zurich and Prague. Their specialization is investment in Web3 projects. Portfolio of company have more than 30 projects. You can find projects there like Solana, SushiSwap, Compound, Cosmos, Uniswap, 1inch and so on.

Blocktower Capital

One of the leaders of the hedge funds companies in digital space. Company is based in Miami, Florida. In their portfolio you can find about 30 – 35 projects.

The most popular projects in their portfolio are Solana, Injective, Axie Infinity, Aptos, Flow and Hedera.

Distributed Global

Company based in Los Angeles, California. They are an investment focused on the blockchain and digital asset ecosystem. Distributed Global was founded in 2018.

In their portfolio are more than 41 projects. One of them are Solana, NEAR Protocol, Flow, Polkadot, Maker DAO and so on.

Polychain Capital

Polychain Capital, founded in 2016 and based in California. This crypto fund manager primarily focuses on private equity investments, seeking opportunities in blockchain-focused companies across various industries. Their portfolio comprises have about 80 investments, with interests spanning finance, IT, and telecommunications.

Pantera Capital

It’s, a California-based firm, launched the first crypto fund in the United States in 2013. Pantera Capital actively invests in ventures at all stages of development. The fund adopts a balanced approach, combining investments in crypto-focused ventures, established large-cap cryptocurrencies, and promising lower-cap cryptocurrencies.

Pantera Capital’s impressive portfolio includes investments in Coinbase, the largest crypto exchange in the United States, as well as innovative blockchain-based ventures like Alchemy and Blockfolio. In their portfolio is about 80 or 85 projects.

Digital Currency Group it was on of the first venture companies specialized in digital investments in cryptocurrency industry. For that reason they took first place in many areas of venture capital companies gains. For them the best project performance were Ethereum.

After a while, another venture capitals companies join the race. On average they have about 40 projects in their portfolio. For them the best performance project in cryptocurrency industry were Solana.

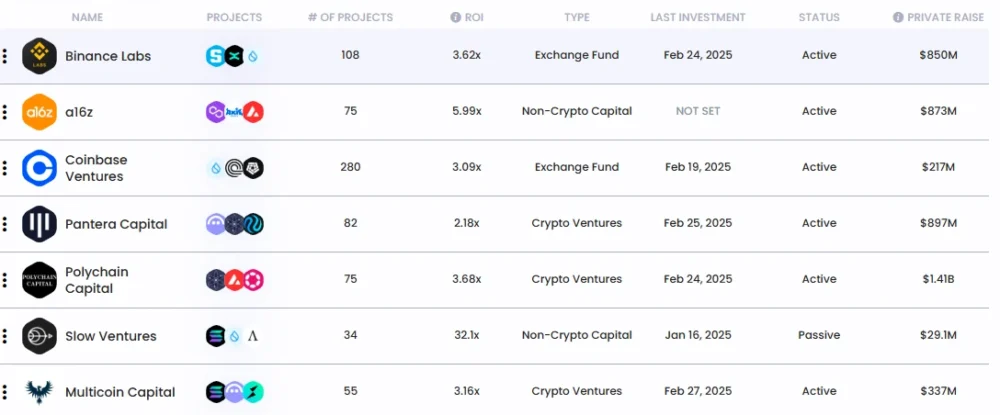

Trending Hedge Funds in Crypto

A lot of companies noticed that hedge funds and investment in early stage of niche projects can be really profitable. Let’s take a look on list below to see what trending hedge funds companies are on horizon.

Source: https://chainbroker.io/funds/list/trending/?ordering=trending

Obviously you can see, that exchanges taking race not just in exchange business, but in hedge funds business as well. The biggest exchanges, like Binance and Coinbase are the best example.

Top Projects so Far to Invest in

Ok, then I wrote about big players in crypto hedge funds game as far as about trending companies. You won’t be surprise I guess what projects bring them the most profit.

Source: https://chainbroker.io/projects/list/top-roi/?ordering=public_roi&orderingDesc=true

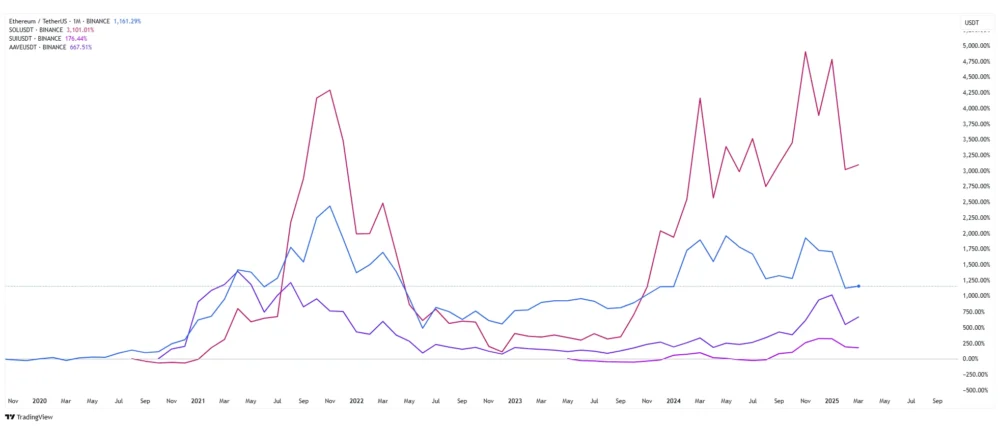

The most 3 profitable projects by return of investment (ROI) were Ethereum, Binance Coin and Solana. Let’s take a look again on the top 10th projects on Coingecko or Coinmarketcap.

Big fishes and whales invest in projects what are on the top of the list of the biggest market capitalizations. Risk taken in minimized by this move.

By the way, ROI from Ethereum were 7040 from initial investment. Someone whose notice investment opportunity, at least at the beginning of 2020 could in very short time gain a lot of profit from that investment.

Source: https://www.tradingview.com/

The last years Solana outperformed Ethereum, but still Ethereum is on the market a few years longer and leader DeFi position is established.

Lessons from Crypto Hedge Funds

It’s crucial to understand that you can learn a lot from hedge funds. There is a few lessons you can take from hedge funds companies.

- Invest in bigger market caps with lower risk of investment

- See opportunities on horizon in emerging markets

- Do business evaluation and business development

- At first, risk management

- Build portfolio of the best projects on the market

I am sure those 5 points is way to little to write about, but those things came to my mind during writing this article. Stick to them and you should be fine on cryptocurrency market.

I have forget, test solutions by yourself and never take 100% things what I am writing here. Some things what working for me those not have to works for you as well! Just writing to remind you.

Afterwards, let’s predict little bit what future hedge funds will be.

Crypto Hedge Funds Future

As for me, I think that crypto hedge funds will do really well. Right now, you can see how many of them are raising money for new projects in the industry. Sometimes they take too much risk, but the risk pays off.

Of course, if you take it with the right approach. ETFs in the cryptocurrency world are completely changing the image of the industry. It is no longer a narrative that cryptocurrencies are just scams. Obviously, these will continue to appear on the market, but over time there will be fewer and fewer of them.

Returning to hedge funds, I think that the development of the cryptocurrency industry will attract even more capital. Wherever the industry is more mature, financial institutions and huge investments appear. By this I mean this type of funds.

You could learn from the article that some projects have made a lot of money.

Well. At first they were seen as scams, and in the meantime smart money accumulated capital and made money. Hedge funds are largely smart money in cryptocurrency markets and other markets. Just telling you.

Conclusions

Crypto hedge funds are companies what invest in digital assets and see opportunities in digital assets. Their main focus are on those kind of assets and article clearly prove that return of investment from digital projects can be very profitable.

You can think about hedge funds companies like smart money of digital assets, because simply they are invest in early stage on the cryptocurrencies start-ups. Most of the projects on cryptocurrency market are still start-ups and after a few years in can change.

On of the best projects to invest in it was Ethereum, Solana, Aave and Cosmos, but a lot of opportunities are still there.

Cryptocurrency industry evolving and in the same time growing sectors like hedge funds investment in digital assets. Digital Currency Group, Slow Ventures and RockawayX are the biggest hedge funds in industry.

I leave you with message:

Follow smart money of digital assets, because it’s simply the best move what you can do to gain profits here.

Just take a look for Return of Investment (ROI) for the best players in the industry. If that not convince you then nothing will.

Leave a Reply

You must be logged in to post a comment.